Title: Understanding Hialeah, Florida Satisfaction, Release, and Cancellation of Mortgage by Individual Introduction: Hialeah, Florida is a vibrant city located in Miami-Dade County known for its cultural diversity, economic growth, and beautiful surroundings. When it comes to real estate, it's crucial to be familiar with the process of satisfaction, release, or cancellation of a mortgage by an individual. In this article, we will delve into the details of these concepts, providing you with a comprehensive understanding of their significance. Keywords: Hialeah, Florida; satisfaction of mortgage; release of mortgage; cancellation of mortgage; individual; Miami-Dade County; real estate. Section 1: Hialeah, Florida and Real Estate Market Overview — Hialeah's booming real estate market offers various residential and commercial properties, attracting both investors and homebuyers. — The city's strategic locationproximityty to Miami, and flourishing economy contribute to the popularity of real estate transactions in Hialeah. Section 2: What is Satisfaction of Mortgage? — Satisfaction of mortgage refers to the legal document indicating that a mortgage has been fully repaid by the borrower to the lender. — Once the mortgage is satisfied, this document releases the property from the lien created by the mortgage, providing proof of ownership to the borrower. Section 3: Release of Mortgage by Individual in Hialeah, Florida — In Hialeah, an individual can request a release of mortgage after settling the outstanding loan amount with their lender. — The release of mortgage serves as evidence that the lender no longer holds rights or claims on the property, giving the borrower complete ownership. Section 4: Cancellation of Mortgage by Individual — Cancellation of mortgage by an individual occurs when the loan is terminated before the agreed-upon timeframe. — Reasons for cancellation may include refinancing, selling the property, or paying off the mortgage completely ahead of schedule. Section 5: Different Types of Hialeah Florida Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Full Satisfaction of Mortgage: — This type of satisfaction occurs when the borrower has successfully repaid the entire loan amount, along with any applicable interest. — A full satisfaction of mortgage removes the lien on the property and signifies the completion of the mortgage obligations. 2. Partial Satisfaction of Mortgage: — In some cases, a borrower may make partial repayments, reducing the outstanding loan balance. — A partial satisfaction of mortgage releases a portion of the property from the lien, proportional to the amount repaid. 3. Voluntary Release or Cancellation: — When refinancing or selling a property, borrowers may voluntarily request a release or cancellation of their existing mortgage. — This process allows the borrower to secure new financing or transfer ownership without the encumbrance of the previous mortgage. Section 6: Importance and Legal Implications — The satisfaction, release, or cancellation of a mortgage is crucial for both lenders and borrowers to maintain a transparent and fully documented real estate transaction. — Failing to obtain the necessary documentation can lead to disputes, confusion regarding ownership, or potential legal issues in the future. Conclusion: Understanding the process and importance of satisfaction, release, or cancellation of a mortgage by an individual in Hialeah, Florida is vital for those involved in real estate transactions. Whether it's a full satisfaction, partial satisfaction, or voluntary release, securing the necessary documentation ensures clarity, proof of ownership, and a smooth transfer of property rights.

Hialeah Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

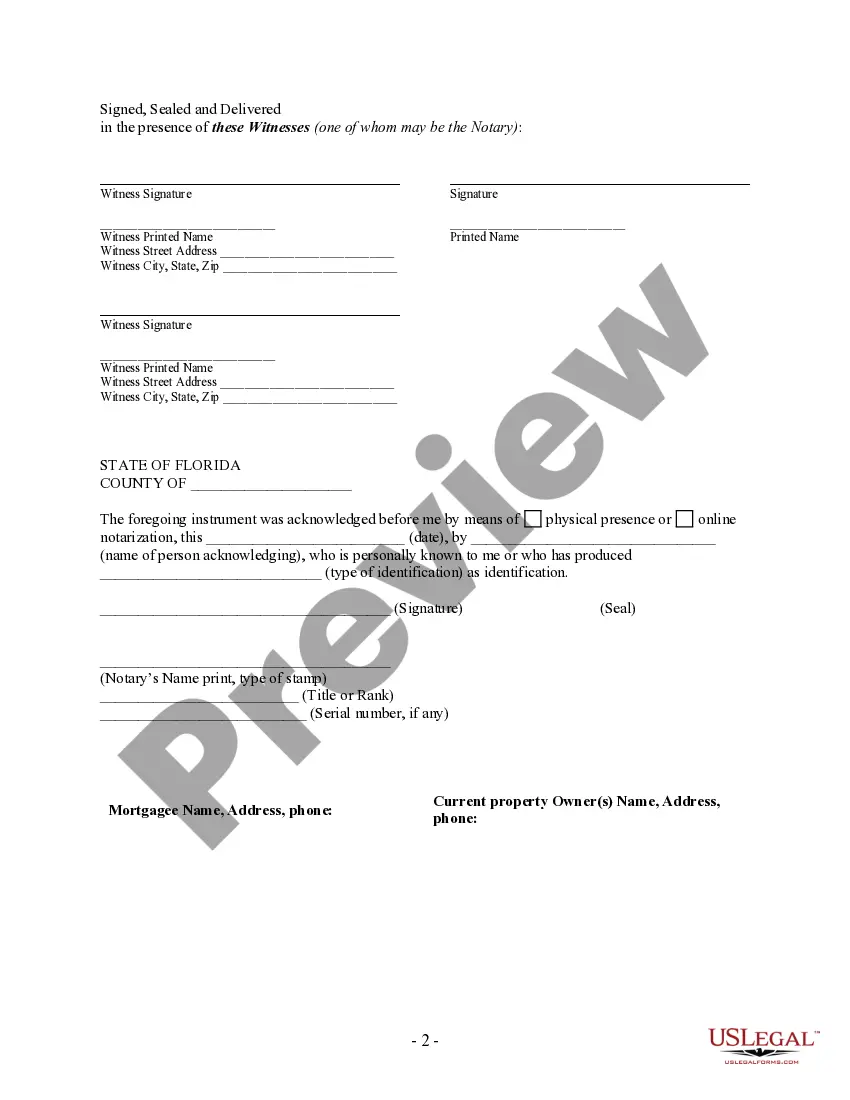

How to fill out Hialeah Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Hialeah Florida Satisfaction, Release or Cancellation of Mortgage by Individual gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Hialeah Florida Satisfaction, Release or Cancellation of Mortgage by Individual takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Hialeah Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!