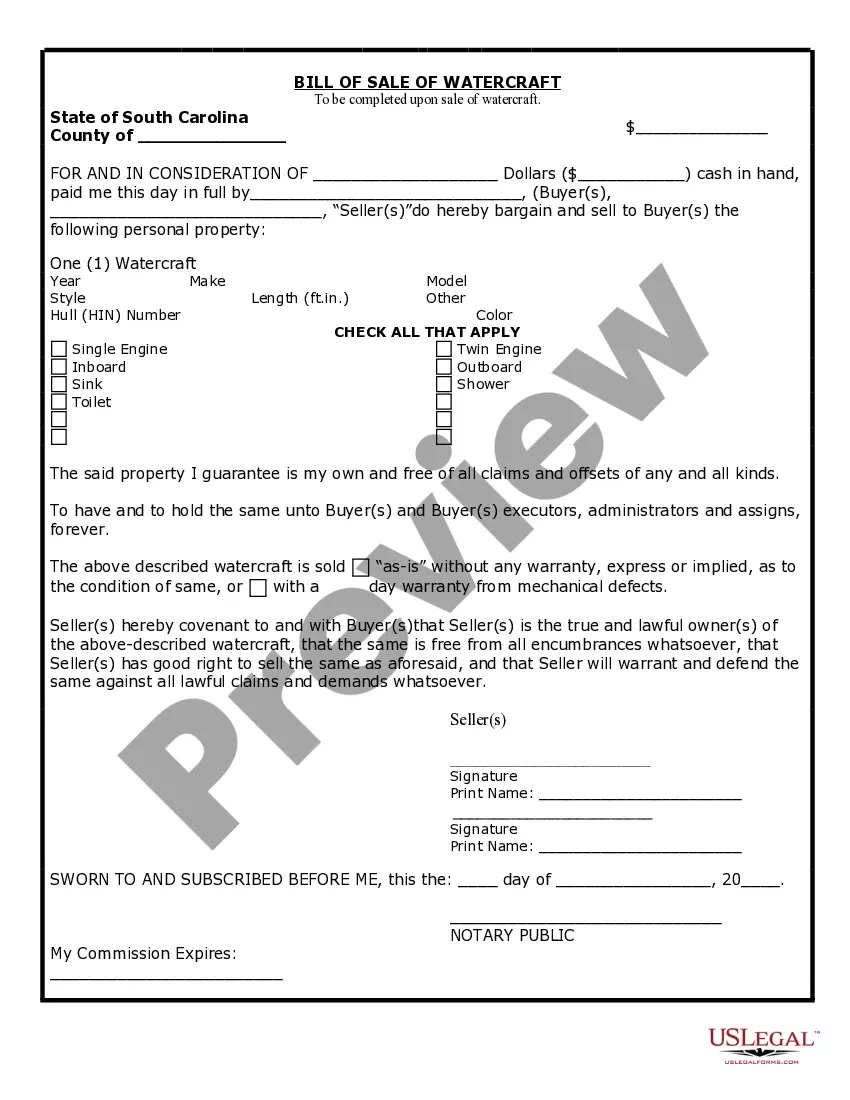

Included in your package are the following forms:

1. Assignment of Deed of Trust by Individual Mortgage Holder;

2. Assignment of Deed of Trust by Corporate Mortgage Holder;

3. Letter of Notice to Borrower of Assignment of Mortgage;

4. Letter to Recording Office for Recording Assignment of Mortgage;

Lakeland Florida Assignment of Mortgage Package is a legal document that facilitates the transfer of mortgage debt from one party to another. This package is essential when the ownership of a property changes hands, whether it be through a sale, a loan assumption, or refinancing. It includes a set of documents that need to be completed and signed by all parties involved, ensuring a smooth transfer of the mortgage. The main purpose of the Lakeland Florida Assignment of Mortgage Package is to officially document the transfer of a mortgage loan from the original lender, often referred to as the assignor, to a new lender or buyer, known as the assignee. This package typically includes the Assignment of Mortgage document, which identifies the original loan details, the assignor, and the assignee. It also highlights any conditions or additional agreements related to the transfer. Apart from the Assignment of Mortgage document, other documents commonly included in the package are the Mortgage Note, which is a written promise to repay the loan amount, and the Deed of Trust or Mortgage, which provides legal security for the loan. Additionally, a Certificate of Satisfaction or a Release of Mortgage might be included to certify that the original loan has been paid in full and the mortgage is no longer valid. There are various types of Lakeland Florida Assignment of Mortgage Packages, depending on the specific circumstances of the transfer of the mortgage. Some common types include: 1. Purchase Assignment of Mortgage Package: Used when a property is sold, allowing the new buyer to assume the existing mortgage and responsibility for making future payments. 2. Assumption Assignment of Mortgage Package: Used when a mortgage loan is taken over by a new borrower, relieving the original borrower from their obligation to repay the loan. 3. Refinance Assignment of Mortgage Package: Used when a homeowner decides to refinance their existing mortgage with a new loan, transferring the debt from the original lender to the new lender. 4. Investment Assignment of Mortgage Package: Used when an investor purchases a property with an existing mortgage, assuming the responsibility for repayment and potential investment gains. In conclusion, the Lakeland Florida Assignment of Mortgage Package is a vital set of documents that facilitate the transfer of mortgage debt in various scenarios. It ensures legal clarity, protects the interests of all parties involved, and establishes the responsibilities of the assignor and assignee.

Lakeland Florida Assignment of Mortgage Package is a legal document that facilitates the transfer of mortgage debt from one party to another. This package is essential when the ownership of a property changes hands, whether it be through a sale, a loan assumption, or refinancing. It includes a set of documents that need to be completed and signed by all parties involved, ensuring a smooth transfer of the mortgage. The main purpose of the Lakeland Florida Assignment of Mortgage Package is to officially document the transfer of a mortgage loan from the original lender, often referred to as the assignor, to a new lender or buyer, known as the assignee. This package typically includes the Assignment of Mortgage document, which identifies the original loan details, the assignor, and the assignee. It also highlights any conditions or additional agreements related to the transfer. Apart from the Assignment of Mortgage document, other documents commonly included in the package are the Mortgage Note, which is a written promise to repay the loan amount, and the Deed of Trust or Mortgage, which provides legal security for the loan. Additionally, a Certificate of Satisfaction or a Release of Mortgage might be included to certify that the original loan has been paid in full and the mortgage is no longer valid. There are various types of Lakeland Florida Assignment of Mortgage Packages, depending on the specific circumstances of the transfer of the mortgage. Some common types include: 1. Purchase Assignment of Mortgage Package: Used when a property is sold, allowing the new buyer to assume the existing mortgage and responsibility for making future payments. 2. Assumption Assignment of Mortgage Package: Used when a mortgage loan is taken over by a new borrower, relieving the original borrower from their obligation to repay the loan. 3. Refinance Assignment of Mortgage Package: Used when a homeowner decides to refinance their existing mortgage with a new loan, transferring the debt from the original lender to the new lender. 4. Investment Assignment of Mortgage Package: Used when an investor purchases a property with an existing mortgage, assuming the responsibility for repayment and potential investment gains. In conclusion, the Lakeland Florida Assignment of Mortgage Package is a vital set of documents that facilitate the transfer of mortgage debt in various scenarios. It ensures legal clarity, protects the interests of all parties involved, and establishes the responsibilities of the assignor and assignee.