A Pompano Beach Florida Durable Power of Attorney for Property, Finances, and Health Care is a legally binding document that grants an individual, known as the "agent," authority to make decisions regarding the principal's property, finances, and health care matters. This power of attorney remains in effect even if the principal becomes incapacitated, ensuring their affairs are managed efficiently and in accordance with their wishes. Key elements of a Pompano Beach Florida Durable Power of Attorney for Property, Finances, and Health Care include: 1. Property Management: This legal document enables the agent to handle the principal's real estate, personal belongings, bank accounts, investments, and other assets. The agent may buy, sell, or manage the principal's property, pay bills, collect rent, or make financial investments on the principal's behalf. 2. Financial Decision Making: The agent is empowered to make financial decisions for the principal, such as managing bank accounts, paying debts, filing taxes, and handling insurance matters. They must act in the best interest of the principal, avoiding any conflicts of interest while making financial decisions. 3. Health Care Authorization: By executing a durable power of attorney, the principal authorizes the agent to make medical decisions on their behalf if they become unable to do so. This includes consenting to or refusing certain medical treatments, choosing healthcare providers, and accessing medical records. The agent should be able to communicate the principal's healthcare preferences effectively. Different types of Pompano Beach Florida Durable Power of Attorney for Property, Finances, and Health Care can be categorized based on the specific areas they cover: 1. Limited Power of Attorney: This type grants the agent authority over only specific financial or medical decisions, often for a specific period. For example, a principal may appoint an agent to handle real estate transactions during their absence. 2. General Power of Attorney: A general power of attorney gives the agent broad authority to handle all financial, property, and health care matters on behalf of the principal. This type of power of attorney is useful in situations where the principal may become incapacitated or unavailable for an extended period. 3. Springing Power of Attorney: Unlike immediate effectiveness, a springing power of attorney becomes active only when a triggering event occurs, typically the principal's incapacity. This type allows the principal to maintain control until it is necessary for the agent to take over. Executing a Pompano Beach Florida Durable Power of Attorney for Property, Finances, and Health Care ensures that individuals have a trusted representative acting on their behalf during times of incapacity or unavailability. It is important to consult with a knowledgeable attorney specializing in estate planning and elder law to understand the specific legal requirements and implications associated with power of attorney documents.

Pompano Beach Florida Durable Power of Attorney for Property, Finances and Health Care

Description

How to fill out Pompano Beach Florida Durable Power Of Attorney For Property, Finances And Health Care?

If you are looking for a relevant form, it’s extremely hard to find a more convenient platform than the US Legal Forms website – one of the most considerable libraries on the internet. With this library, you can find a huge number of form samples for company and individual purposes by types and states, or keywords. With our high-quality search feature, discovering the newest Pompano Beach Florida Durable Power of Attorney for Property, Finances and Health Care is as elementary as 1-2-3. Furthermore, the relevance of each and every file is proved by a group of expert lawyers that on a regular basis check the templates on our platform and update them according to the newest state and county regulations.

If you already know about our platform and have an account, all you should do to receive the Pompano Beach Florida Durable Power of Attorney for Property, Finances and Health Care is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the form you require. Look at its description and utilize the Preview option to see its content. If it doesn’t meet your needs, use the Search field near the top of the screen to get the needed document.

- Confirm your selection. Click the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Select the format and save it on your device.

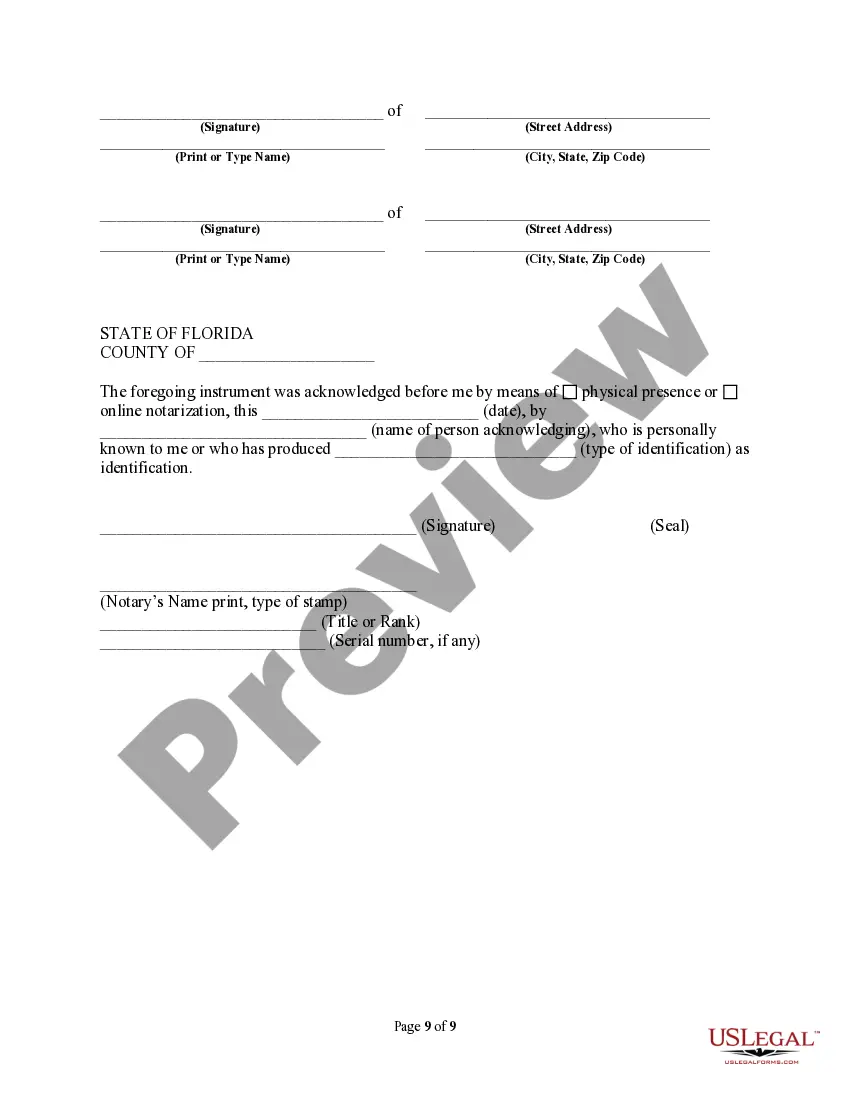

- Make modifications. Fill out, modify, print, and sign the obtained Pompano Beach Florida Durable Power of Attorney for Property, Finances and Health Care.

Each and every template you save in your profile does not have an expiration date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an extra version for editing or printing, feel free to return and export it again anytime.

Take advantage of the US Legal Forms professional library to gain access to the Pompano Beach Florida Durable Power of Attorney for Property, Finances and Health Care you were looking for and a huge number of other professional and state-specific templates in one place!