The Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual refers to a legal process that allows an individual borrower to release or cancel a mortgage on their property located in Orange County, Florida. This procedure is essential for homeowners who have paid off their mortgage or fulfilled all obligations towards a lending institution, signaling the completion of their mortgage term and granting them full ownership rights over their property. Keywords: Orange Florida, Satisfaction, Release, Cancellation, Mortgage, Individual, Property, Ownership, Lending institution. There are various types of Satisfaction, Release, or Cancellation of Mortgage by Individual procedures that can take place in Orange County, Florida: 1. Full Satisfaction: This type of satisfaction occurs when the borrower has successfully repaid the entire mortgage loan amount, including principal and interest, to the lending institution. The lender then acknowledges this complete payment and provides a Satisfaction, Release, or Cancellation of Mortgage document to the borrower. 2. Partial Satisfaction: In certain cases, borrowers may repay a portion of the mortgage loan, either through prepayments or clearing off an associated property lien. The lender issues a Partial Satisfaction, Release, or Cancellation of Mortgage document, indicating that a specific amount of the loan has been satisfied. 3. Loan Modification or Restructuring: Mortgage borrowers sometimes negotiate with their lenders to modify the loan terms, wherein the existing mortgage agreement is altered to be more favorable or manageable for the borrower. Once this modification is finalized, a Satisfaction, Release, or Cancellation of Mortgage document reflecting the modified terms is provided to the borrower. 4. Refinancing: When borrowers decide to refinance their mortgage, they secure a new loan to pay off the existing one. The lender issues a Satisfaction, Release, or Cancellation of Mortgage for the original loan, allowing the borrower to replace it with the new one. 5. Loan Assumption: In cases where the borrower sells the property to a buyer who assumes the existing mortgage, the lender provides a Satisfaction, Release, or Cancellation of Mortgage to release the borrower from their mortgage obligations. It is important for individuals in Orange County, Florida, to complete the Satisfaction, Release, or Cancellation of Mortgage process accurately and promptly to ensure their property ownership records are updated accordingly. This legal procedure protects the borrower's rights and prevents any future claims or disputes regarding the mortgage on their property. In conclusion, the Orange Florida Satisfaction, Release, or Cancellation of Mortgage by Individual describes the process of freeing an individual borrower from their mortgage obligations, granting them full ownership rights over their property in Orange County, Florida. The different types of this procedure include Full Satisfaction, Partial Satisfaction, Loan Modification or Restructuring, Refinancing, and Loan Assumption. Properly completing this legal process ensures that borrowers can enjoy the benefits of having a paid-off mortgage and a clear ownership status of their property.

Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

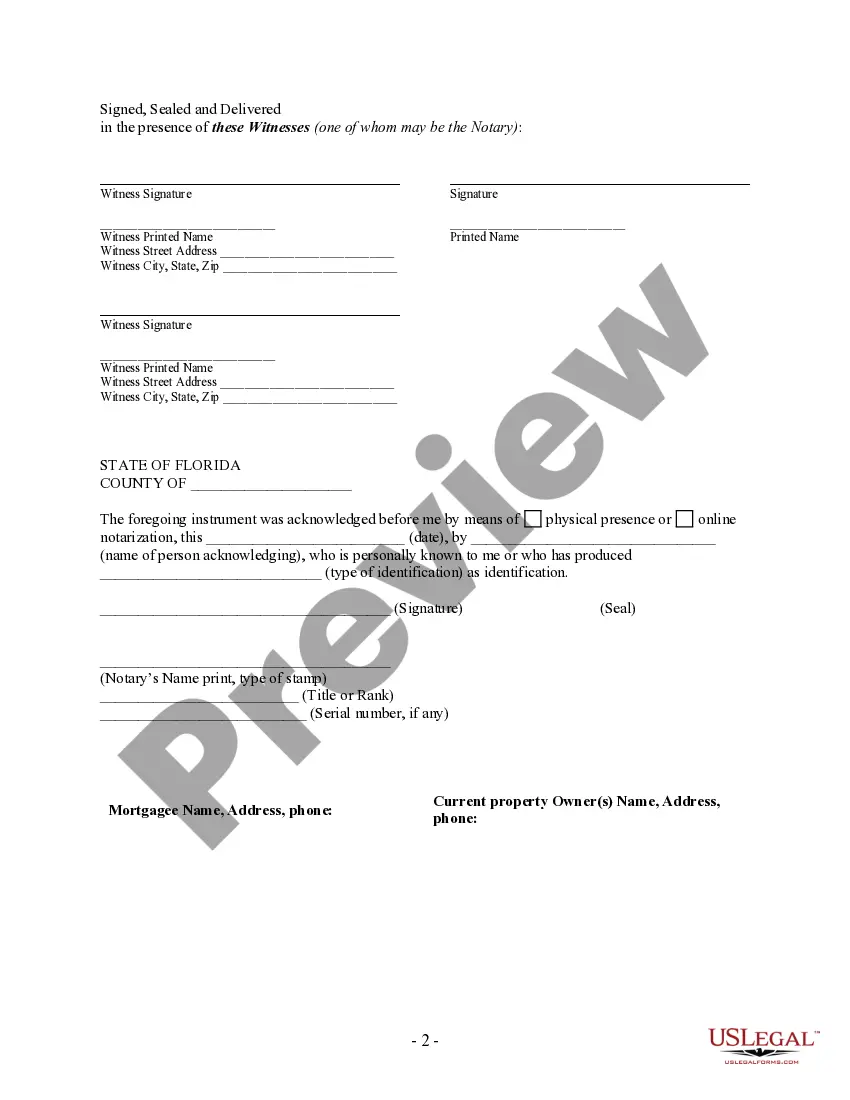

How to fill out Orange Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person without any law education to draft this sort of papers from scratch, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our platform provides a huge library with more than 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual in minutes employing our trustworthy platform. In case you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are new to our platform, make sure to follow these steps prior to downloading the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual:

- Be sure the form you have chosen is good for your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief description (if available) of cases the document can be used for.

- If the form you picked doesn’t meet your needs, you can start over and look for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Select the payment method and proceed to download the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual once the payment is done.

You’re all set! Now you can proceed to print the form or complete it online. Should you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.