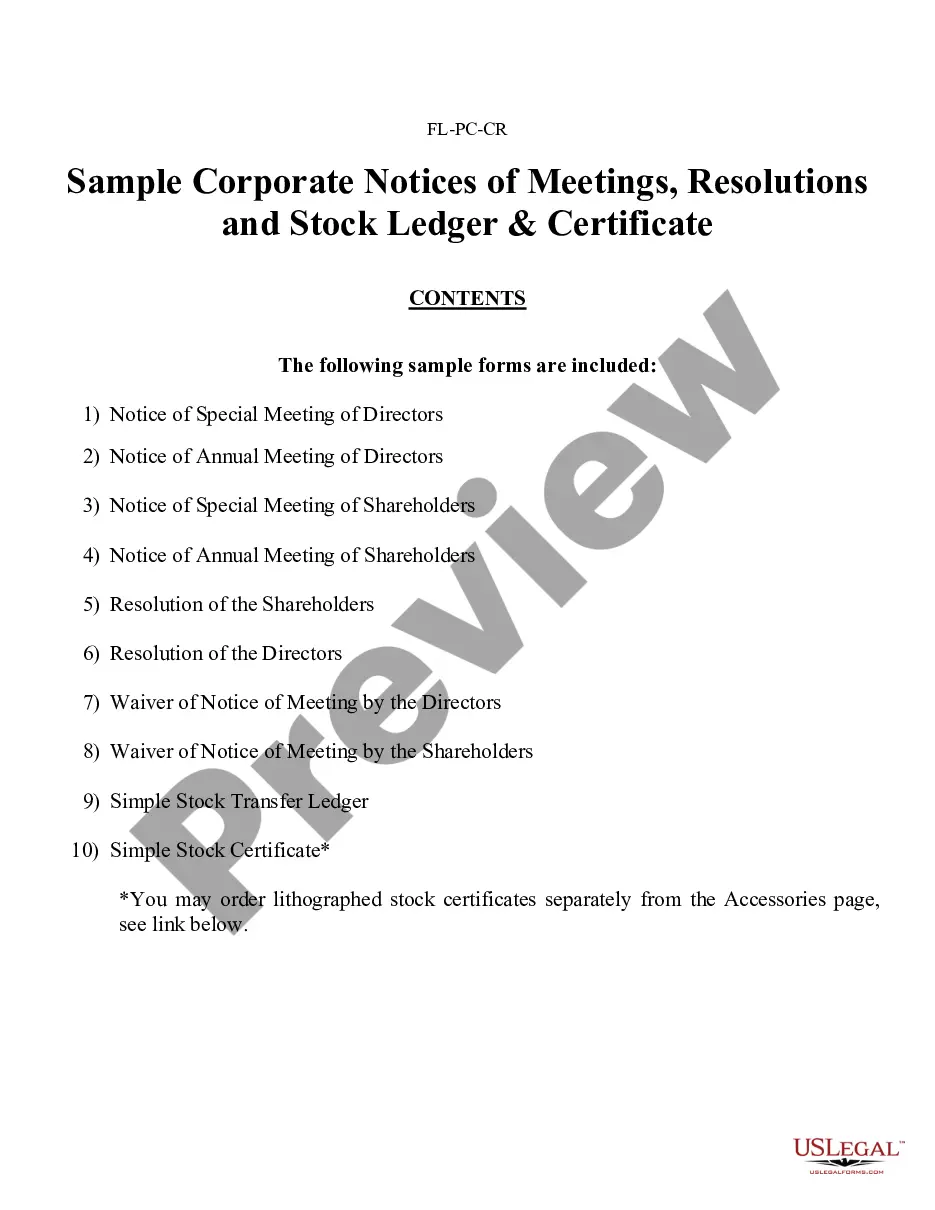

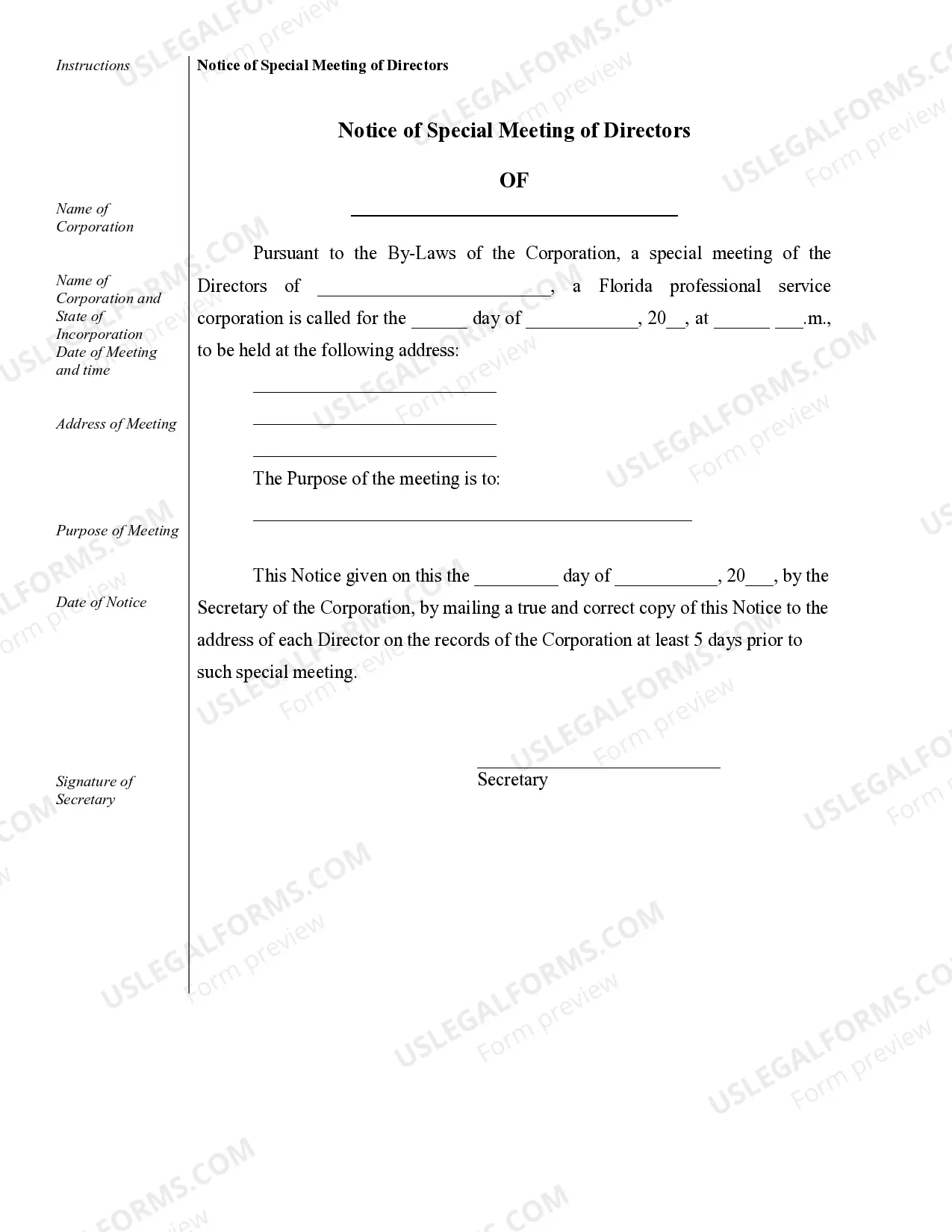

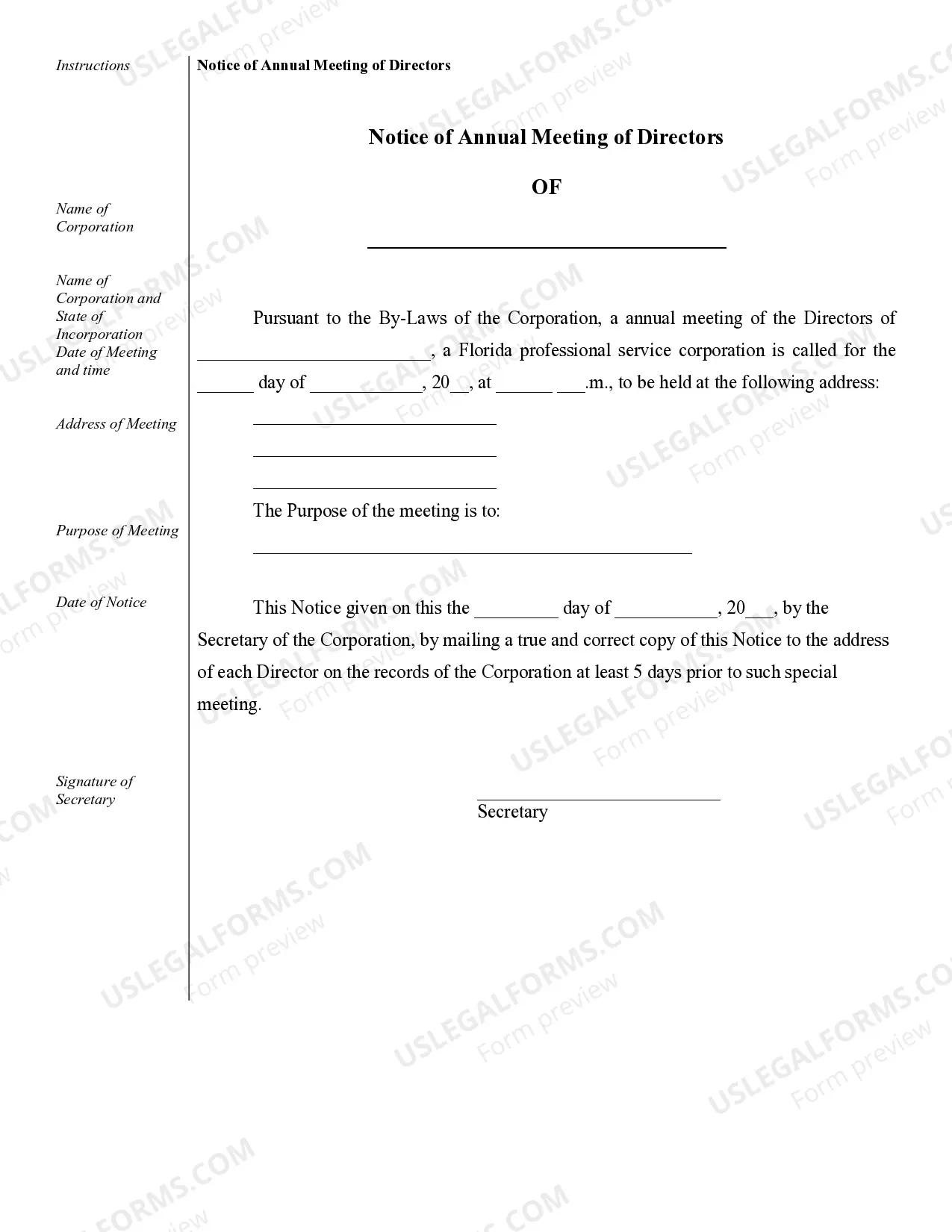

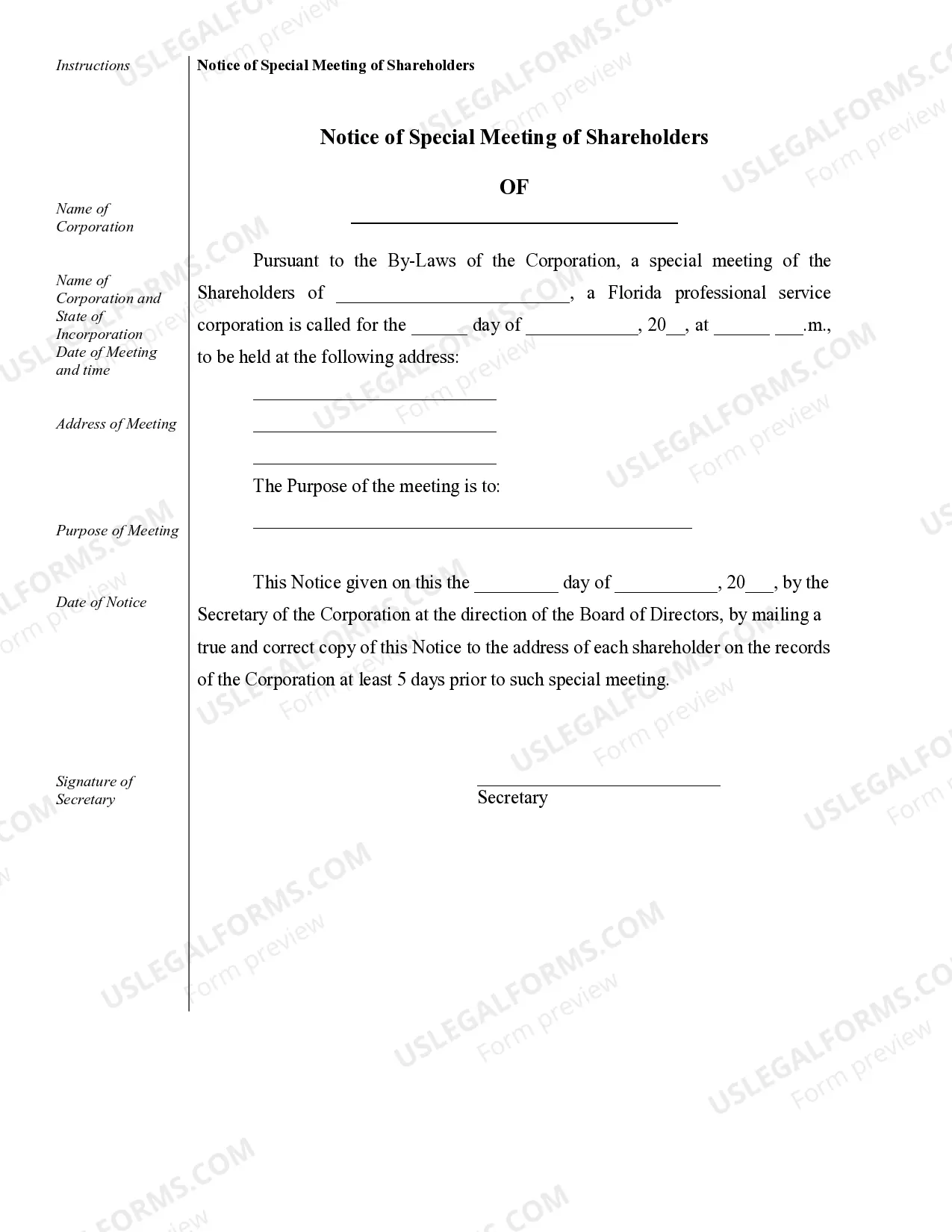

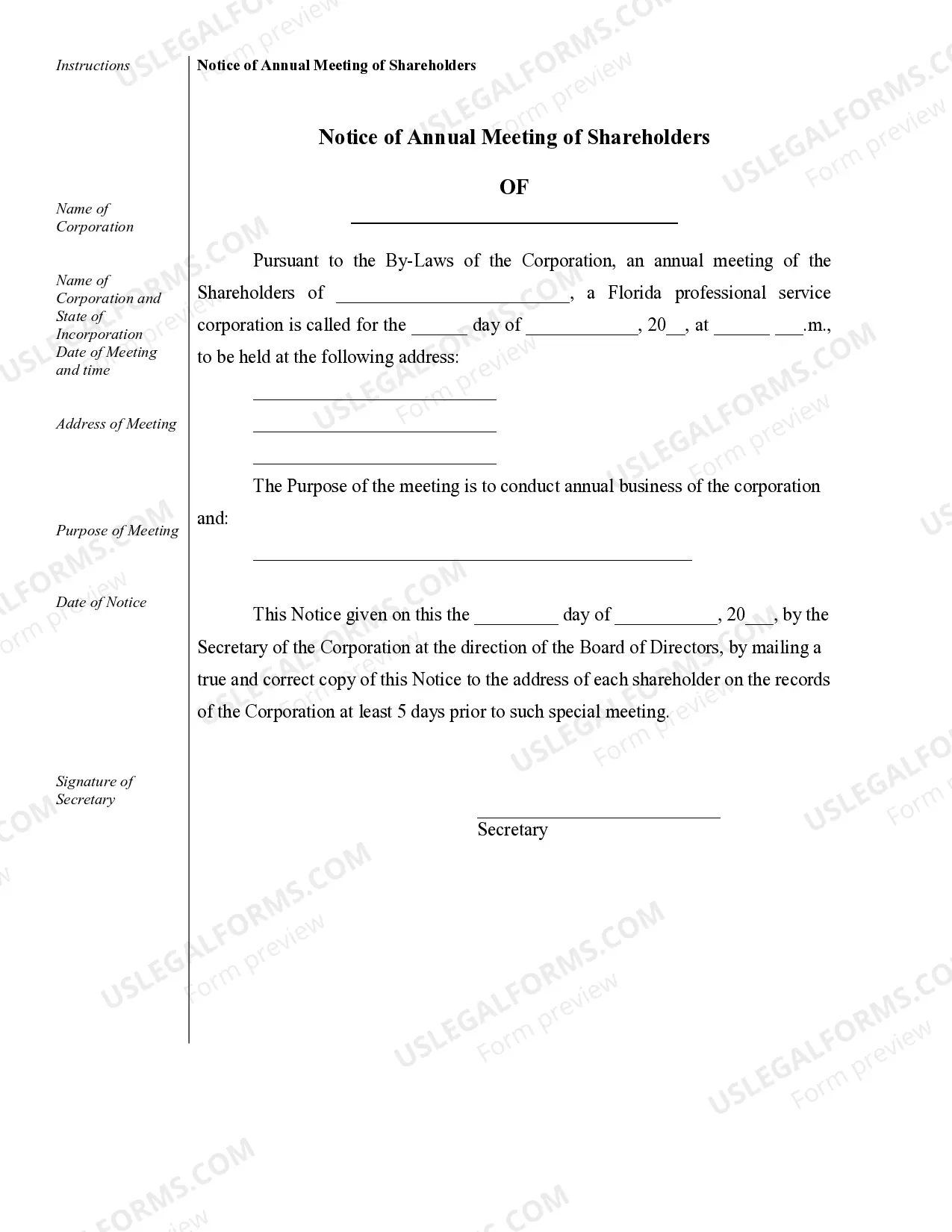

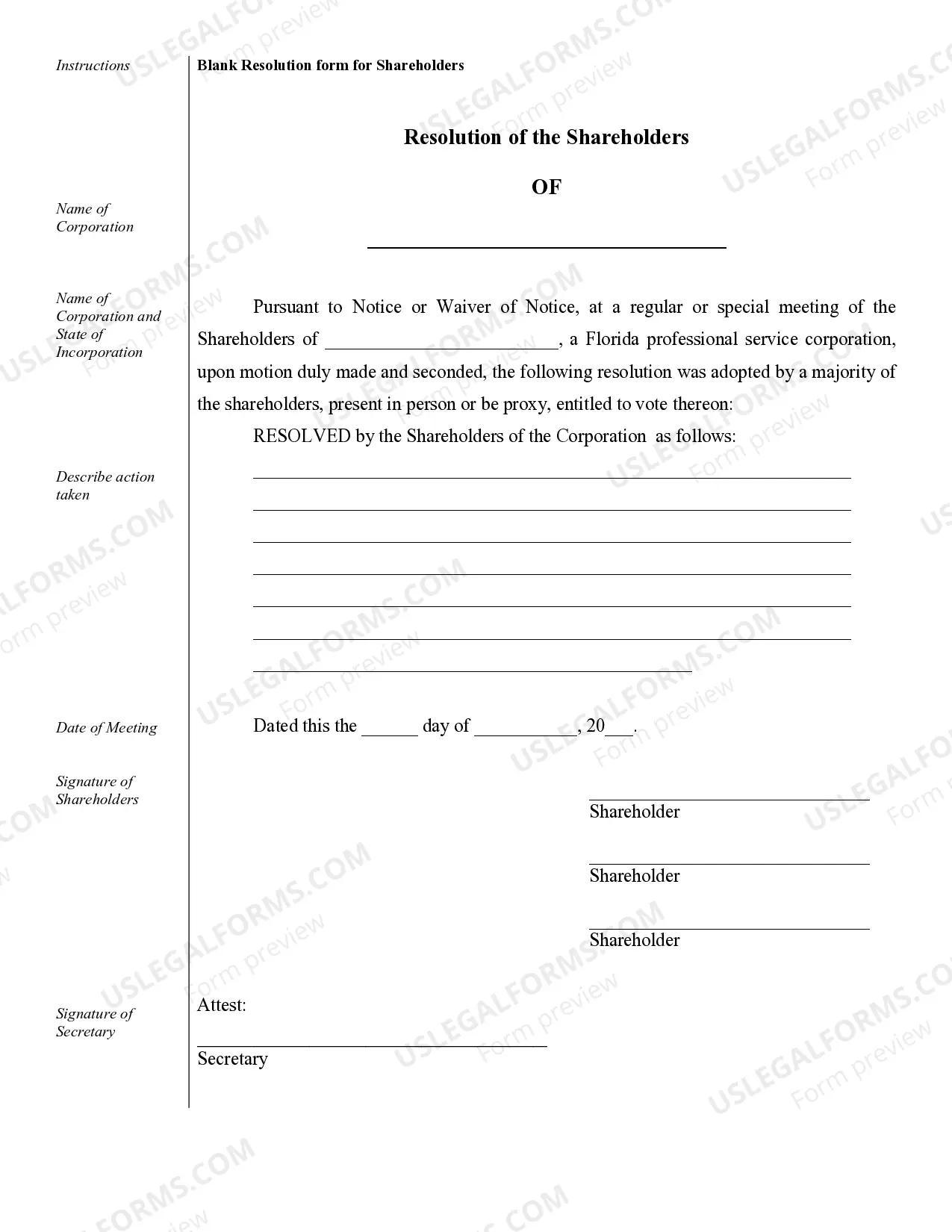

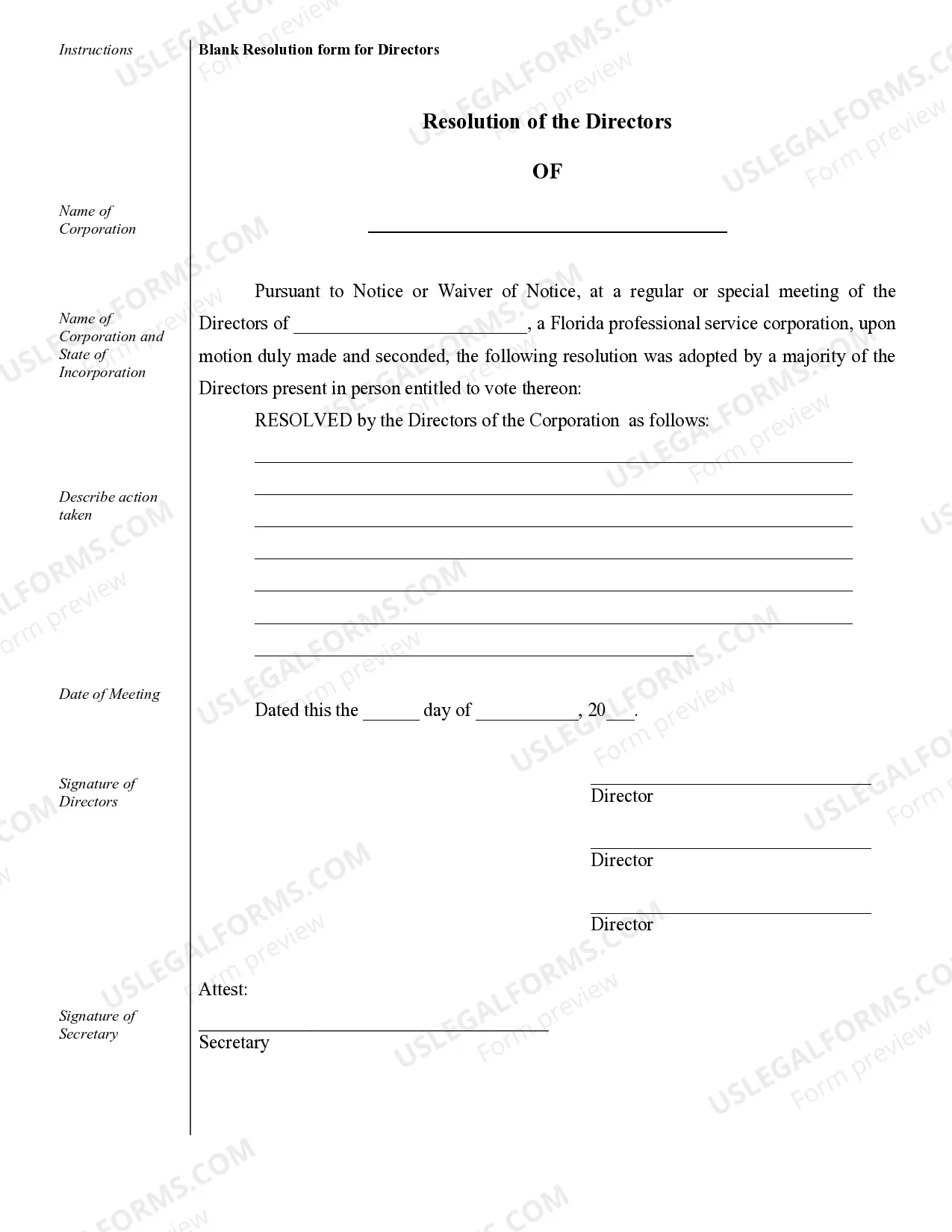

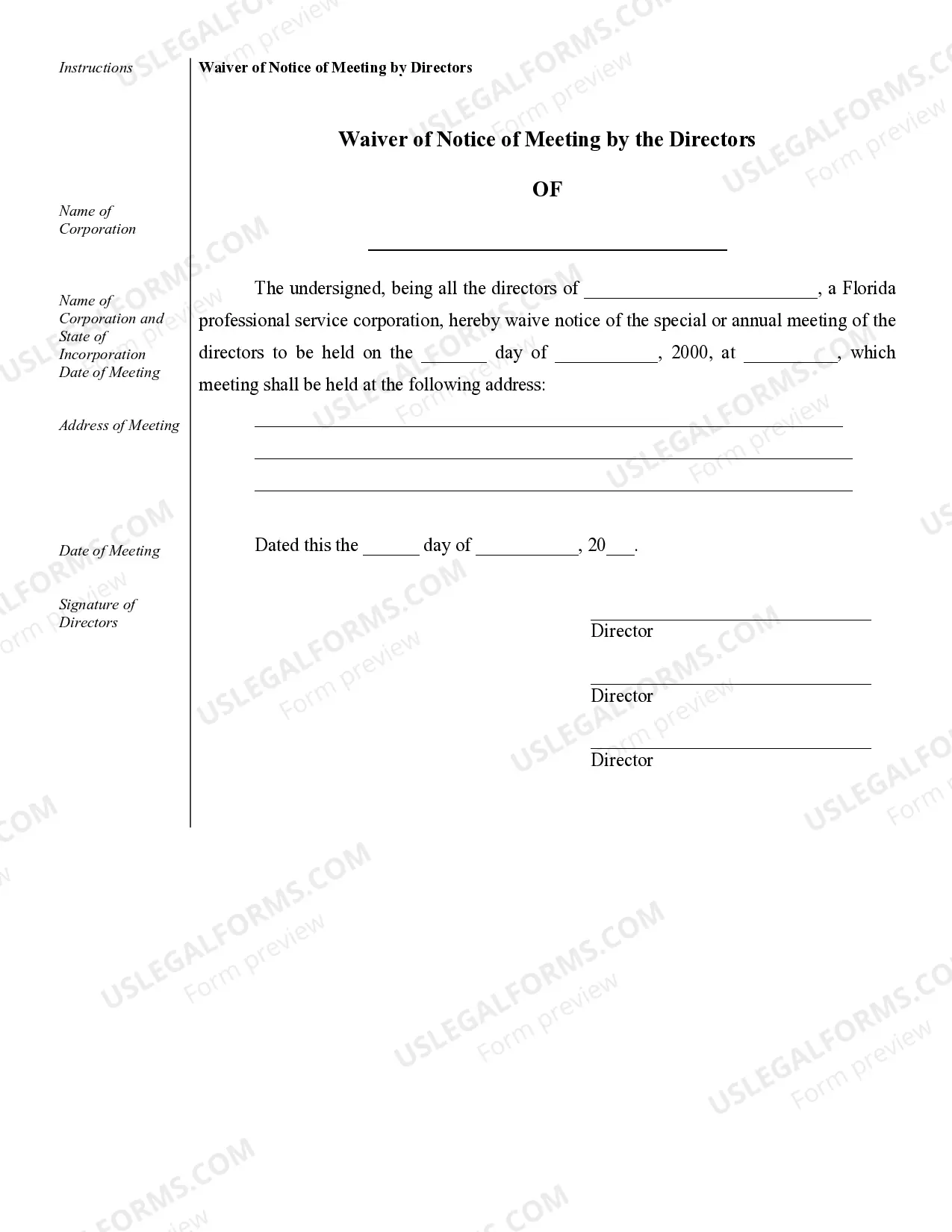

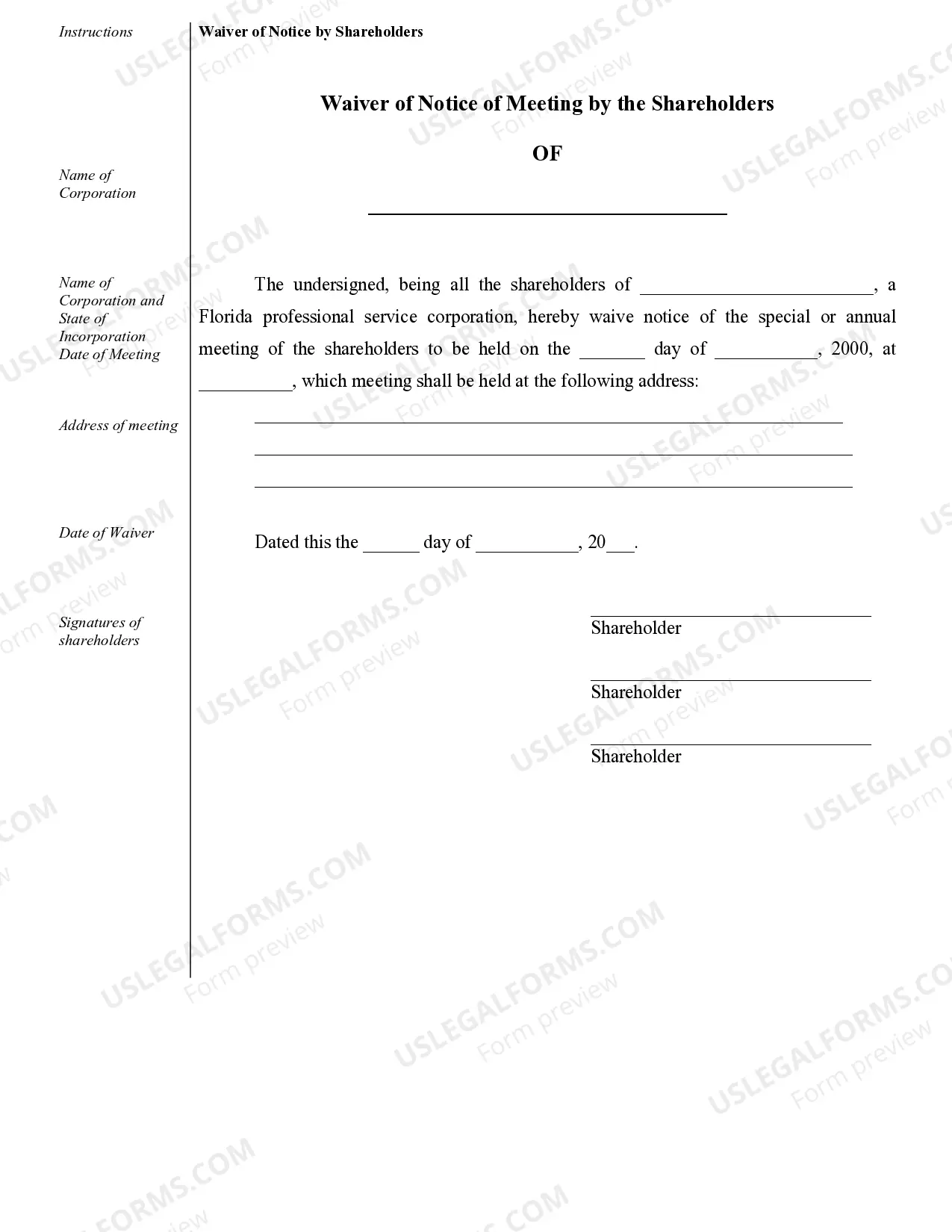

Hillsborough Sample Corporate Records for a Florida Professional Corporation are essential documents that provide a comprehensive overview of the company's structure, ownership, and legal compliance. These records act as an official archive of the corporation's activities and are crucial for maintaining transparency and meeting regulatory obligations. Here are some of the key types of Hillsborough Sample Corporate Records that are typically maintained for a Florida Professional Corporation: 1. Articles of Incorporation: This document serves as the initial filing with the Florida Secretary of State to establish the existence of the corporation. It includes vital information such as the corporation's name, purpose, registered agent, capital stock details, and duration of existence. 2. Bylaws: Bylaws outline the internal rules and regulations that govern the corporation's operations, including procedures for holding meetings, electing officers and directors, and distributing profits. These records ensure consistency in the decision-making process and define the roles and responsibilities of various corporate members. 3. Meeting Minutes: Meeting minutes are detailed records of discussions, resolutions, and decisions made during board meetings, shareholder meetings, and other corporate gatherings. They document topics addressed, actions taken, and any voting or approval processes. These records are crucial for demonstrating compliance and the responsible management of corporate affairs. 4. Stock Ledger: The stock ledger maintains a record of shareholders, their contact details, stock certificates issued, and transaction history. This record is vital for tracking ownership changes, facilitating communication with shareholders, and ensuring compliance with applicable laws and regulations. 5. Annual Reports: Florida Professional Corporations are required to file annual reports with the Florida Department of State. These reports provide updated information about the corporation's registered agent, officers, directors, and its principal place of business. Adequate maintenance of annual reports ensures accurate public representation and fulfills statutory obligations. 6. Financial Statements: Corporations must maintain accurate financial records, including balance sheets, income statements, and cash flow statements. These records are crucial for evaluating the financial health of the corporation, securing financing, preparing tax returns, and ensuring compliance with accounting standards. 7. Shareholder Agreements: In cases where multiple shareholders exist, a shareholder agreement may be established to detail the rights, responsibilities, and obligations of each shareholder. These agreements may cover matters such as dividend distribution, dispute resolution mechanisms, transfer restrictions, and buy-sell provisions. 8. Employment Agreements: Employment agreements between the corporation and its officers or key employees may include terms related to compensation, benefits, termination, and non-disclosure. These records help protect the rights of both parties and ensure clarity regarding employment terms. By maintaining these Hillsborough Sample Corporate Records, a Florida Professional Corporation can demonstrate its professionalism, compliance with legal requirements, and commitment to transparent business practices. These records contribute to the corporation's overall reputation and provide a basis for informed decision-making and legal protection.

Hillsborough Sample Corporate Records for a Florida Professional Corporation

Description

How to fill out Hillsborough Sample Corporate Records For A Florida Professional Corporation?

Make use of the US Legal Forms and get instant access to any form you need. Our beneficial website with a huge number of document templates simplifies the way to find and obtain virtually any document sample you will need. You can download, fill, and sign the Hillsborough Sample Corporate Records for a Florida Professional Corporation in a few minutes instead of browsing the web for many hours trying to find a proper template.

Using our collection is an excellent strategy to raise the safety of your document submissions. Our experienced lawyers regularly review all the records to ensure that the templates are appropriate for a particular state and compliant with new acts and polices.

How do you get the Hillsborough Sample Corporate Records for a Florida Professional Corporation? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

- Find the form you require. Make sure that it is the form you were seeking: verify its title and description, and make use of the Preview option when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order using a credit card or PayPal.

- Save the document. Indicate the format to get the Hillsborough Sample Corporate Records for a Florida Professional Corporation and edit and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and reliable template libraries on the internet. Our company is always ready to help you in virtually any legal procedure, even if it is just downloading the Hillsborough Sample Corporate Records for a Florida Professional Corporation.

Feel free to benefit from our service and make your document experience as efficient as possible!