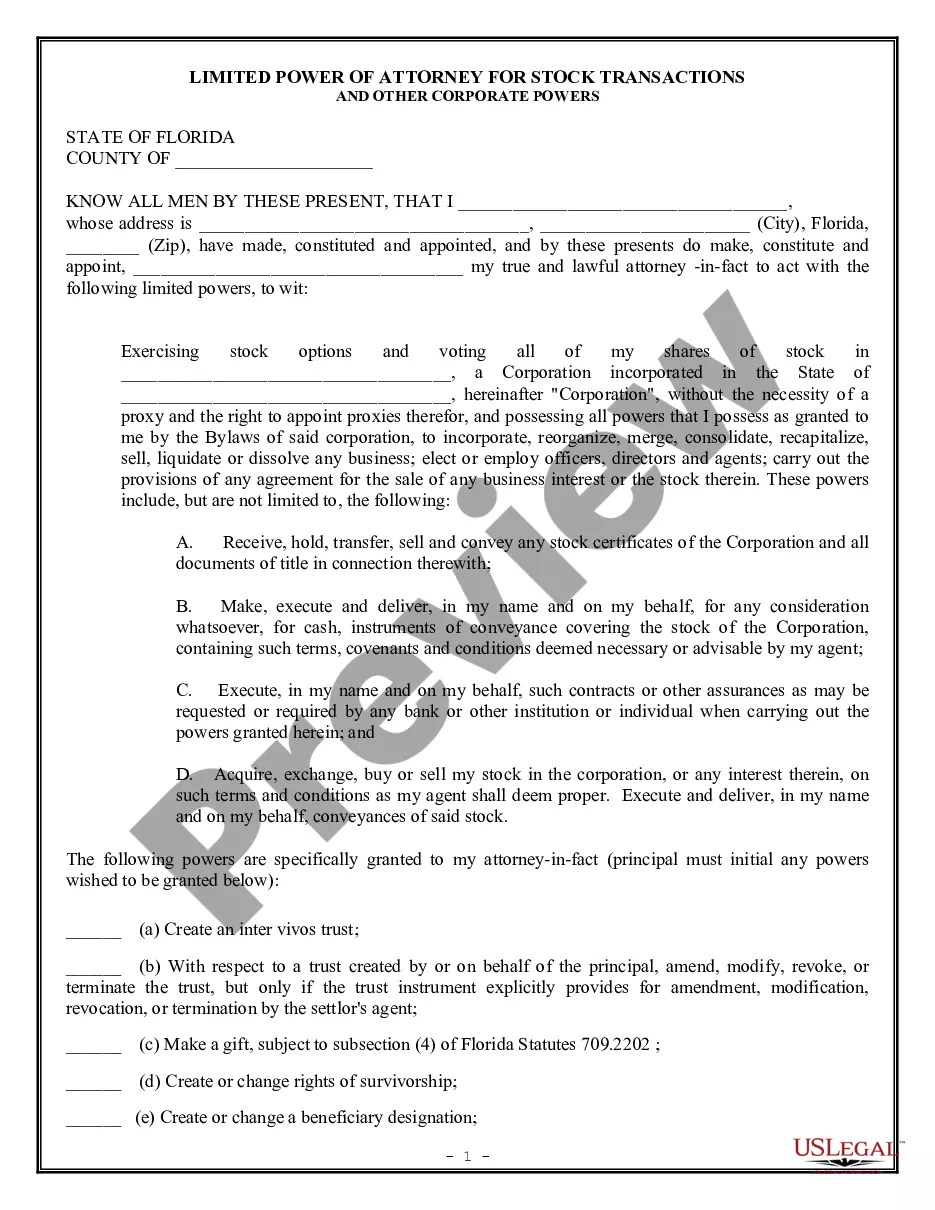

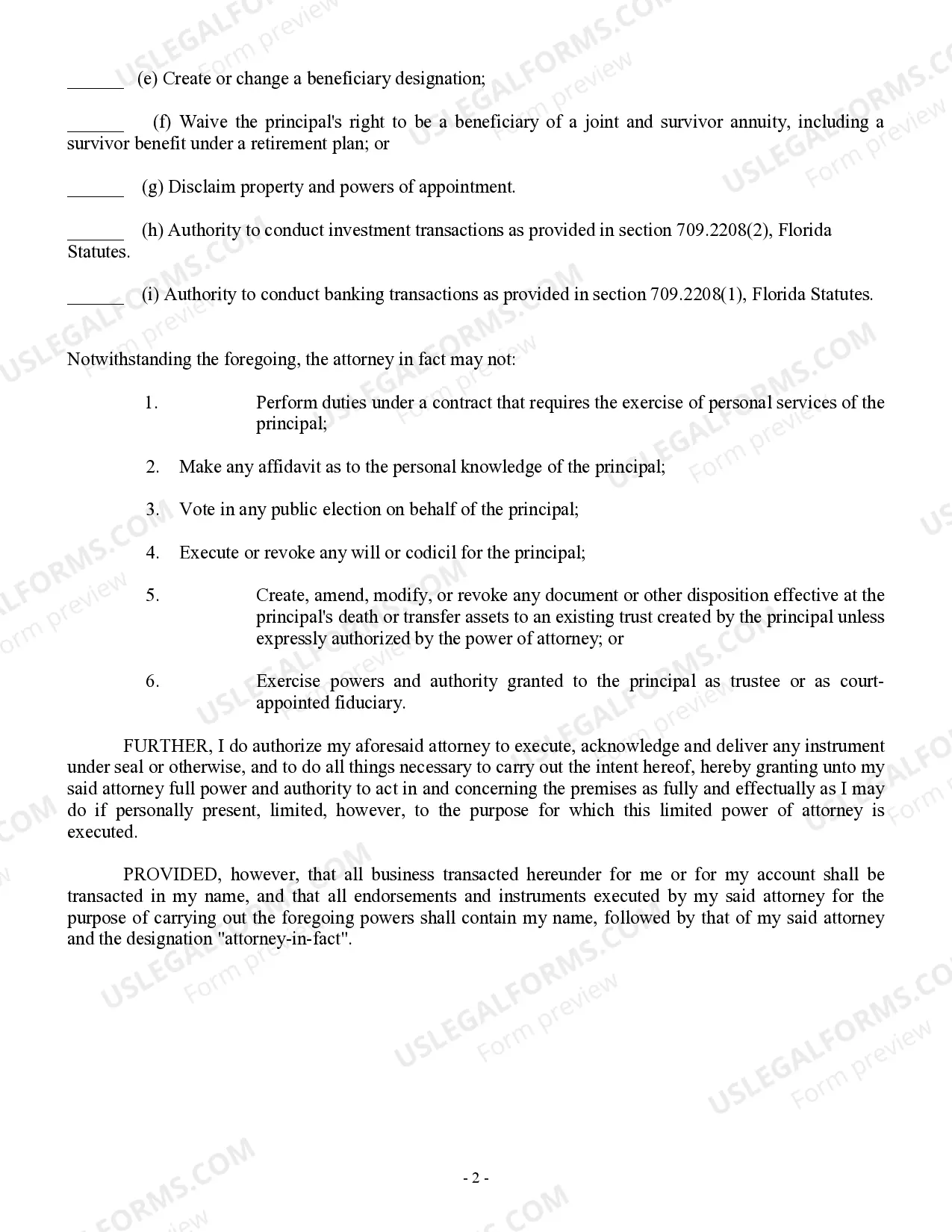

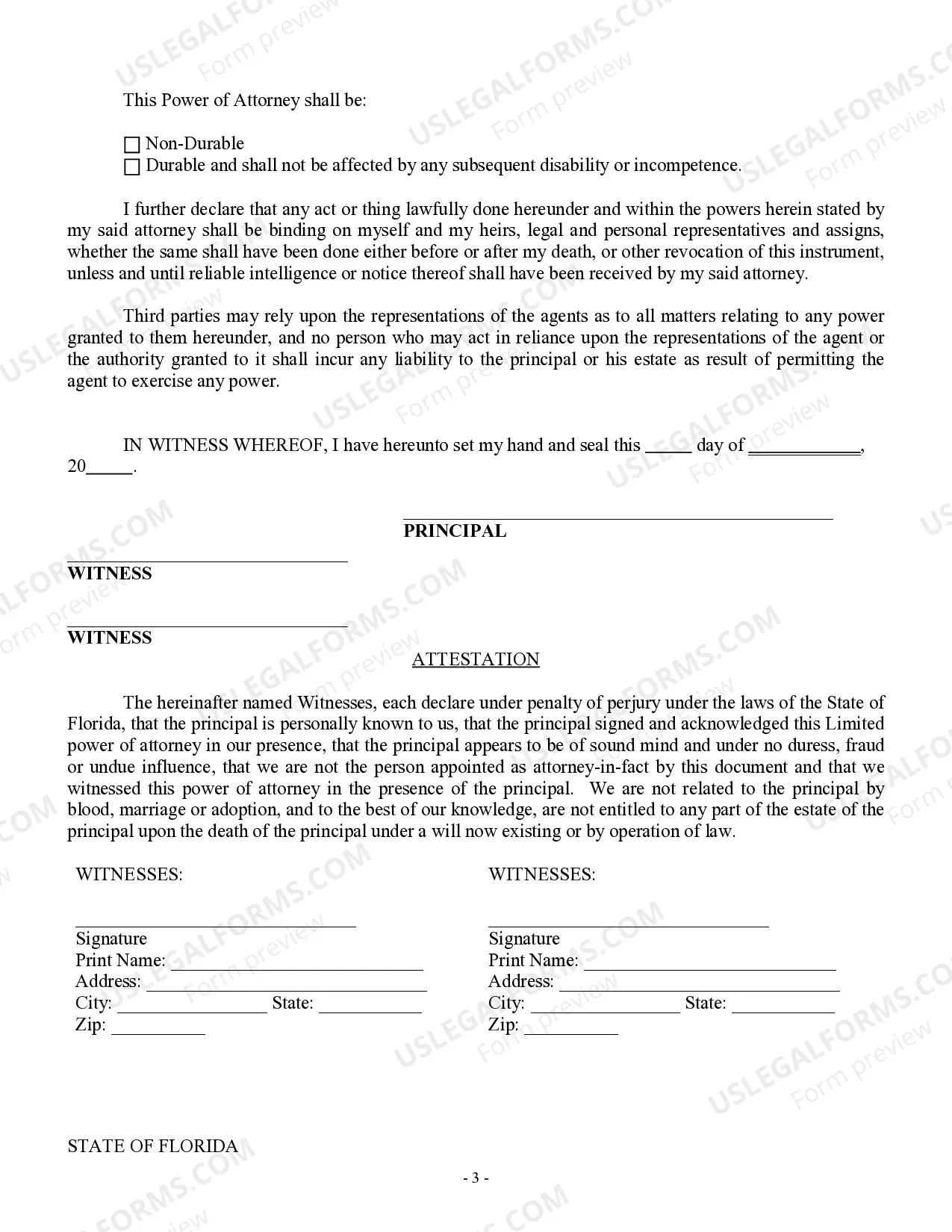

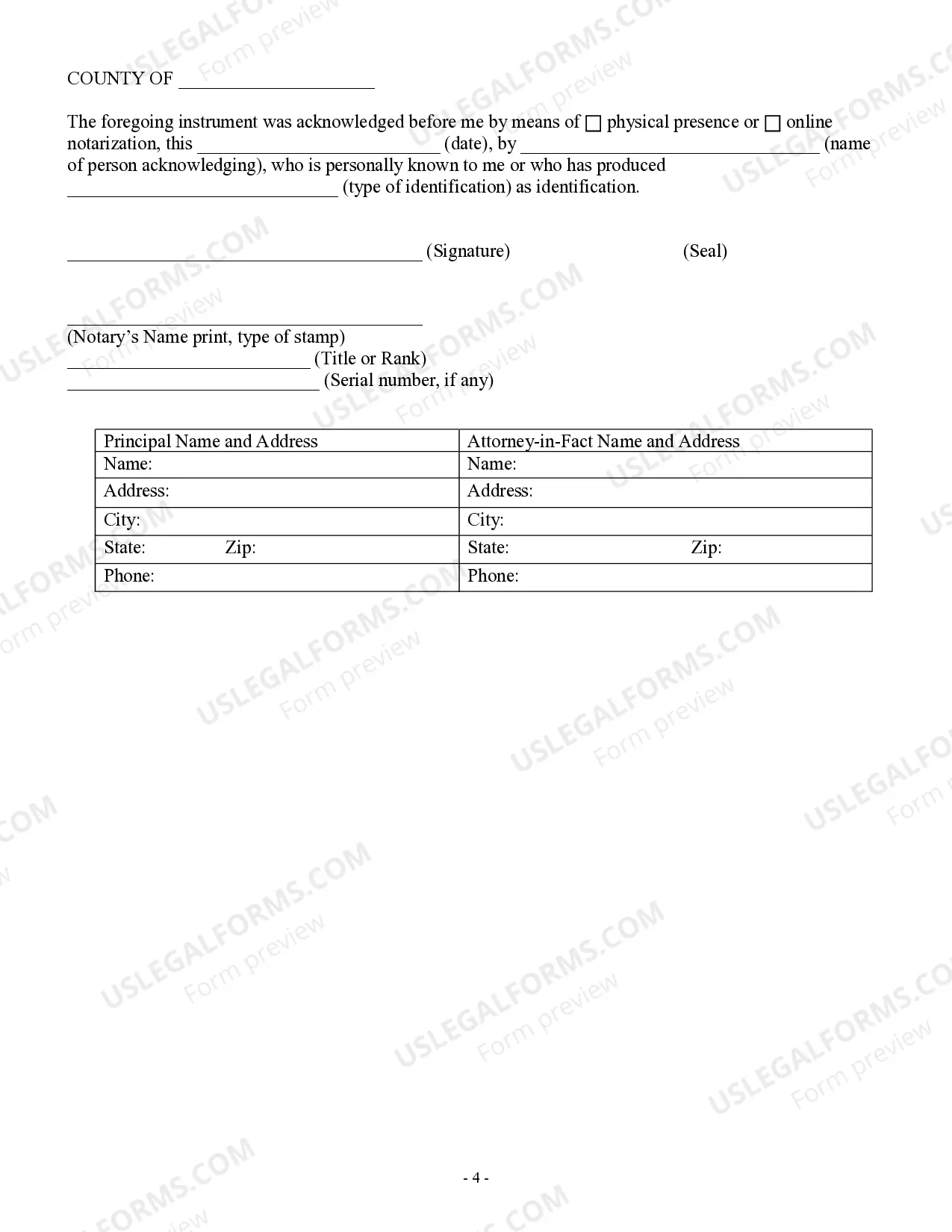

A Tallahassee Florida Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document authorizing an individual or entity (the "agent") to act on behalf of another person or organization (the "principal") in matters relating to stock transactions and corporate powers within the boundaries of Tallahassee, Florida. This legal instrument grants the agent with specific authority to make decisions, sign documents, and undertake actions to manage and conduct various business affairs of the principal in relation to stocks and corporate matters. In Tallahassee, Florida, there may exist different types of Limited Power of Attorney for Stock Transactions and Corporate Powers, depending on the specific scope and coverage of authority granted by the principal. Some variations or types of this limited power of attorney within Tallahassee, Florida may include: 1. Tallahassee Florida Limited Power of Attorney for Stock Trading: This type of limited power of attorney primarily focuses on stock trading activities. The agent appointed by the principal gains authority and is empowered to execute stock trading transactions, buy or sell stocks, manage stock portfolios, and make decisions related to stock investments on behalf of the principal. 2. Tallahassee Florida Limited Power of Attorney for Corporate Governance: This variation of limited power of attorney mainly deals with corporate governance matters. The agent, acting on behalf of the principal, gains authority to attend corporate meetings, exercise voting rights on shares, and make decisions concerning corporate actions, such as mergers, acquisitions, partnerships, or other significant business transactions. 3. Tallahassee Florida Limited Power of Attorney for Dividend Collection: With this type of limited power of attorney, the agent is authorized to collect dividends and other financial benefits on behalf of the principal. The agent has the power to endorse dividend checks, deposit them into the principal's designated accounts, or take any necessary steps to procure monetary gains associated with the stocks held by the principal. 4. Tallahassee Florida Limited Power of Attorney for Proxy Voting: This variant focuses specifically on granting the agent authority to vote on behalf of the principal in corporate matters. The agent can attend meetings, represent the principal's interests while casting votes, and act as a proxy for the principal in all voting-related proceedings. Regardless of the specific type of Tallahassee Florida Limited Power of Attorney for Stock Transactions and Corporate Powers, it is crucial to draft the document meticulously, defining the scope, limitations, and duration of the authority granted to the agent. Consulting with a qualified attorney experienced in Florida law is strongly advised to ensure this legal document accurately reflects the intentions and requirements of the principal, providing a robust framework for the agent to act in the principal's best interests.

Tallahassee Florida Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Tallahassee Florida Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Make use of the US Legal Forms and obtain immediate access to any form template you require. Our helpful website with a huge number of templates makes it easy to find and get virtually any document sample you want. You are able to export, complete, and certify the Tallahassee Florida Limited Power of Attorney for Stock Transactions and Corporate Powers in a few minutes instead of surfing the Net for many hours attempting to find an appropriate template.

Utilizing our catalog is a great strategy to increase the safety of your record submissions. Our experienced attorneys on a regular basis check all the documents to make certain that the templates are appropriate for a particular state and compliant with new laws and polices.

How do you get the Tallahassee Florida Limited Power of Attorney for Stock Transactions and Corporate Powers? If you already have a profile, just log in to the account. The Download option will appear on all the documents you look at. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Find the form you require. Make sure that it is the form you were looking for: examine its title and description, and take take advantage of the Preview option when it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Download the document. Choose the format to obtain the Tallahassee Florida Limited Power of Attorney for Stock Transactions and Corporate Powers and modify and complete, or sign it for your needs.

US Legal Forms is among the most significant and reliable document libraries on the internet. Our company is always ready to assist you in virtually any legal procedure, even if it is just downloading the Tallahassee Florida Limited Power of Attorney for Stock Transactions and Corporate Powers.

Feel free to benefit from our platform and make your document experience as efficient as possible!