Miramar Florida Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Florida Special Durable Power Of Attorney For Bank Account Matters?

We consistently aim to lessen or evade legal repercussions when handling intricate law-related or financial issues.

To achieve this, we enroll in attorney services that, generally speaking, are quite expensive.

Nevertheless, not every legal issue is as intricate.

A majority of them can be managed independently.

Take advantage of US Legal Forms whenever you need to acquire and download the Miramar Florida Special Durable Power of Attorney for Bank Account Matters or any other document effortlessly and securely.

- US Legal Forms is an online repository of current DIY legal documents concerning everything from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to manage your issues independently without seeking legal assistance.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are specific to state and region, greatly simplifying the search process.

Form popularity

FAQ

Yes, a durable power of attorney can cover bank accounts if it explicitly grants that authority. This enables your designated agent to manage, withdraw, or transfer funds as needed. By creating a Miramar Florida Special Durable Power of Attorney for Bank Account Matters, you ensure that your agent has the necessary rights to handle your banking needs effectively.

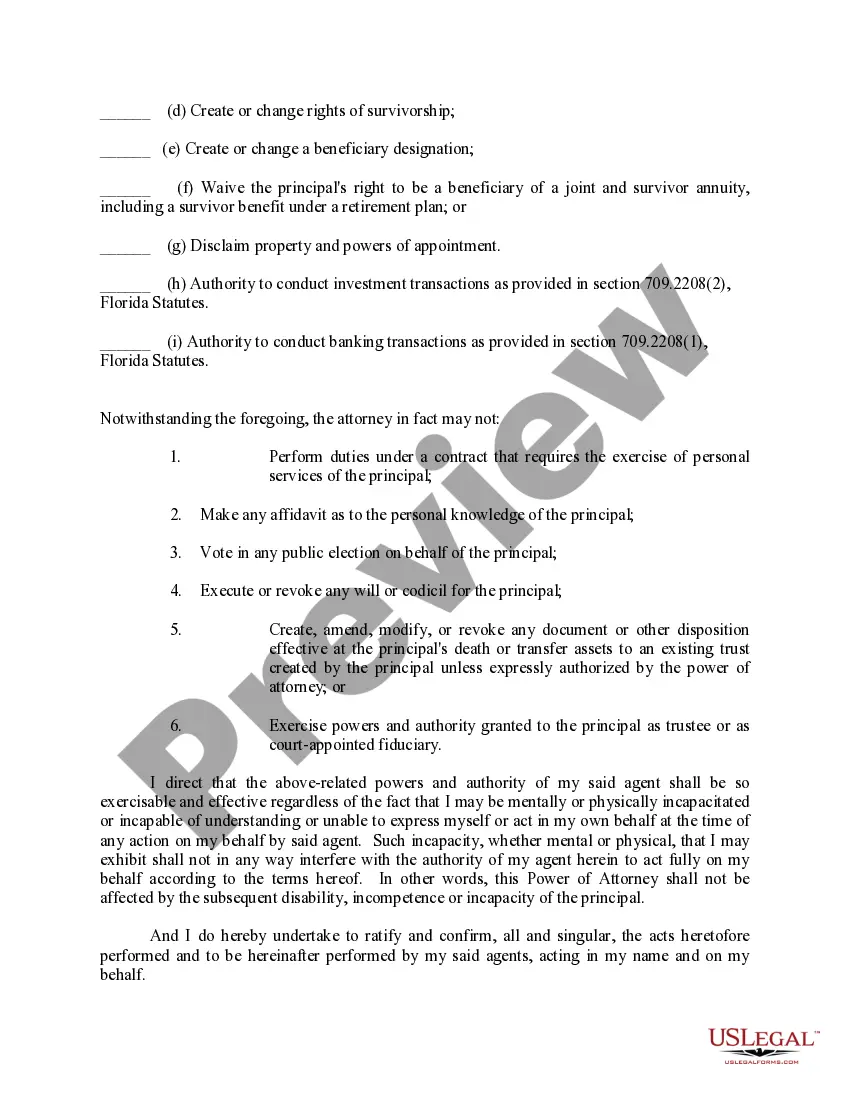

A legal power of attorney generally cannot make decisions about your medical care, make or change a will, or vote on your behalf. These actions typically require your direct input or specialized documents. Therefore, when setting up your Miramar Florida Special Durable Power of Attorney for Bank Account Matters, it's essential to understand these limitations.

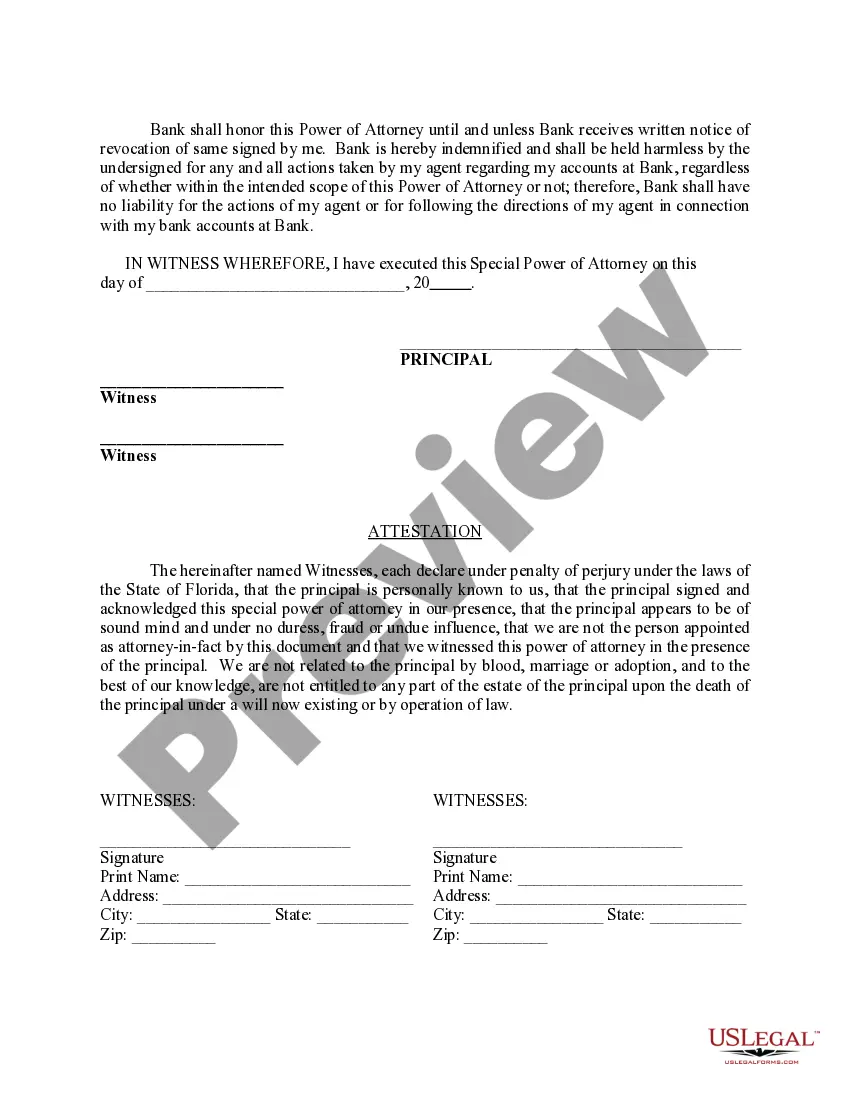

Banks are often cautious with powers of attorney to prevent fraud and protect customer assets. They need to ensure that the document is properly executed and the powers are clearly defined. A Miramar Florida Special Durable Power of Attorney for Bank Account Matters minimizes ambiguity, which can help ensure that your bank respects the authority provided.

A bank may deny a power of attorney for several reasons, including if it lacks the required signatures or if the powers granted are unclear. Sometimes, banks have internal policies that lead to additional scrutiny. To ensure acceptance, it is wise to create a Miramar Florida Special Durable Power of Attorney for Bank Account Matters that meets the bank's requirements.

In Florida, a durable power of attorney allows you to designate someone to handle your financial matters if you become incapacitated. This includes the management of bank accounts, real estate transactions, and investment decisions. A Miramar Florida Special Durable Power of Attorney for Bank Account Matters specifically enables your agent to take actions regarding your bank accounts seamlessly.

Having a power of attorney can have disadvantages, such as the potential for misuse if the agent acts against your wishes. It is crucial to select a trustworthy individual as your agent. Additionally, once you grant a Miramar Florida Special Durable Power of Attorney for Bank Account Matters, the authority doesn’t automatically expire, so you must revoke it if circumstances change.

Yes, banks typically honor a durable power of attorney. However, it's important to ensure that the document complies with state laws and clearly outlines the powers granted. In Miramar, Florida, a Special Durable Power of Attorney for Bank Account Matters specifically addresses the authority over bank transactions, making it more likely to be accepted by financial institutions.

The approval time for a power of attorney at a bank can vary but typically takes a few days. It often involves the bank reviewing the document to ensure it complies with their guidelines. Having your Miramar Florida Special Durable Power of Attorney for Bank Account Matters organized and correctly formatted can expedite the approval process.

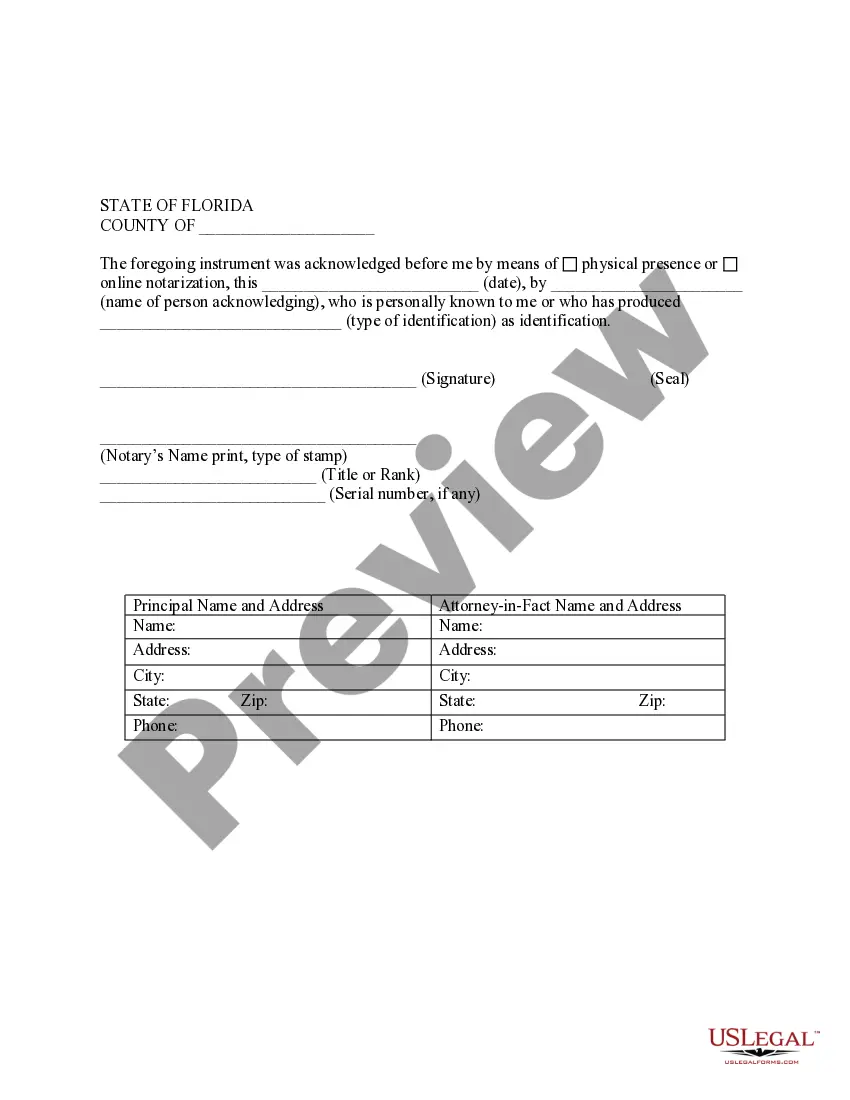

To write a power of attorney letter for a bank, start by clearly stating your name, the name of the agent, and the powers being granted. Be specific about the authority regarding your bank accounts to ensure clarity. Using a service like uslegalforms can simplify drafting your Miramar Florida Special Durable Power of Attorney for Bank Account Matters with customizable templates.

Choosing between a power of attorney and a joint bank account depends on your needs. A power of attorney allows specific authority over financial matters without sharing ownership, which can be especially useful for managing your Miramar Florida Special Durable Power of Attorney for Bank Account Matters. A joint account, on the other hand, automatically grants shared access to funds, which may not be preferable in all situations.