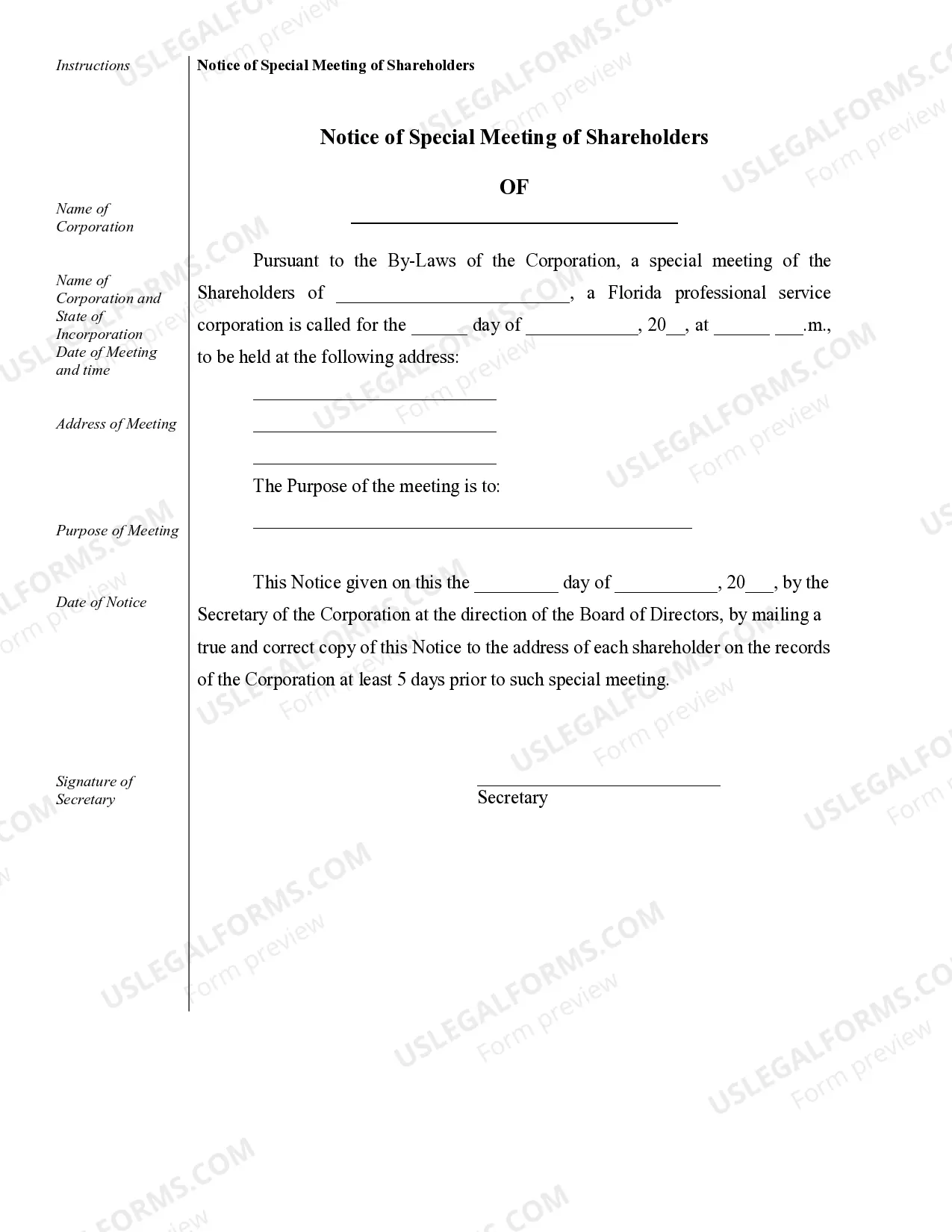

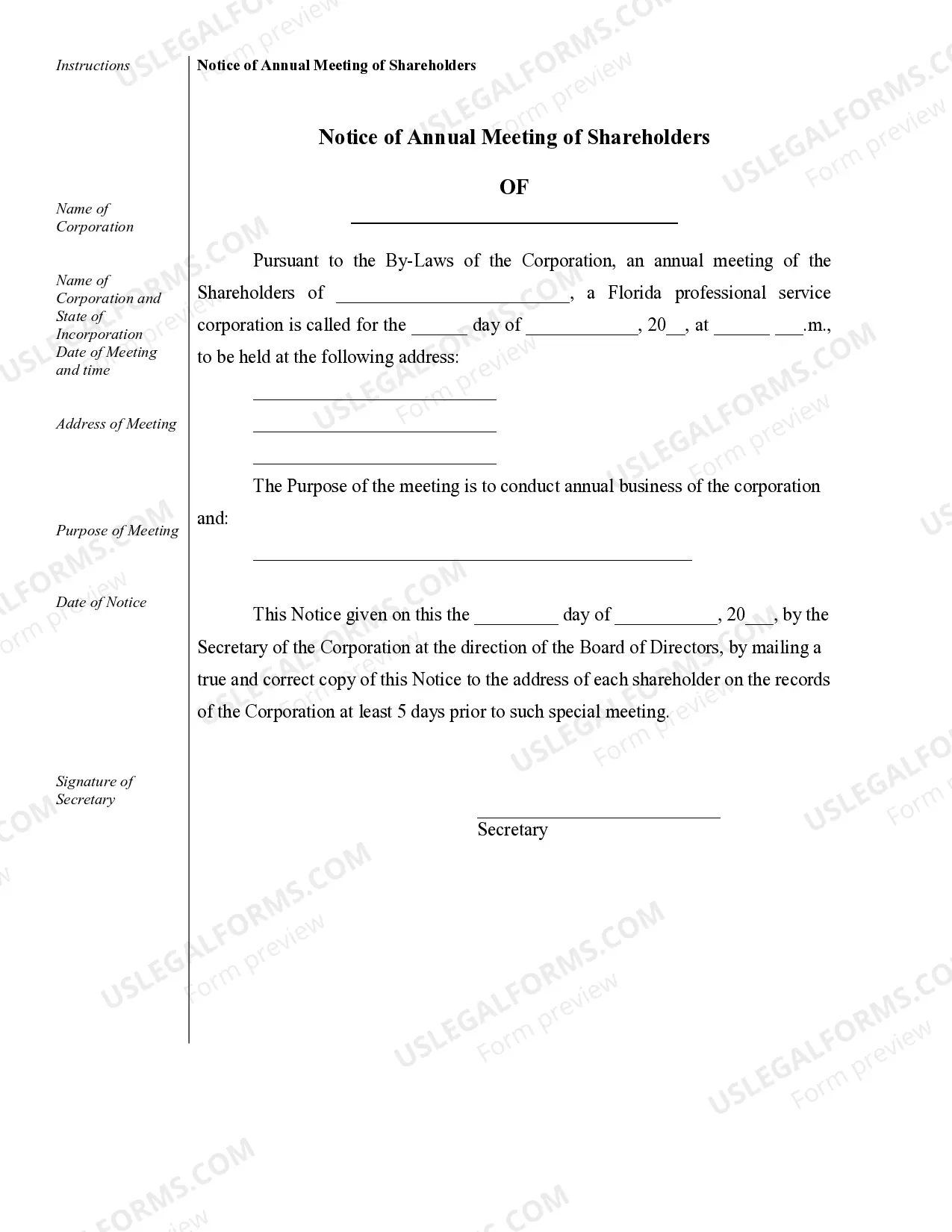

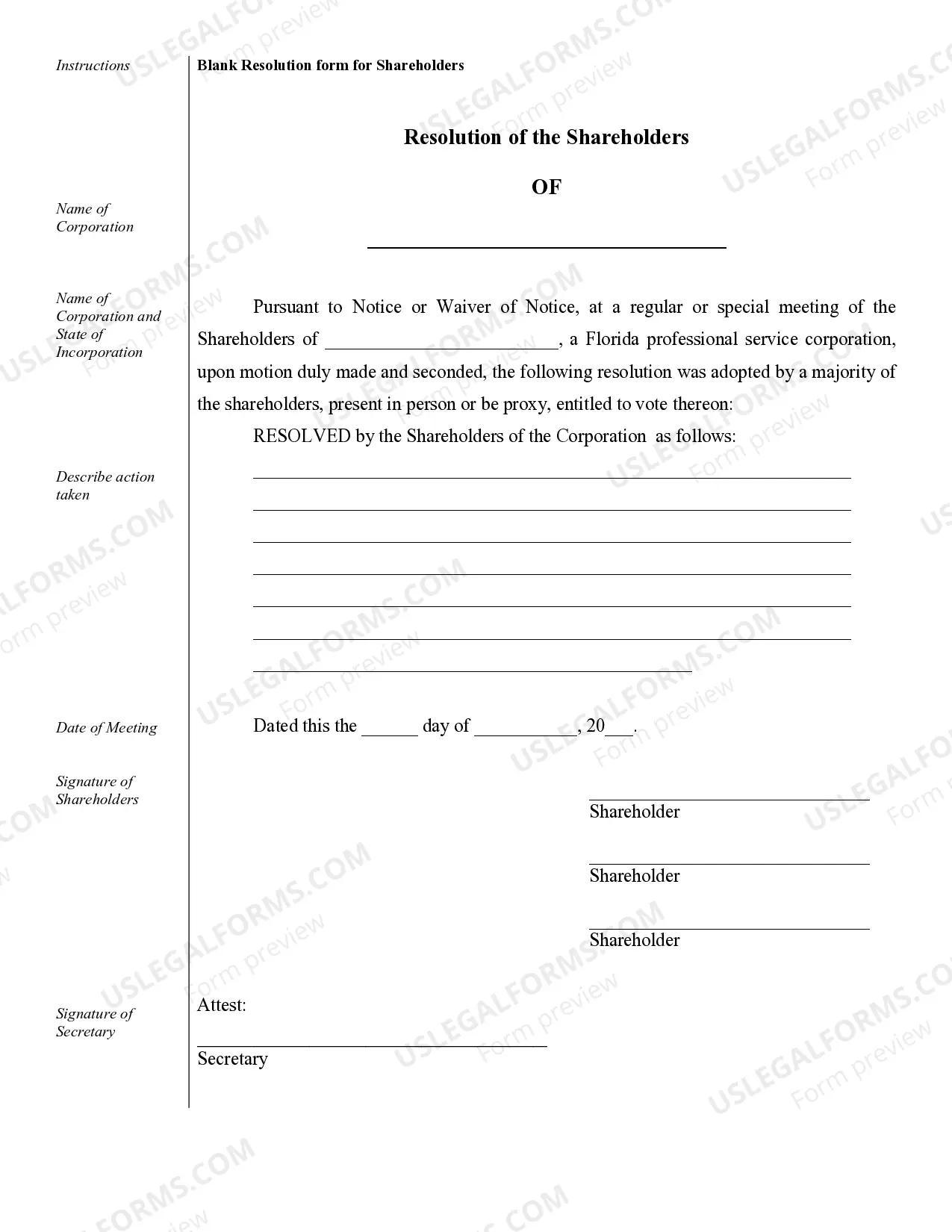

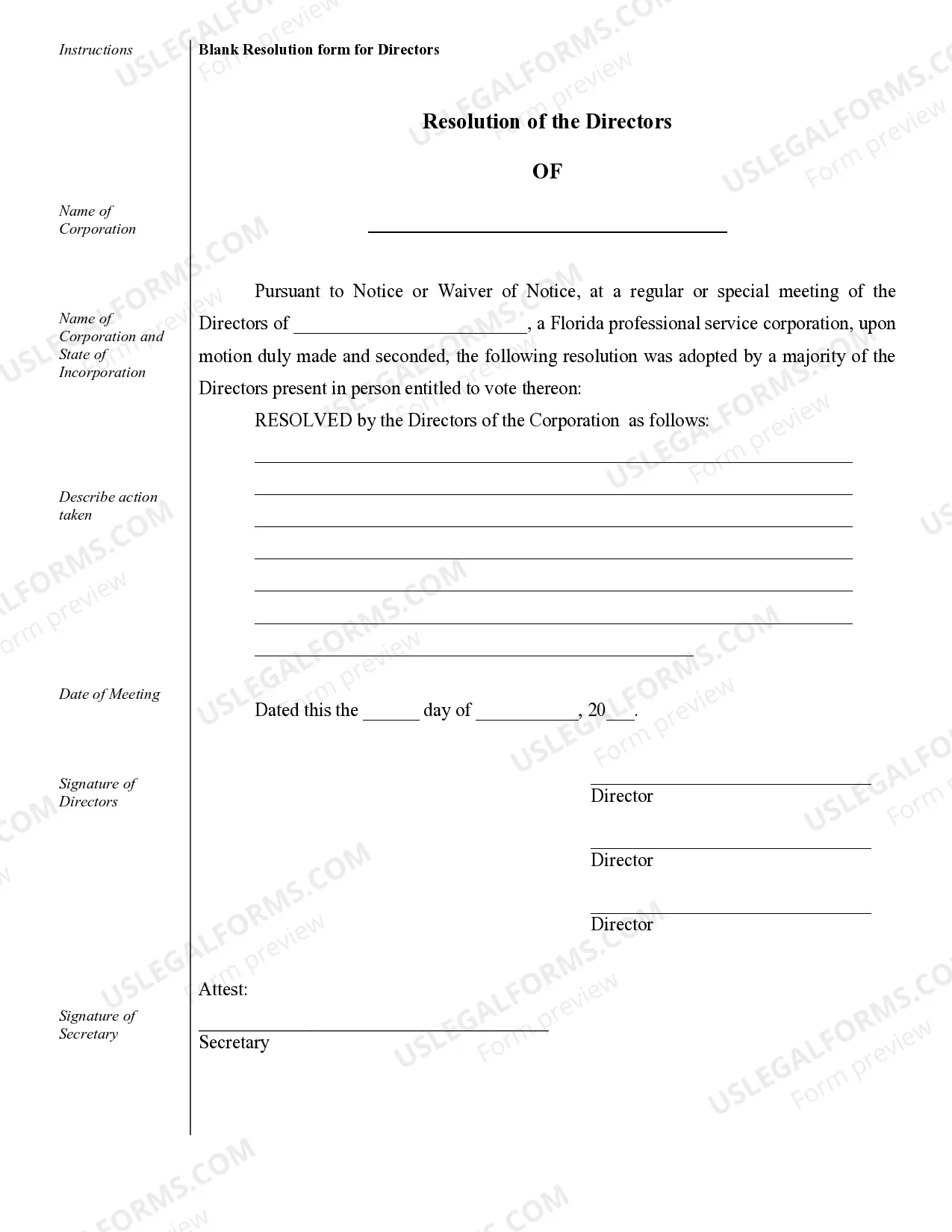

Cape Coral Sample Corporate Records for a Florida Professional Corporation are essential documents that provide a comprehensive record of the company's legal, financial, and operational aspects. These records serve as a vital resource for the corporation and its stakeholders, including shareholders, directors, officers, and regulators. They outline the company's structure, activities, and compliance with legal and regulatory requirements. Several types of Cape Coral Sample Corporate Records for a Florida Professional Corporation include: 1. Articles of Incorporation: This document establishes the legal existence of the corporation and includes crucial information such as the company's name, purpose, registered agent, and initial directors. 2. Bylaws: Bylaws are a set of rules and regulations that govern the internal operations and management of the professional corporation. It outlines procedures for holding meetings, electing officers, responsibilities of directors, and corporate governance. 3. Shareholder Agreement: If the professional corporation has multiple shareholders, a shareholder agreement outlines the rights and obligations of each shareholder, voting rights, share transfer restrictions, and dispute resolution mechanisms. 4. Meeting Minutes: These records document the discussions, resolutions, and decisions made during board meetings, annual general meetings, or special shareholder meetings. They serve as an official record of corporate actions and must be prepared and maintained as per legal requirements. 5. Financial Statements: Financial records, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial position, performance, and cash flows. These statements should comply with generally accepted accounting principles (GAAP) and be reviewed or audited by certified public accountants (CPA's). 6. Stock Ledgers: A stock ledger is a record that tracks the issuance, transfer, and ownership of the corporation's shares. It provides details about shareholders, their shareholdings, and any changes in ownership. 7. Annual Reports: Florida law requires professional corporations to file an annual report with the state's Division of Corporations. This report includes essential information like the current officers, directors, registered agent, principal address, and a brief business description. 8. Contracts and Agreements: Copies of contracts, agreements, and legal documents entered into by the professional corporation should be included in the records. These may include client contracts, employment agreements, lease agreements, or vendor agreements. Maintaining accurate and up-to-date Cape Coral Sample Corporate Records for a Florida Professional Corporation is crucial for demonstrating compliance with legal obligations, facilitating effective corporate governance, and ensuring transparency. These records also act as a valuable resource during audits, due diligence processes, and potential legal disputes.

Cape Coral Sample Corporate Records for a Florida Professional Corporation

State:

Florida

City:

Cape Coral

Control #:

FL-PC-CR

Format:

Word;

Rich Text

Instant download

Description

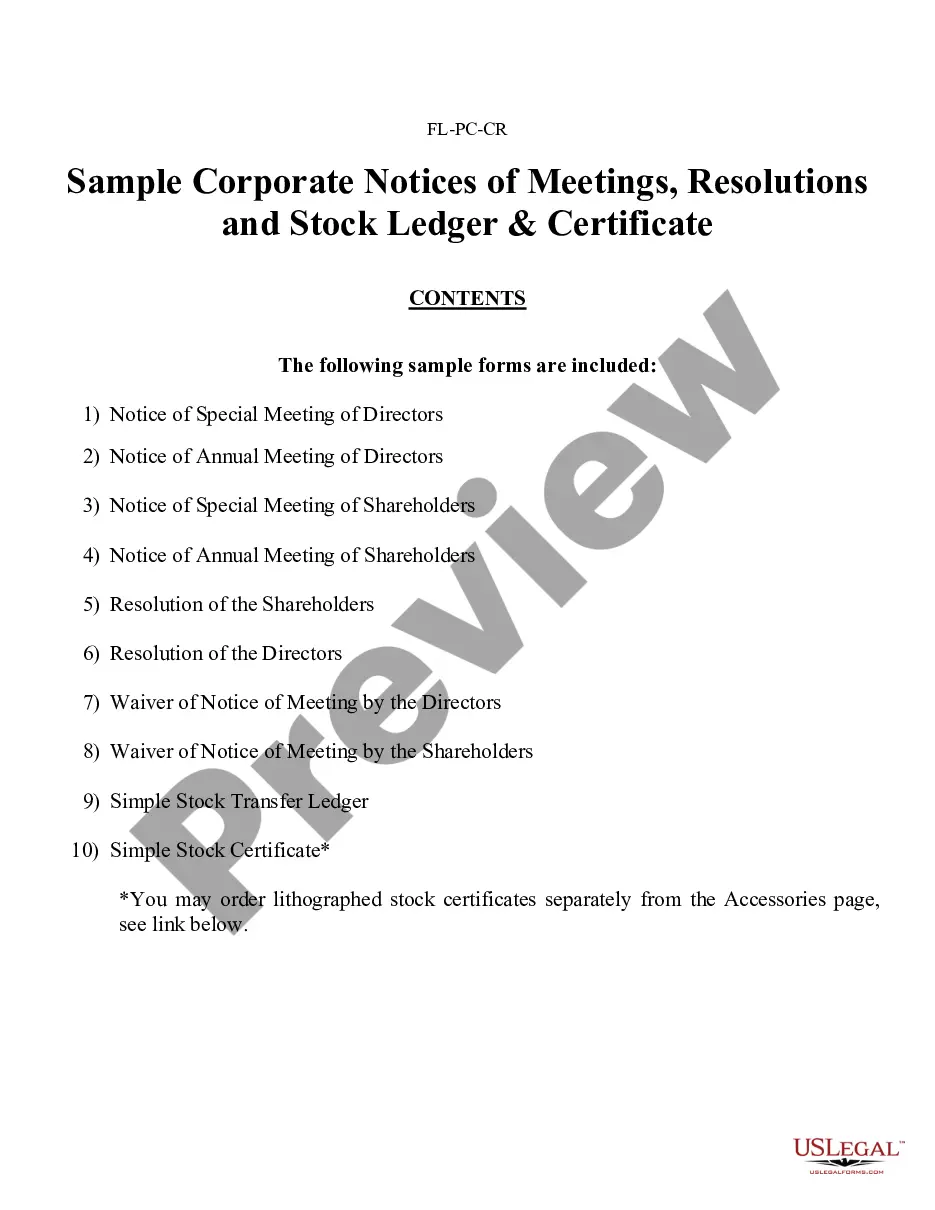

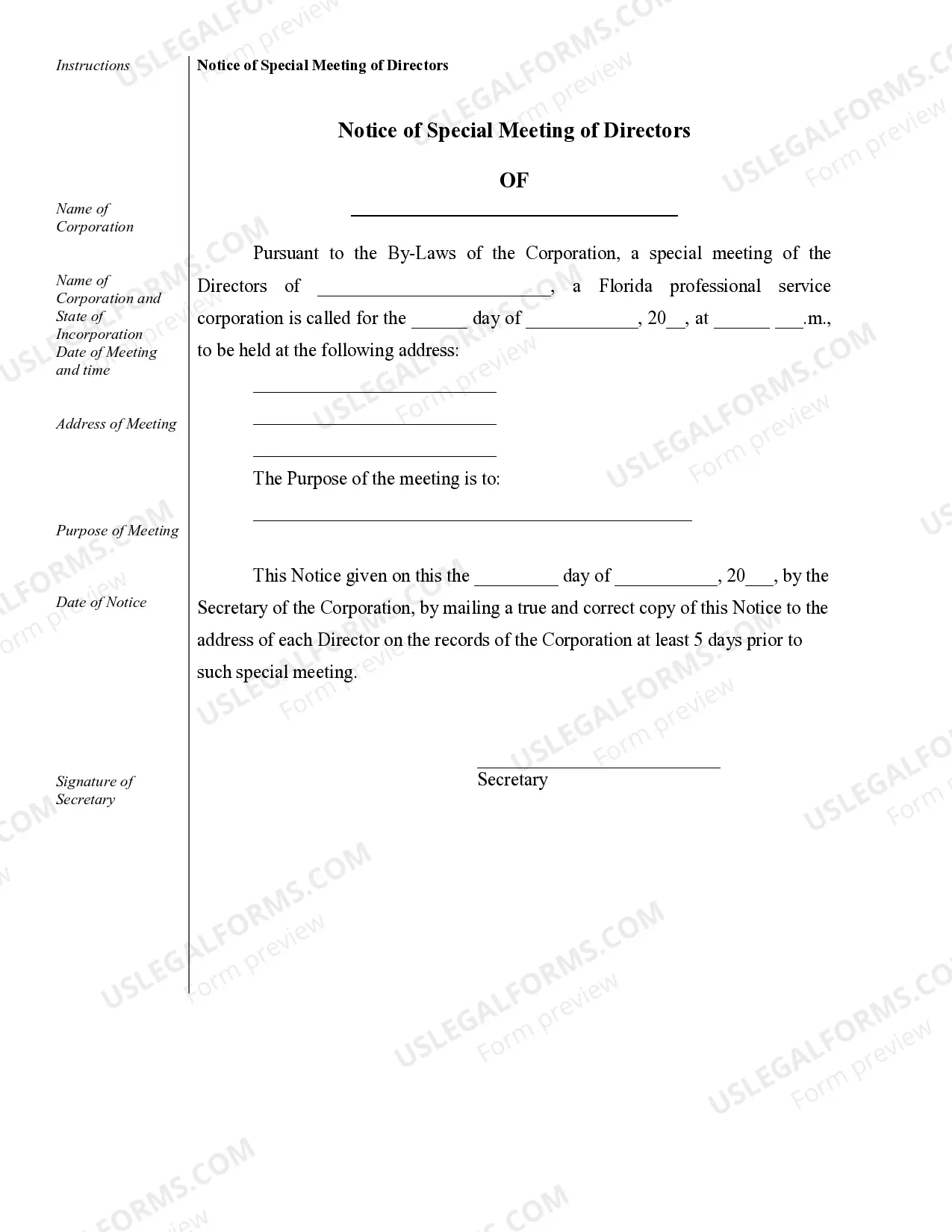

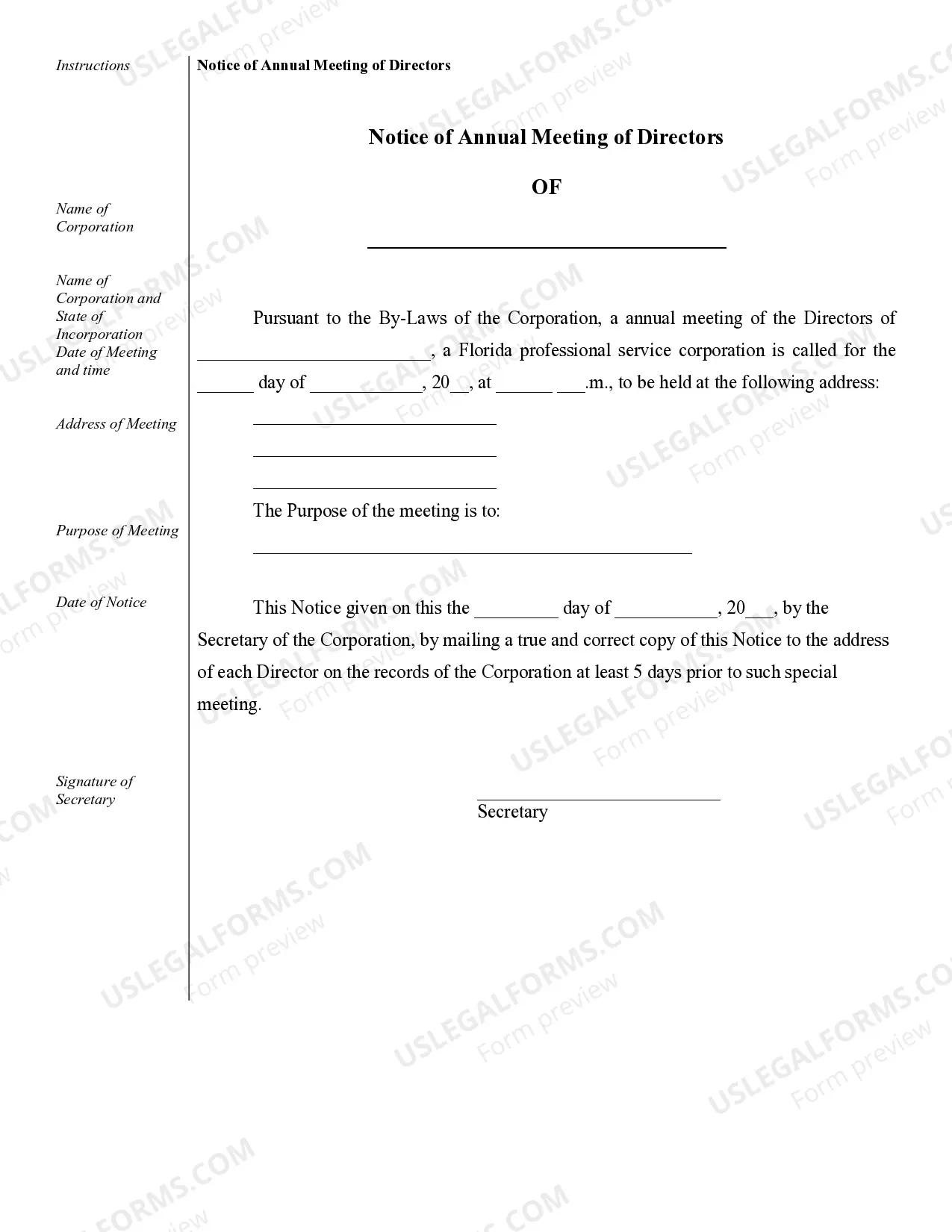

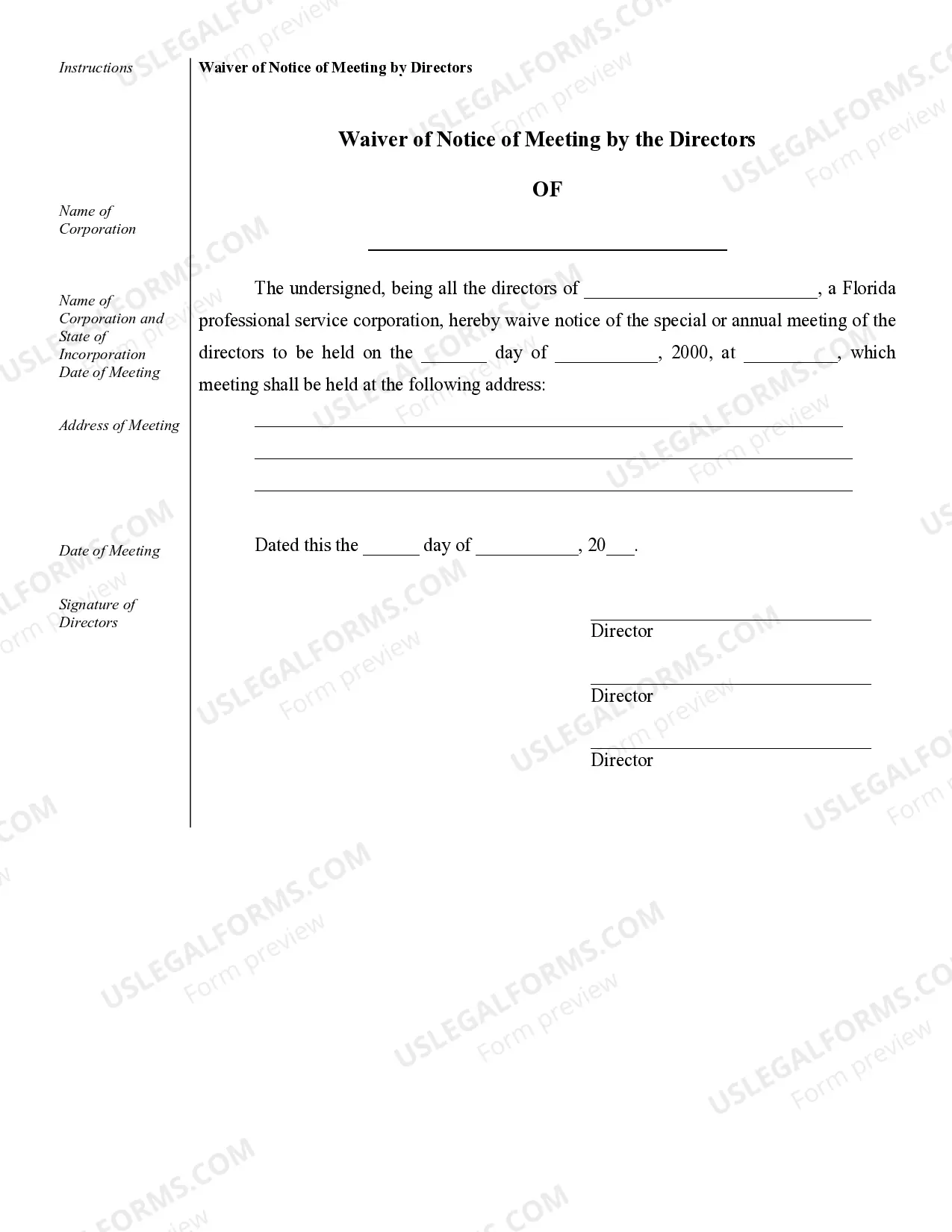

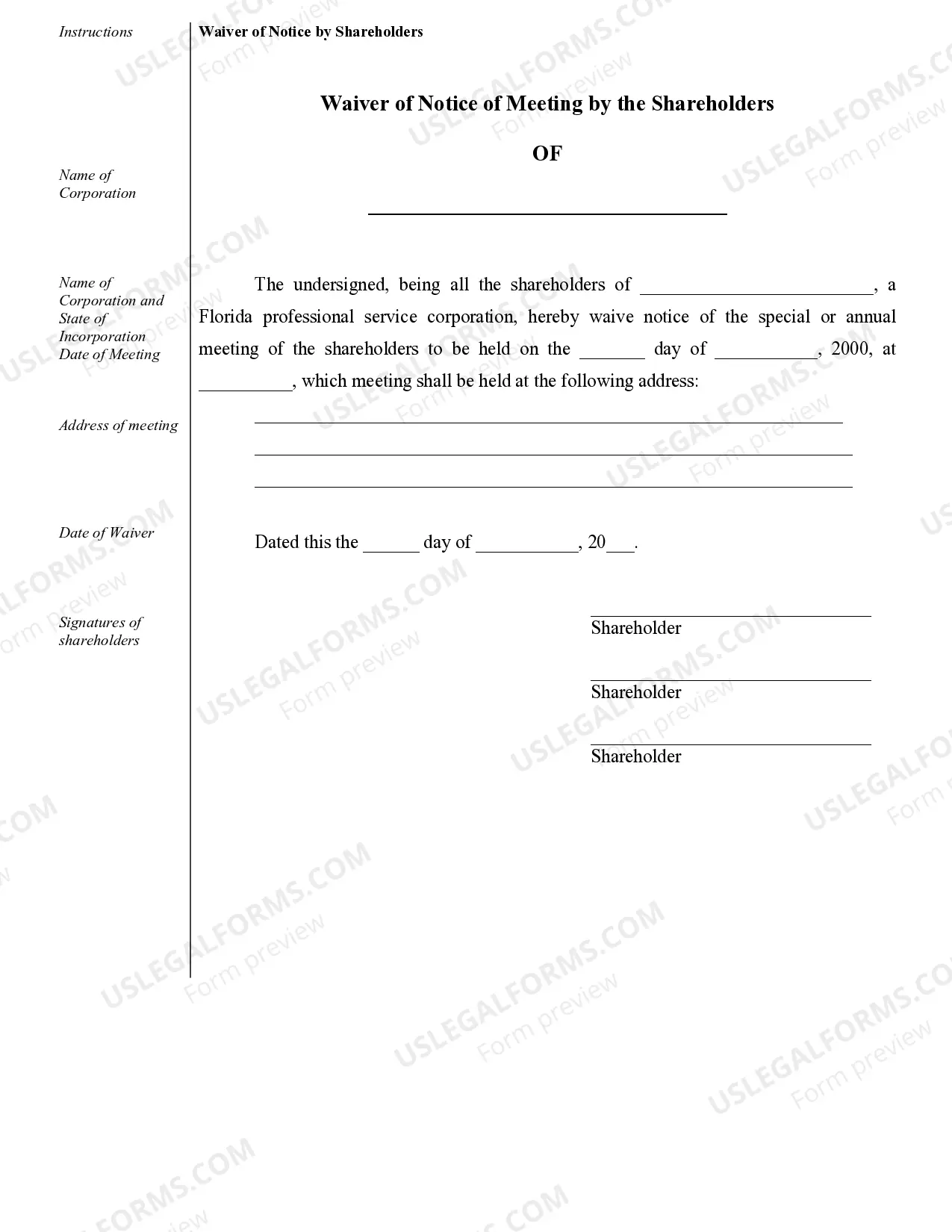

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Cape Coral Sample Corporate Records for a Florida Professional Corporation are essential documents that provide a comprehensive record of the company's legal, financial, and operational aspects. These records serve as a vital resource for the corporation and its stakeholders, including shareholders, directors, officers, and regulators. They outline the company's structure, activities, and compliance with legal and regulatory requirements. Several types of Cape Coral Sample Corporate Records for a Florida Professional Corporation include: 1. Articles of Incorporation: This document establishes the legal existence of the corporation and includes crucial information such as the company's name, purpose, registered agent, and initial directors. 2. Bylaws: Bylaws are a set of rules and regulations that govern the internal operations and management of the professional corporation. It outlines procedures for holding meetings, electing officers, responsibilities of directors, and corporate governance. 3. Shareholder Agreement: If the professional corporation has multiple shareholders, a shareholder agreement outlines the rights and obligations of each shareholder, voting rights, share transfer restrictions, and dispute resolution mechanisms. 4. Meeting Minutes: These records document the discussions, resolutions, and decisions made during board meetings, annual general meetings, or special shareholder meetings. They serve as an official record of corporate actions and must be prepared and maintained as per legal requirements. 5. Financial Statements: Financial records, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial position, performance, and cash flows. These statements should comply with generally accepted accounting principles (GAAP) and be reviewed or audited by certified public accountants (CPA's). 6. Stock Ledgers: A stock ledger is a record that tracks the issuance, transfer, and ownership of the corporation's shares. It provides details about shareholders, their shareholdings, and any changes in ownership. 7. Annual Reports: Florida law requires professional corporations to file an annual report with the state's Division of Corporations. This report includes essential information like the current officers, directors, registered agent, principal address, and a brief business description. 8. Contracts and Agreements: Copies of contracts, agreements, and legal documents entered into by the professional corporation should be included in the records. These may include client contracts, employment agreements, lease agreements, or vendor agreements. Maintaining accurate and up-to-date Cape Coral Sample Corporate Records for a Florida Professional Corporation is crucial for demonstrating compliance with legal obligations, facilitating effective corporate governance, and ensuring transparency. These records also act as a valuable resource during audits, due diligence processes, and potential legal disputes.

Free preview

How to fill out Cape Coral Sample Corporate Records For A Florida Professional Corporation?

If you’ve already utilized our service before, log in to your account and download the Cape Coral Sample Corporate Records for a Florida Professional Corporation on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Cape Coral Sample Corporate Records for a Florida Professional Corporation. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!