Tallahassee Florida Satisfaction, Release or Cancellation of Mortgage by Individual: A Comprehensive Guide In Tallahassee, Florida, the Satisfaction, Release, or Cancellation of Mortgage by Individual is a crucial legal process that occurs when a mortgage has been fully repaid or when certain conditions stipulated in the mortgage agreement have been met. This process ensures that the property owner obtains clear and unencumbered title to their property. Understanding the different types of satisfaction, release, or cancellation of mortgage is essential. Here are several key types to be aware of: 1. Full Satisfaction of Mortgage: This type of satisfaction occurs when the mortgage debt is paid in full, either through regular installments or as a lump sum. Once the final payment is made, the lender issues a Satisfaction of Mortgage that officially releases the borrower from the financial obligation, allowing them to possess a clear title to their property. 2. Partial Satisfaction of Mortgage: In some cases, a borrower may wish to satisfy only a portion of the mortgage instead of the entire balance. This partial satisfaction can occur when refinancing, selling a portion of the property, or modifying the loan terms. The partial satisfaction will release the lien on the specific portion of the property addressed. 3. Mortgage Release: A mortgage release is particularly relevant in cases where the mortgage was taken out jointly. When one individual involved in the mortgage wishes to be released from their responsibility, they can seek a mortgage release. This process ensures that the remaining party continues to be responsible for the mortgage while the released individual is no longer liable. 4. Mortgage Cancellation: In certain scenarios, a mortgage may need to be cancelled due to errors or mistakes in the original mortgage agreement, illegitimate liens, or fraudulent activities. Mortgage cancellations are usually initiated through a court order, which declares the mortgage null and void. To initiate any of these processes, the individual seeking satisfaction, release, or cancellation of their mortgage must follow specific procedures as mandated by the state of Florida. These procedures generally involve filing the appropriate legal documents with the county clerk's office, providing proof of mortgage satisfaction or other relevant circumstances, and paying any required fees. It is important to note that hiring an experienced real estate attorney or seeking professional advice is highly recommended throughout this process. They can ensure all legal requirements are met, offer guidance on documentation, and streamline the satisfaction, release, or cancellation of mortgage by individual procedure. In conclusion, the Tallahassee Florida Satisfaction, Release, or Cancellation of Mortgage by Individual involves various types of transactions depending on the circumstances. These transactions include full satisfaction, partial satisfaction, mortgage release, and mortgage cancellation. It is vital to understand the specific requirements and procedures associated with each type to achieve a clear title efficiently. Seeking legal assistance is always advisable to navigate through the complexities of this process successfully.

Tallahassee Florida Satisfaction, Release or Cancellation of Mortgage by Individual

State:

Florida

City:

Tallahassee

Control #:

FL-S123-Z

Format:

Word;

Rich Text

Instant download

Description

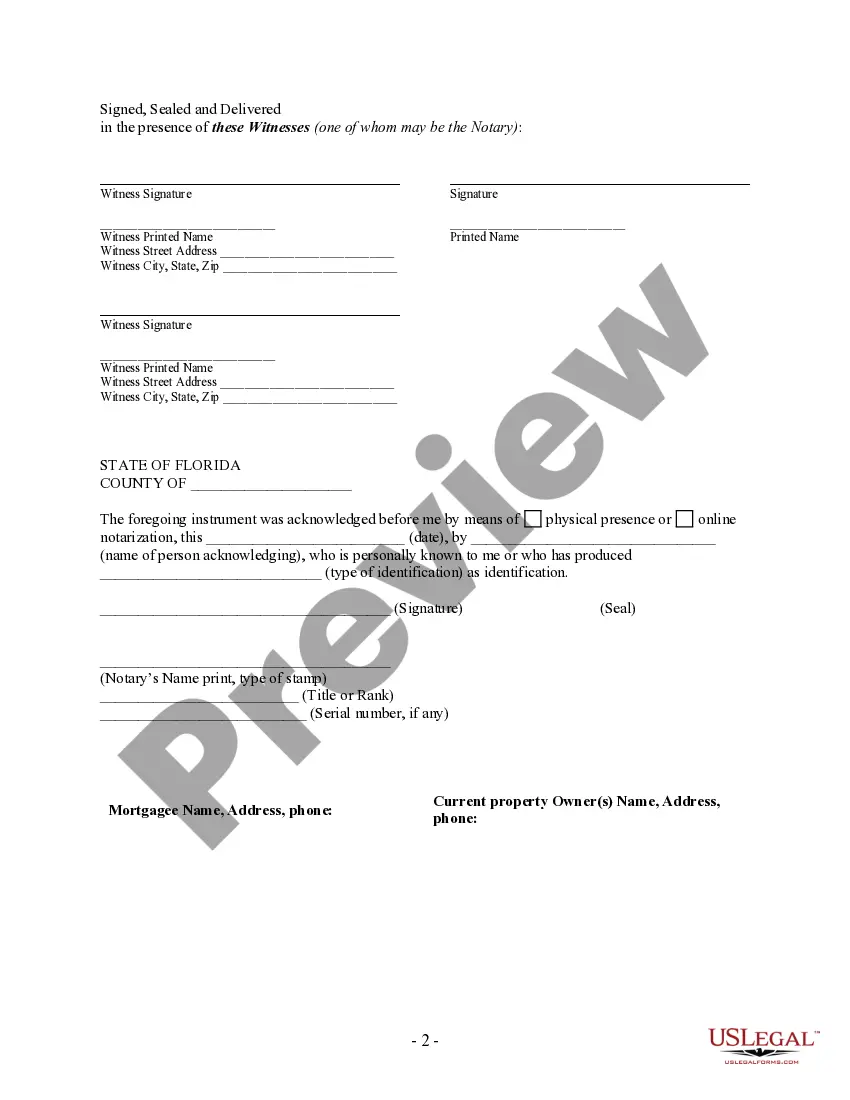

This form is for the satisfaction or release of a mortgage for the state of Florida by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Tallahassee Florida Satisfaction, Release or Cancellation of Mortgage by Individual: A Comprehensive Guide In Tallahassee, Florida, the Satisfaction, Release, or Cancellation of Mortgage by Individual is a crucial legal process that occurs when a mortgage has been fully repaid or when certain conditions stipulated in the mortgage agreement have been met. This process ensures that the property owner obtains clear and unencumbered title to their property. Understanding the different types of satisfaction, release, or cancellation of mortgage is essential. Here are several key types to be aware of: 1. Full Satisfaction of Mortgage: This type of satisfaction occurs when the mortgage debt is paid in full, either through regular installments or as a lump sum. Once the final payment is made, the lender issues a Satisfaction of Mortgage that officially releases the borrower from the financial obligation, allowing them to possess a clear title to their property. 2. Partial Satisfaction of Mortgage: In some cases, a borrower may wish to satisfy only a portion of the mortgage instead of the entire balance. This partial satisfaction can occur when refinancing, selling a portion of the property, or modifying the loan terms. The partial satisfaction will release the lien on the specific portion of the property addressed. 3. Mortgage Release: A mortgage release is particularly relevant in cases where the mortgage was taken out jointly. When one individual involved in the mortgage wishes to be released from their responsibility, they can seek a mortgage release. This process ensures that the remaining party continues to be responsible for the mortgage while the released individual is no longer liable. 4. Mortgage Cancellation: In certain scenarios, a mortgage may need to be cancelled due to errors or mistakes in the original mortgage agreement, illegitimate liens, or fraudulent activities. Mortgage cancellations are usually initiated through a court order, which declares the mortgage null and void. To initiate any of these processes, the individual seeking satisfaction, release, or cancellation of their mortgage must follow specific procedures as mandated by the state of Florida. These procedures generally involve filing the appropriate legal documents with the county clerk's office, providing proof of mortgage satisfaction or other relevant circumstances, and paying any required fees. It is important to note that hiring an experienced real estate attorney or seeking professional advice is highly recommended throughout this process. They can ensure all legal requirements are met, offer guidance on documentation, and streamline the satisfaction, release, or cancellation of mortgage by individual procedure. In conclusion, the Tallahassee Florida Satisfaction, Release, or Cancellation of Mortgage by Individual involves various types of transactions depending on the circumstances. These transactions include full satisfaction, partial satisfaction, mortgage release, and mortgage cancellation. It is vital to understand the specific requirements and procedures associated with each type to achieve a clear title efficiently. Seeking legal assistance is always advisable to navigate through the complexities of this process successfully.

Free preview

How to fill out Tallahassee Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

If you’ve already utilized our service before, log in to your account and download the Tallahassee Florida Satisfaction, Release or Cancellation of Mortgage by Individual on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Tallahassee Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!