Miramar Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Regardless of social or occupational rank, finishing legal paperwork is an unfortunate obligation in the current professional climate.

Frequently, it’s nearly impossible for someone without legal training to create this type of documentation from scratch, largely due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Verify that the template you have selected is specifically for your area, as the laws of one state may not apply to another.

Examine the document and review a brief description (if available) of scenarios for which the form can be utilized.

- Our platform provides an extensive array of over 85,000 ready-to-use state-specific documents that are suitable for nearly any legal circumstance.

- US Legal Forms is also an excellent resource for associates or legal advisors aiming to improve their time management by utilizing our DYI papers.

- No matter if you need the Miramar Florida Satisfaction, Release, or Cancellation of Mortgage by Individual or another form that will be beneficial in your jurisdiction, with US Legal Forms, everything is accessible.

- Here’s how you can obtain the Miramar Florida Satisfaction, Release, or Cancellation of Mortgage by Individual in just minutes using our reliable platform.

- If you are already a registered user, you can proceed to Log In to your account to download the required form.

- However, if you are not familiar with our library, be sure to follow these steps before acquiring the Miramar Florida Satisfaction, Release, or Cancellation of Mortgage by Individual.

Form popularity

FAQ

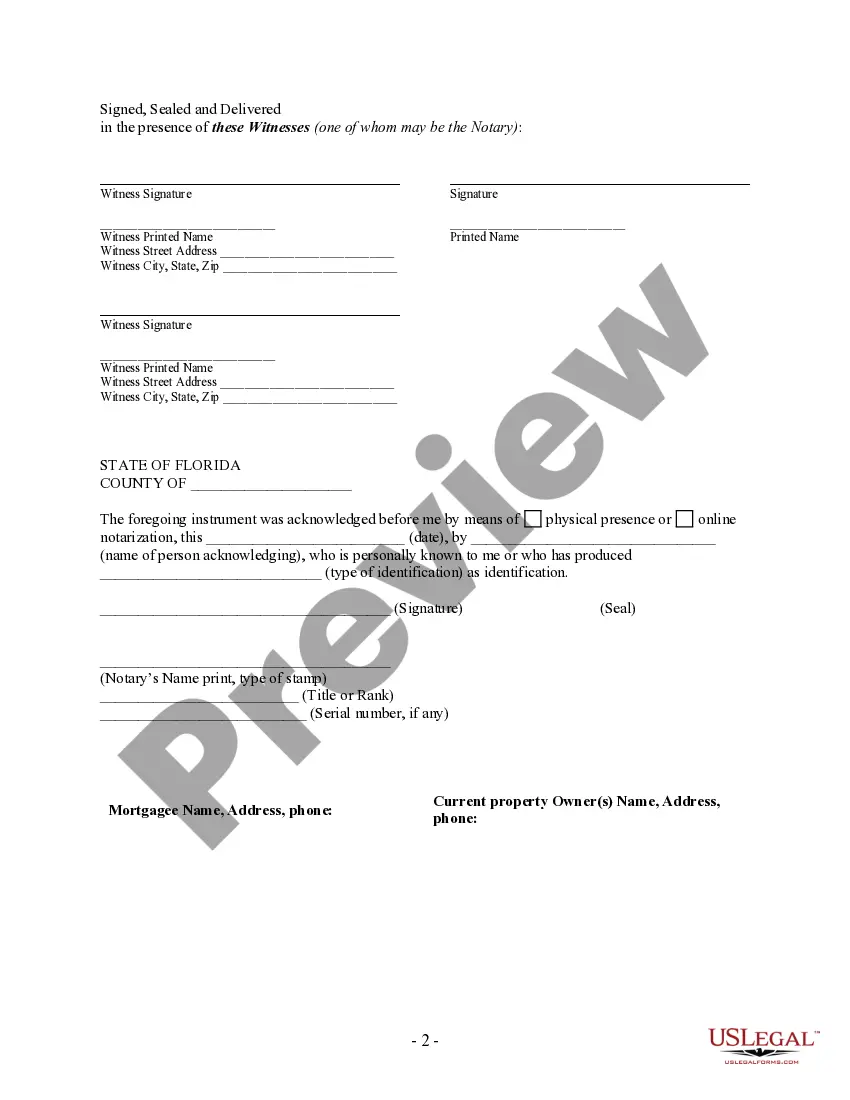

Yes, a mortgage document must be notarized in Florida to be enforceable. Notarization helps confirm that all parties involved have acted voluntarily and are aware of what they are signing. By following this important step, individuals can ensure a smooth process for the Miramar Florida satisfaction, release, or cancellation of mortgage by an individual, minimizing any future complications.

Yes, in Florida, a satisfaction of a mortgage must be notarized to ensure its legal standing. Notarization authenticates the document and confirms that the signing party is indeed who they claim to be. This process enhances the security and validity of the Miramar Florida satisfaction, release, or cancellation of mortgage by an individual, making it easier to handle subsequent transactions.

In Florida, a satisfaction of a mortgage does not require a witness for it to be valid. However, having a witness may provide an extra layer of credibility and could be beneficial in resolving any potential disputes. It’s advisable to consult with legal experts to understand all facets involved in the Miramar Florida satisfaction, release, or cancellation of mortgage by an individual.

In Miramar, Florida, you can obtain a satisfaction of a mortgage through your local county recorder's office or a title company. It is essential to ensure that all documents are completed correctly to comply with Florida requirements. Additionally, you can utilize platforms like USLegalForms, which provide templates and guidance for the release or cancellation of your mortgage by an individual.

To file a satisfaction of mortgage in Florida, you must first obtain a satisfied mortgage document from your lender. Next, you will need to notarize this document and submit it to your local county clerk’s office for recording. Following these steps ensures that your Miramar Florida satisfaction is officially recognized. Utilizing services like US Legal Forms can simplify the filing process, providing you with the necessary tools and templates.

A release of a mortgage means that the lender has agreed to formally remove their claim against a property. This action follows the borrower fulfilling the terms of the mortgage, such as making all required payments. For individuals in Miramar, Florida, this signifies a positive change in financial status. By obtaining a release, you pave the way for potential future transactions without the burden of prior debts.

In Florida, a satisfaction of a mortgage does need to be notarized. This requirement ensures that the document is legally binding and recognized by the public. After the satisfaction is notarized, it must be recorded in the public records to effectively release the obligation. This process is essential for achieving proper Miramar Florida satisfaction, release, or cancellation of mortgage by an individual.

To record a release of a mortgage in Miramar, Florida, first gather the necessary documentation, including the original mortgage and the release document from the lender. Visit your local county clerk's office or their online portal. Submit the release document along with any required fees to officially record the release. This action legally removes the mortgage lien from the property.