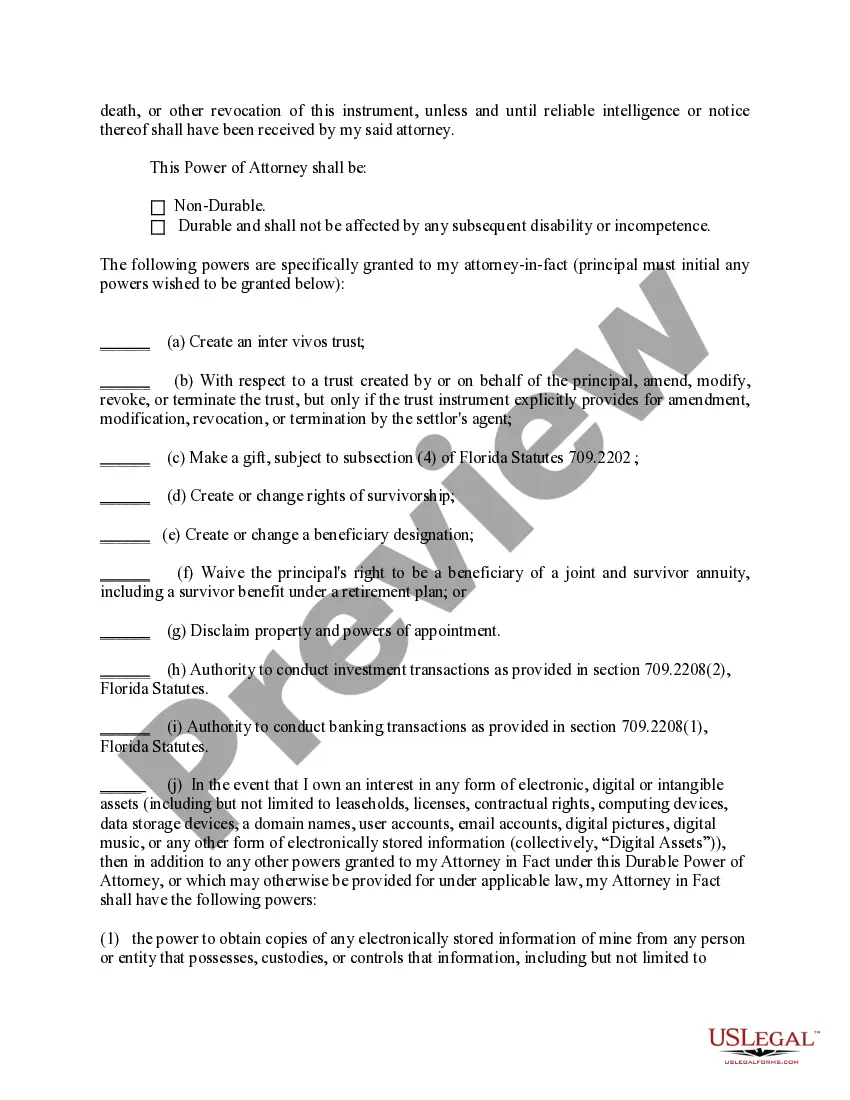

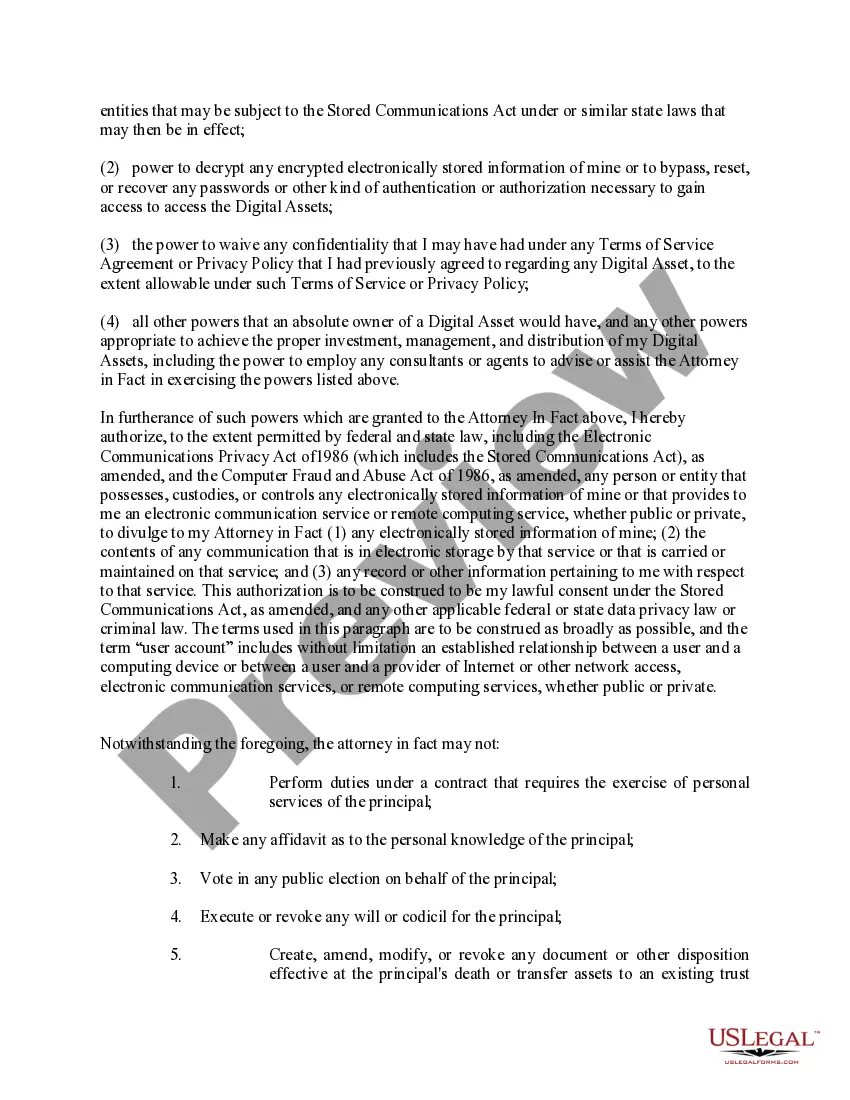

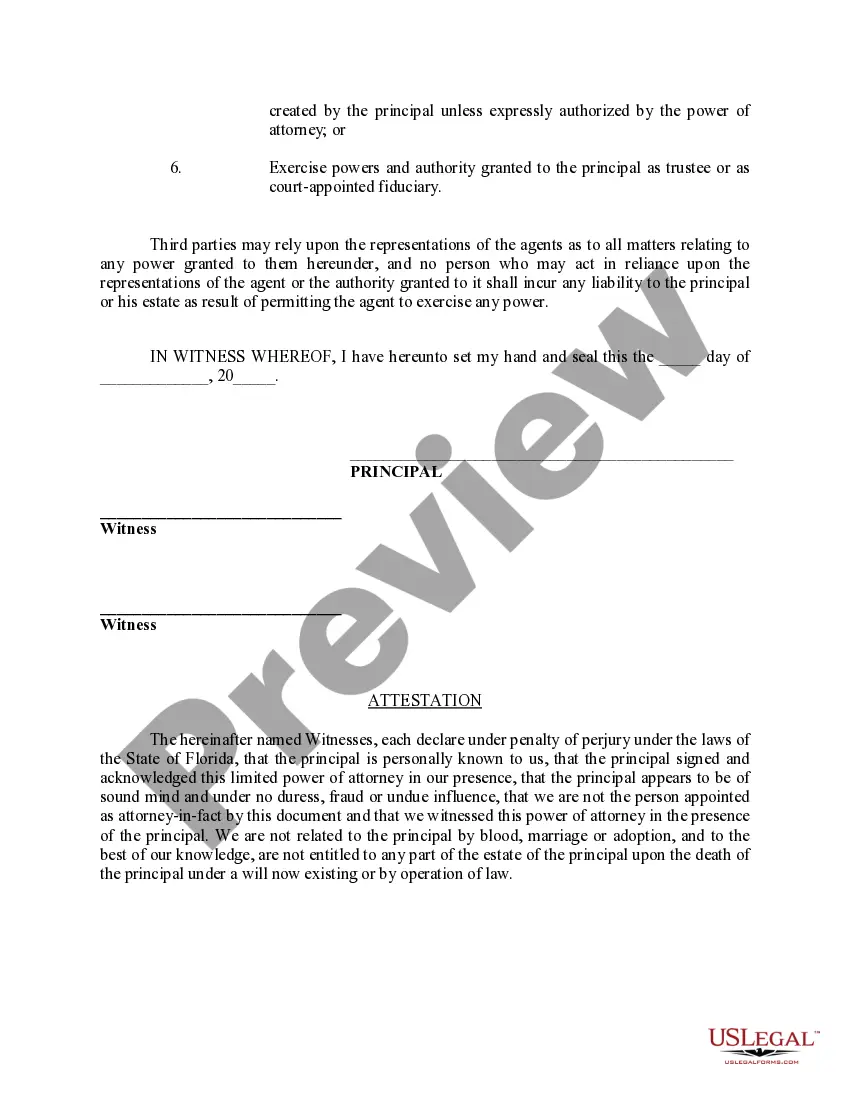

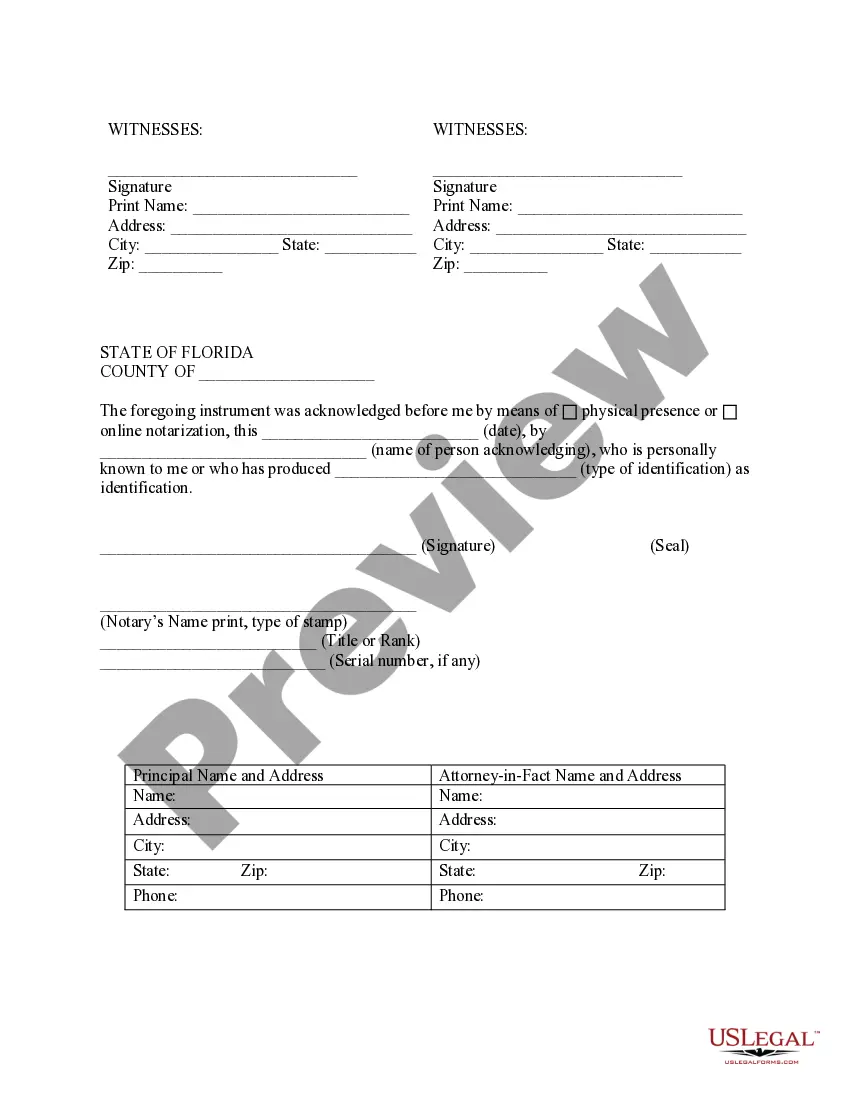

The Hillsborough Florida Limited Power of Attorney is a legal document that grants an individual, known as the "agent" or "attorney-in-fact," the authority to act on behalf of another person, known as the "principal," for specific matters and limited periods. In this type of power of attorney, the powers granted to the agent are explicitly specified, putting limitations on the agent's authority. This way, the principal can ensure that the agent only has the necessary powers to handle specific transactions or situations. The limited power of attorney can be beneficial when the principal is unavailable, incapacitated, or wants to authorize someone else to make decisions on their behalf for specific matters. Here are some common powers that can be specified in a Hillsborough Florida Limited Power of Attorney: 1. Real Estate Transactions: Granting the agent authority to buy, sell, mortgage, lease, or manage real estate properties on behalf of the principal. 2. Financial Management: Allowing the agent to manage the principal's bank accounts, investments, stocks, and other financial assets. 3. Legal Matters: Empowering the agent to engage in legal actions, including hiring attorneys, settling claims, and representing the principal in litigation matters. 4. Tax Matters: Authorizing the agent to file tax returns, receive tax refunds, correspond with tax authorities, and handle tax-related issues. 5. Business Transactions: Granting the power to the agent to enter into contracts, negotiate deals, manage business affairs, and sign legal documents on behalf of the principal. 6. Personal and Family Matters: Allowing the agent to make decisions regarding the principal's healthcare, education, welfare, and other personal matters. 7. Insurance Matters: Giving the agent the power to handle insurance policies, file claims, and make changes to existing coverage. It is important to note that the Hillsborough Florida Limited Power of Attorney can be customized to meet the specific needs and preferences of the principal. Different types of limited powers of attorney may exist depending on the situation. For instance, there could be a limited power of attorney solely for real estate matters, a limited power of attorney for financial management, or a limited power of attorney for healthcare decisions. To ensure the validity and effectiveness of a Hillsborough Florida Limited Power of Attorney, it is highly recommended consulting with an experienced attorney who can guide both the principal and the agent through the process. Additionally, the document should be executed in accordance with the legal requirements of Florida law. Remember, a power of attorney is a legal document that grants significant authority to the agent, so it should only be given to someone the principal trusts implicitly. It is also crucial to review and update the power of attorney periodically to reflect any changes in the principal's wishes or circumstances.

Hillsborough Florida Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Hillsborough Florida Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Benefit from the US Legal Forms and have instant access to any form you require. Our beneficial platform with thousands of documents simplifies the way to find and obtain virtually any document sample you require. You are able to download, complete, and sign the Hillsborough Florida Limited Power of Attorney where you Specify Powers with Sample Powers Included in a couple of minutes instead of browsing the web for several hours trying to find the right template.

Utilizing our library is an excellent strategy to improve the safety of your form submissions. Our professional legal professionals regularly check all the documents to make sure that the templates are relevant for a particular region and compliant with new acts and polices.

How do you get the Hillsborough Florida Limited Power of Attorney where you Specify Powers with Sample Powers Included? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you view. Furthermore, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Open the page with the template you need. Make certain that it is the template you were looking for: verify its name and description, and make use of the Preview function if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Pick the format to get the Hillsborough Florida Limited Power of Attorney where you Specify Powers with Sample Powers Included and revise and complete, or sign it for your needs.

US Legal Forms is one of the most significant and reliable template libraries on the web. Our company is always ready to help you in any legal procedure, even if it is just downloading the Hillsborough Florida Limited Power of Attorney where you Specify Powers with Sample Powers Included.

Feel free to make the most of our platform and make your document experience as convenient as possible!