Orange Florida Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Florida Special Durable Power Of Attorney For Bank Account Matters?

Acquiring validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online database of over 85,000 legal documents catering to both personal and professional requirements across various real-world scenarios.

All the paperwork is systematically organized by field of application and jurisdiction categories, making it simple to find the Orange Florida Special Durable Power of Attorney for Bank Account Matters effortlessly.

Essential to keep documents organized and in accordance with legal standards. Leverage the US Legal Forms repository to always have crucial document templates readily available!

- Ensure to check the Preview mode and document description.

- Select the correct template that fulfills your requirements and aligns with your local jurisdiction standards.

- Search for an alternative template if necessary.

- If there are discrepancies, utilize the Search tab above to find the accurate document. If it fits your needs, proceed to the next step.

- Finalize the purchase by clicking the Buy Now button and choosing your desired subscription plan.

Form popularity

FAQ

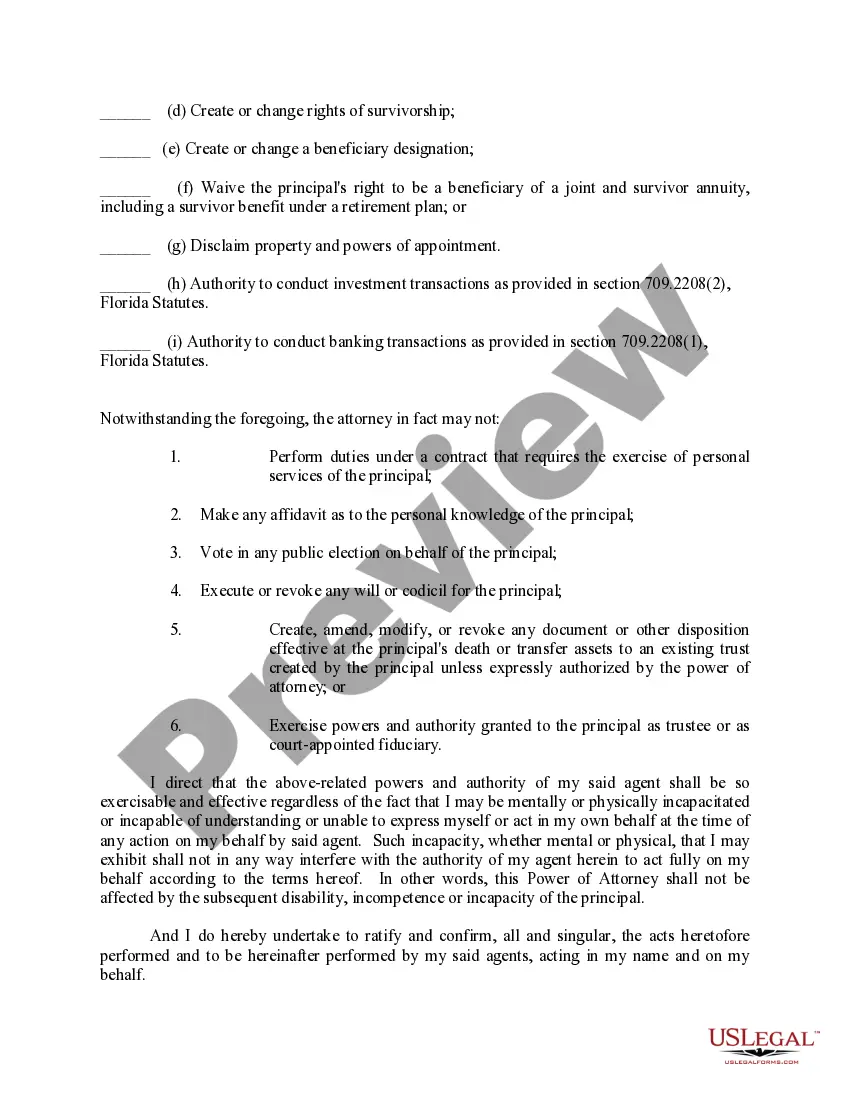

In Florida, a durable power of attorney enables you to designate someone to handle your financial matters if you become unable to do so. This includes managing your bank accounts, paying bills, and making other financial decisions on your behalf. The Orange Florida Special Durable Power of Attorney for Bank Account Matters specifically ensures that your trusted individual can act on your behalf regarding bank-related issues. By using this document, you provide peace of mind, knowing that your financial affairs will be managed according to your wishes.

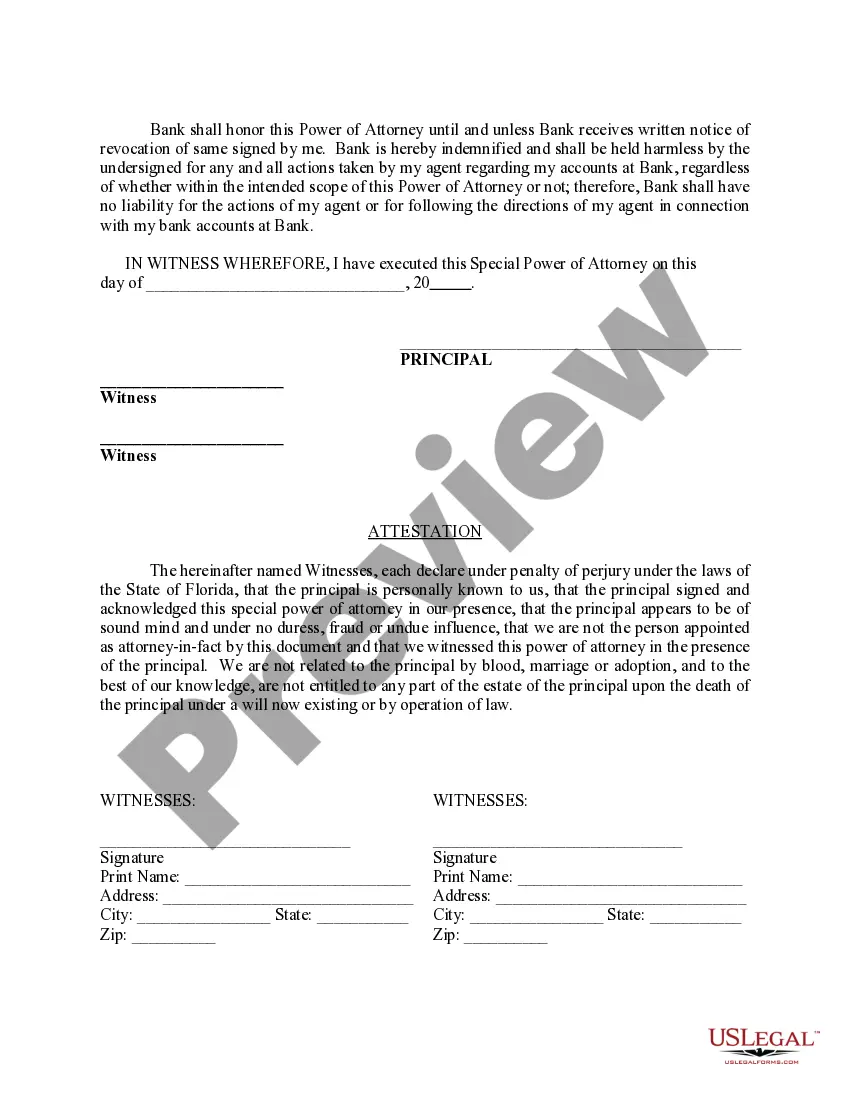

Writing a power of attorney letter for a bank involves including specific information in a structured manner. Begin with the principal's details, followed by the agent's information and the specific powers granted, focusing on bank account matters. Consider utilizing the Orange Florida Special Durable Power of Attorney for Bank Account Matters template from USLegalForms to ensure compliance with state laws. Finally, include signature sections for both parties and a notary acknowledgment.

To add power of attorney to your bank account, you will need to provide the bank with a copy of your Orange Florida Special Durable Power of Attorney for Bank Account Matters. Visit your bank's branch, and speak to a representative about your intention to add a POA. Complete any necessary paperwork provided by the bank, and ensure that you and the principal are both present for verification.

Most banks do recognize power of attorney documents, including the Orange Florida Special Durable Power of Attorney for Bank Account Matters. However, recognition may vary by institution, so it's wise to confirm with your bank beforehand. Ensure your POA complies with Florida laws to facilitate acceptance, and be prepared to provide identification and any additional required documents.

Yes, you can speak to the bank on behalf of someone else if you hold a valid power of attorney, such as the Orange Florida Special Durable Power of Attorney for Bank Account Matters. This document grants you the authority to manage specified financial affairs for the principal. Make sure to present the POA to bank officials to establish your legal ability to act on their behalf.

Presenting your power of attorney to the bank involves a few straightforward steps. First, gather your Orange Florida Special Durable Power of Attorney for Bank Account Matters document. Next, visit your bank branch in person and ask to speak with a representative. It’s important to have valid identification ready, as the bank will need to verify both your identity and your authority under the POA.

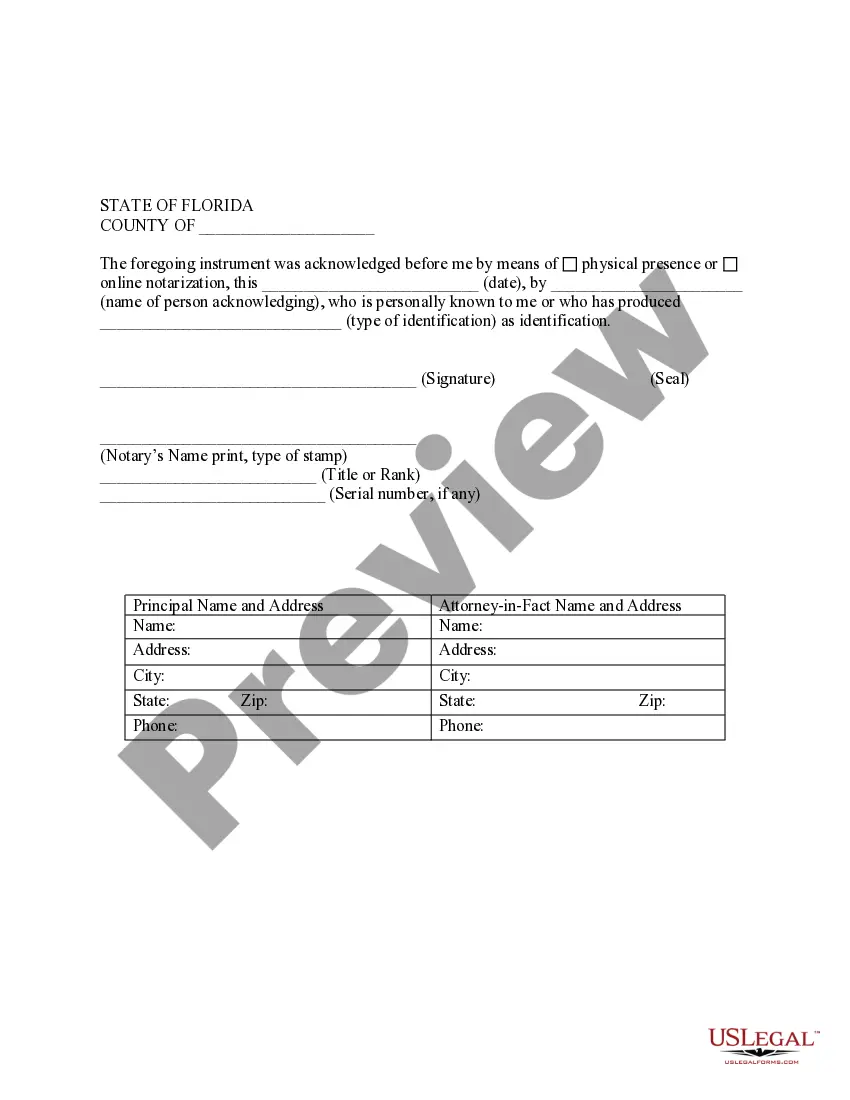

Filling out a financial power of attorney, especially an Orange Florida Special Durable Power of Attorney for Bank Account Matters, requires clear identification of the principal and the agent. Begin by using official forms that comply with Florida laws. You should specify the powers granted, which may include managing bank account transactions. Finally, ensure the document is signed in front of a notary public to make it valid.

Getting power of attorney for your bank account is a structured process. Start by determining if you need a general or durable power of attorney, depending on your long-term needs. Next, create the document, and ensure it is appropriately signed and notarized. If you want a quick and reliable option, USLegalForms provides resources to help you establish an Orange Florida Special Durable Power of Attorney for Bank Account Matters efficiently.

Obtaining a durable power of attorney in Florida involves a few straightforward steps. First, you need to draft the document, ensuring it meets Florida's legal requirements. After that, you should sign your durable power of attorney in front of a notary public and witness. To streamline the process, you can utilize USLegalForms to access templates specifically for the Orange Florida Special Durable Power of Attorney for Bank Account Matters.

While a durable power of attorney is beneficial, it does have certain drawbacks. One potential issue is the risk of misuse, as the agent may act without proper oversight. Additionally, once the durable power of attorney is established, it can be challenging to revoke unless specified in the document. Thus, it is crucial to carefully choose your agent when creating an Orange Florida Special Durable Power of Attorney for Bank Account Matters.