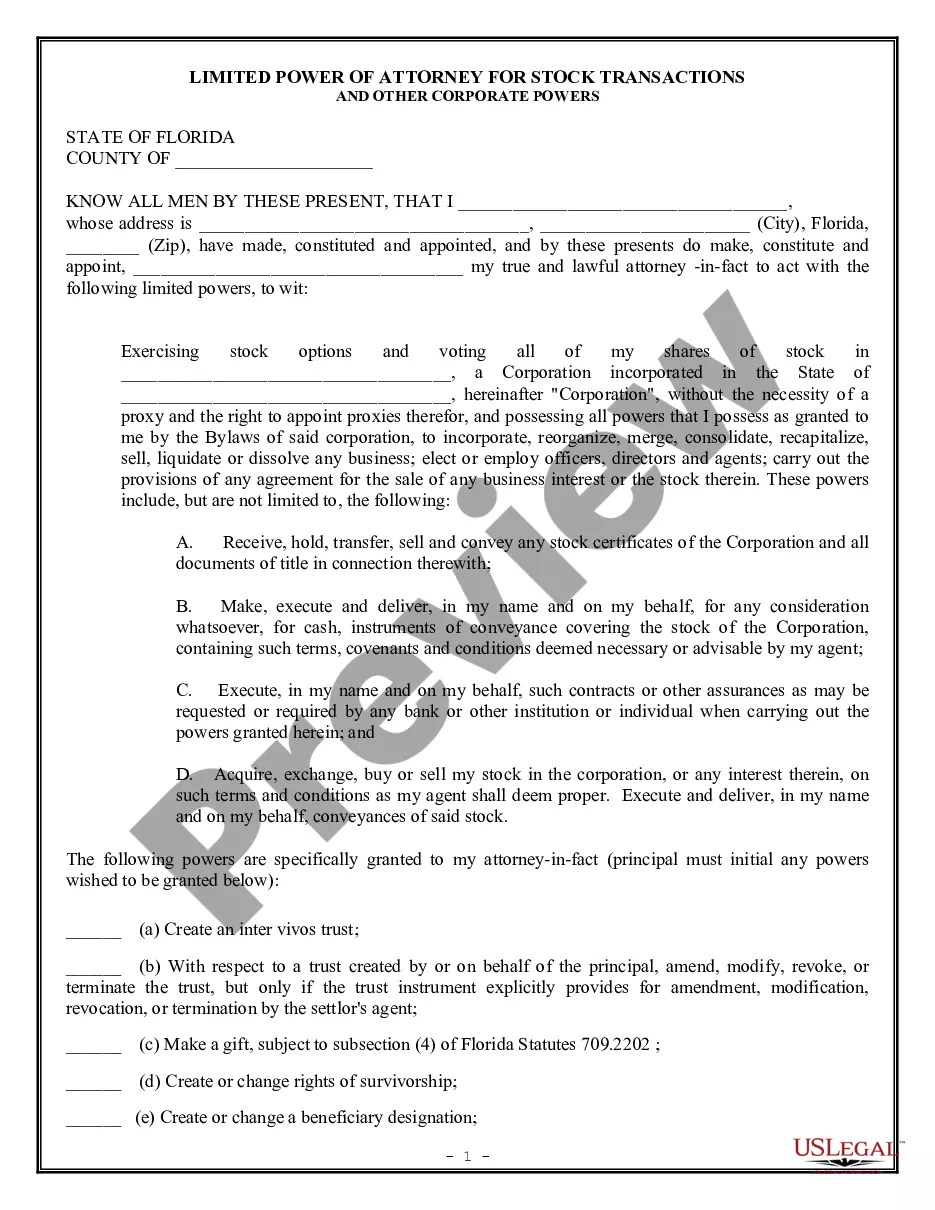

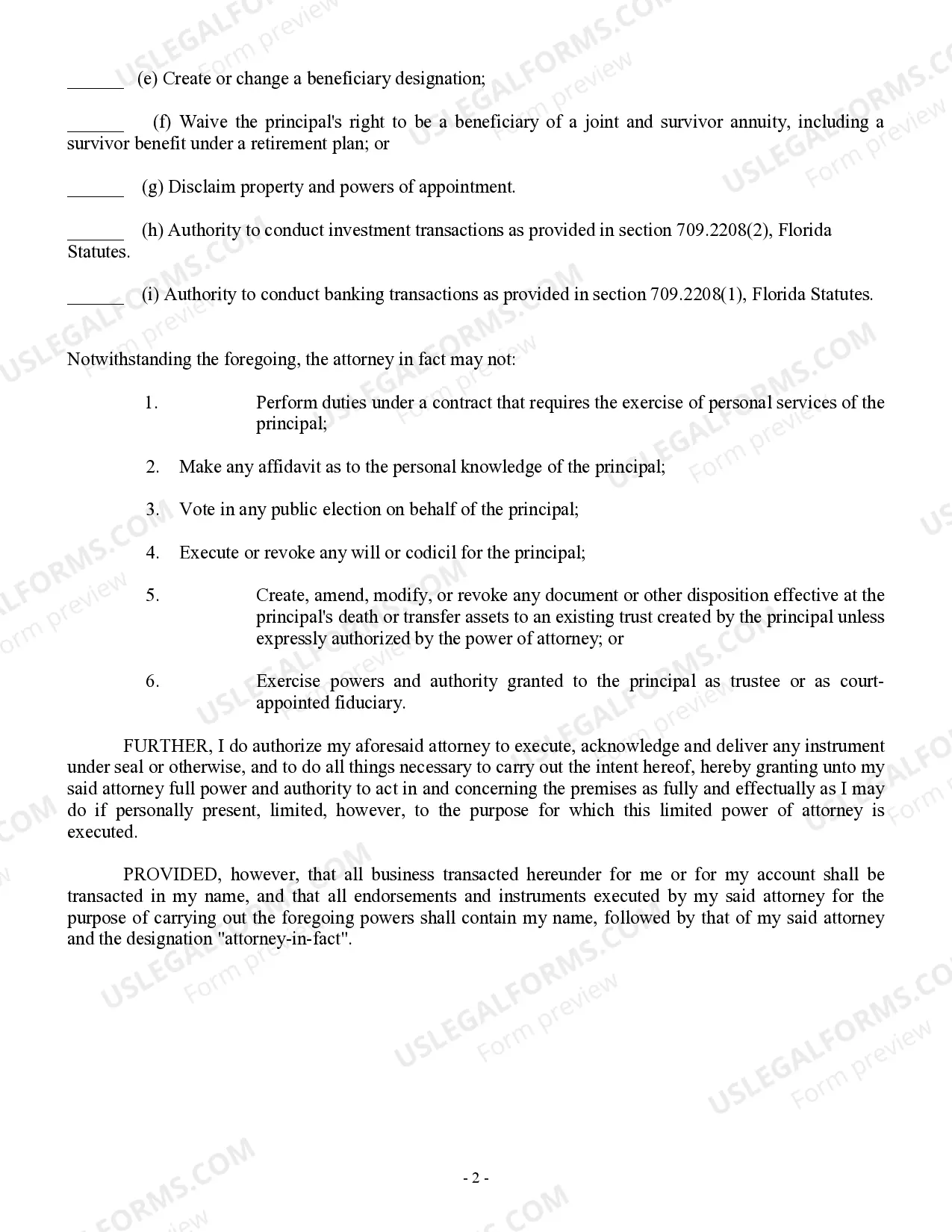

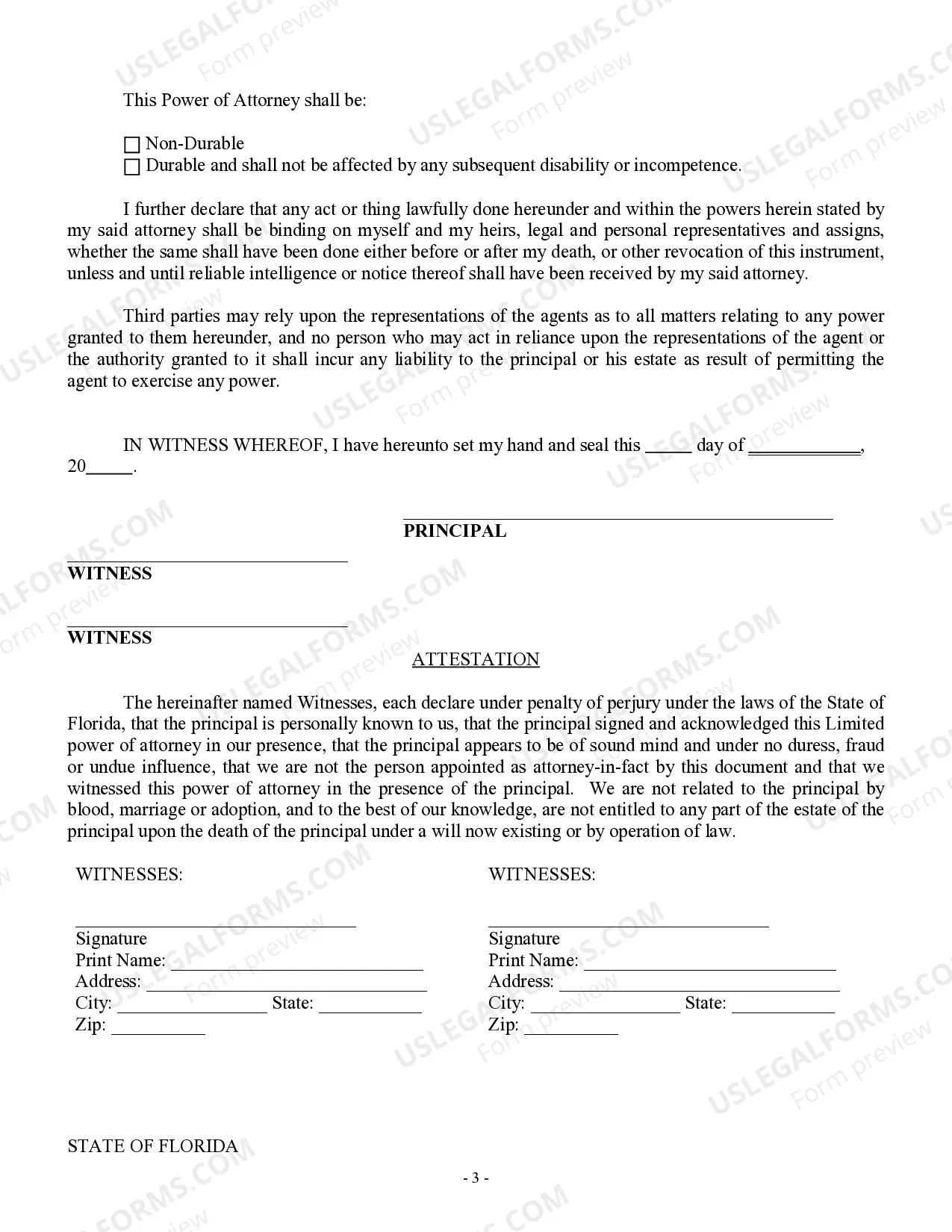

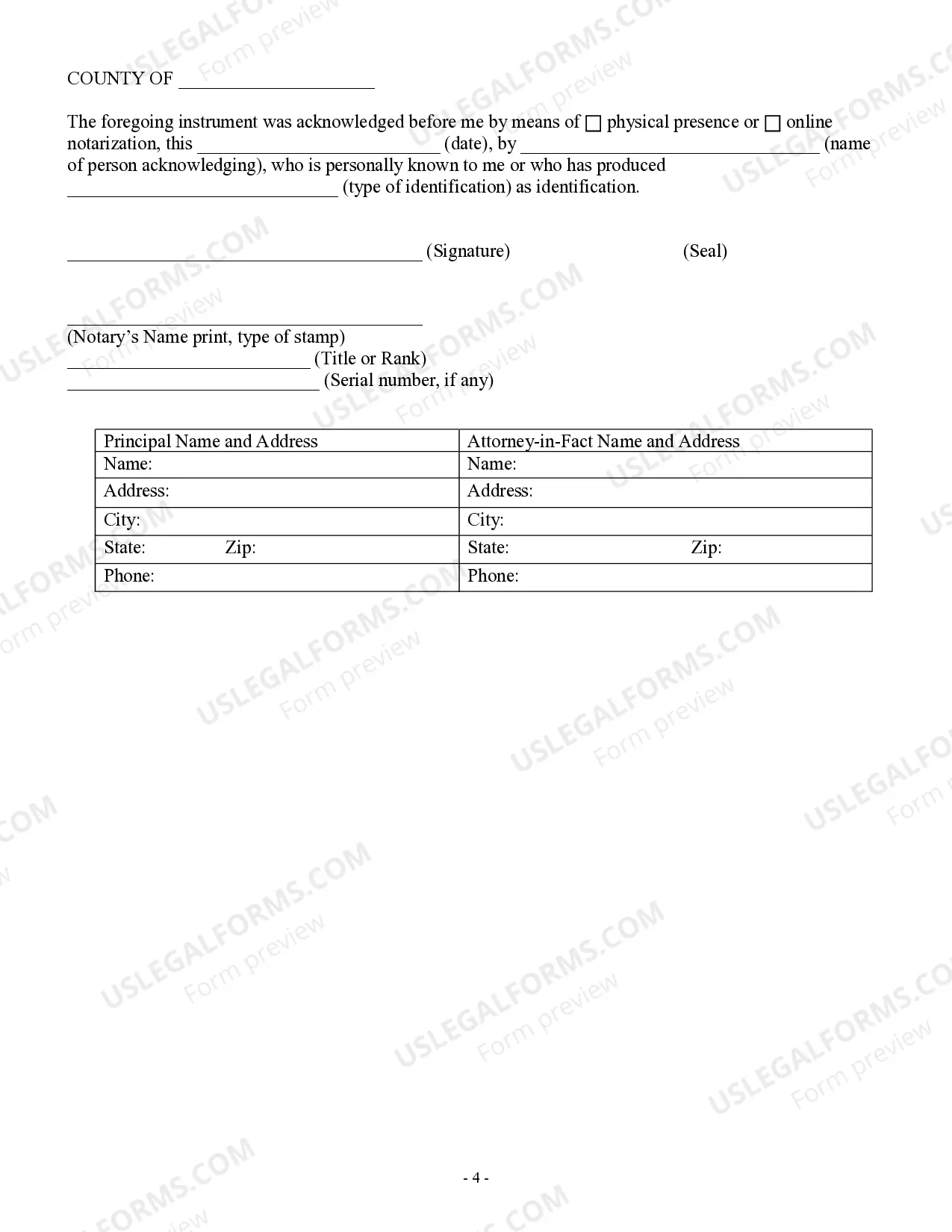

Title: Understanding the Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers Introduction: The Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal arrangement designed to grant a specified individual or entity the authority to handle specific financial and corporate matters on behalf of another party. This document is crucial in facilitating the execution of important stock transactions and corporate decisions while ensuring compliance with applicable laws and regulations. Types of Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers: 1. General Overview: The Lakeland Florida Limited Power of Attorney for Stock Transactions covers various aspects related to stock investments and transactional activities within the corporate realm. It can be divided into two main types: a) Lakeland Florida Limited Power of Attorney for Stock Transactions: This type specifically grants the designated party the authority to manage and conduct stock-related transactions on behalf of the individual or entity granting the power of attorney. The authorized party would have the power to buy, sell, trade, and transfer stocks within the specified limitations and guidelines outlined within the document. b) Lakeland Florida Limited Power of Attorney for Corporate Powers: Under this type, the designee gains the authority to act on behalf of the granter in corporate matters. This includes attending board meetings, voting on significant issues, signing important documents, and representing the granter's interests within the corporate structure. 2. Scope of Authority: The Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers defines the extent of authority granted to the designated party. It outlines the specific limitations, restrictions, and conditions under which the designee can exercise their powers. The document can be tailored to suit individual preferences, allowing the granter to retain control over certain aspects while delegating responsibility in others. 3. Validity and Termination: The Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers typically outlines the specified duration of authority granted to the designee. The granter can define a specific timeframe or specify circumstances that would lead to the termination of the power of attorney. Additionally, the document should highlight the methods by which it can be revoked, ensuring flexibility and protection for the granter. Conclusion: The Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal instrument that authorizes a designated party to act on behalf of another in specific financial and corporate matters. It provides a structured framework for executing stock transactions and corporate decisions while safeguarding the interests of the granter. This document can be customized to meet individual needs, granting the required level of control and flexibility.

Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

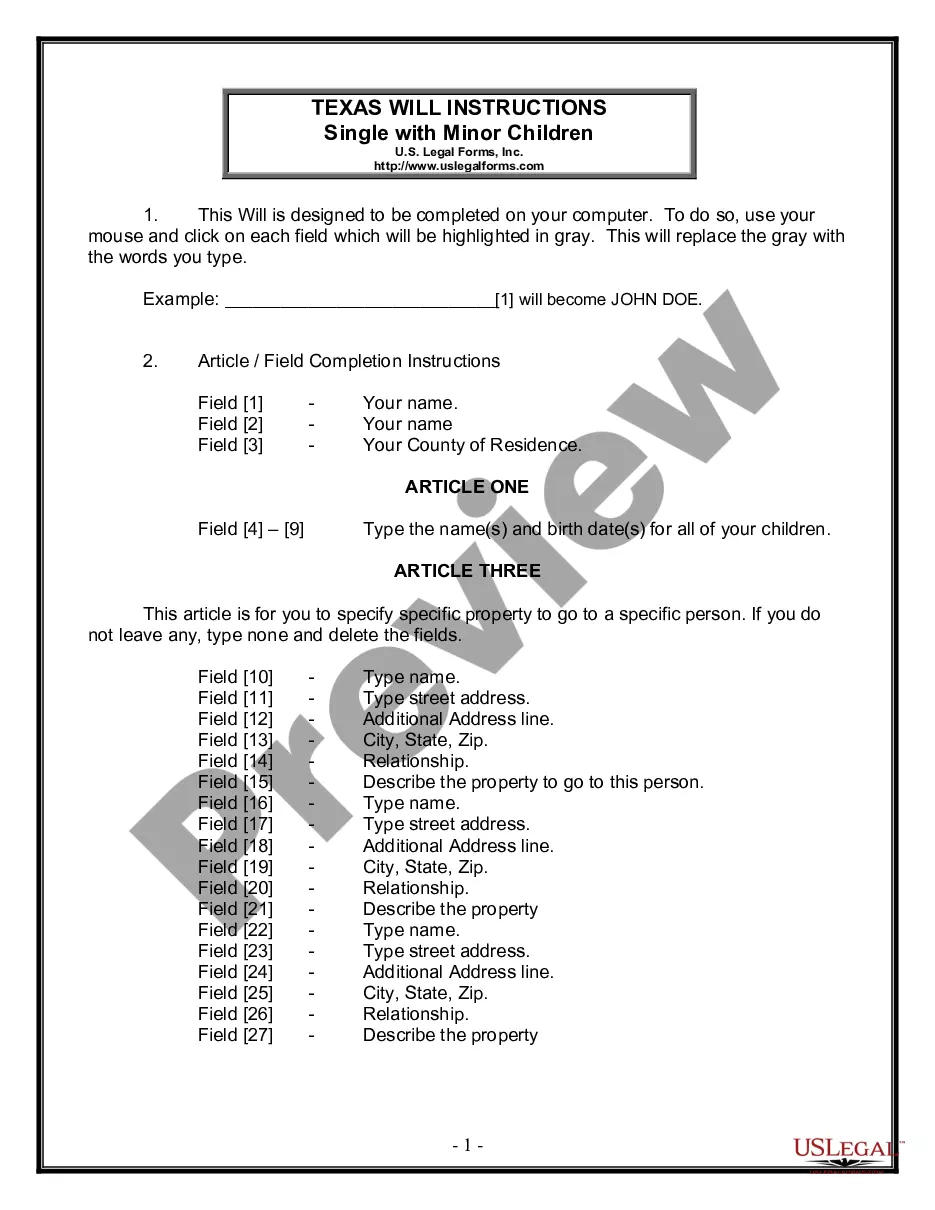

How to fill out Lakeland Florida Limited Power Of Attorney For Stock Transactions And Corporate Powers?

If you are looking for a relevant form, it’s impossible to choose a more convenient service than the US Legal Forms website – one of the most comprehensive libraries on the internet. With this library, you can get a large number of templates for company and individual purposes by types and regions, or key phrases. With our high-quality search option, getting the latest Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers is as elementary as 1-2-3. Furthermore, the relevance of every document is proved by a team of professional lawyers that on a regular basis check the templates on our website and update them in accordance with the latest state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have found the form you want. Check its information and utilize the Preview function to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the proper file.

- Affirm your selection. Select the Buy now option. Following that, select the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Pick the format and download it to your system.

- Make adjustments. Fill out, edit, print, and sign the received Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers.

Every single form you save in your profile has no expiry date and is yours permanently. You can easily access them using the My Forms menu, so if you want to receive an additional duplicate for modifying or creating a hard copy, you may return and download it once again at any moment.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Lakeland Florida Limited Power of Attorney for Stock Transactions and Corporate Powers you were looking for and a large number of other professional and state-specific templates in a single place!