Tampa, Florida is a city known for its vibrant culture, stunning beaches, and a thriving real estate market. In the realm of mortgages, one common legal process that occurs in Tampa is the Satisfaction, Release, or Cancellation of Mortgage by an Individual. This significant event marks the completion or termination of a mortgage agreement, freeing the property from the encumbrance of the loan. The Satisfaction, Release, or Cancellation of Mortgage by Individual in Tampa, Florida necessitates specific steps and documentation. The mortgage holder, often the lender or financial institution, must file a release or satisfaction of mortgage deed with the appropriate authorities, such as the Hillsborough County Clerk of Court. This record ensures that the mortgage is officially canceled and the property is no longer collateral for the loan. Various scenarios may arise where this process becomes relevant. For instance, when a homeowner pays off their mortgage in full, they can request the lender to issue a Satisfaction, Release, or Cancellation of Mortgage by Individual. This document declares that all debt obligations have been met, offering peace of mind and legal proof that the property is unencumbered. Additionally, individuals who have refinanced their mortgage may also need to carry out this process. Refinancing entails paying off an existing mortgage and replacing it with a new loan. In such cases, a Satisfaction, Release, or Cancellation of Mortgage by Individual is necessary to remove the previous lender's claim on the property. This step ensures that the refinanced loan becomes the primary mortgage, providing clarity to all parties involved. Furthermore, individuals who have sold their property in Tampa, Florida might seek a Satisfaction, Release, or Cancellation of Mortgage by Individual. When the sale is finalized, the mortgage holder releases the mortgage, confirming that the loan is paid off from the proceeds of the sale. Keywords: Tampa, Florida, Satisfaction, Release, Cancellation, Mortgage, Individual, legal process, completion, termination, encumbrance, loan, lender, financial institution, documentation, Hillsborough County Clerk of Court, homeowner, debt obligations, refinancing, peace of mind, legal proof, primary mortgage, claim, property sale.

Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Individual

State:

Florida

City:

Tampa

Control #:

FL-S123-Z

Format:

Word;

Rich Text

Instant download

Description

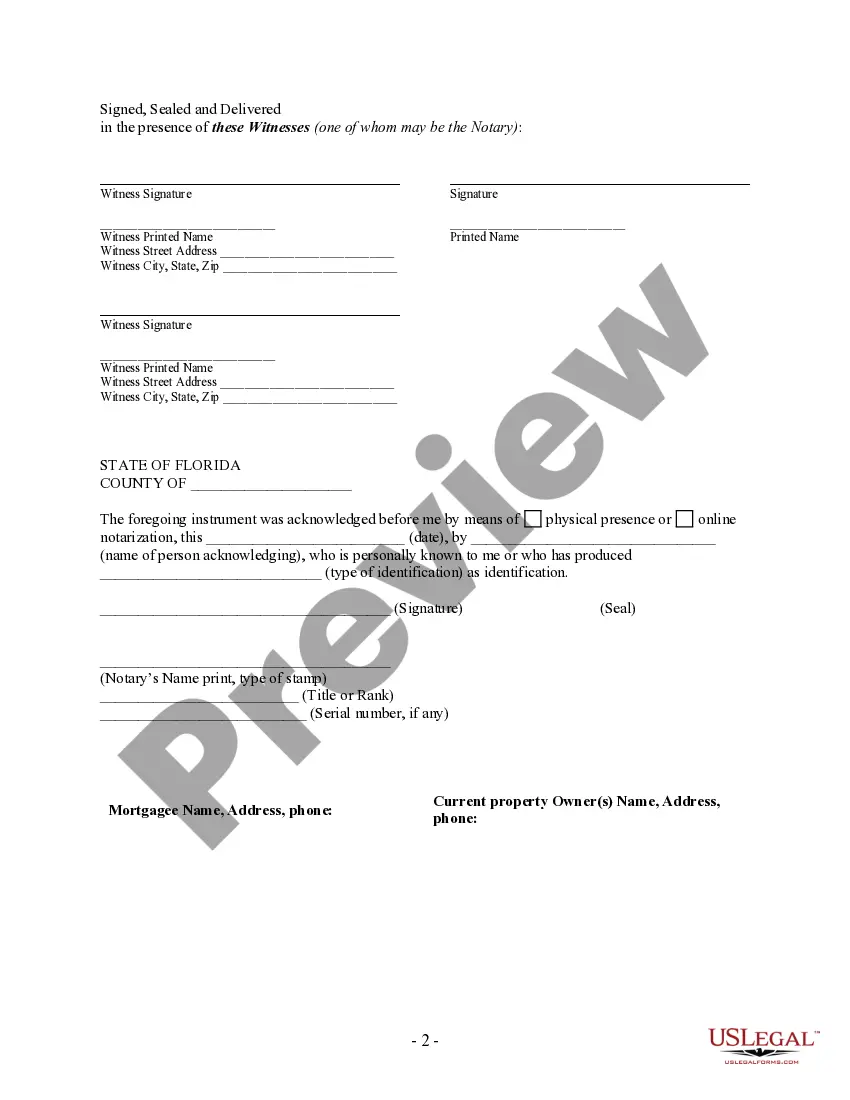

This form is for the satisfaction or release of a mortgage for the state of Florida by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Tampa, Florida is a city known for its vibrant culture, stunning beaches, and a thriving real estate market. In the realm of mortgages, one common legal process that occurs in Tampa is the Satisfaction, Release, or Cancellation of Mortgage by an Individual. This significant event marks the completion or termination of a mortgage agreement, freeing the property from the encumbrance of the loan. The Satisfaction, Release, or Cancellation of Mortgage by Individual in Tampa, Florida necessitates specific steps and documentation. The mortgage holder, often the lender or financial institution, must file a release or satisfaction of mortgage deed with the appropriate authorities, such as the Hillsborough County Clerk of Court. This record ensures that the mortgage is officially canceled and the property is no longer collateral for the loan. Various scenarios may arise where this process becomes relevant. For instance, when a homeowner pays off their mortgage in full, they can request the lender to issue a Satisfaction, Release, or Cancellation of Mortgage by Individual. This document declares that all debt obligations have been met, offering peace of mind and legal proof that the property is unencumbered. Additionally, individuals who have refinanced their mortgage may also need to carry out this process. Refinancing entails paying off an existing mortgage and replacing it with a new loan. In such cases, a Satisfaction, Release, or Cancellation of Mortgage by Individual is necessary to remove the previous lender's claim on the property. This step ensures that the refinanced loan becomes the primary mortgage, providing clarity to all parties involved. Furthermore, individuals who have sold their property in Tampa, Florida might seek a Satisfaction, Release, or Cancellation of Mortgage by Individual. When the sale is finalized, the mortgage holder releases the mortgage, confirming that the loan is paid off from the proceeds of the sale. Keywords: Tampa, Florida, Satisfaction, Release, Cancellation, Mortgage, Individual, legal process, completion, termination, encumbrance, loan, lender, financial institution, documentation, Hillsborough County Clerk of Court, homeowner, debt obligations, refinancing, peace of mind, legal proof, primary mortgage, claim, property sale.

Free preview

How to fill out Tampa Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

If you’ve already used our service before, log in to your account and save the Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Individual on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!