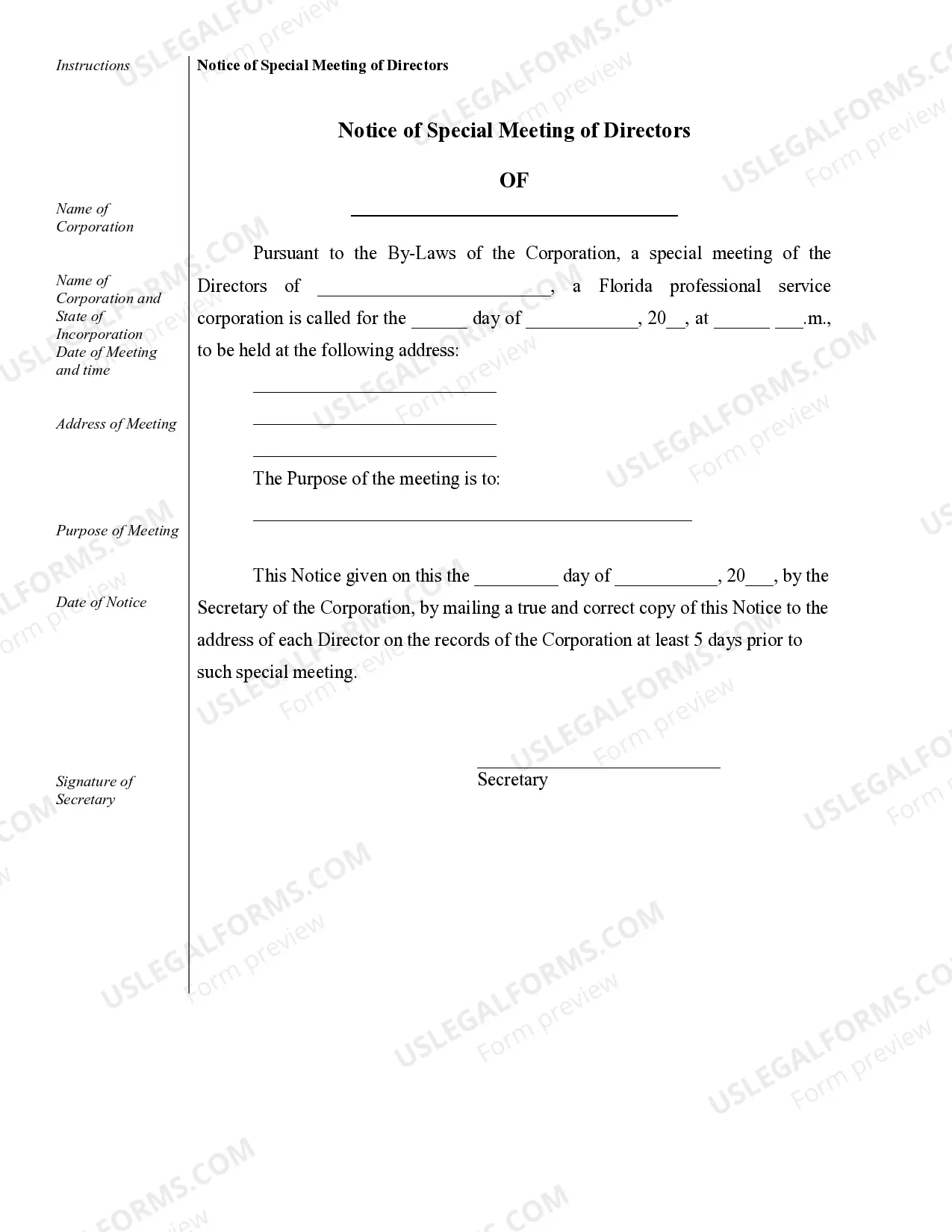

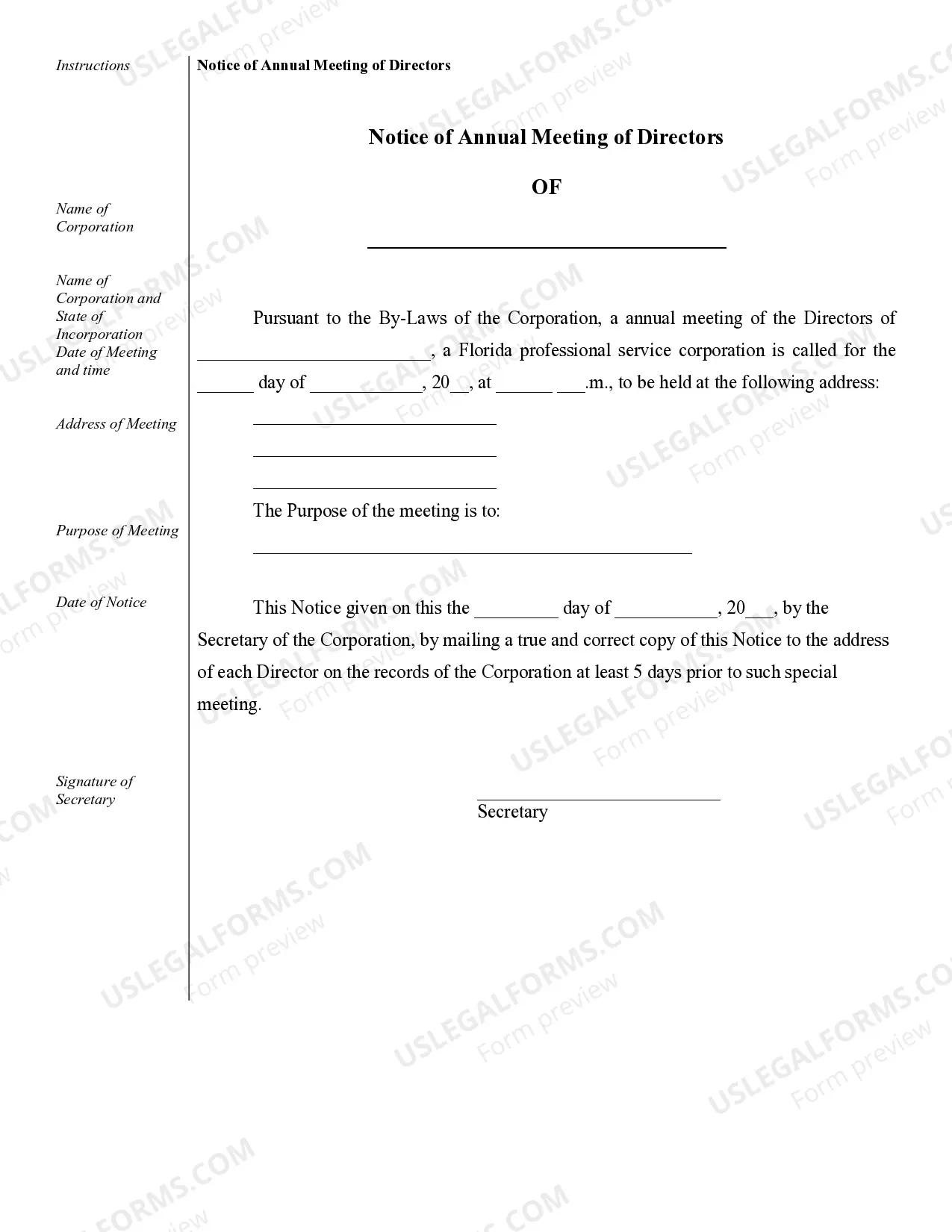

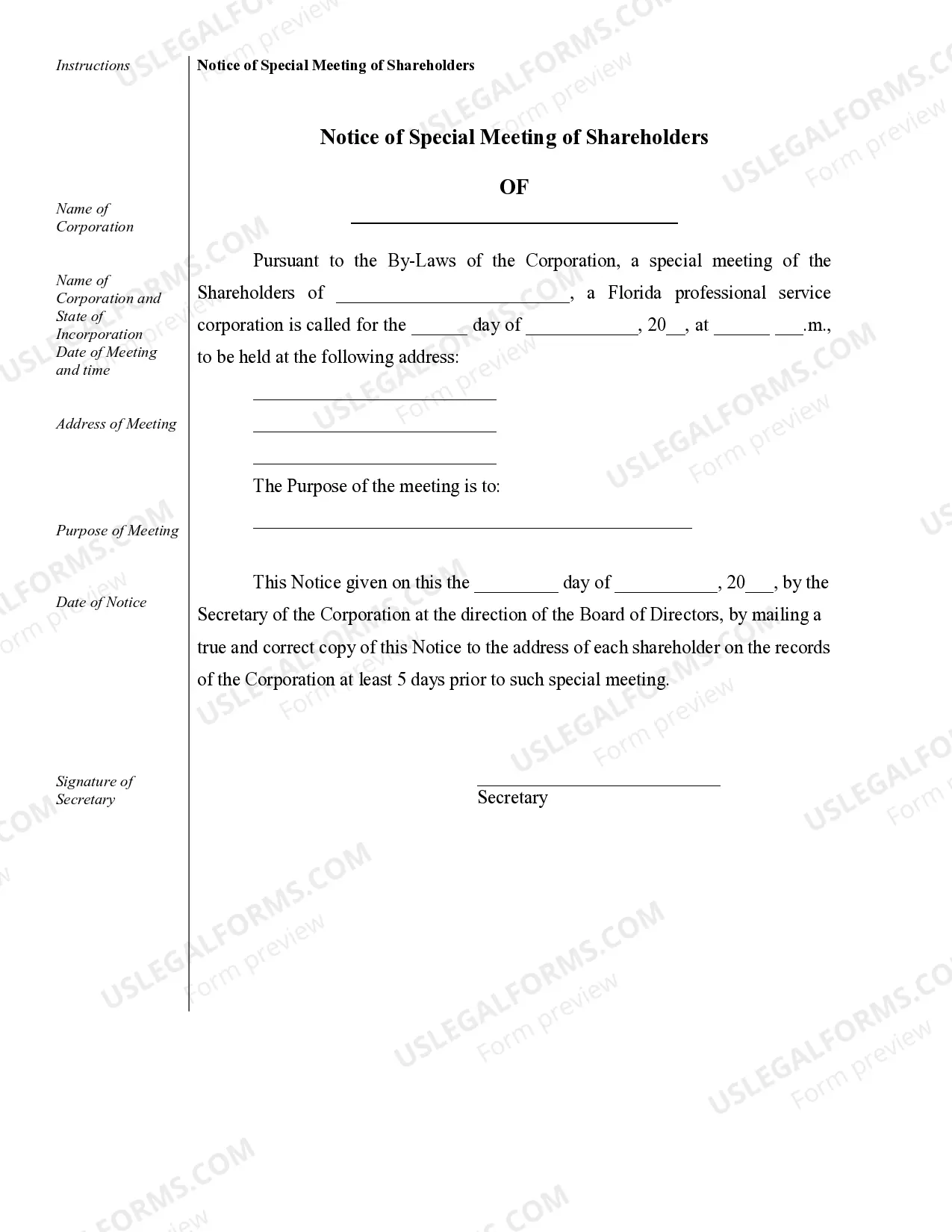

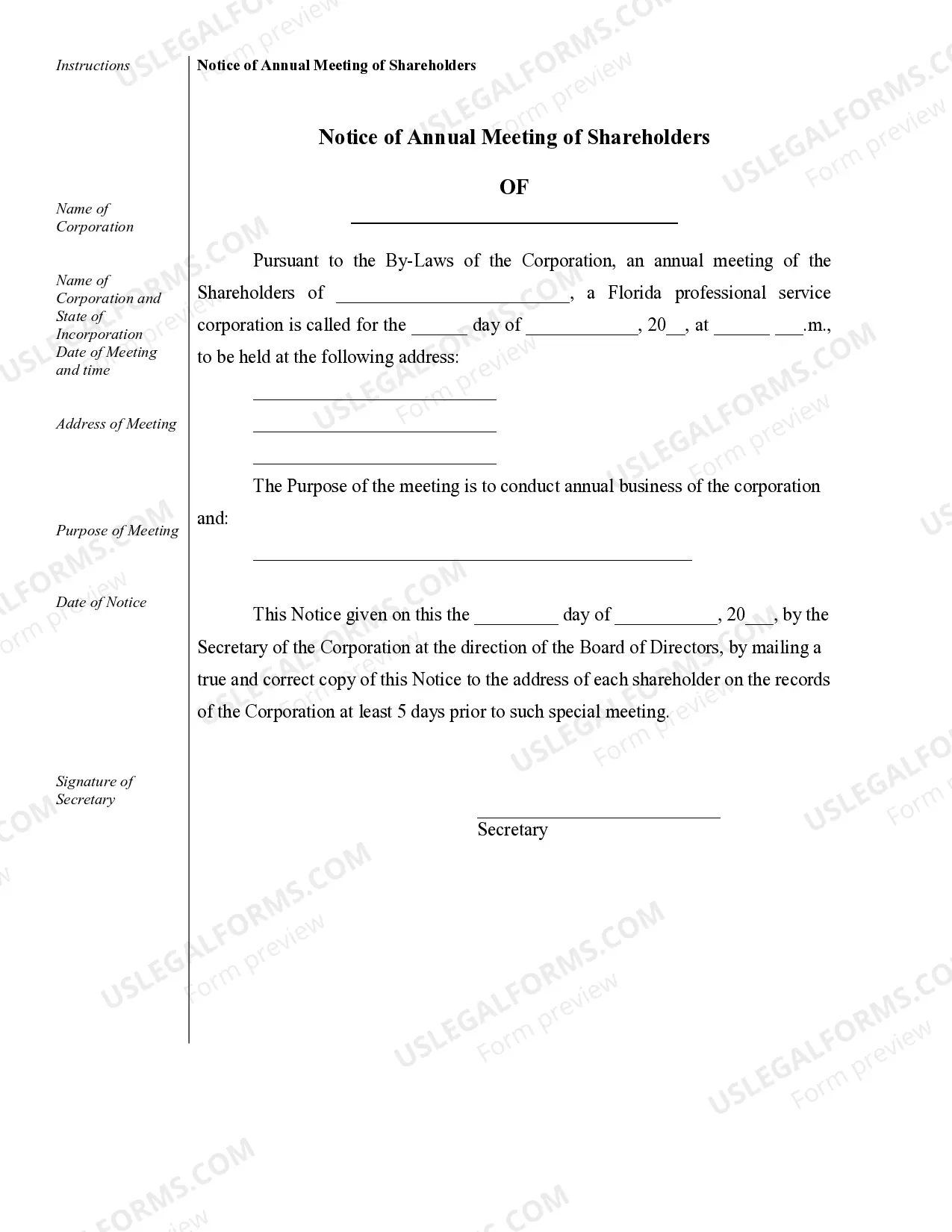

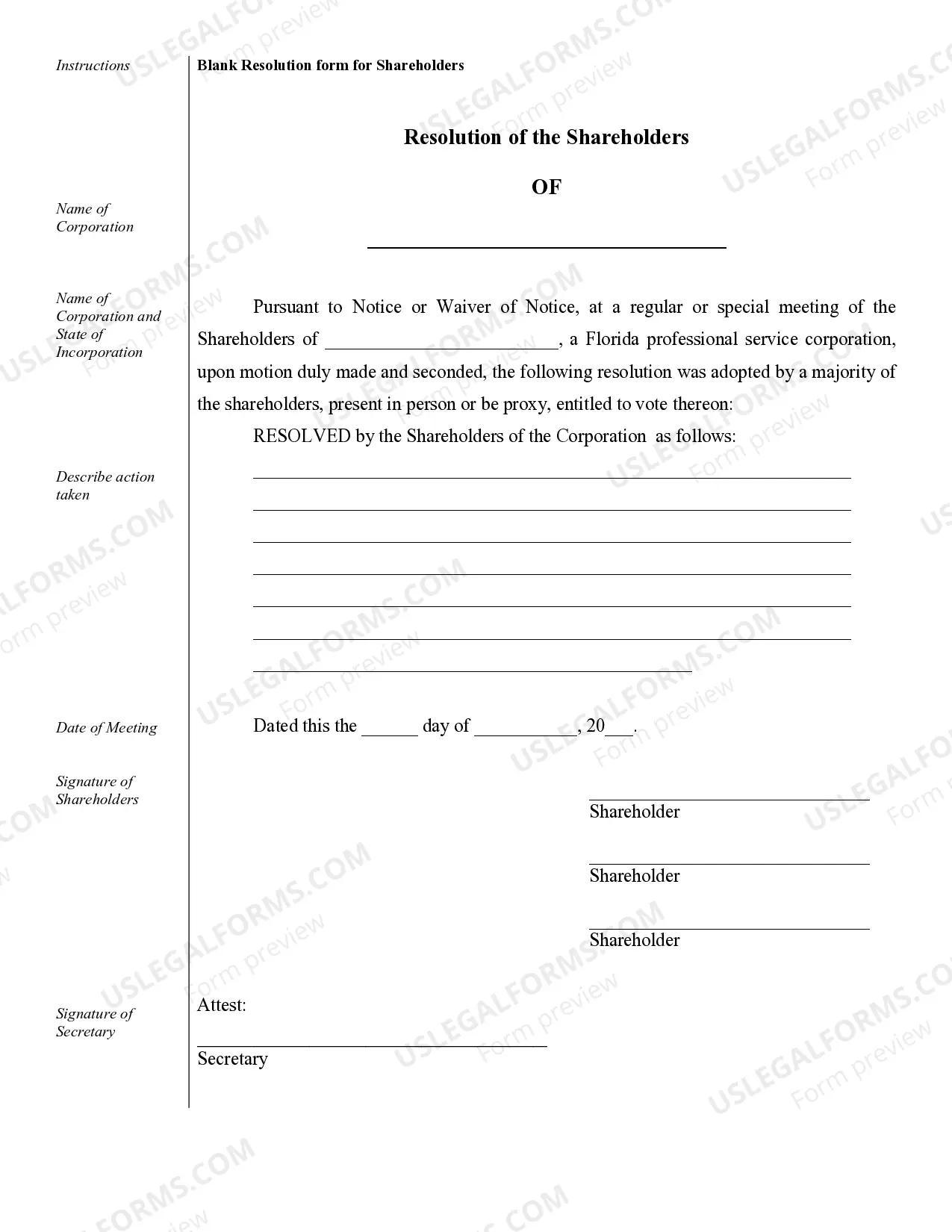

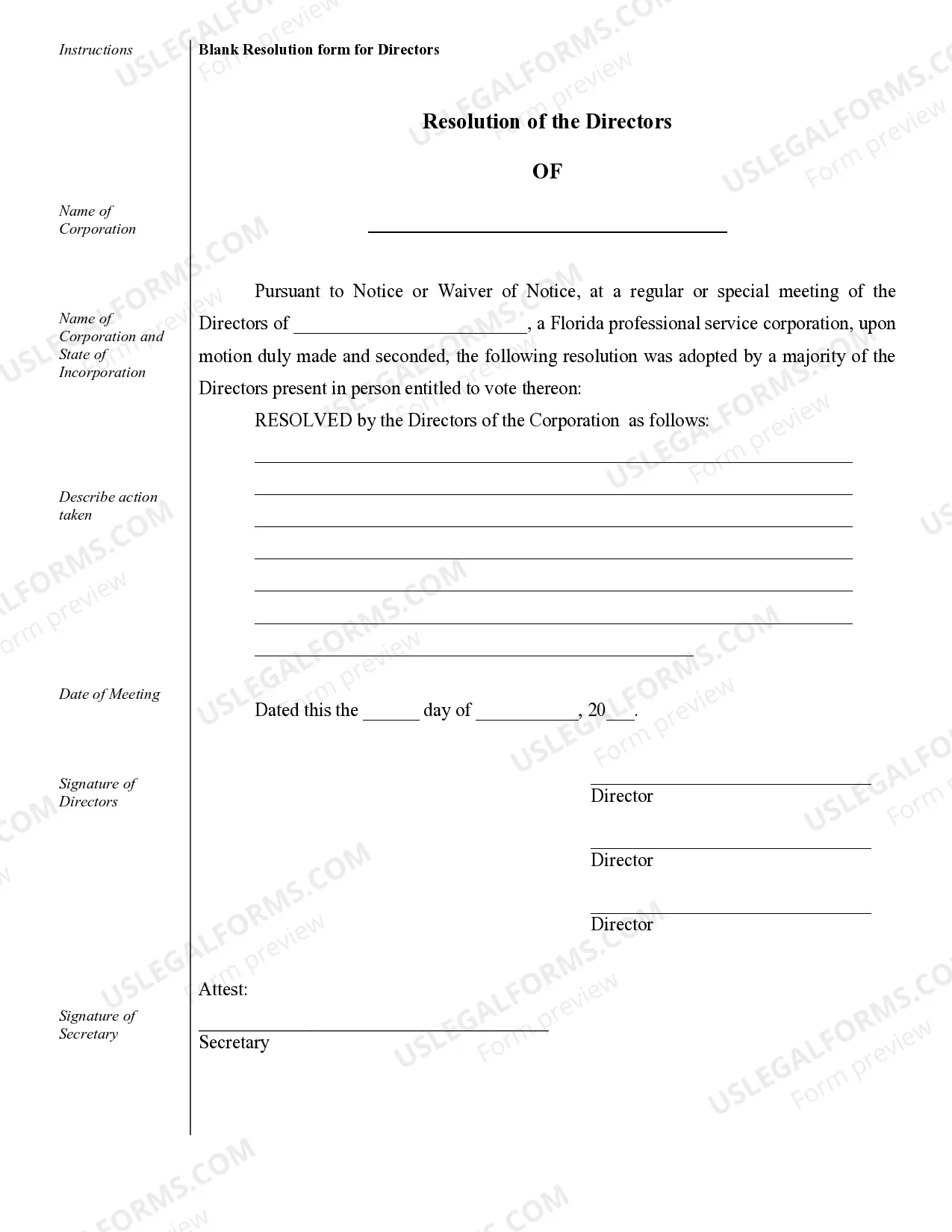

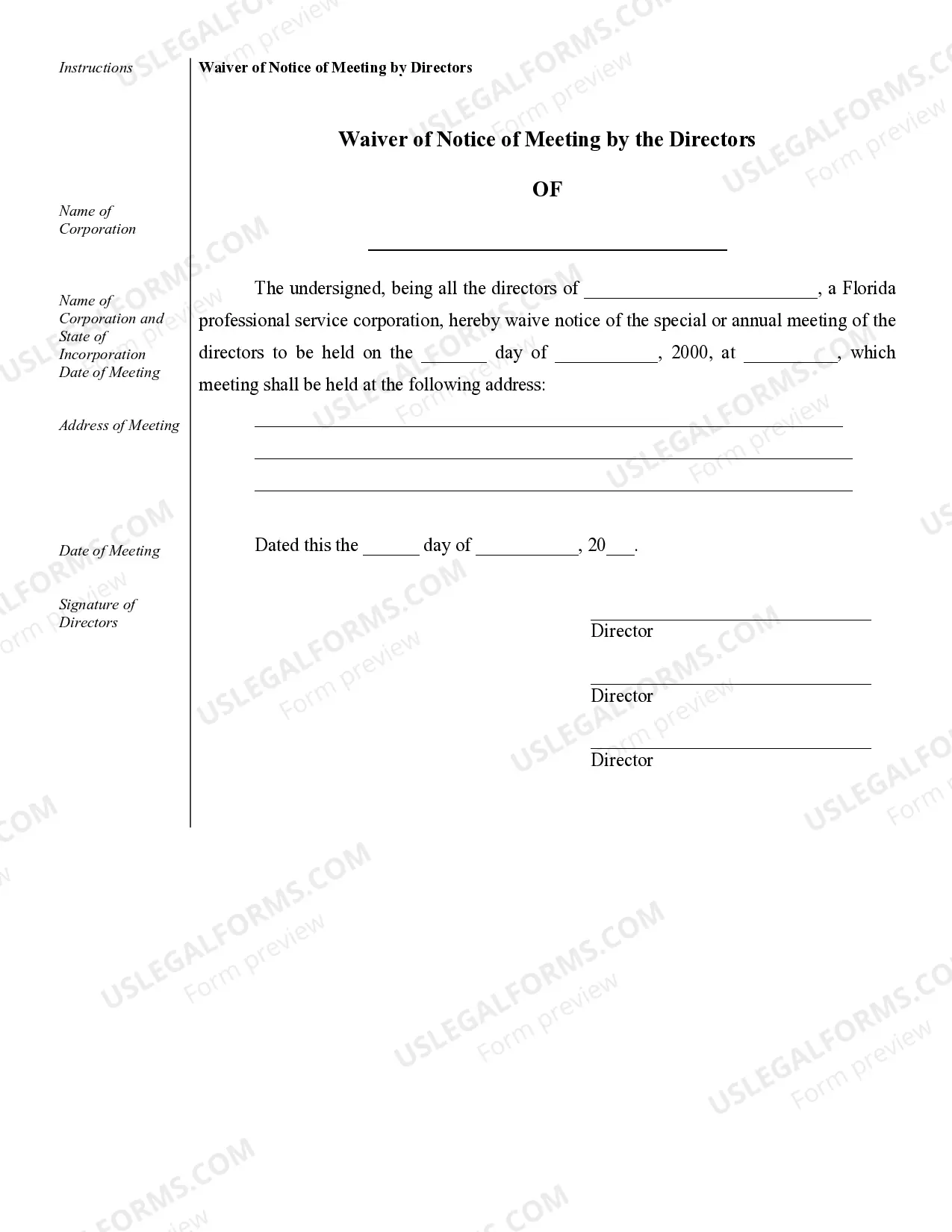

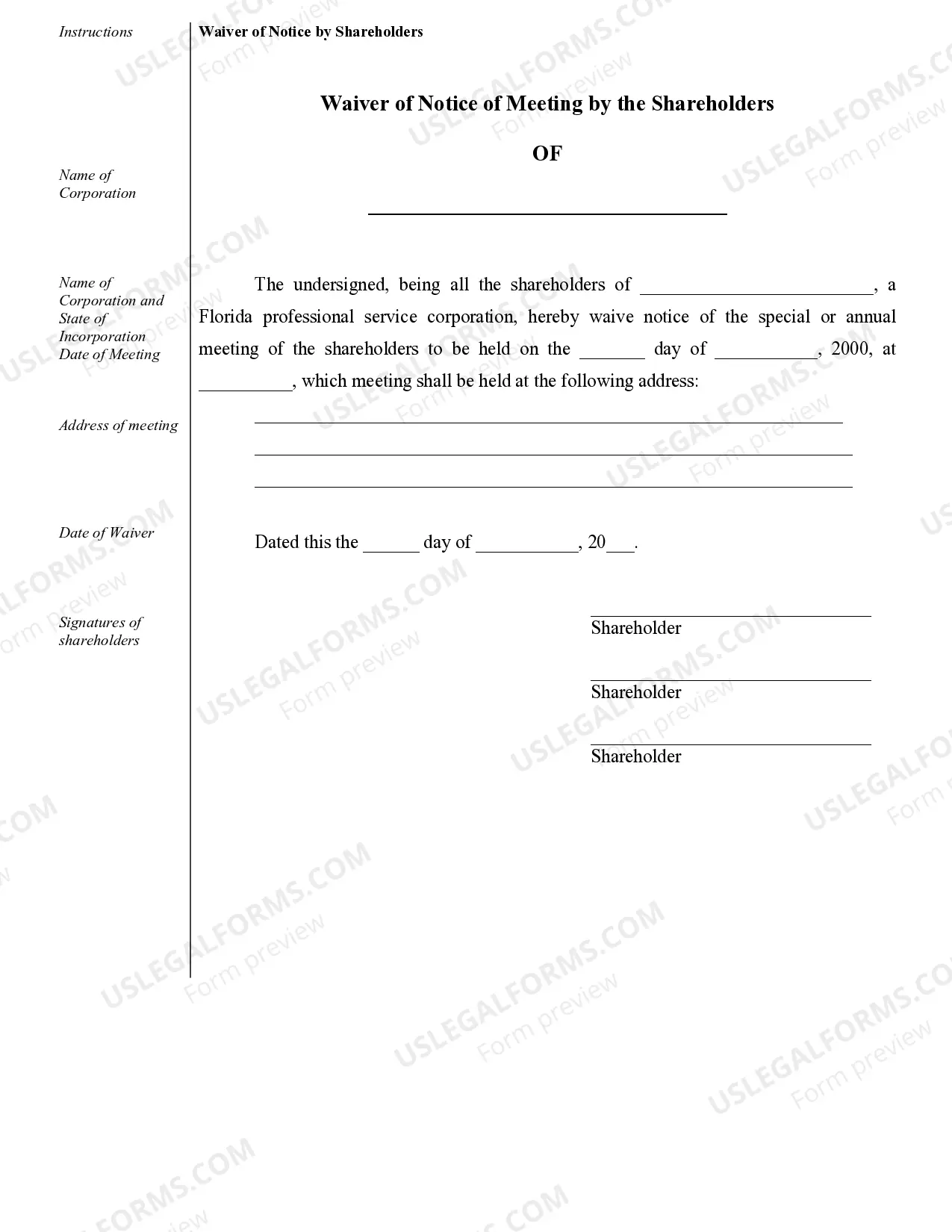

Miami-Dade Sample Corporate Records for a Florida Professional Corporation are essential documents that track the legal and financial activities of a professional corporation registered in Miami-Dade County, Florida. These records serve as a comprehensive record-keeping system, ensuring compliance with state regulations and facilitating smooth business operations. The following types of corporate records are commonly maintained for a Florida Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation establish the legal existence of a professional corporation in Florida. They contain essential information such as the corporation's name, purpose, registered agent, and the names and addresses of the incorporates. 2. Bylaws: The Bylaws dictate the internal rules and regulations that govern the operation and management of the professional corporation. These include guidelines on shareholder meetings, election procedures, duties of officers and directors, and other corporate governance matters. 3. Meeting Minutes: Accurate meeting minutes document the proceedings and decisions made during shareholder and director meetings. These minutes provide a detailed account of discussions, resolutions, and voting that occur in each meeting, ensuring transparency and record-keeping. 4. Shareholder Records: Shareholder records maintain information about the company's shareholders, including their names, addresses, ownership percentages, and stock certificates. 5. Director Records: Director records document the details of the corporation's directors, including their names, addresses, terms of service, and committee memberships. 6. Financial Records: Financial records encompass a range of documents such as financial statements, tax returns, budgets, and audit reports. These records offer a snapshot of the corporation's financial health and ensure compliance with accounting standards and tax regulations. 7. Annual Reports: Annual reports summarize the corporation's activities and achievements during a particular fiscal year. Required by the state of Florida, they typically include financial statements, management discussions, and analysis of the corporation's performance. 8. Register of Contracts: This record compiles all contracts, agreements, and legal documents entered into by the corporation. It includes details of parties involved, key terms, and expiration dates, ensuring all legal obligations are met. 9. Shareholder Resolutions: Shareholder resolutions document any formal decisions made by shareholders, such as capital investments, dividend distributions, major corporate transactions, and changes to the corporation's structure. Maintaining accurate and up-to-date Miami-Dade Sample Corporate Records for a Florida Professional Corporation is crucial for legal compliance, effective corporate governance, and successful business operations. These records enhance transparency, safeguard investor trust, and aid in resolving disputes or legal matters that may arise.

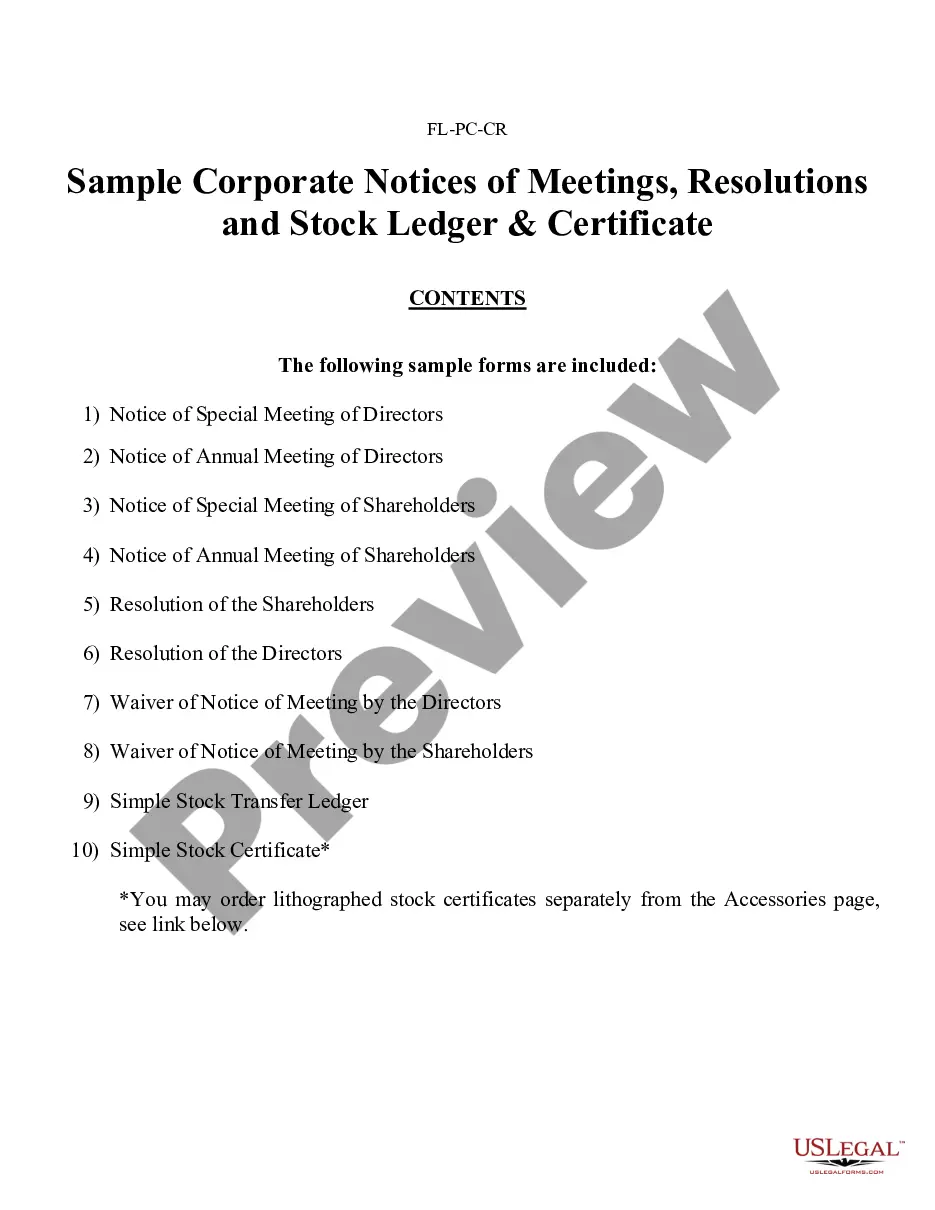

Miami Dade Form Certificate

Description

How to fill out Miami-Dade Sample Corporate Records For A Florida Professional Corporation?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for attorney solutions that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Miami-Dade Sample Corporate Records for a Florida Professional Corporation or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Miami-Dade Sample Corporate Records for a Florida Professional Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Miami-Dade Sample Corporate Records for a Florida Professional Corporation is suitable for your case, you can select the subscription option and make a payment.

- Then you can download the document in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!