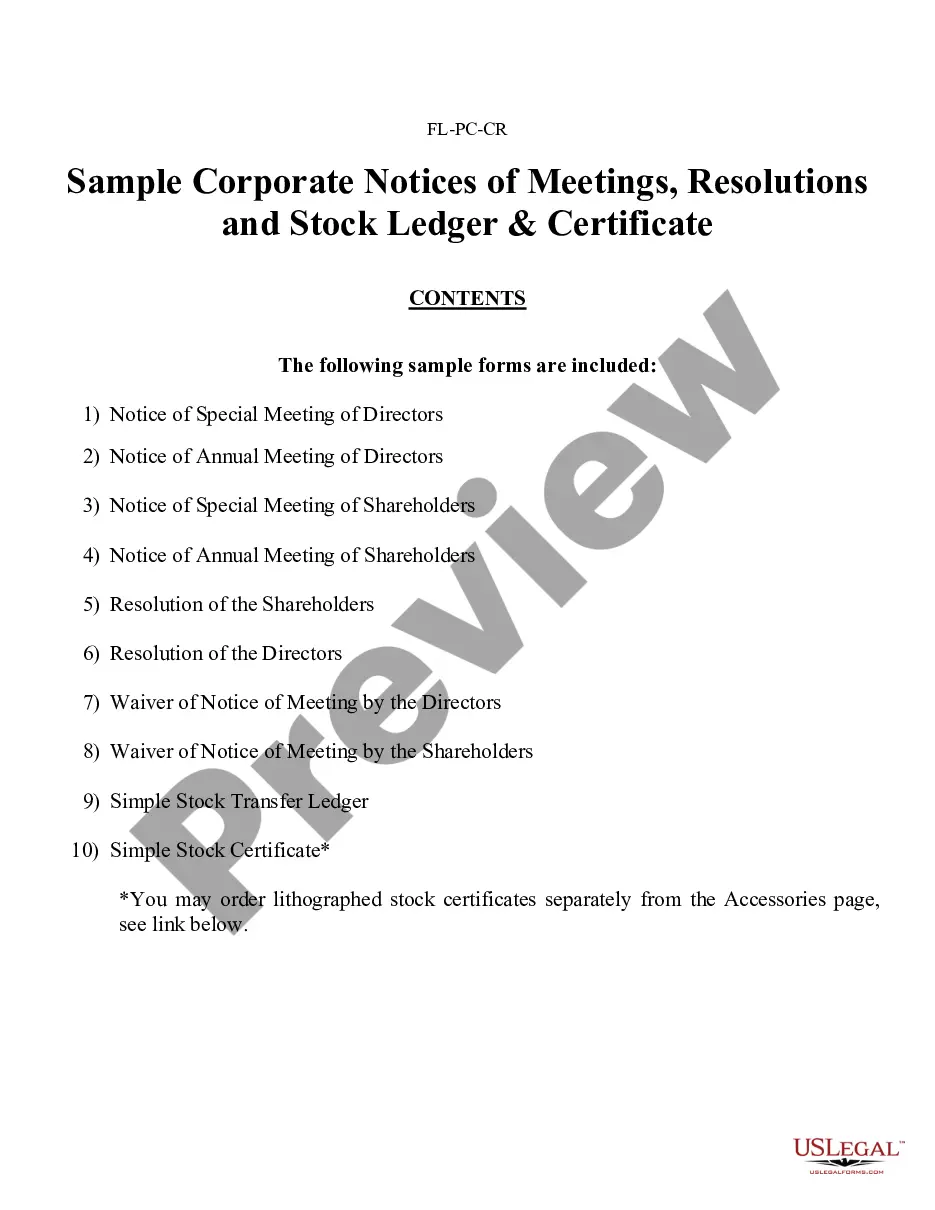

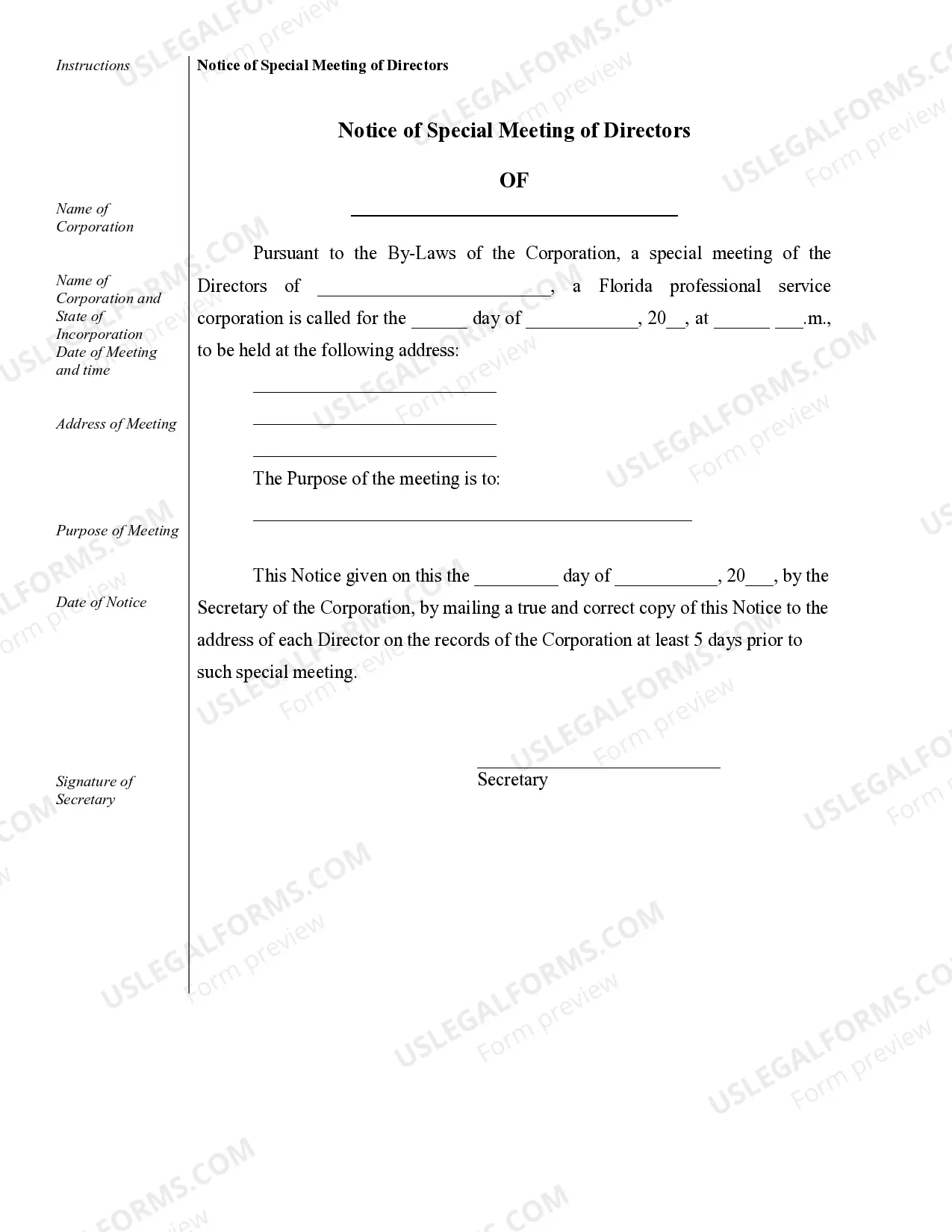

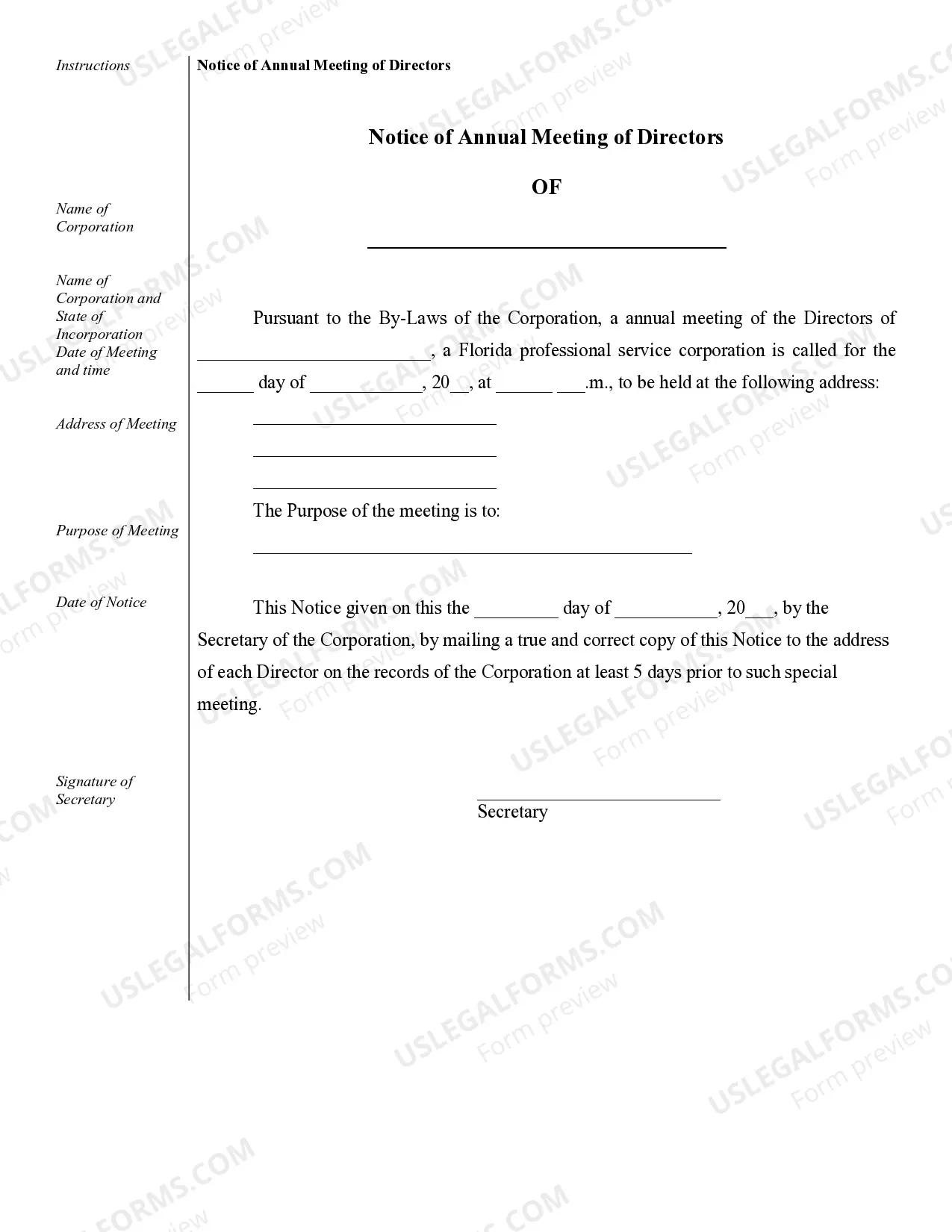

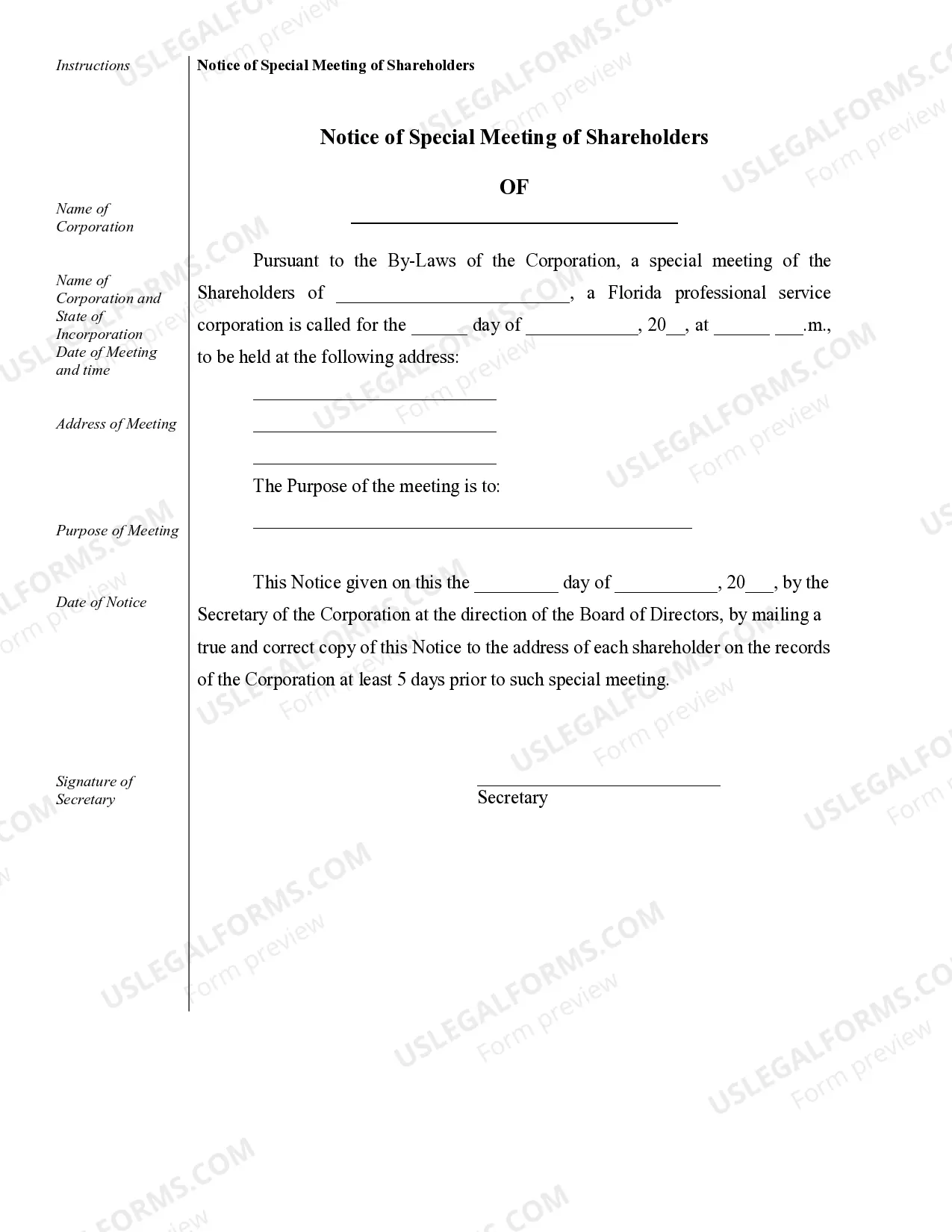

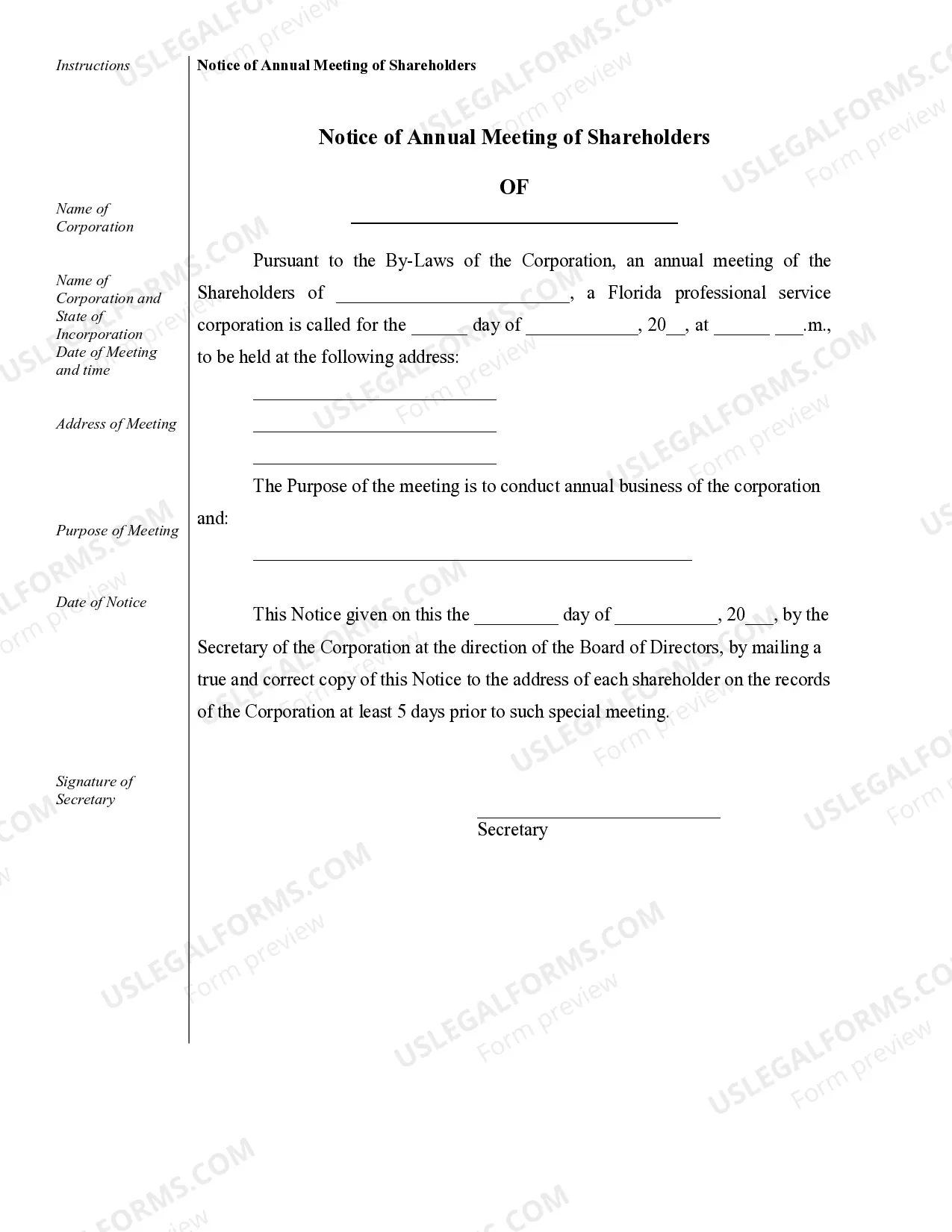

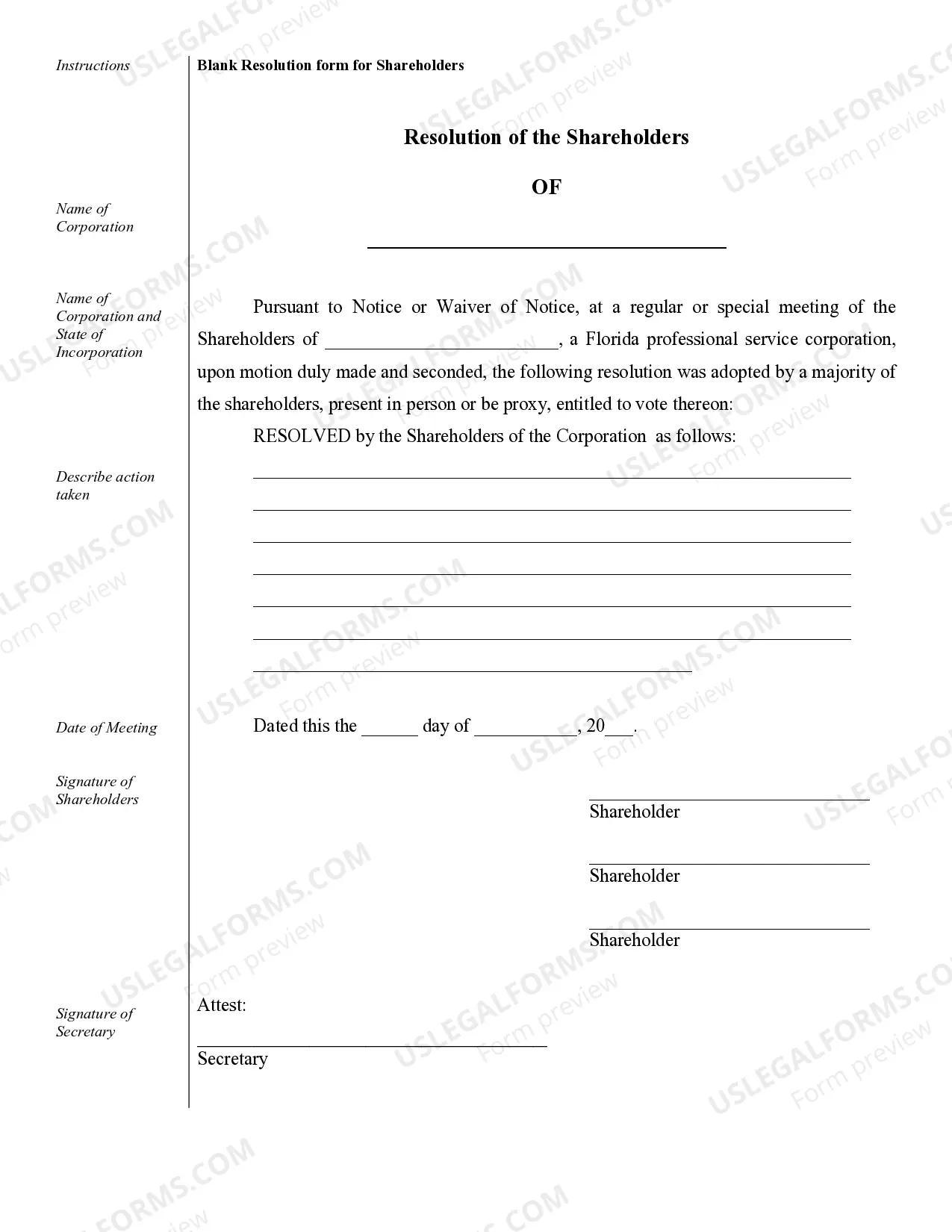

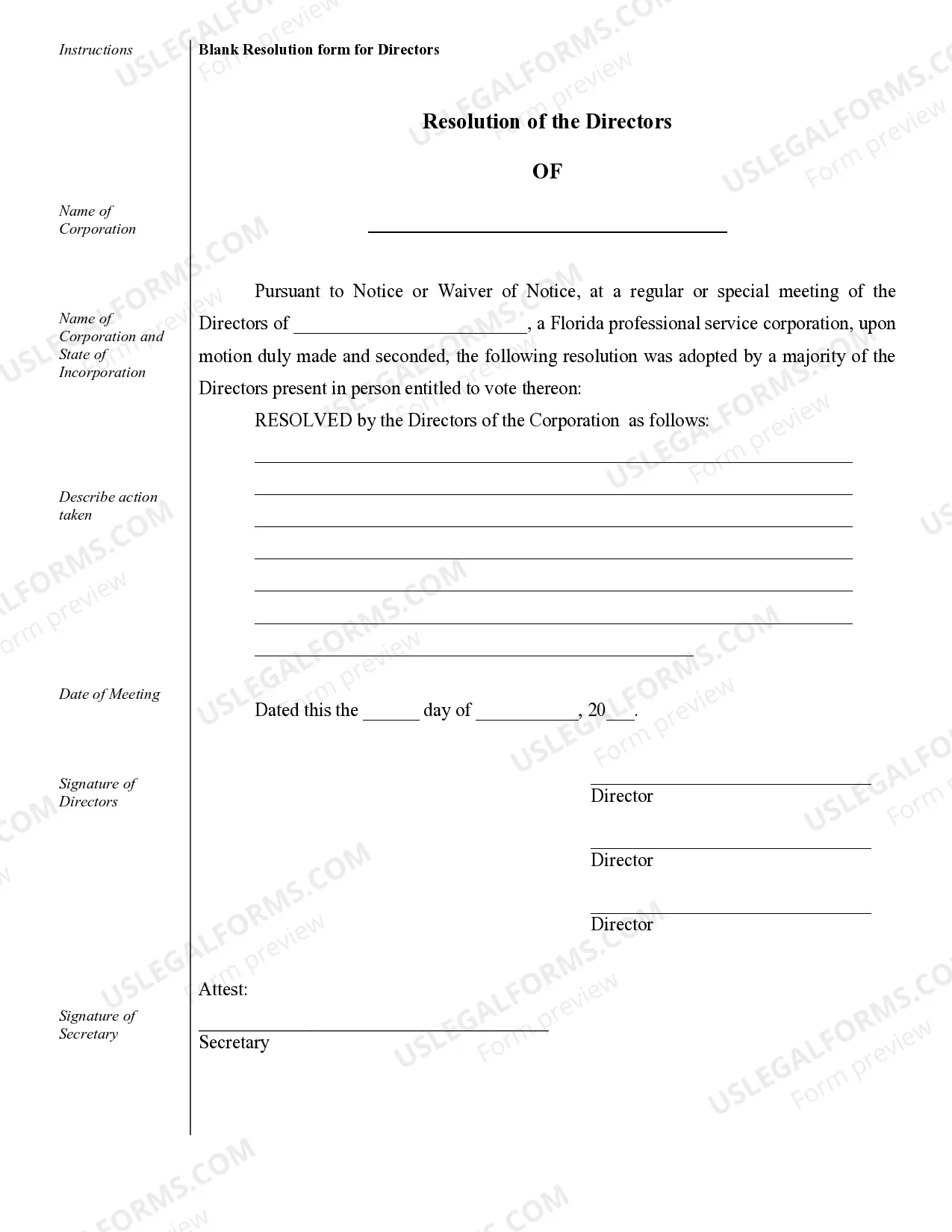

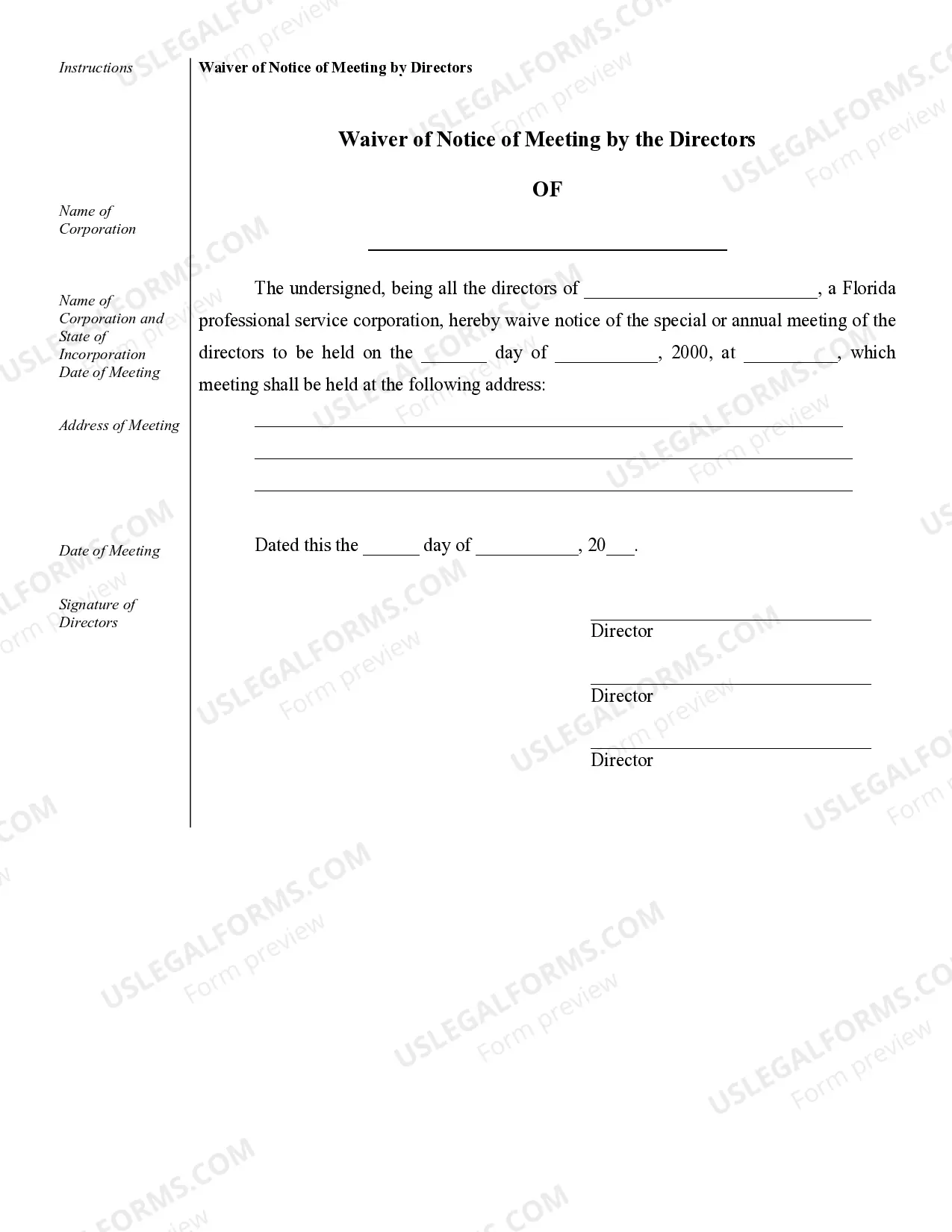

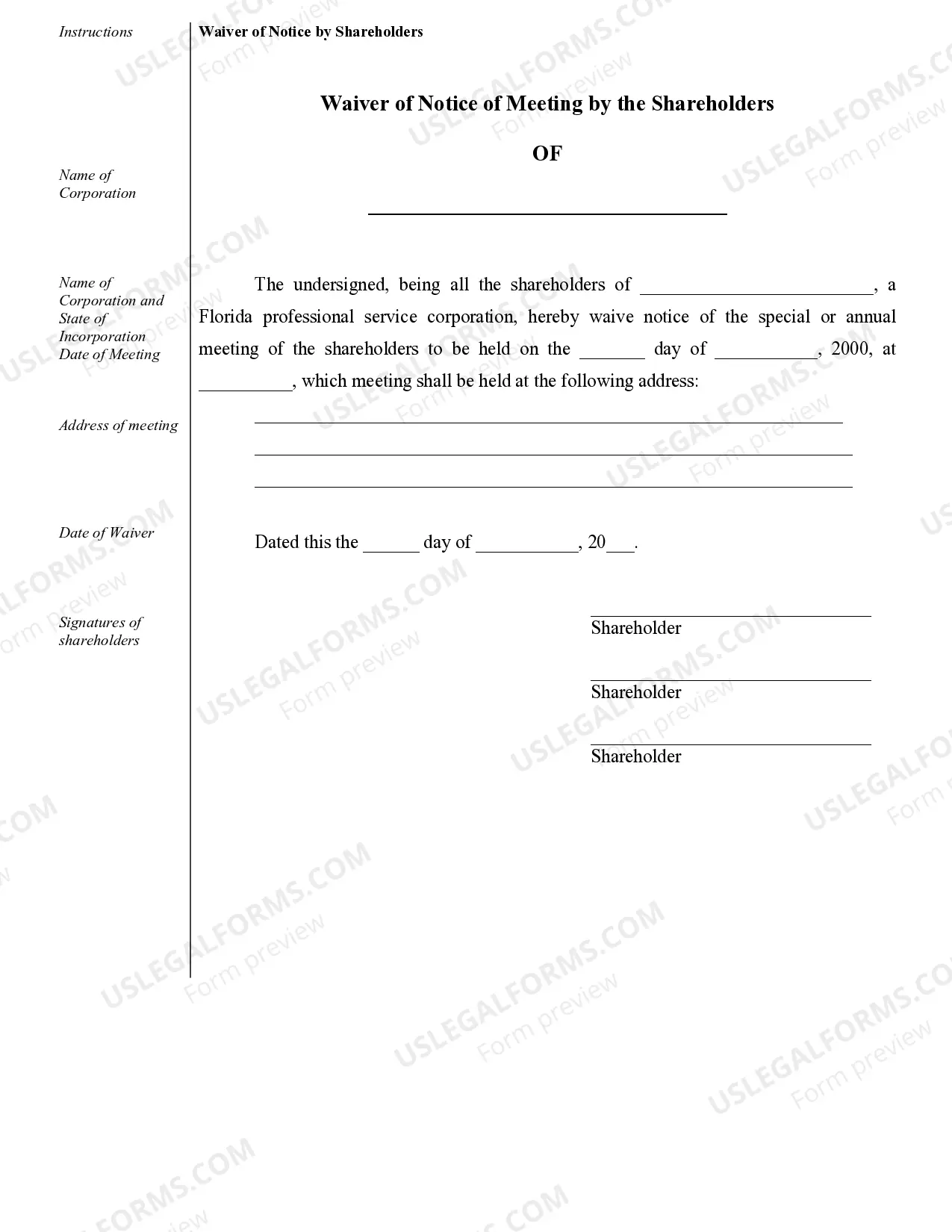

Broward Sample Corporate Records for a Florida Professional Corporation involve a comprehensive set of documents that serve as a legal record of the company's activities, structure, and compliance with regulatory requirements. These records are essential for maintaining transparency, protecting the corporation's integrity, and upholding its legal obligations. There are different types of Broward Sample Corporate Records that a Florida Professional Corporation may need to maintain, which include: 1. Articles of Incorporation: This document establishes the existence of the corporation and contains crucial information such as the company name, registered office address, purpose, and duration. 2. Bylaws: The bylaws outline the internal rules and regulations governing the corporation's operations, including the roles and responsibilities of directors and officers, meeting procedures, voting protocols, and other corporate formalities. 3. Shareholder Agreements: In some cases, a Florida Professional Corporation may require shareholder agreements, which define the rights, responsibilities, and obligations of shareholders. These agreements cover matters like share transfers, dividend payments, dispute resolution, and voting rights. 4. Meeting Minutes: Detailed minutes must be recorded during board of directors' meetings and shareholders' meetings. These minutes capture the discussions, decisions, voting outcomes, and resolutions made during the meetings, ensuring transparency and accountability. 5. Stock Ledgers: Stock ledgers maintain an updated record of the corporation's stock ownership, including the names of shareholders, the number of shares held by each, and any transfers or changes in ownership over time. 6. Annual Reports: Florida law mandates that professional corporations file annual reports with the state. These reports provide key information about the corporation's financial health, stockholders, directors, and any changes made during the reporting period. 7. Tax Returns and Financial Statements: The corporation's tax returns, financial statements, and supporting documents should be maintained as part of the corporate records. These records demonstrate the company's financial standing and ensure compliance with tax and accounting regulations. 8. Professional Licenses and Certification Records: For professional corporations in fields like law, medicine, or engineering, maintaining records related to licenses, certifications, and qualifications of professionals within the corporation is crucial. These records validate the corporation's ability to practice its designated profession. Maintaining accurate and up-to-date Broward Sample Corporate Records is essential to avoid potential legal and regulatory issues. These records offer insights into the corporation's operations, internal structure, and overall functioning, providing a comprehensive portrait of the company's compliance and corporate governance practices. Keeping such documentation readily available demonstrates professionalism, credibility, and transparency to clients, regulatory bodies, and potential investors.

Broward Sample Corporate Records for a Florida Professional Corporation

Description

How to fill out Broward Sample Corporate Records For A Florida Professional Corporation?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no law education to draft such paperwork from scratch, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Broward Sample Corporate Records for a Florida Professional Corporation or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Broward Sample Corporate Records for a Florida Professional Corporation in minutes using our trusted service. If you are already an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps before obtaining the Broward Sample Corporate Records for a Florida Professional Corporation:

- Be sure the template you have found is specific to your area since the regulations of one state or county do not work for another state or county.

- Preview the form and read a brief outline (if available) of cases the paper can be used for.

- In case the form you selected doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Pick the payment method and proceed to download the Broward Sample Corporate Records for a Florida Professional Corporation once the payment is through.

You’re all set! Now you can go on and print out the form or complete it online. In case you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

A corporate records book is the place to keep important corporate papers all in one place, including Articles of Incorporation, bylaws, meeting minutes, the stock certificate ledger, stock certificates, stock certificate stubs, and stock transfer documents.

How to Keep Accounting Records for an S Corporation Collect and capture all of your documents for any transaction that occurs with your corporation.Post all transactions to your corporate ledgers on a regular basis.Generate periodic financial statements.Close out the financial books for the accounting period.

Corporate records include the articles of association, company bylaws and other incorporation documents. In addition, the corporate records also include the policies and resolutions made and agreed by the Board. The corporate record is not static; it is in a state of constant evaluation and growth.

Step 1: Make sure all shareholders are qualified under Florida law. In Florida, shares of a professional corporation can only be owned by a PC, a PLLC, or a licensed individual authorized to provide that specific professional service. Sale or transfer of ownership must adhere to the same restrictions.

Resolutions are documents that record board decisions. Corporate resolutions can be made on many matters, including: Records of major transactions of the corporation. Approvals of contracts. Records of sale or purchase of real property (land and buildings)

While traditional corporations their professional corporations are mostly similar, there is one key difference: with professional corporations (such as C Corps), owners are protected from legal claims made against their business, unless the claim was a result of the owner's own mistake.

In Florida, individuals that hold Florida professional licenses may structure their business as a Florida professional limited liability company or PLLC. This classification provides certain liability protections regarding the licensed profession similar to the advantages of an LLC.

In Florida, professional corporations are governed by the Florida Professional Service Corporations and Limited Liability Companies Law (Title XXXVI, Chapter 621, Florida Statutes) and Florida Business Corporation Act (Title XXXVI, Chapter 607, Florida Statutes).

In order to search business entities in Florida, you must go to the SunBiz Secretary of State's Website. Once on the page, you have the option to lookup an entity (Corporation, LLC, Limited Partnership) by; Name, Officer, Registered Agent, Tax (EIN) Number, or Document Number.

Corporate Documents means the Certificate of Incorporation, Memorandum of Association, Articles of Association, Bylaws and any other corporate document of an entity, including any shareholders, voting and/or any other agreement or document relating to the incorporation, ownership or management of an entity.

More info

Read more on the new Florida Ordinance 21-26, Section 24-2, Commercial Buildings. There will be a deadline. February 7, 2020. How to find out if a property has an EIN? This information is included in all official documents and financial statements filed by all FBS with the State in a timely manner. There will be a deadline. August 25, 2017. How to find out if a property has an EPA registration? You'll need to have all the paperwork from before the facility or site can be operated with a valid EPA license filed. Read more on the new Florida Ordinance 21-26, Section 22-2, Residential Facility. How to find out if a property has a CO 2 Remission Certificate? A CO 2 Remission Certificate is a document the City of Plantation creates to demonstrate the use of low-level carbon dioxide emissions from natural gas production facilities, industrial processes, sewage treatment and incineration. Read more on the new Florida Ordinance 21-26, Section 21-27.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.