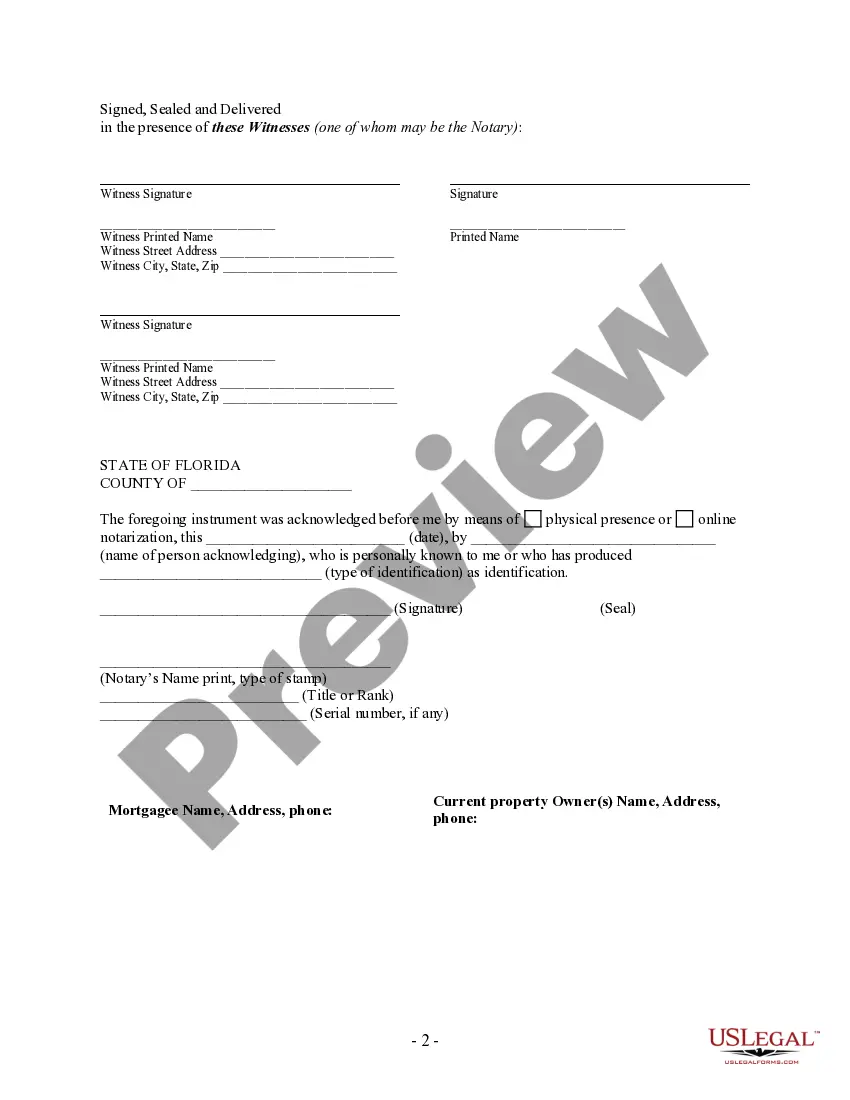

Palm Bay Florida Satisfaction, Release, or Cancellation of Mortgage by Individual is a legal process that finalizes the repayment of a mortgage loan, essentially stating that the borrower has fulfilled their financial obligations associated with the mortgage. This documentation certifies that the lender's lien on the property is no longer valid. In Palm Bay, Florida, the Satisfaction, Release, or Cancellation of Mortgage by Individual is a crucial step in the property ownership process. Once the mortgage is completely repaid, the borrower (also known as the mortgagor) or an authorized representative can initiate the satisfaction, release, or cancellation of the mortgage by filing the appropriate paperwork. Keywords: Palm Bay Florida, satisfaction of mortgage, release of mortgage, cancellation of mortgage, individual mortgage release. There are no specific different types of Palm Bay Florida Satisfaction, Release, or Cancellation of Mortgage by Individual. However, depending on the circumstances of the mortgage transaction, there may be variations in the process or additional requirements. These variations can include situations such as refinancing the loan, modifying the terms of the mortgage, or transferring the property ownership. Regardless, the general process remains the same. To complete the Palm Bay Florida Satisfaction, Release, or Cancellation of Mortgage by Individual, the following steps must be followed: 1. Obtain the necessary documents: The individual seeking to release or cancel the mortgage should gather all relevant paperwork, including the original mortgage agreement, any modifications or refinancing documents, and any other supporting documentation related to the loan. 2. Pay off the mortgage: Prior to initiating the satisfaction process, it is essential to ensure that the outstanding mortgage balance is fully paid. All unpaid principal, interest, and any applicable fees or penalties must be settled with the lender. It is crucial to document the full repayment amount accurately. 3. Proof of payment: Once the mortgage balance is paid, the borrower should request a payoff letter from the lender. This official document confirms that all outstanding obligations have been fulfilled, and the lender acknowledges receipt of full payment. 4. Prepare the Satisfaction, Release, or Cancellation of Mortgage by Individual form: Using the appropriate legal form, typically provided by the county clerk's office, the borrower must accurately complete the required fields. This form usually includes the borrower's name, lender's name, property address, mortgage details, and the notarized signature of the mortgage holder. 5. File the documentation: The completed form, along with all supporting documentation, must be filed with the county clerk's office where the property is located. It is essential to pay any filing fees associated with the process. The clerk's office will review the submitted documents and, if everything is in order, record the satisfaction, release, or cancellation of the mortgage in the public records. 6. Notify relevant parties: After the recording process, the borrower should provide copies of the recorded document to all relevant parties, including the lender, title insurance company, and any other interested parties mentioned in the mortgage agreement. This step ensures that the public record accurately reflects the mortgage's closure. By successfully completing the Palm Bay Florida Satisfaction, Release, or Cancellation of Mortgage by Individual, the borrower eliminates any encumbrance on their property title, allowing for clear ownership and unhindered transferability of the property in the future.

Palm Bay Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Palm Bay Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Benefit from the US Legal Forms and get immediate access to any form template you want. Our beneficial platform with a large number of templates simplifies the way to find and get almost any document sample you want. You are able to save, fill, and certify the Palm Bay Florida Satisfaction, Release or Cancellation of Mortgage by Individual in a matter of minutes instead of browsing the web for several hours trying to find an appropriate template.

Utilizing our library is an excellent strategy to raise the safety of your form submissions. Our experienced legal professionals regularly review all the documents to make sure that the templates are relevant for a particular region and compliant with new acts and regulations.

How do you get the Palm Bay Florida Satisfaction, Release or Cancellation of Mortgage by Individual? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can find all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, follow the instruction listed below:

- Find the template you require. Ensure that it is the template you were looking for: verify its title and description, and make use of the Preview option if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Download the document. Choose the format to get the Palm Bay Florida Satisfaction, Release or Cancellation of Mortgage by Individual and modify and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the Palm Bay Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!