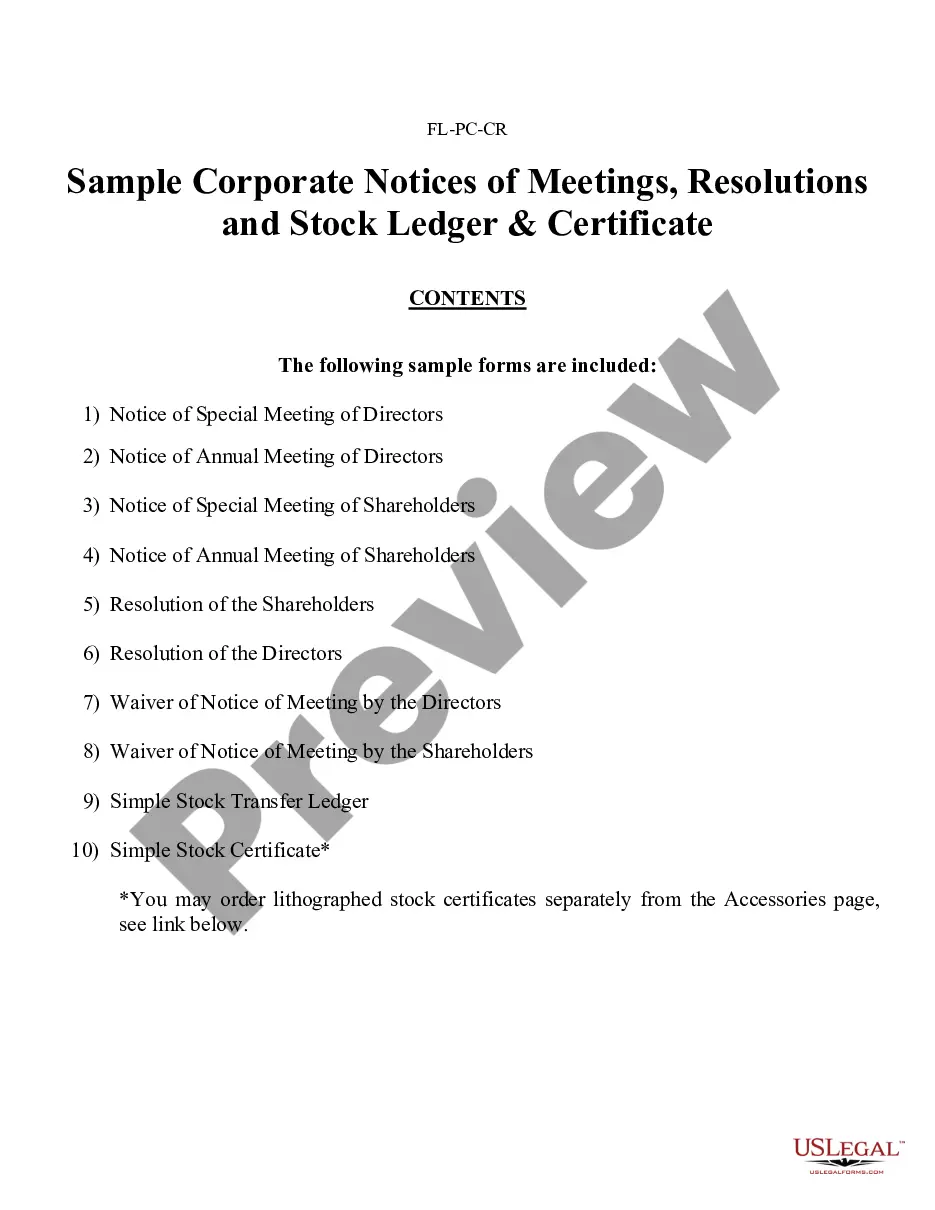

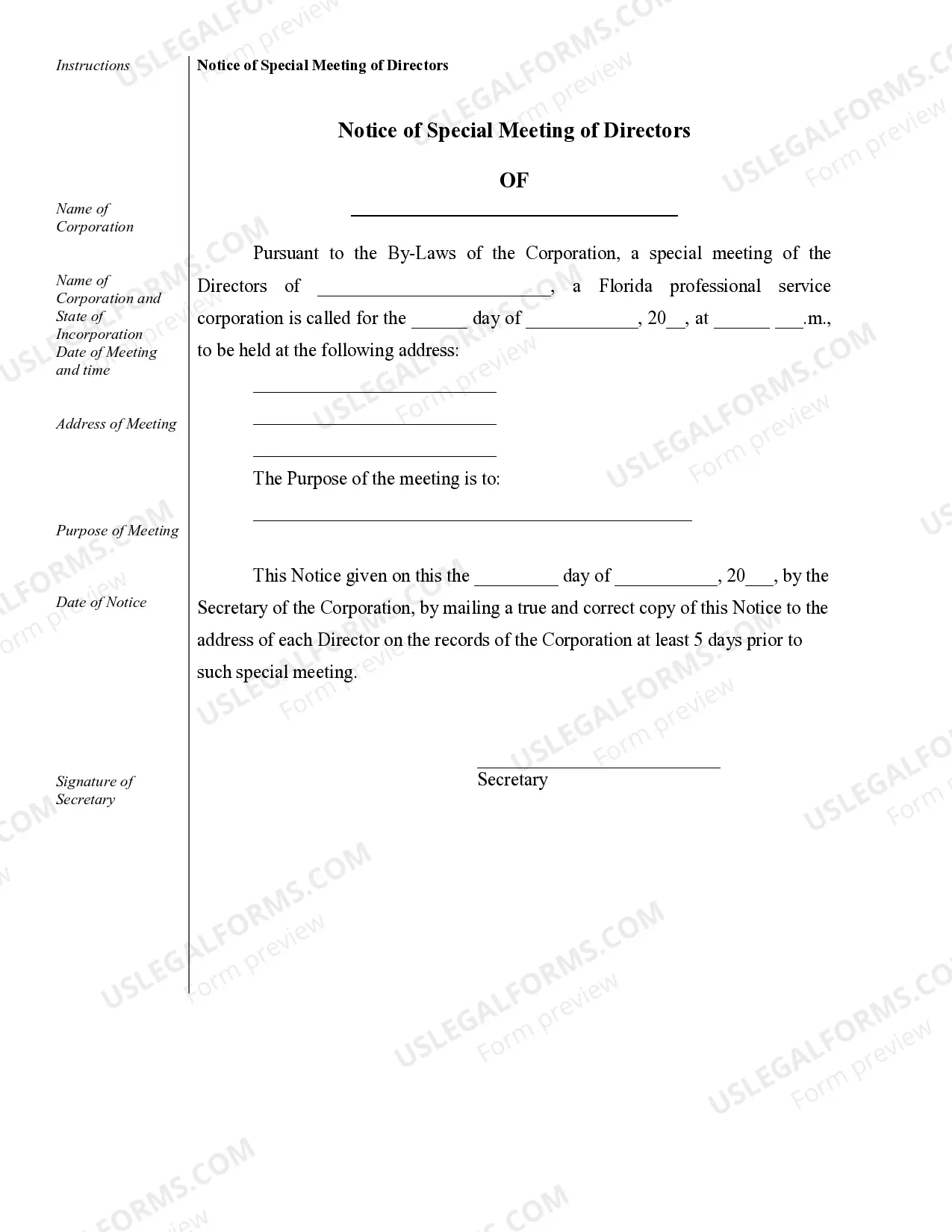

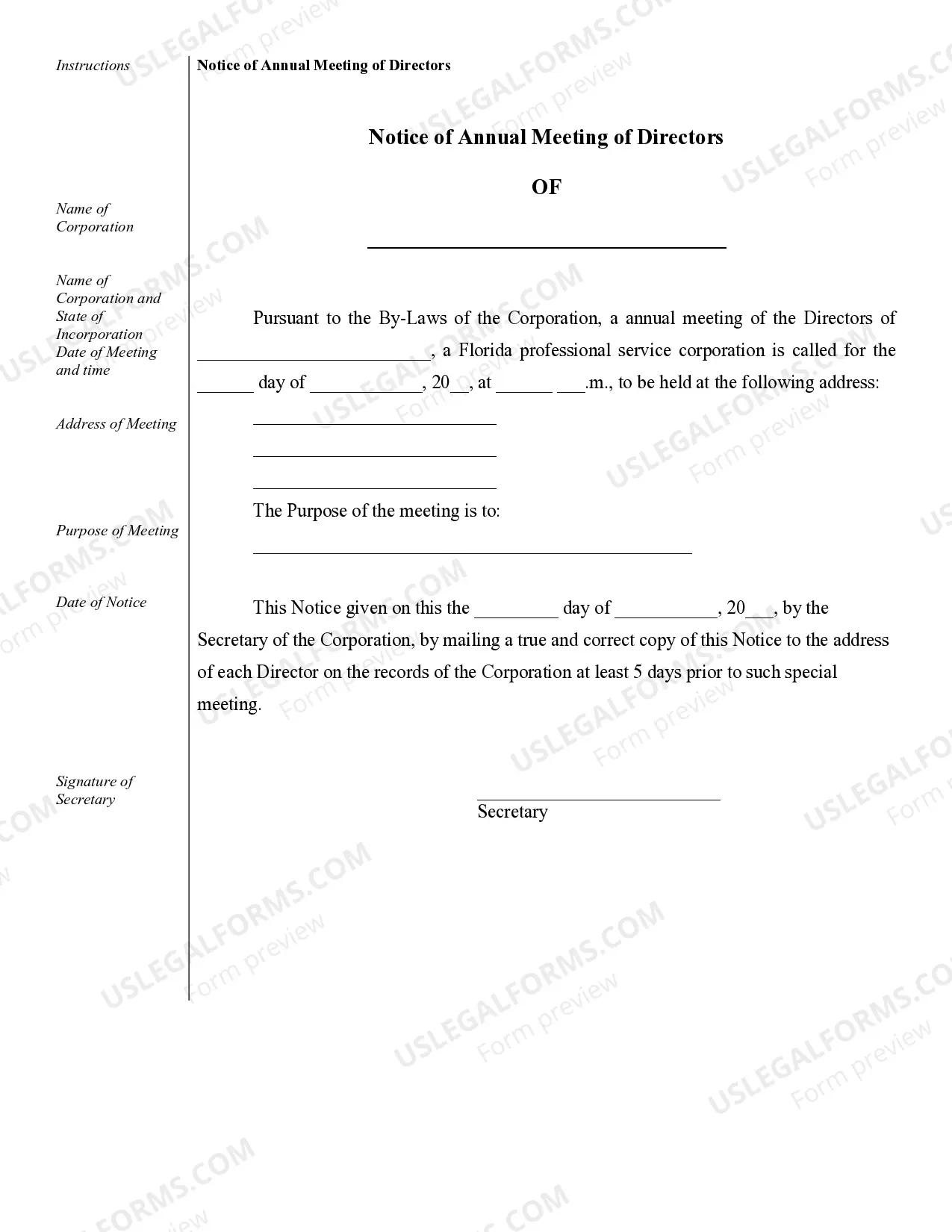

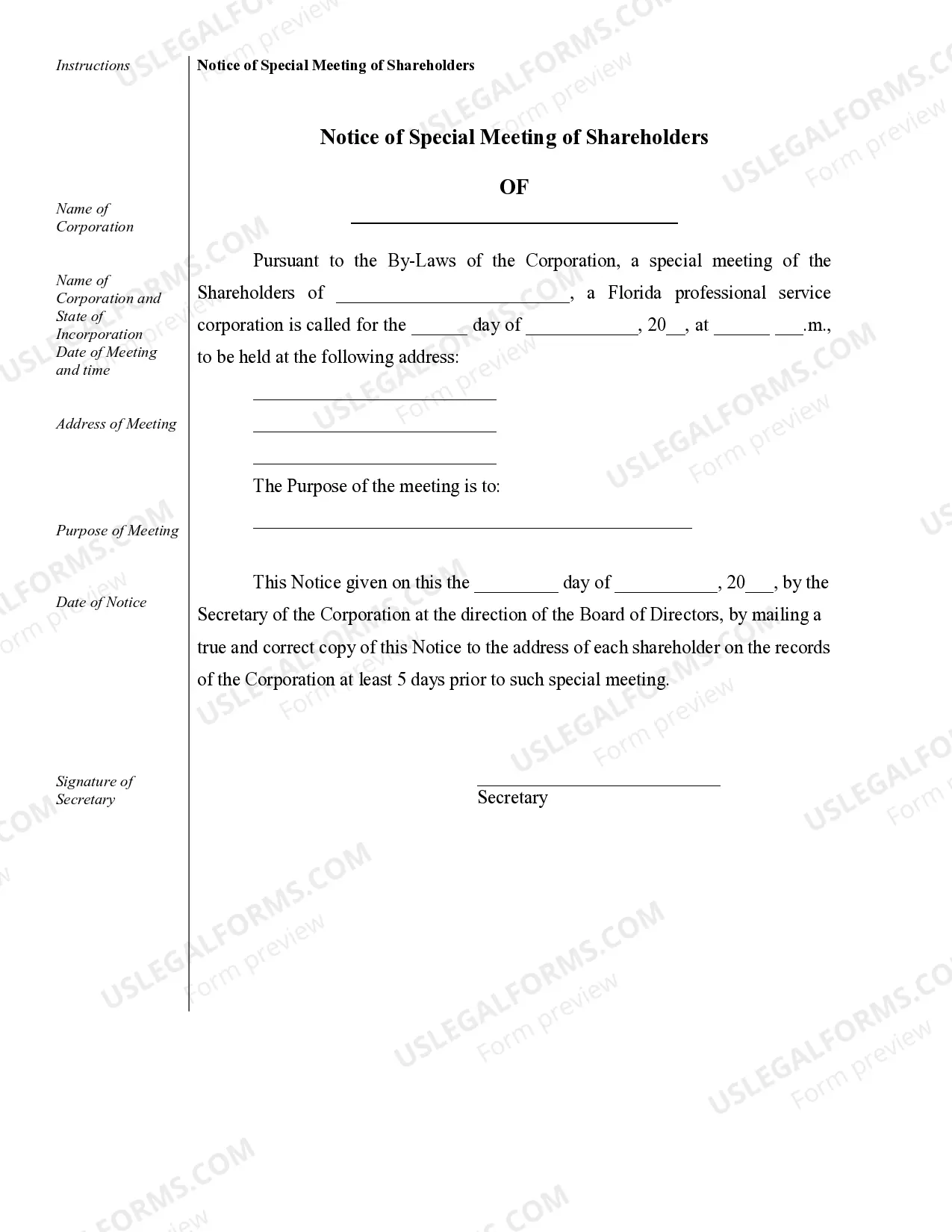

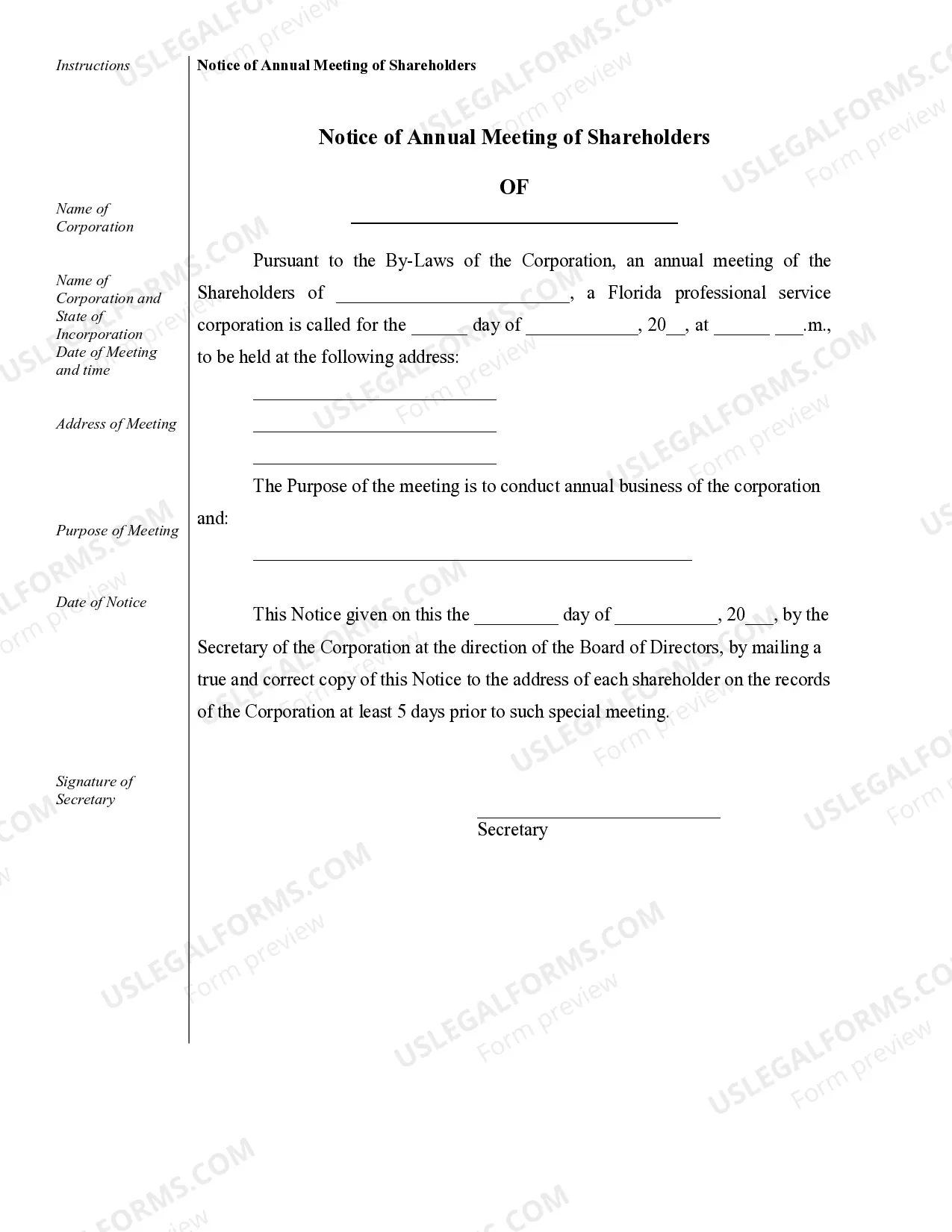

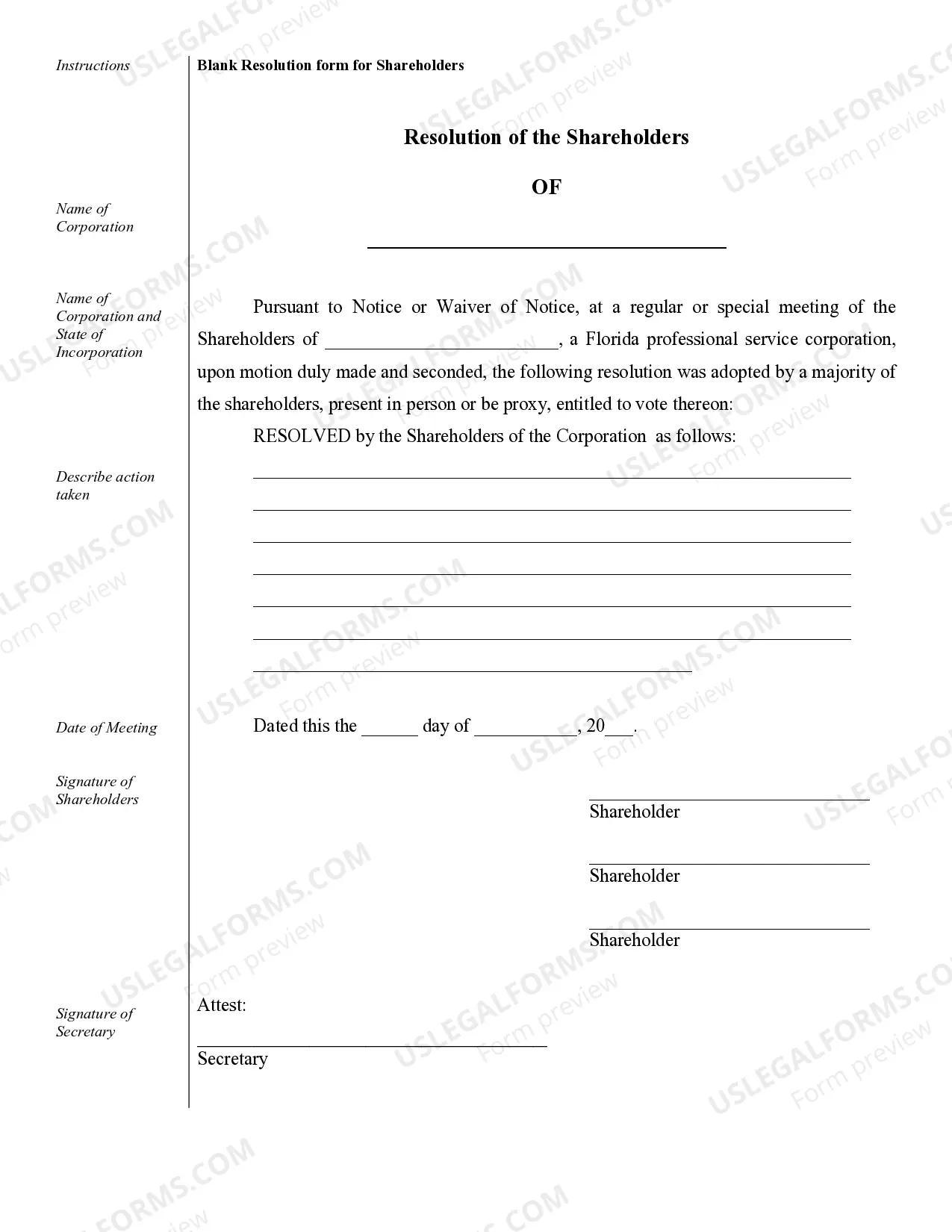

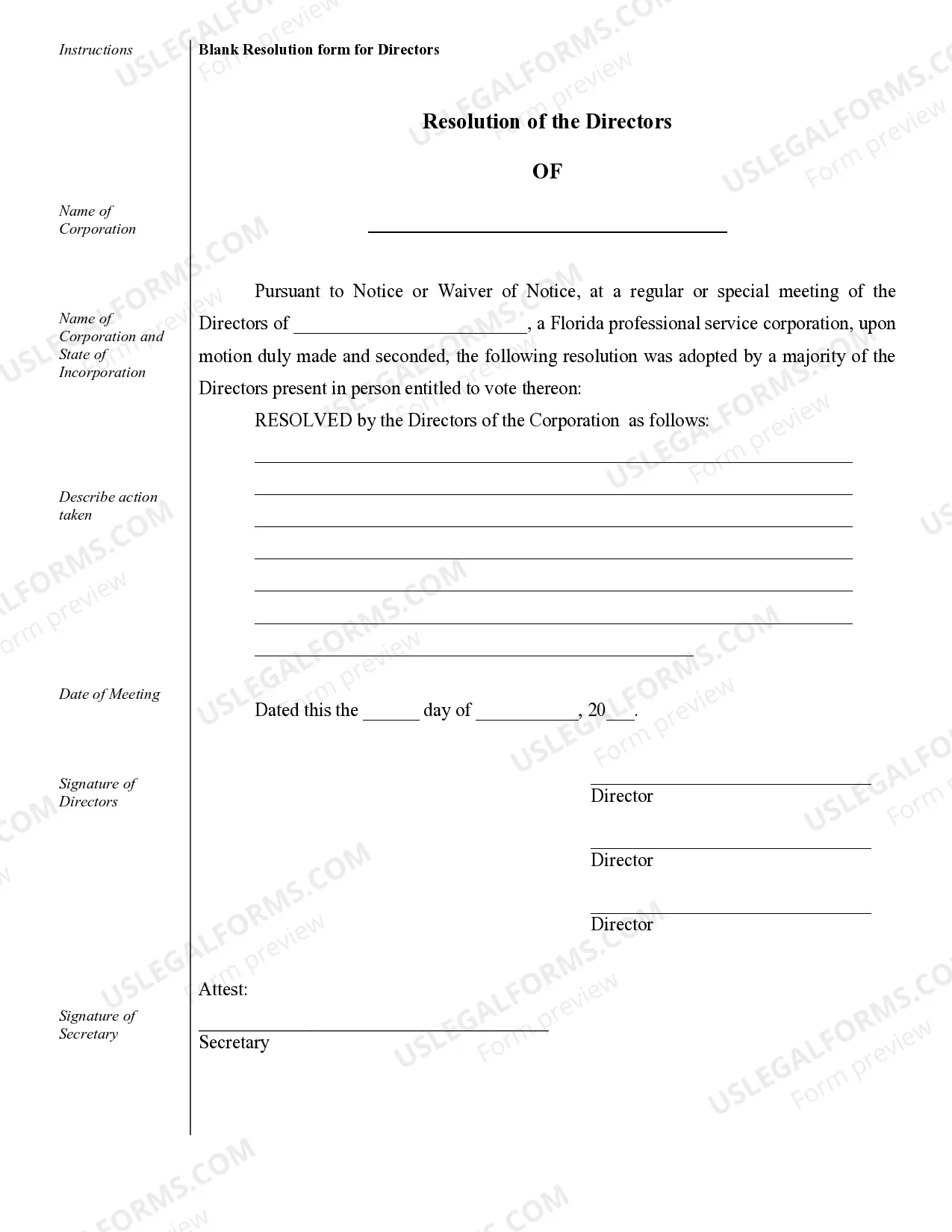

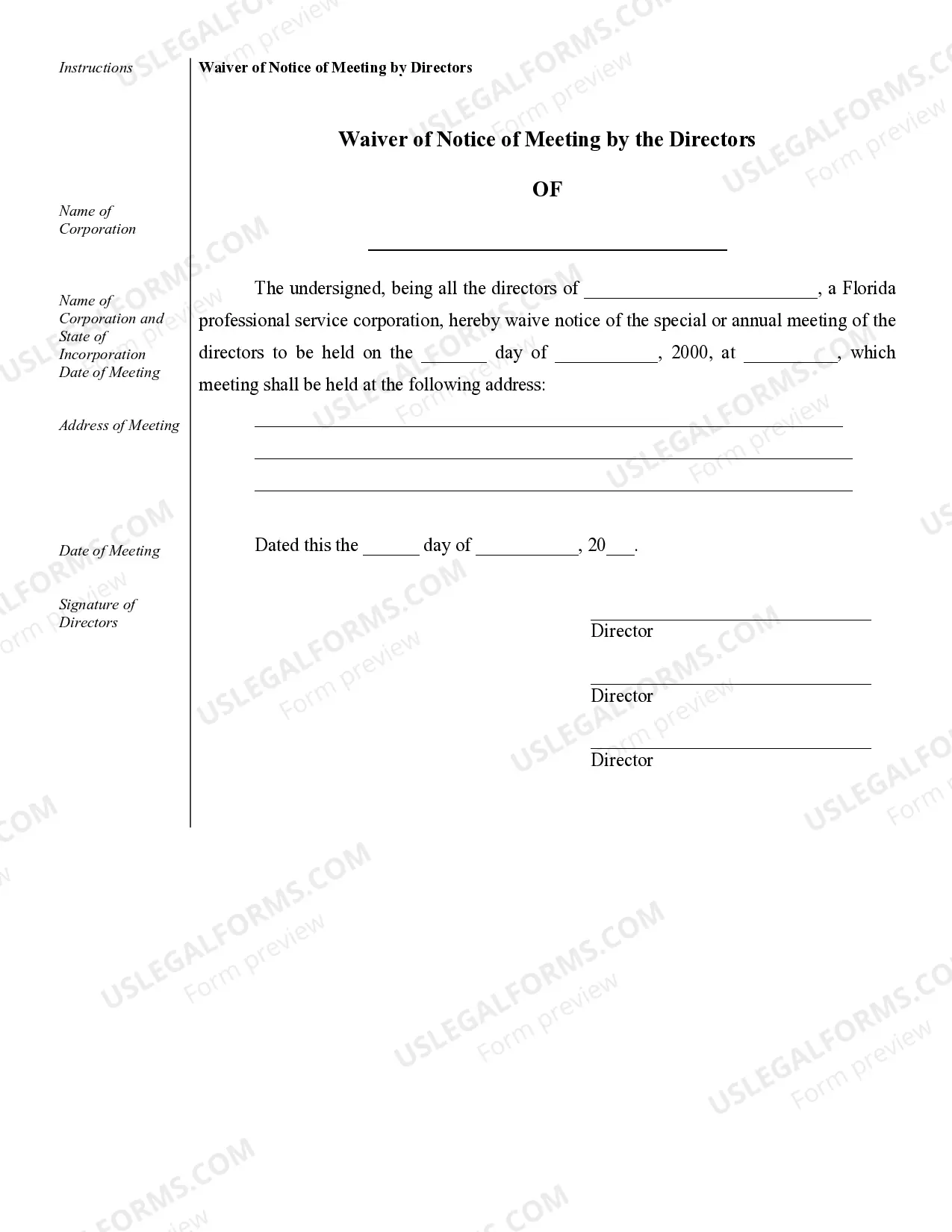

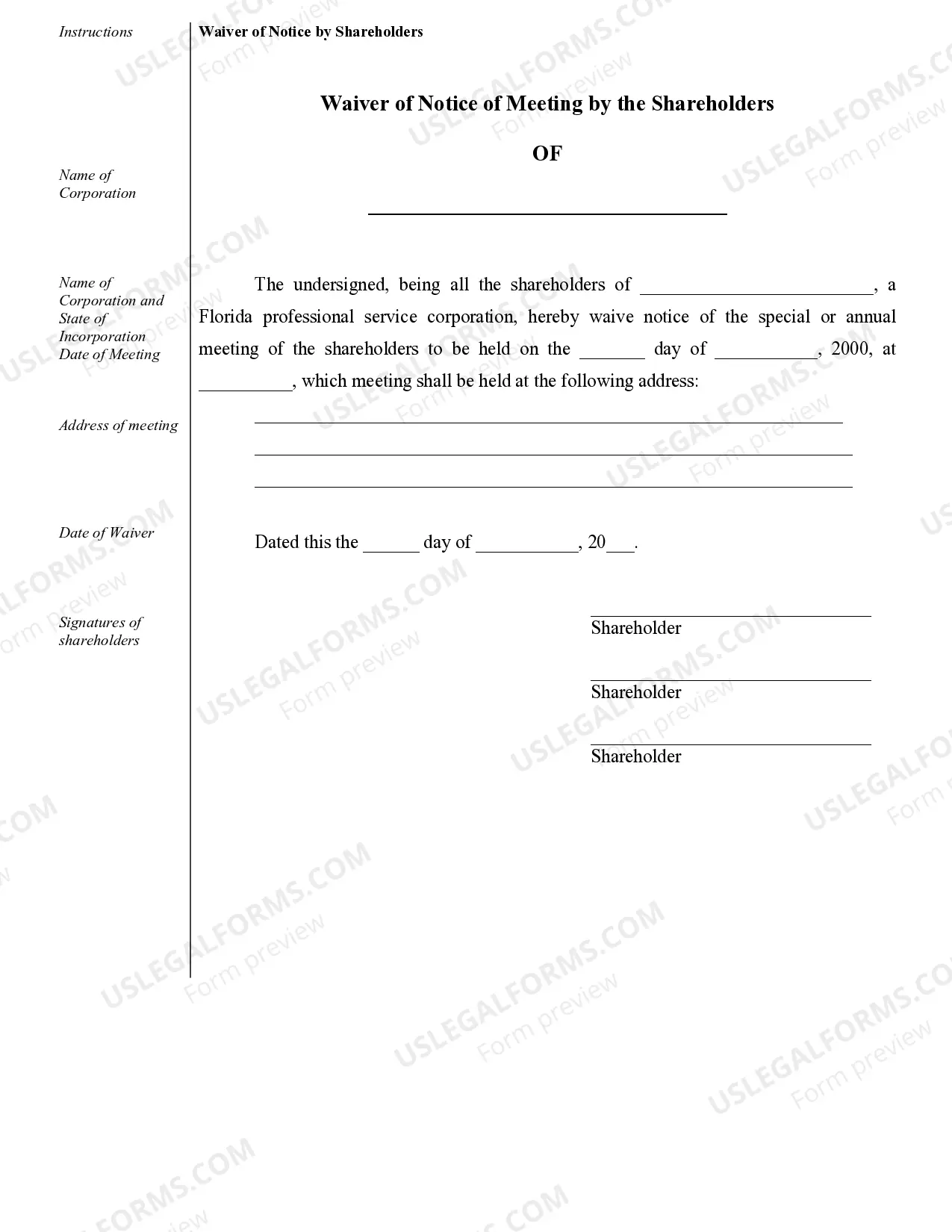

Palm Beach Sample Corporate Records for a Florida Professional Corporation play a vital role in ensuring the proper functioning and compliance of the organization. These records serve as official documentation and evidence of the corporation's activities, decisions, and financial transactions. Maintaining accurate and up-to-date corporate records is crucial for legal and regulatory purposes, such as audits, taxes, and potential legal disputes. The following are some essential types of Palm Beach Sample Corporate Records for a Florida Professional Corporation: 1. Articles of Incorporation: This document outlines the company's basic information, including its name, purpose, registered agent, and the number and types of shares it can issue. It is filed with the Florida Department of State and establishes the legal existence of the corporation. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, management structure, and decision-making processes. Bylaws typically cover topics like shareholder meetings, board of directors' responsibilities, officer roles, and the corporation's general policies. 3. Meeting Minutes: Detailed records of board of directors' and shareholders' meetings are essential for keeping track of important decisions, discussions, and resolutions. Meeting minutes should document attendees, topics discussed, actions taken, and voting results. 4. Stock Ledger: A stock ledger is a record of the corporation's stock ownership, including the names and contact information of shareholders, the number of shares they hold, and any transfers or changes in ownership. It helps in tracking ownership percentages and issuing dividends or stock certificates. 5. Financial Statements: Accurate financial records are crucial for evaluating the corporation's financial health and complying with accounting standards. This includes balance sheets, income statements, cash flow statements, and any related schedules or supporting documents. 6. Business Licenses and Permits: Any licenses or permits required by the corporation to operate legally should be properly recorded and maintained. This may include professional licenses, trade permits, sales tax certificates, and any industry-specific authorizations. 7. Contracts and Agreements: Records of contracts entered into by the corporation, such as lease agreements, vendor contracts, customer agreements, and employment contracts, should be maintained. These documents serve as evidence of the corporation's legal obligations and protect its interests in case of disputes. 8. Intellectual Property Documents: Patents, trademarks, copyrights, and any other intellectual property registrations or applications should be recorded and updated regularly. These documents safeguard the corporation's unique assets and give it exclusive rights to its creations. 9. Insurance Policies: Maintaining records of various insurance policies, including general liability, professional liability, property insurance, and workers' compensation, is crucial for managing potential risks and protecting the corporation's assets. 10. Tax Returns and Filings: All tax-related documents, such as federal, state, and local tax returns, payroll tax forms, and any other tax filings, should be properly recorded and retained as required by law. Properly organizing and maintaining Palm Beach Sample Corporate Records for a Florida Professional Corporation not only ensures legal compliance but also aids in efficient decision-making, facilitates potential financing or partnerships, and helps demonstrate transparency and accountability in corporate governance.

Palm Beach Sample Corporate Records for a Florida Professional Corporation

Description

How to fill out Palm Beach Sample Corporate Records For A Florida Professional Corporation?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Palm Beach Sample Corporate Records for a Florida Professional Corporation becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Palm Beach Sample Corporate Records for a Florida Professional Corporation takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Palm Beach Sample Corporate Records for a Florida Professional Corporation. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!