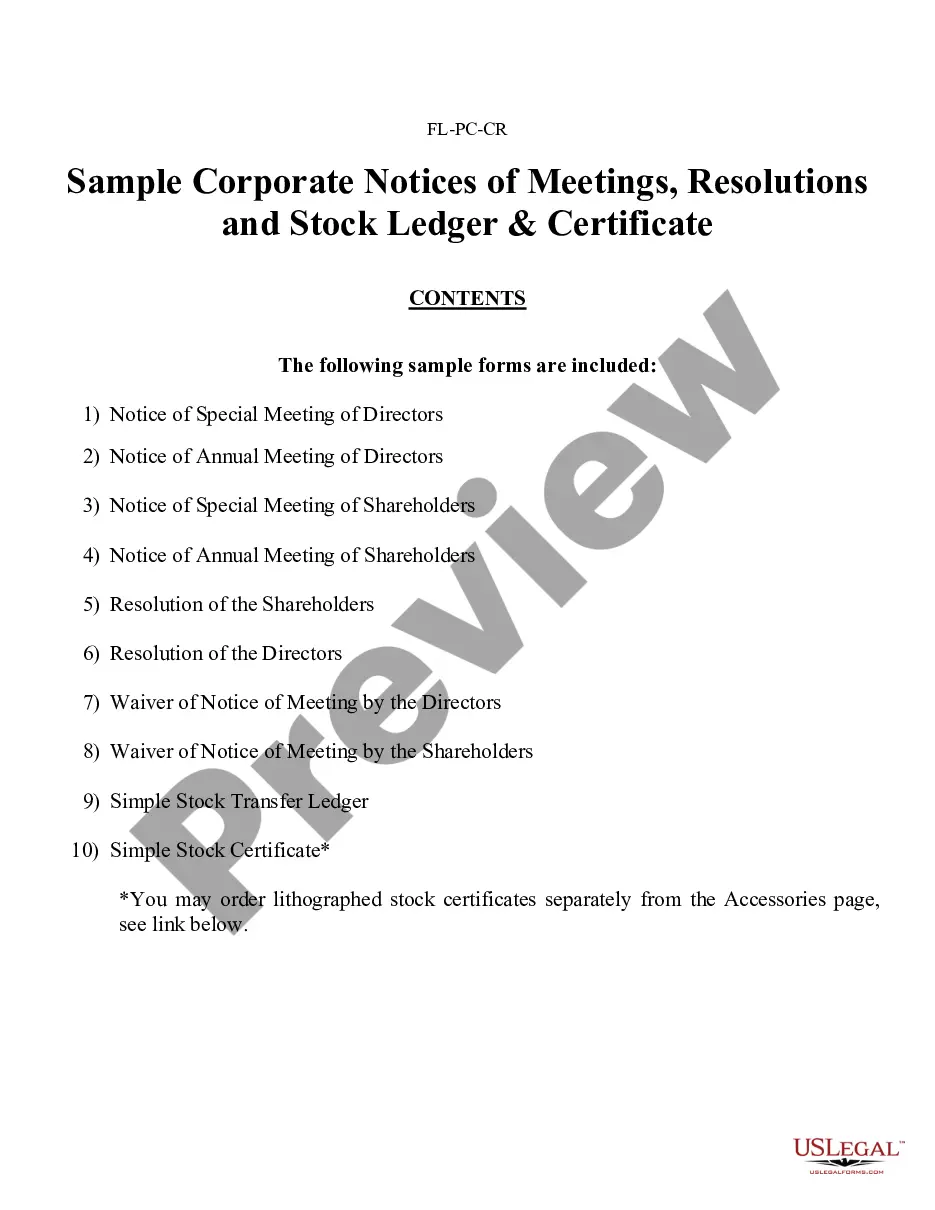

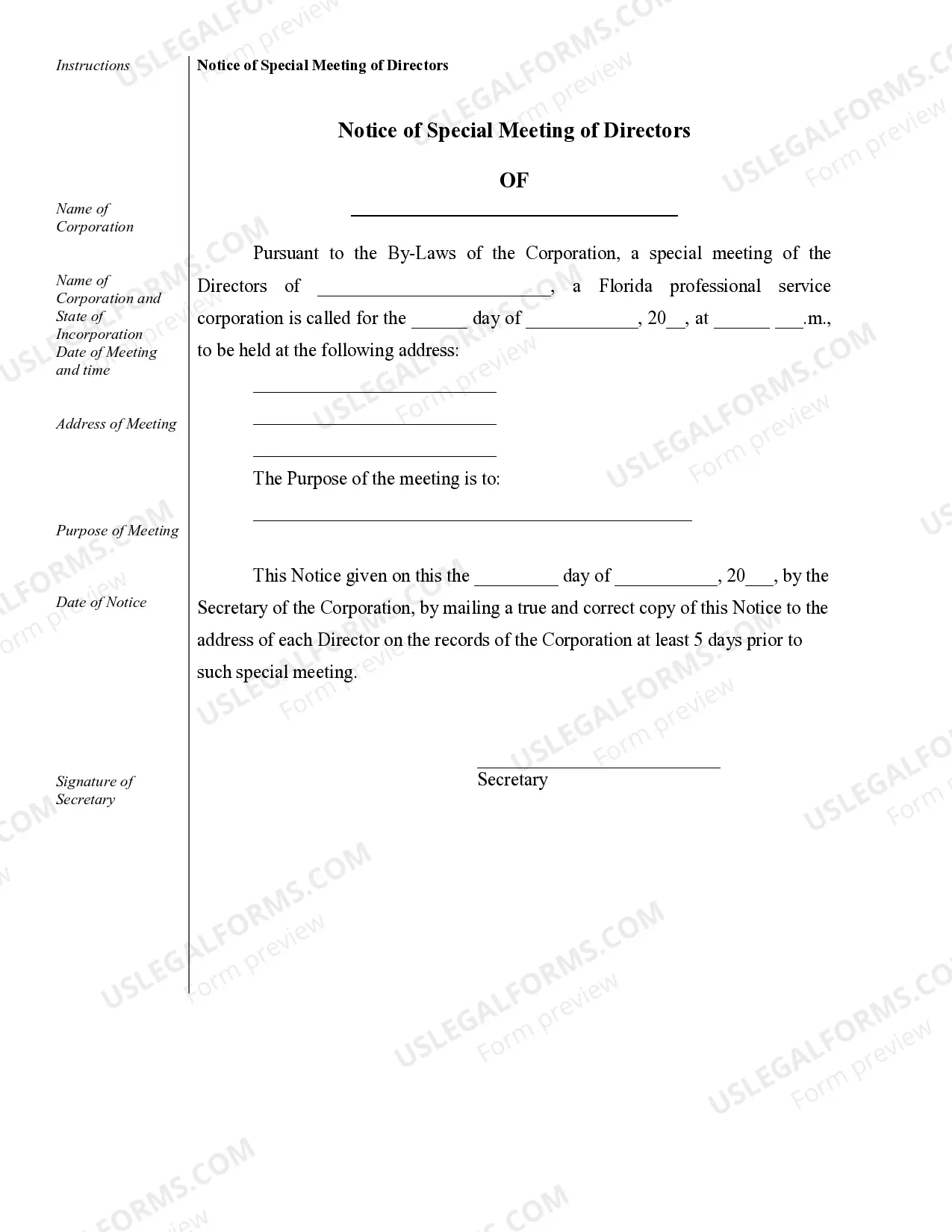

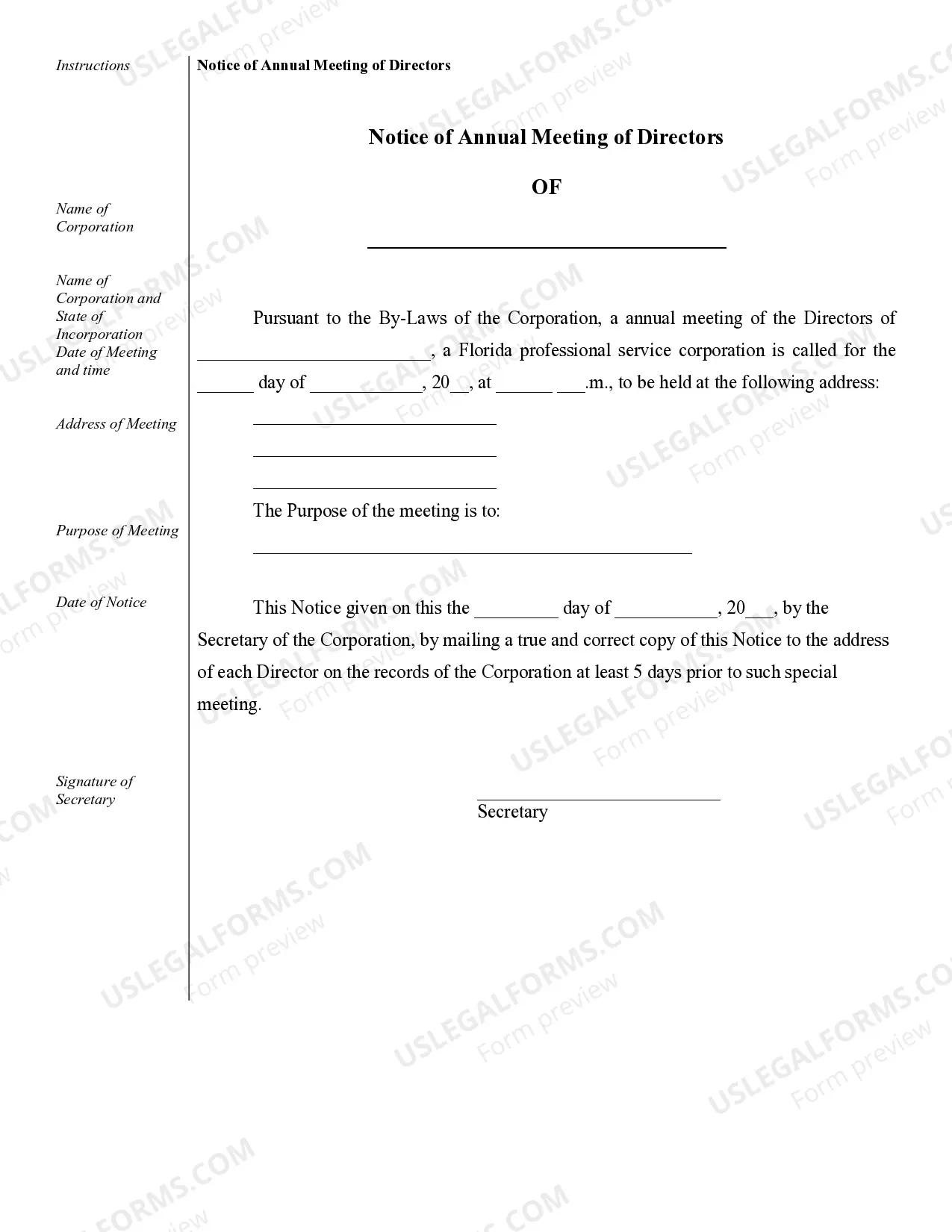

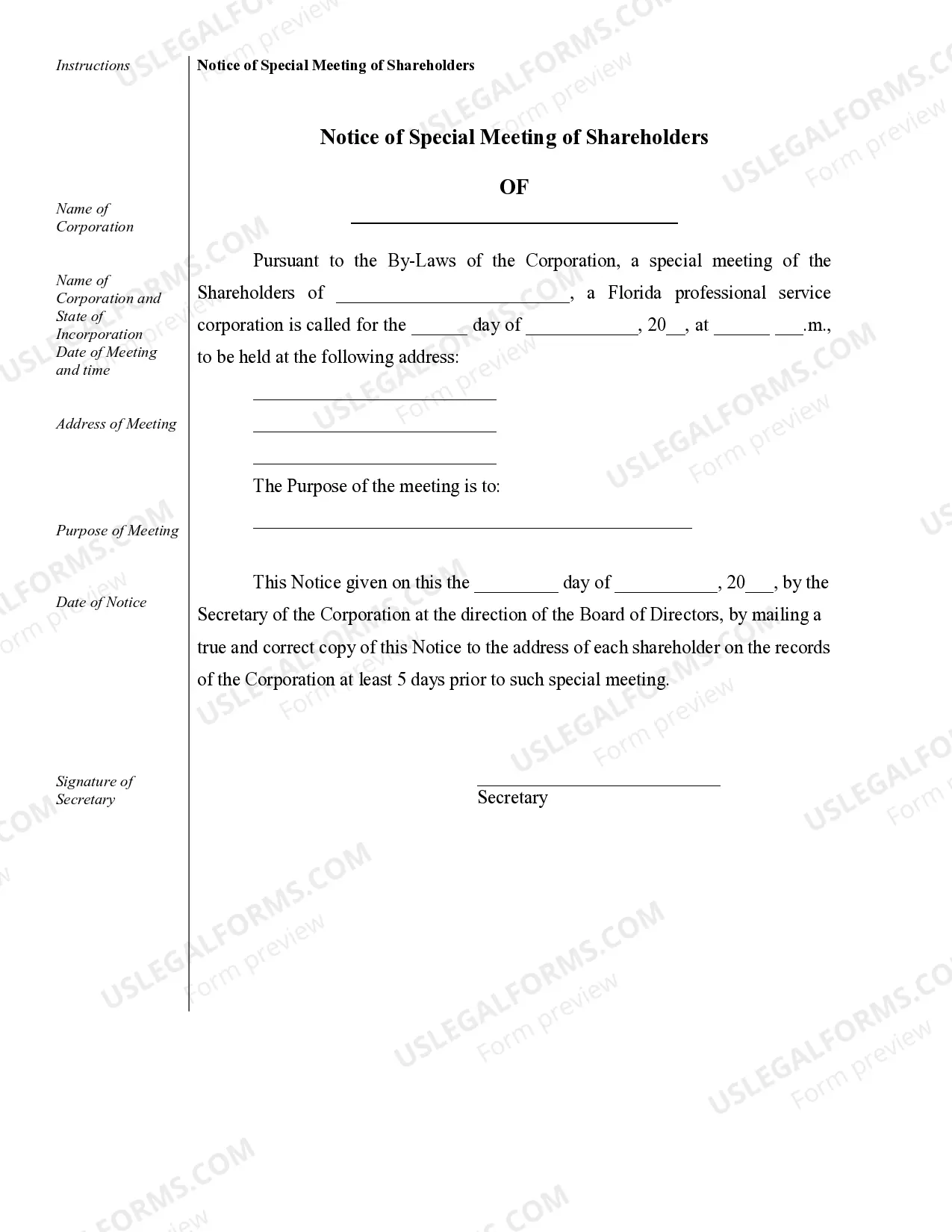

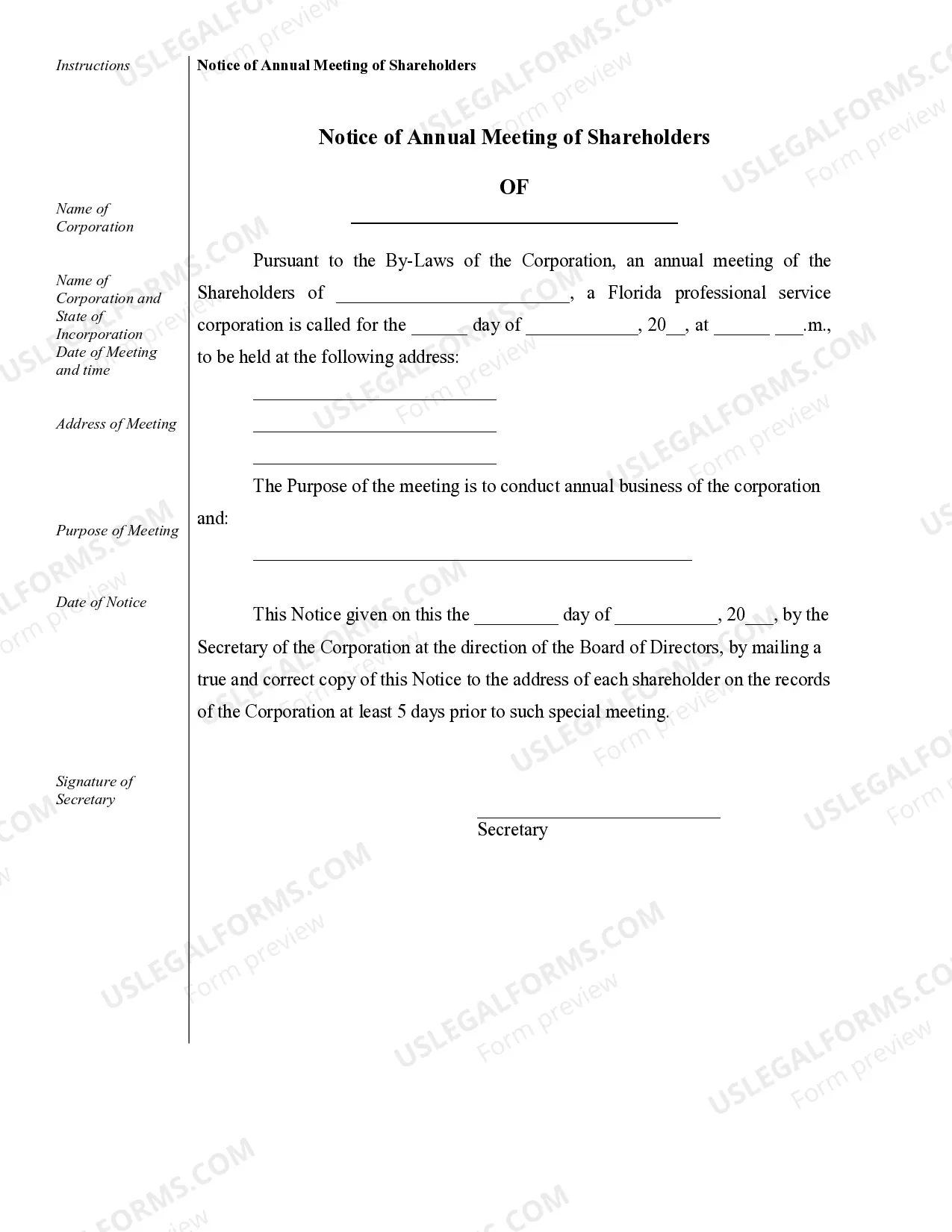

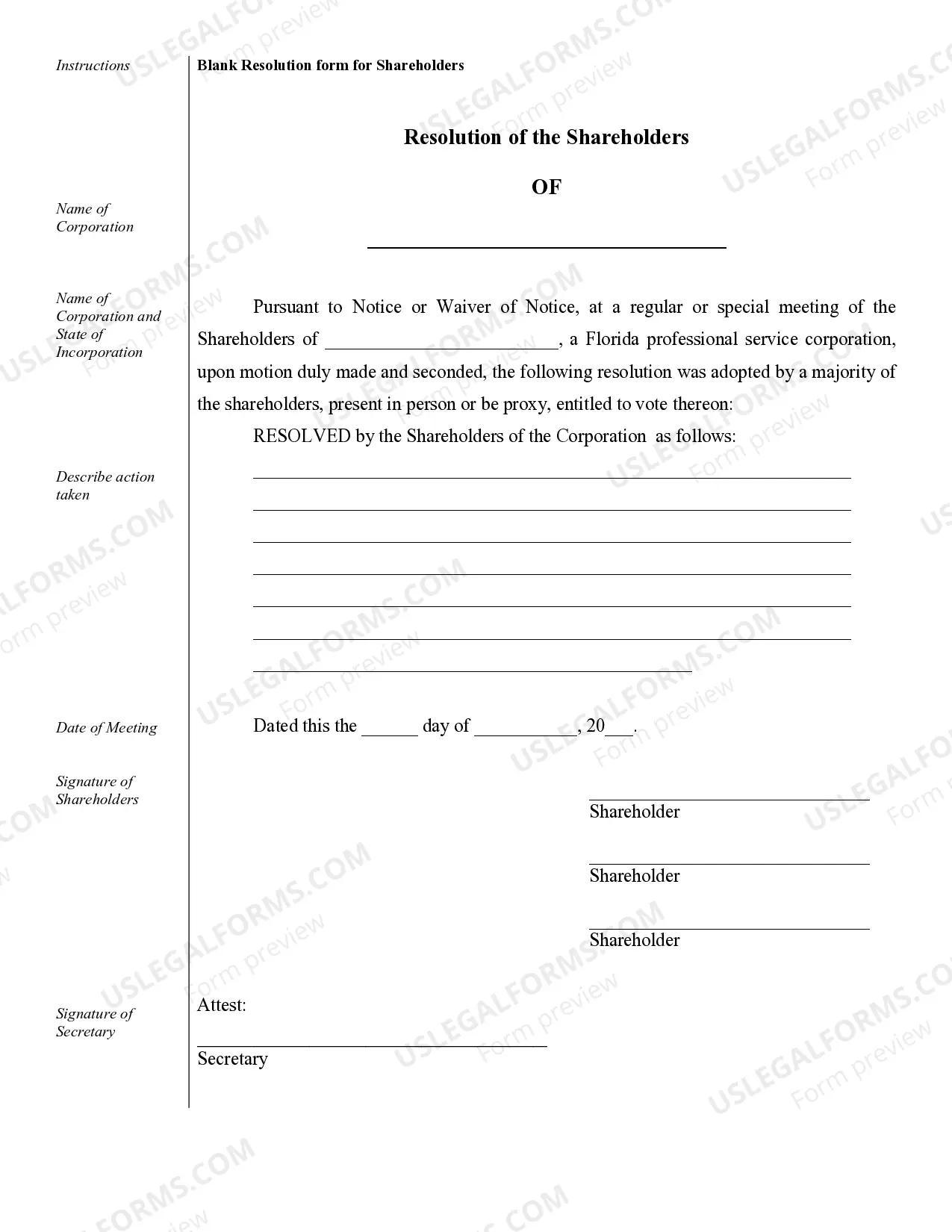

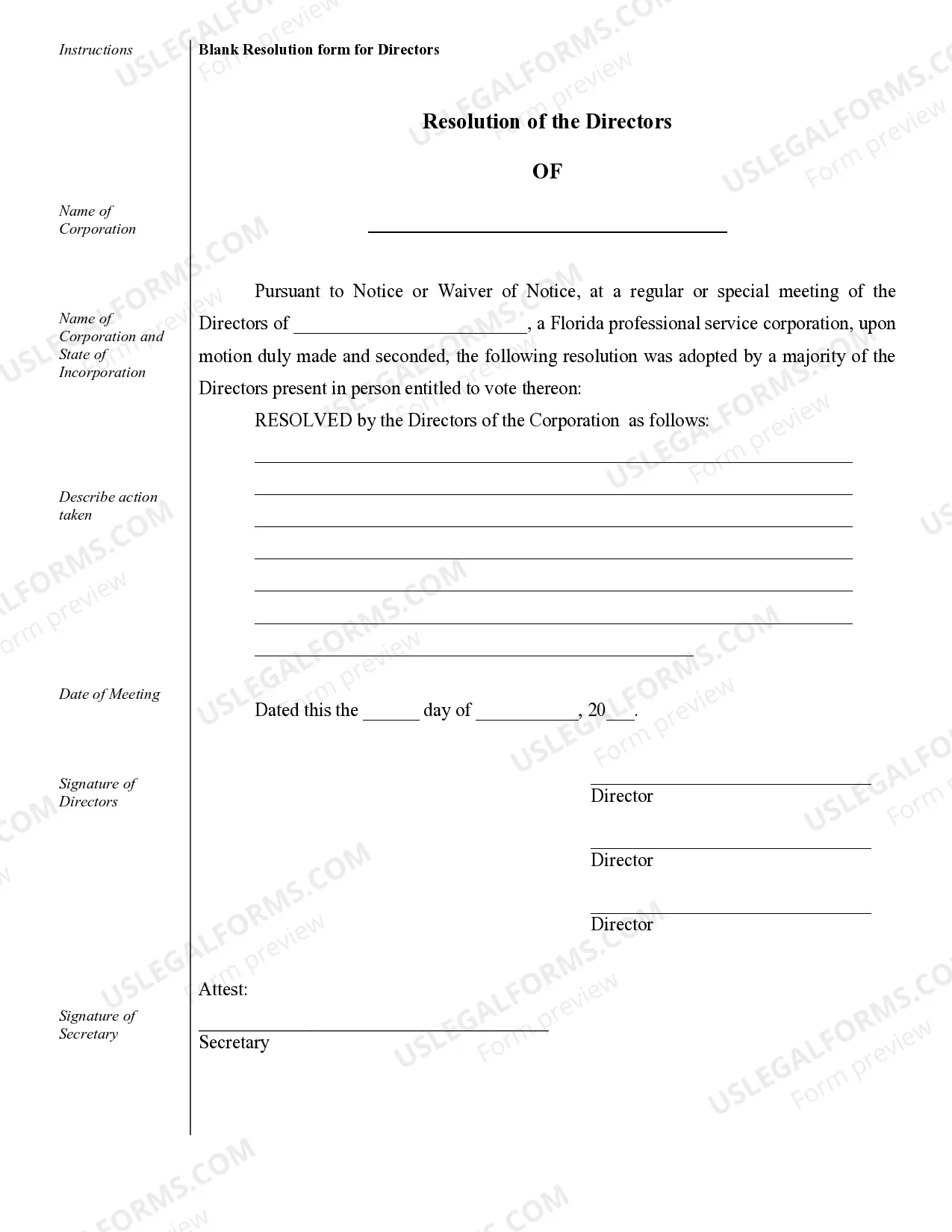

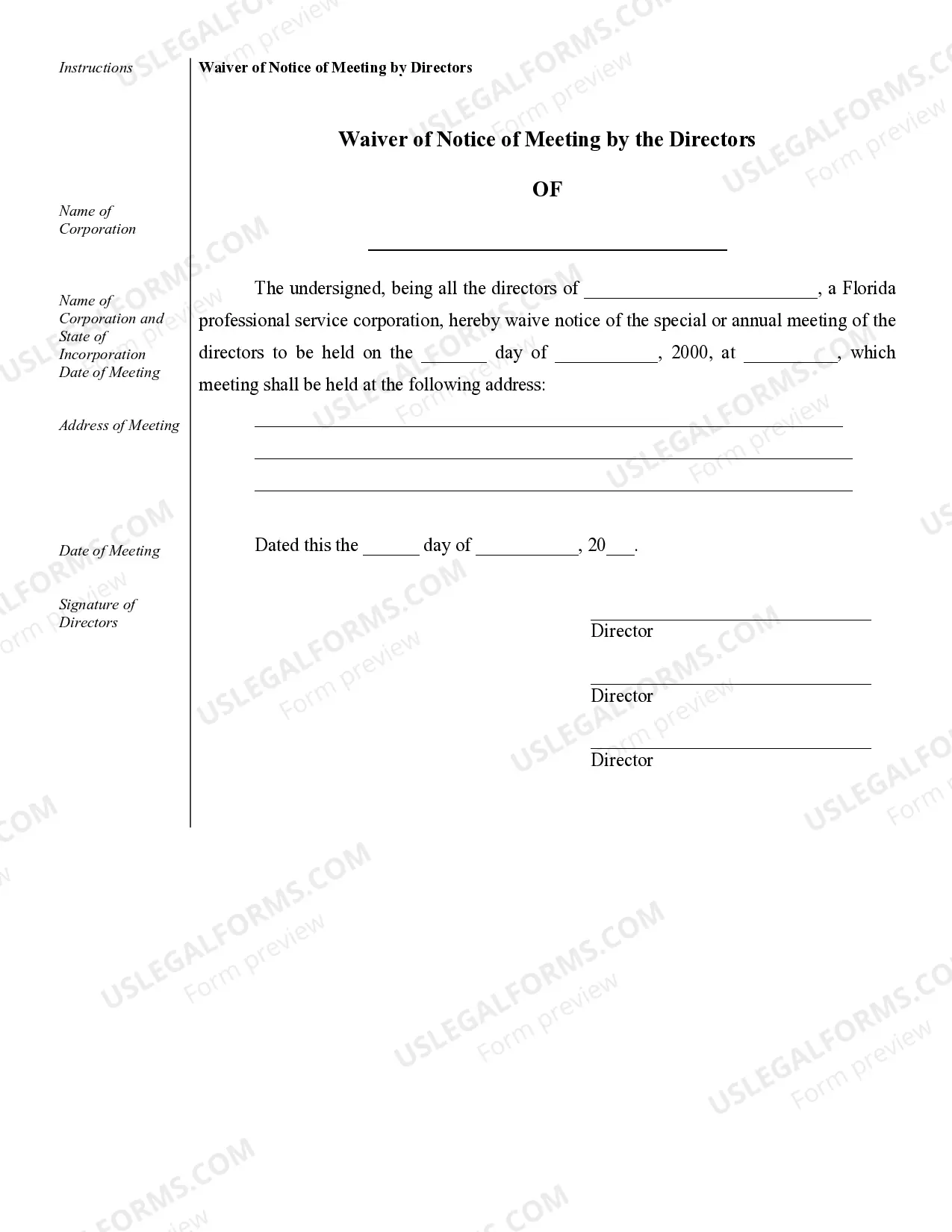

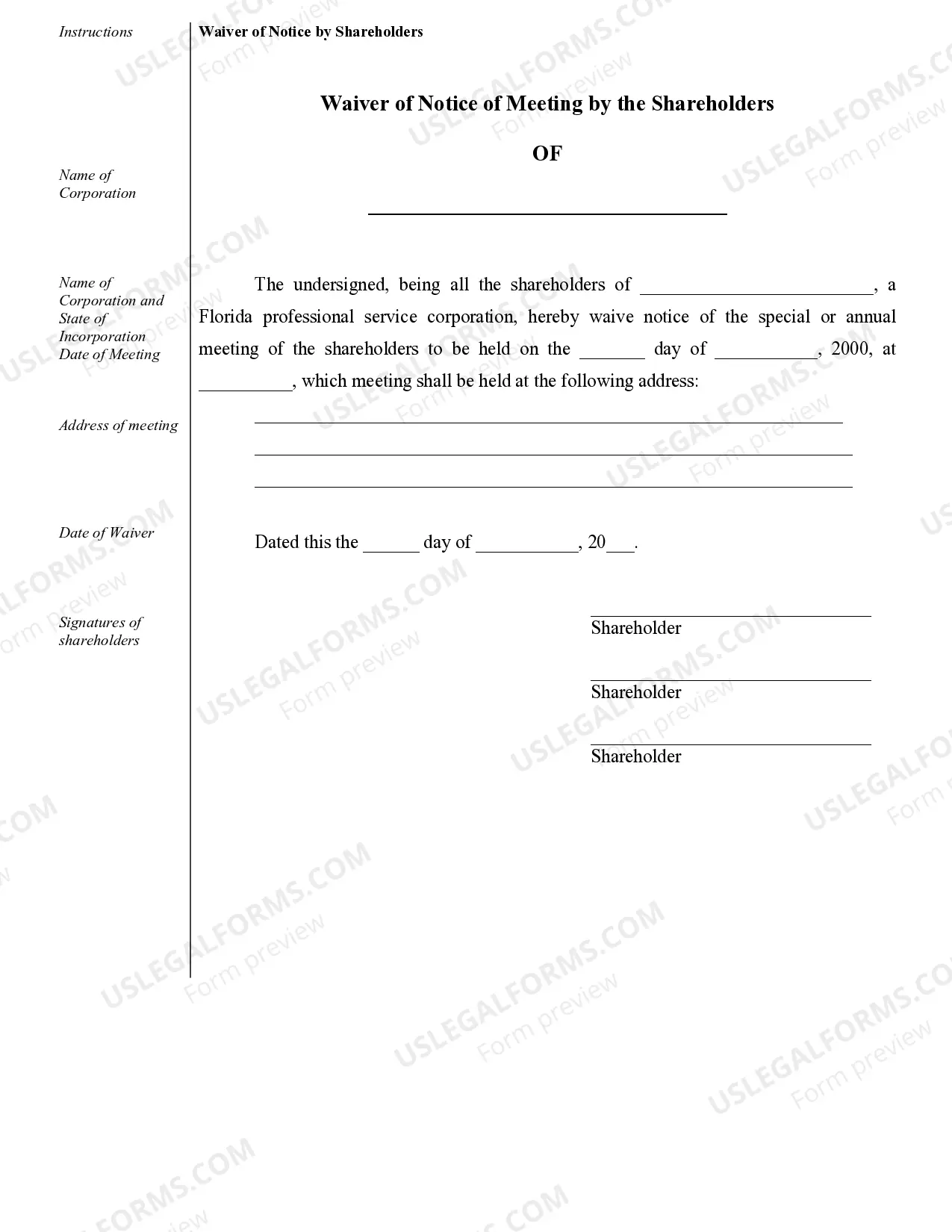

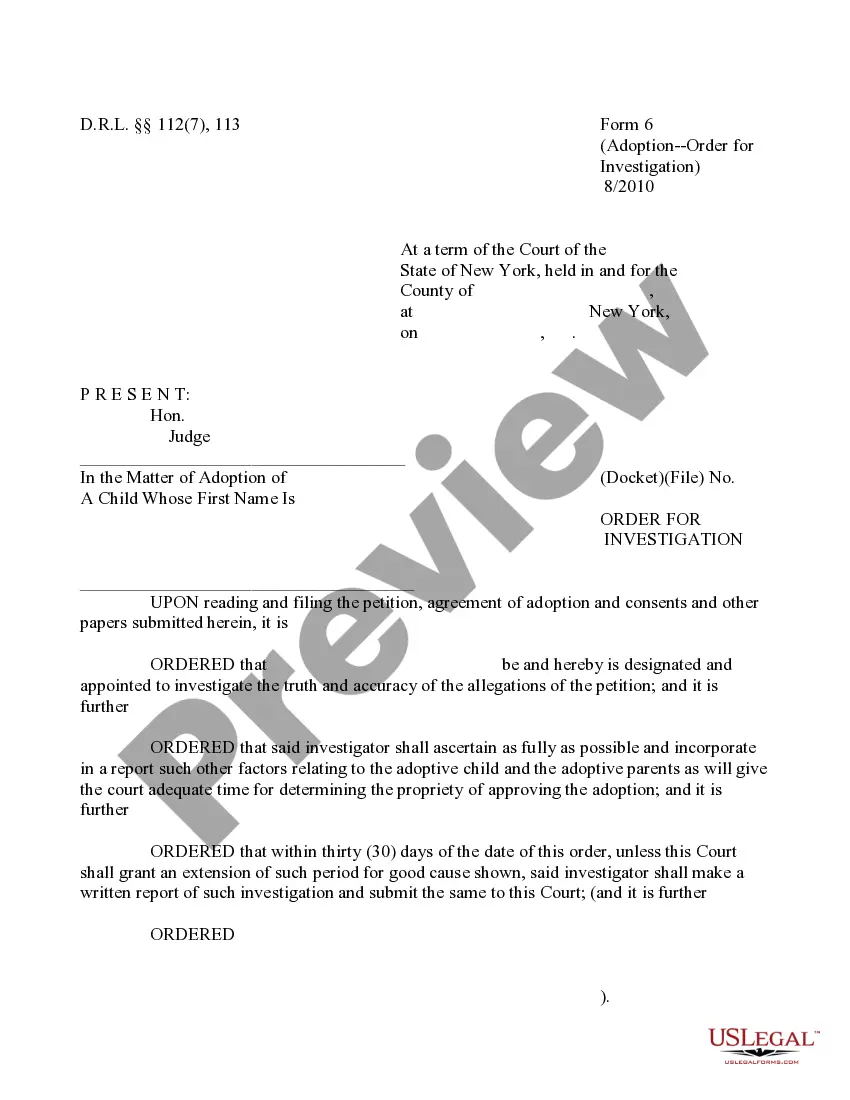

Jacksonville Sample Corporate Records for a Florida Professional Corporation refer to a collection of documents and records that are created and maintained by a professional corporation based in Jacksonville, Florida. These records play a crucial role in documenting and organizing the essential information related to the company's operations, shareholders, and compliance with relevant laws and regulations. The Jacksonville Sample Corporate Records for a Florida Professional Corporation can be categorized into several types, including: 1. Articles of Incorporation: This document establishes the existence of the professional corporation and provides essential information such as the corporate name, purpose, registered agent, and initial directors. 2. Bylaws: Bylaws outline the internal rules and regulations governing the corporation's operations, including shareholder and director meetings, decision-making processes, and other corporate procedures. 3. Shareholder Records: These records document the ownership of shares and other relevant information about the corporation's shareholders. It includes details such as the names and contact information of shareholders, the number of shares owned, and any restrictions or agreements related to share transfers. 4. Board of Directors Records: These records pertain to the directors of the professional corporation. They include information about the board meetings, resolutions, appointment or removal of directors, and other matters related to corporate governance. 5. Meeting Minutes: Meeting minutes provide a concise and accurate record of the discussions, decisions, and actions taken during board meetings, shareholder meetings, or committee meetings. They serve as a historical record of the corporation's activities and decision-making processes. 6. Financial Records: These records include financial statements, such as balance sheets, income statements, cash flow statements, and tax returns. They are crucial for assessing the financial health of the professional corporation, providing transparency to shareholders, and complying with accounting and taxation obligations. 7. Annual Reports: Professional corporations in Florida are required to file annual reports with the state. These reports provide updates on the corporation's current status, contact information, principal office address, and details of officers and directors. 8. Licenses and Permits: Depending on the nature of the professional corporation's activities, there may be specific licenses or permits required. Records related to these licenses and permits should be maintained, including any renewal or compliance documentation. It's important to note that the specific content and format of these records may vary depending on the individual professional corporation's activities, size, and industry. However, the above-listed records are commonly found in the Jacksonville Sample Corporate Records for a Florida Professional Corporation and are necessary for legal compliance, financial transparency, and efficient corporate governance.

Jacksonville Sample Corporate Records for a Florida Professional Corporation

Description

How to fill out Jacksonville Sample Corporate Records For A Florida Professional Corporation?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, usually, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Jacksonville Sample Corporate Records for a Florida Professional Corporation or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Jacksonville Sample Corporate Records for a Florida Professional Corporation complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Jacksonville Sample Corporate Records for a Florida Professional Corporation is proper for you, you can select the subscription option and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!