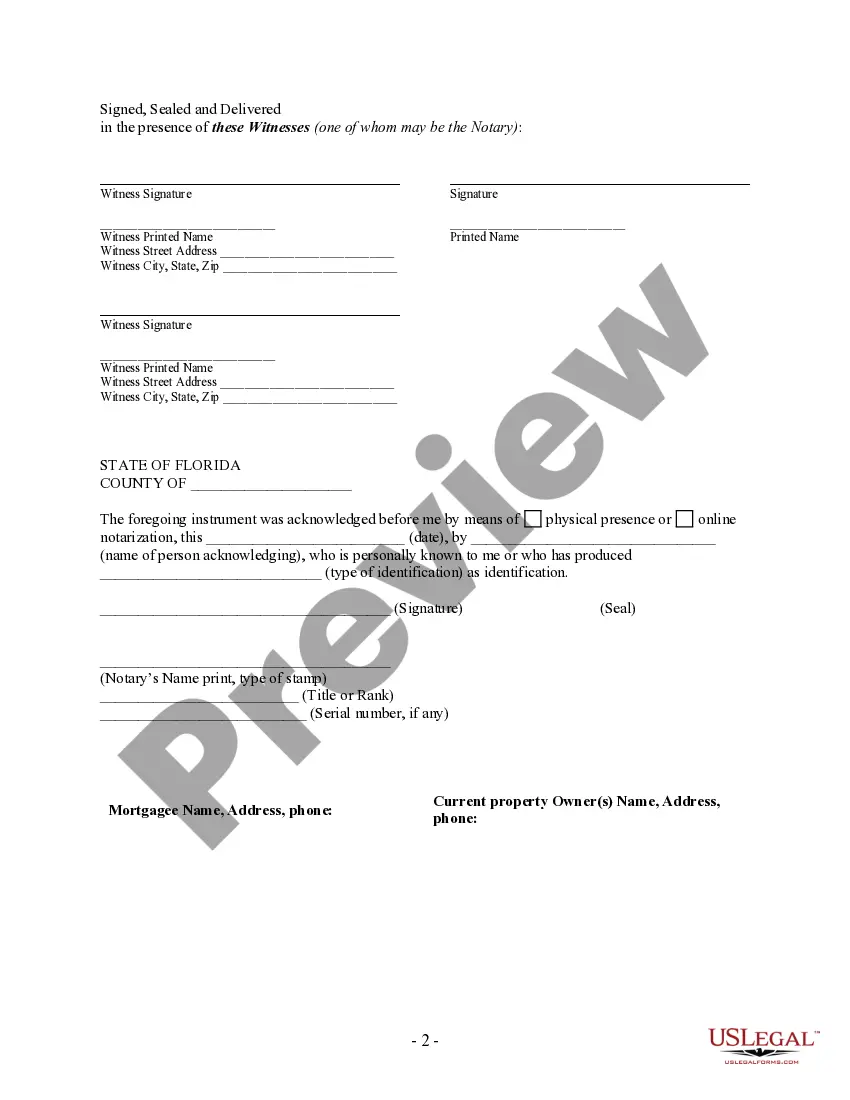

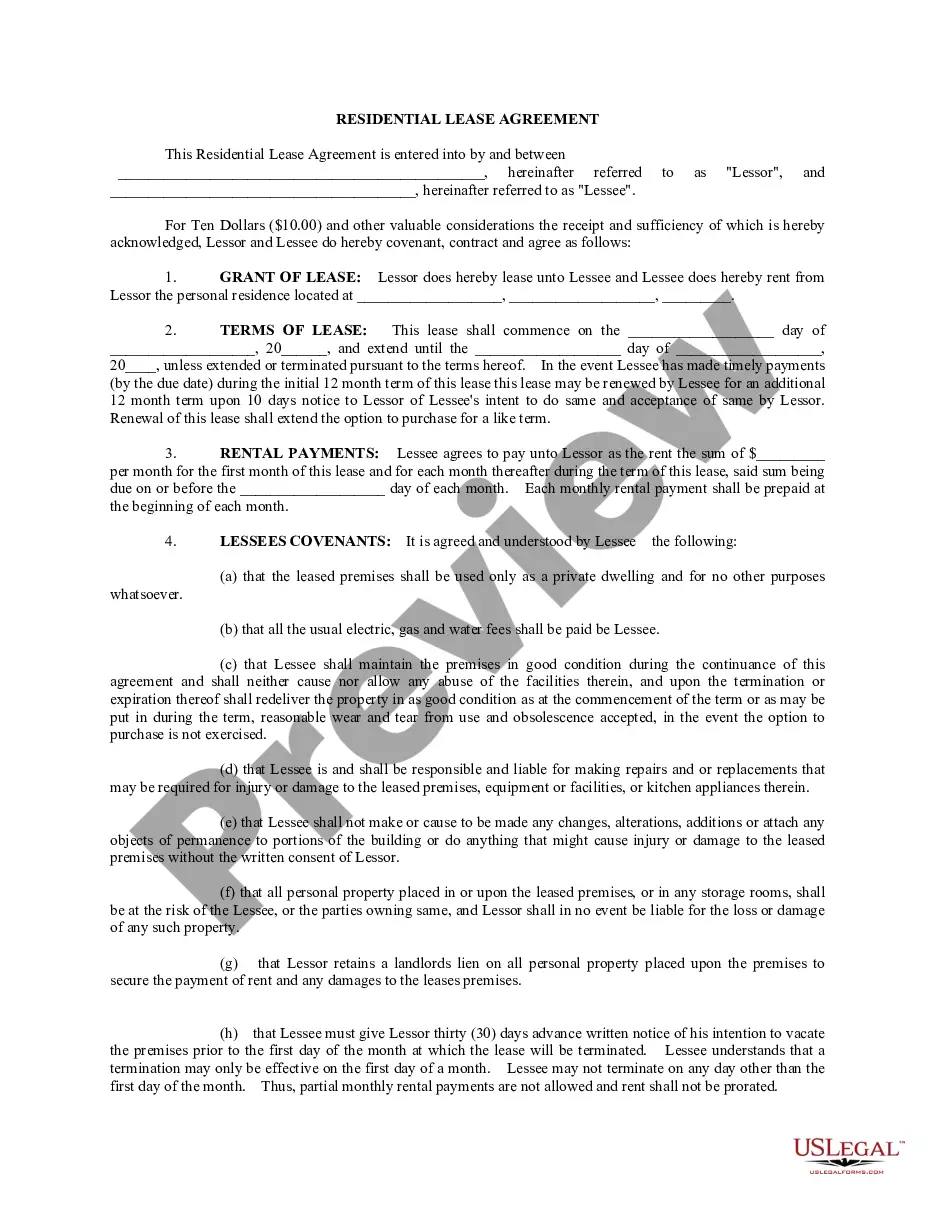

Pompano Beach Florida Satisfaction, Release, or Cancellation of Mortgage by Individual: A Comprehensive Guide In Pompano Beach, Florida, individuals involved in a mortgage agreement have the right to request the satisfaction, release, or cancellation of their mortgage. These legal actions allow borrowers to officially indicate that they have fulfilled the terms of their mortgage and have no further financial obligation to the lender. By submitting the appropriate documents, individuals can clear the title of their property, paving the way for future transactions and ensuring legal recognition of their property rights. Keywords: Pompano Beach Florida, satisfaction of mortgage, release of mortgage, cancellation of mortgage, individual, borrower, document submission, property title, legal recognition. Types of Pompano Beach Florida Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Voluntary Satisfaction or Release of Mortgage: This type of satisfaction or release occurs when the borrower has fulfilled their mortgage obligations, repaid the loan in full, and wishes to clear their property title from any encumbrances. To initiate this process, the borrower must submit a notarized satisfaction or release of mortgage document to the lender or mortgagee. 2. Mortgage Cancellation Due to Refinancing: When a homeowner in Pompano Beach refinances their mortgage with a new lender or obtains a new loan to pay off the existing mortgage, the original mortgage is canceled. This process involves the borrower obtaining a mortgage payoff letter from the previous lender stating the amount required to satisfy the existing mortgage. Once the new loan is secured and the previous mortgage is paid off, the borrower must file a satisfaction or release of mortgage with the relevant authorities to remove the lien on their property. 3. Mortgage Cancellation Due to Sale: Individuals selling their property in Pompano Beach need to ensure that their mortgage is canceled to transfer a clear title to the buyer. During the sale process, the borrower's attorney or title company requests a payoff letter from the lender to determine the outstanding mortgage balance. On the closing date, the proceeds from the property sale are used to pay off the mortgage, and the lender provides a satisfaction or release of mortgage, which is recorded with the appropriate authorities. 4. Mortgage Cancellation Due to Loan Repayment: Borrowers who have fulfilled their mortgage obligations by completing the repayment term can request a satisfaction, release, or cancellation of mortgage. Upon completing the final payment, the lender should provide the borrower with a document confirming the mortgage's satisfaction or release. The borrower must record this document with the relevant authorities to ensure the mortgage is officially canceled and remove any potential legal encumbrances on the property. 5. Discharge of Mortgage Due to Bankruptcy: In some cases, individuals in Pompano Beach may seek bankruptcy protection, and as a result, their mortgage may be discharged or canceled through the bankruptcy court proceedings. It is essential for borrowers to consult with a bankruptcy attorney to understand the implications and requirements for this type of mortgage cancellation. In conclusion, Pompano Beach, Florida, residents have various ways to achieve satisfaction, release, or cancellation of a mortgage by an individual. Whether it be voluntary satisfaction, refinancing, sale, loan repayment, or discharge due to bankruptcy, it is crucial to follow the appropriate legal procedures and consult professionals for guidance throughout the process. Through these actions, individuals can ensure a clear property title, removing any encumbrances associated with their mortgage.

Pompano Beach Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Pompano Beach Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Take advantage of the US Legal Forms and get instant access to any form you require. Our beneficial platform with a huge number of documents makes it easy to find and get almost any document sample you require. You can save, fill, and sign the Pompano Beach Florida Satisfaction, Release or Cancellation of Mortgage by Individual in just a couple of minutes instead of browsing the web for several hours seeking a proper template.

Utilizing our collection is a wonderful way to improve the safety of your document submissions. Our experienced attorneys on a regular basis check all the records to ensure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How can you obtain the Pompano Beach Florida Satisfaction, Release or Cancellation of Mortgage by Individual? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. Moreover, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Find the form you need. Make sure that it is the template you were hoping to find: check its name and description, and make use of the Preview feature when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Indicate the format to get the Pompano Beach Florida Satisfaction, Release or Cancellation of Mortgage by Individual and revise and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy form libraries on the internet. Our company is always ready to assist you in any legal case, even if it is just downloading the Pompano Beach Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

Feel free to benefit from our service and make your document experience as efficient as possible!