Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Florida Special Durable Power Of Attorney For Bank Account Matters?

Do you require a trustworthy and cost-effective provider of legal forms to obtain the Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Issues? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce through the court, we have you covered. Our website offers over 85,000 current legal document templates for individual and business purposes. All templates that we provide access to are not generic and are designed in accordance with the specific requirements of particular states and regions.

To download the document, you must Log In to your account, find the necessary form, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time in the My documents section.

Are you unfamiliar with our platform? No problem. You can set up an account with ease, but prior to that, make sure to do the following.

Now you can create your account. Then choose the subscription option and proceed to payment. After completing the payment, download the Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Issues in any available file format. You can revisit the website whenever needed and redownload the document at no additional cost.

Finding current legal documents has never been simpler. Give US Legal Forms a try now, and eliminate the hassle of spending hours searching for legal paperwork online for good.

- Verify if the Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Issues complies with the laws of your state and local jurisdiction.

- Review the form’s specifics (if available) to understand who and what the document is meant for.

- Restart the search if the form is not applicable to your individual circumstances.

Form popularity

FAQ

You do not necessarily need a lawyer to create a power of attorney in Florida, but having legal guidance can help ensure your document is properly structured and complies with state laws. Many individuals choose to use services like UsLegalForms to streamline the process and avoid potential pitfalls. Should you need assistance in setting up a Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters, professional support can be invaluable.

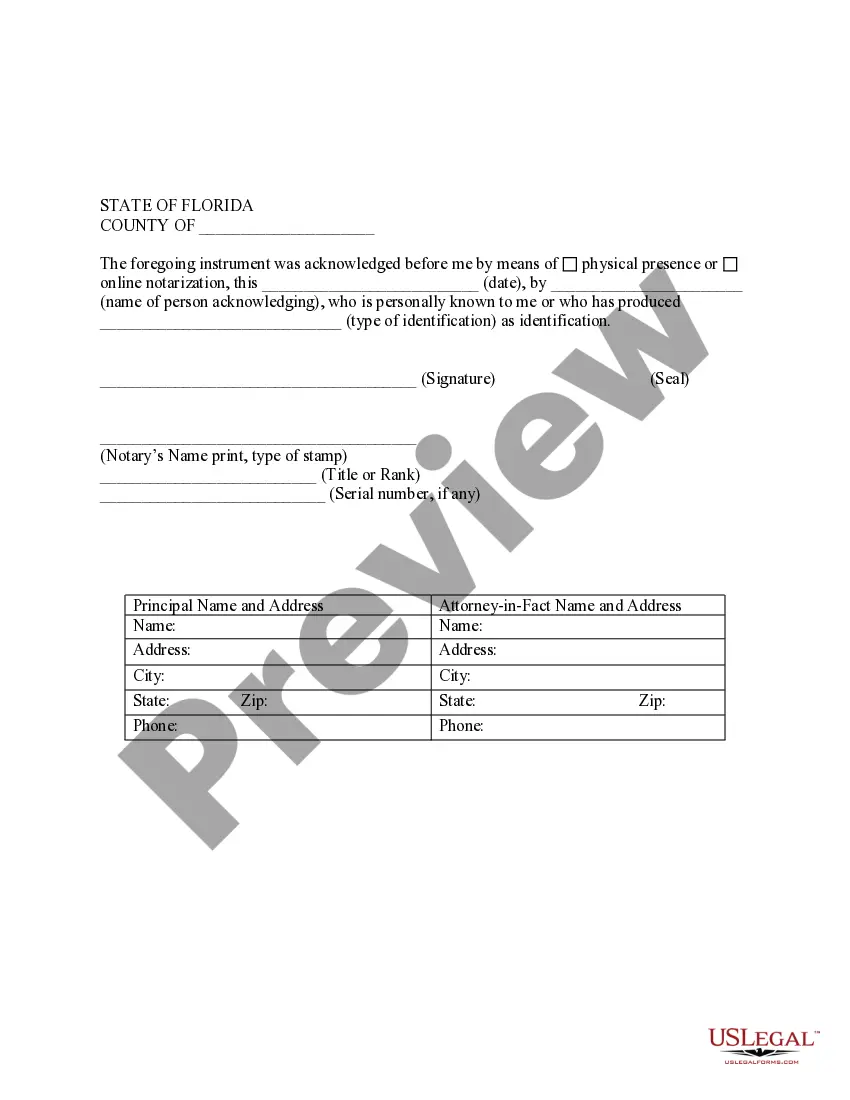

A durable power of attorney does not require recording in Florida, but recording can provide an extra layer of security, particularly in financial matters. If you plan to use your Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters regularly, consider recording it to ensure banks recognize its authority. Always check with your financial institution for their policies regarding recorded documents.

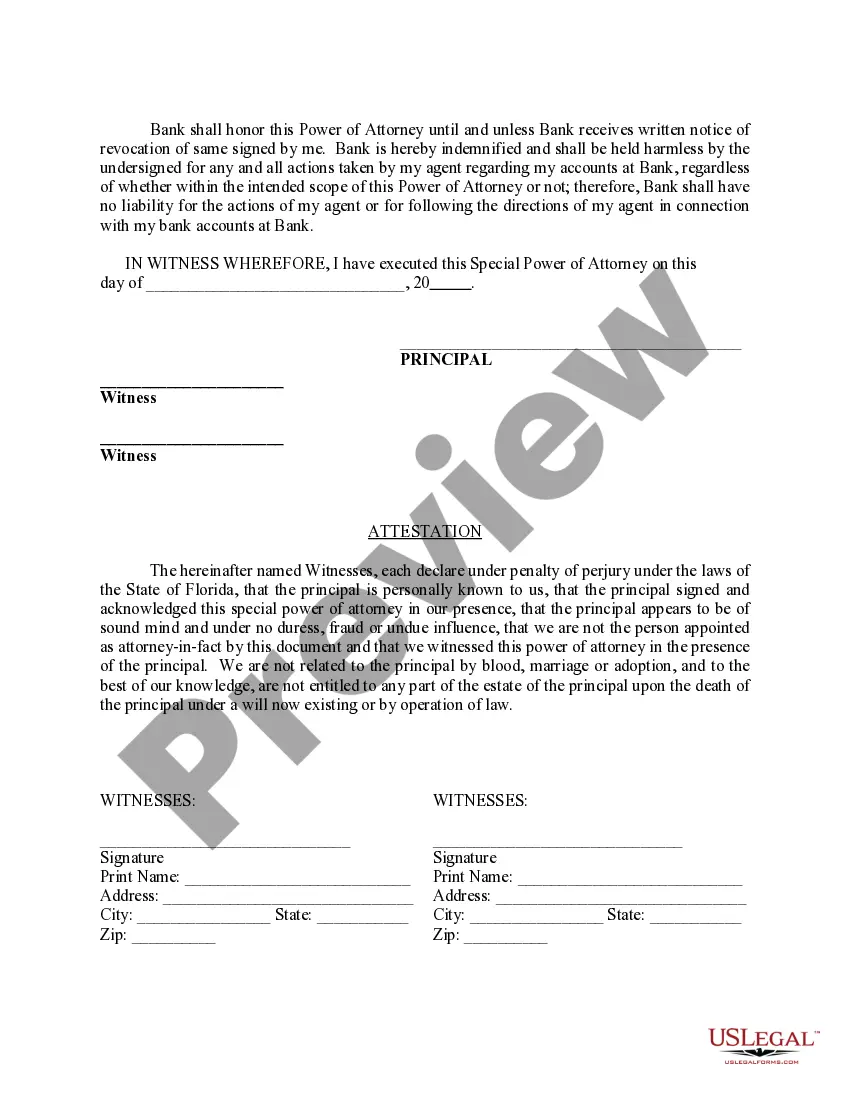

In Florida, a health care power of attorney must be signed in the presence of a notary public or two witnesses. This requirement ensures the document is valid and legally binding, which is crucial for making medical decisions on someone’s behalf. Therefore, when working on your Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters, make sure to meet all notarization and witness requirements.

To create a durable power of attorney in Florida, you must include specific language that indicates it remains effective despite the principal’s incapacity. Consulting a professional can help ensure your Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters meets all legal requirements. You can also use UsLegalForms for templates and guidance in drafting your document.

In Florida, a power of attorney does not need to be recorded unless it is used for real estate transactions. However, recording a Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters can provide additional protection when managing financial affairs. It is wise to check with your bank or financial institution for their specific requirements.

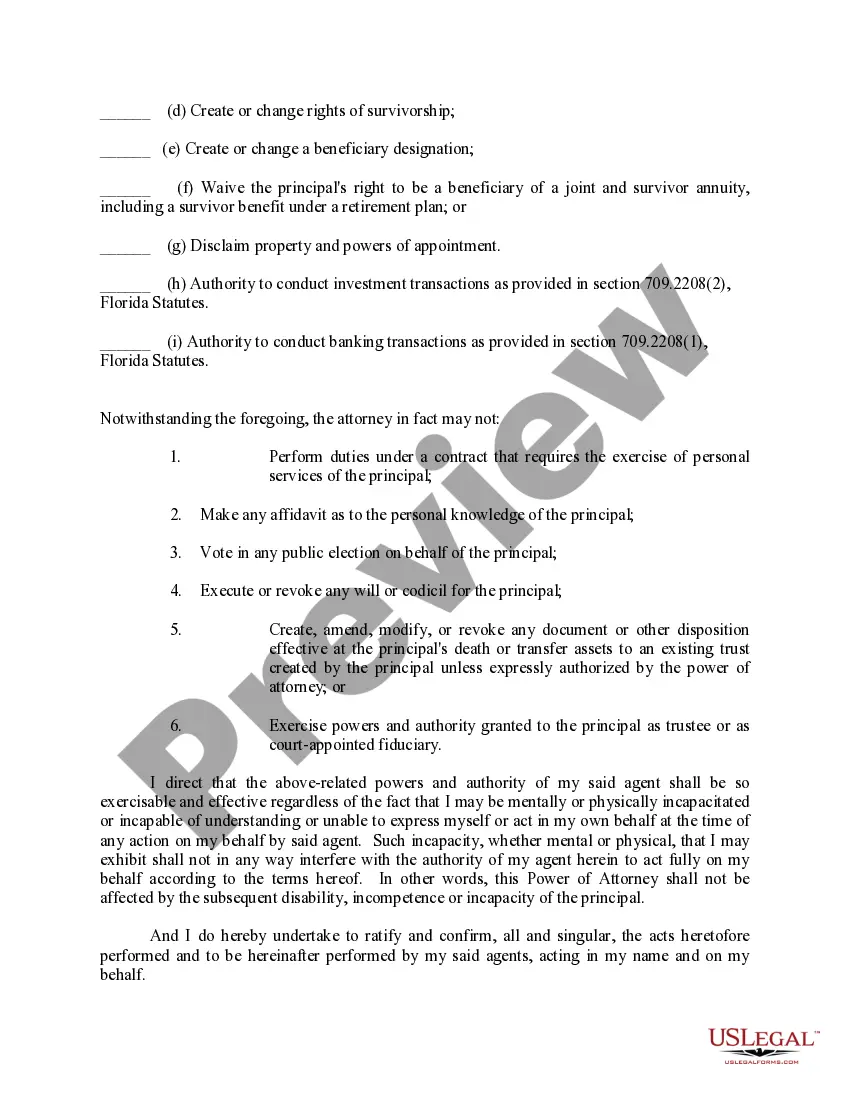

When formatting a power of attorney in Florida, begin with a clear title stating that it is a power of attorney. Include your name, the name of your agent, and a declaration of your intent to grant them authority over specified matters, including financial ones. List the powers being granted in clear, specific language, and conclude with your signature, date, and rules for notarization. For precise formatting, US Legal Forms can provide templates tailored for creating a Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters.

The primary difference between durable power of attorney and standard power of attorney in Florida lies in the authority granted during incapacity. A durable power of attorney remains effective even if you become incapacitated, allowing your designated agent to manage bank account matters seamlessly. Understanding this distinction can significantly impact your financial security, making it essential to select the appropriate option. For a thorough overview, consider US Legal Forms to guide you in establishing your Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters.

Yes, you can write your own power of attorney in Florida, but it is crucial to ensure it meets specific legal requirements. If you decide to create your own document, clearly outline the powers granted, especially for bank account matters, and follow the required signing and notarization process. To avoid pitfalls, using a professional service like US Legal Forms can help create a valid Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters tailored to your needs.

To fill out a Florida power of attorney form, start by gathering the necessary information about yourself and the person you wish to appoint. Clearly specify the powers you want to grant, especially concerning bank account matters. Be sure to sign the document in front of a notary public, as required by Florida law. For a streamlined process, consider using the services of US Legal Forms to ensure your Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters is correctly completed.

The time it takes to obtain a power of attorney varies based on the complexity of your needs and the method you choose. Generally, if you use a service like uslegalforms, you can complete the process relatively quickly, often within a few hours. However, ensure you allow additional time for notarization and filing, particularly for your Fort Lauderdale Florida Special Durable Power of Attorney for Bank Account Matters.