Register your Partnership with the Florida Dept of State, Division of Corporations.

Palm Bay Florida Partnership Registration Statement

Description

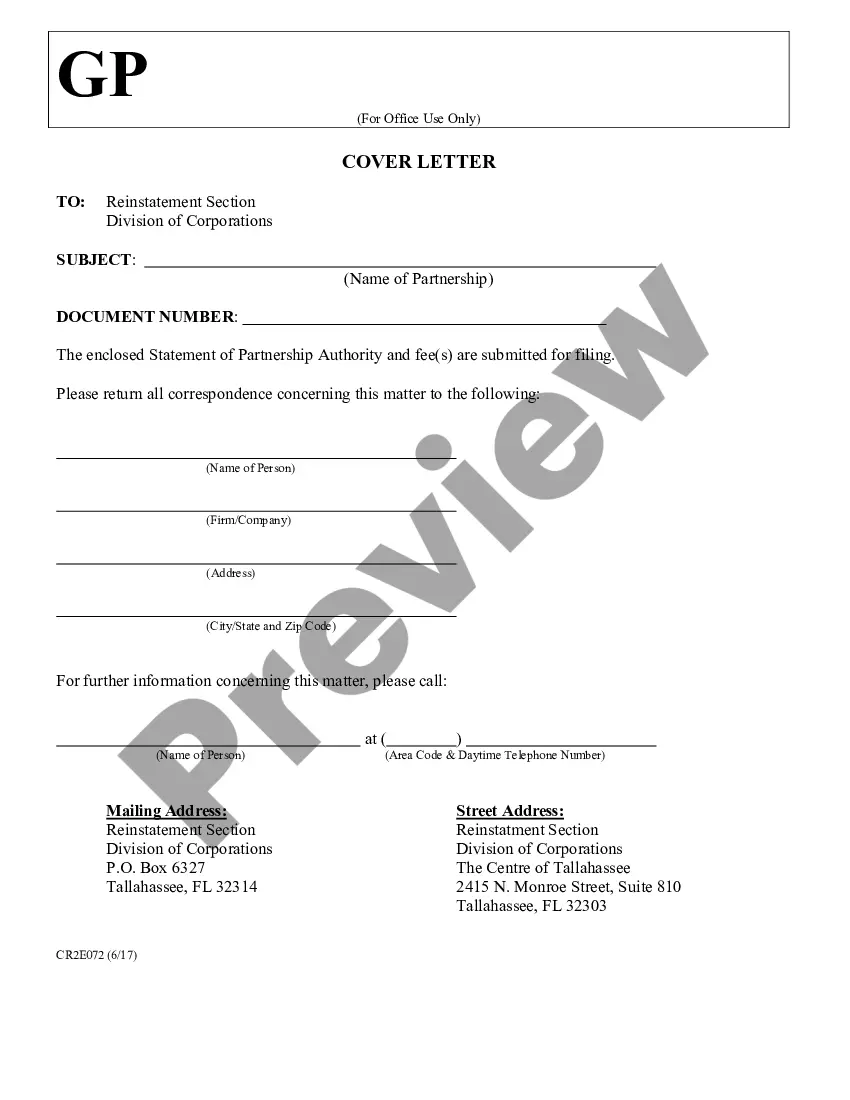

How to fill out Florida Partnership Registration Statement?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our advantageous website with thousands of document templates enables you to discover and acquire nearly any document example you need.

You can save, fill out, and endorse the Palm Bay Florida Partnership Registration Statement in just a few minutes rather than spending hours online searching for a suitable template.

Leveraging our repository is an excellent method to enhance the security of your form submission.

If you haven’t created an account yet, follow the steps below.

Locate the template you require. Verify that it is the document you were searching for: review its title and description, and make use of the Preview option when available. Alternatively, use the Search field to find the right one.

- Our skilled attorneys frequently review all the documents to confirm that the templates are pertinent for a specific area and adhere to new laws and regulations.

- How can you access the Palm Bay Florida Partnership Registration Statement.

- If you already have an account, simply Log In to your profile.

- The Download button will be activated on all the documents you view.

- Additionally, you can retrieve all previously stored documents in the My documents section.

Form popularity

FAQ

Yes, you must renew your registration for your Palm Bay Florida Partnership Registration Statement each year. Maintaining your registration helps ensure your partnership remains in good standing with the state. It's essential to keep track of renewal deadlines to avoid any penalties. For an easy and efficient process, consider using US Legal Forms, where you can find everything needed for your renewal.

To fill out a partnership agreement, begin by drafting key terms such as partner information, responsibilities, and profit-sharing details. Carefully articulate each partner's role and any provisions for conflict resolution. The Palm Bay Florida Partnership Registration Statement can serve as a helpful resource to ensure all essential aspects are covered.

Yes, general partnerships must register with the state of Florida to operate legally. This registration is necessary to protect the rights and liabilities of the partners. Utilize the Palm Bay Florida Partnership Registration Statement for guidance on registering your partnership accurately.

Filling out a partnership form requires inputting specific details such as each partner’s name, address, and the nature of the partnership’s business. Ensure to double-check all entries for accuracy and completeness. The uslegalforms platform offers the Palm Bay Florida Partnership Registration Statement, making this process easier and more guided.

Yes, partnerships have a filing requirement with the IRS and, in most cases, with the state of Florida. They must file annual returns, typically using Form F-1065 to report the partnership's financial activities. Detailed instructions are available in the Palm Bay Florida Partnership Registration Statement to help ensure compliance.

A comprehensive partnership agreement should include details about ownership percentages, responsibilities, profit distribution, and procedures for adding or removing partners. Additionally, clarify dispute resolution methods. Utilizing the Palm Bay Florida Partnership Registration Statement as a guide can help include all necessary components and legal requirements.

To write a simple partnership agreement, start by listing the partners' names and the purpose of the partnership. Clearly state the roles of each partner and how profits and losses will be shared. Reference the Palm Bay Florida Partnership Registration Statement to ensure all legal components are addressed to protect each partner.

In Florida, partnerships must file an annual tax return if they have income. This filing requirement typically involves submitting Form F-1065, which reports the partnership's earnings and allows for profit distribution among partners. For more details, refer to the Palm Bay Florida Partnership Registration Statement, which outlines these necessities.

Yes, partnerships in Florida generally must file a return using Form F-1065. This return reports the partnership's income, deductions, and other pertinent information. By filing this return correctly, you can ensure adherence to Florida's tax regulations laid out in the Palm Bay Florida Partnership Registration Statement.

Filling a partnership form involves providing accurate details about the partners, the business name, and its address. You should also include the nature of the business and its structure. For assistance, consider using the Palm Bay Florida Partnership Registration Statement provided by uslegalforms to ensure compliance and completeness.