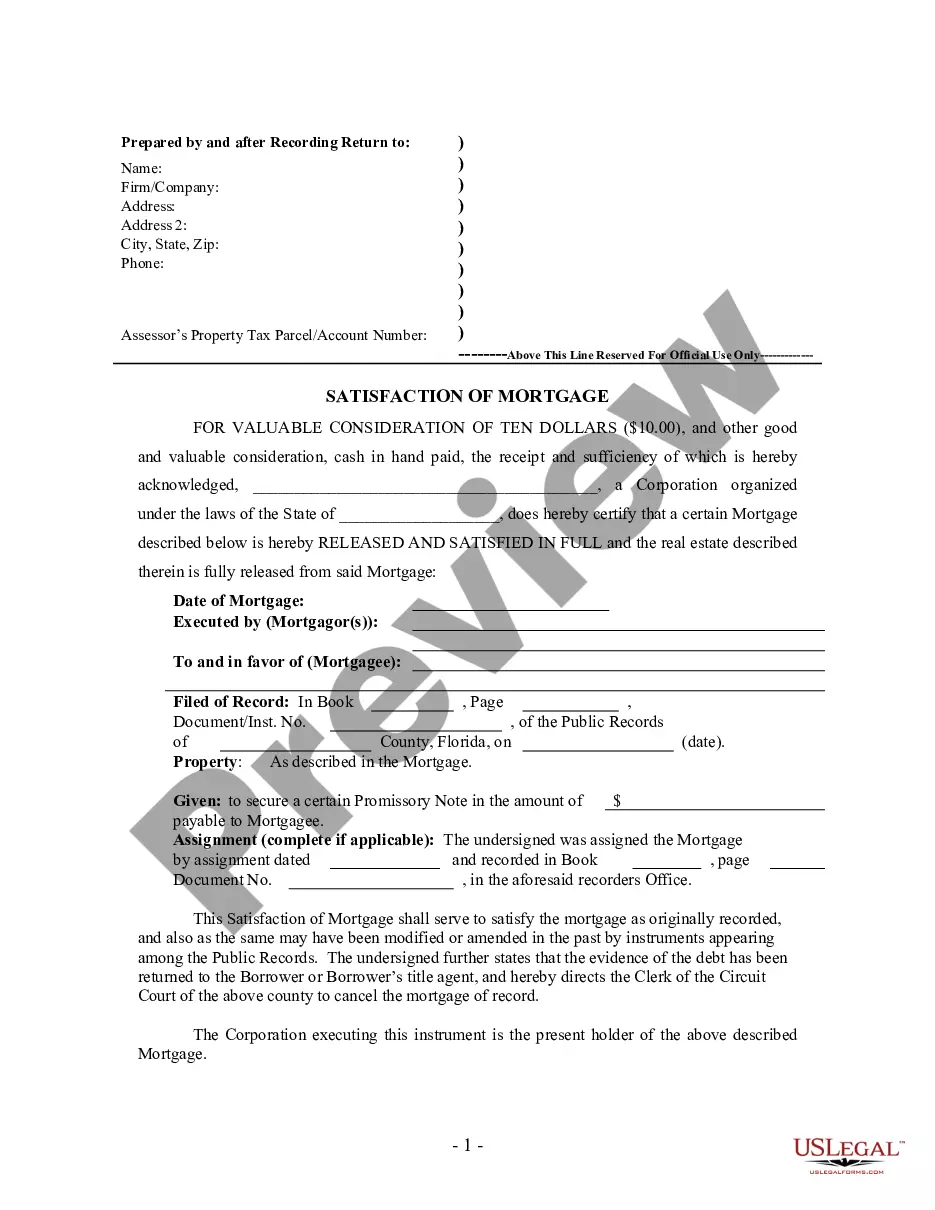

Cape Coral Florida's Satisfaction, Release, or Cancellation of Mortgage by Corporation is a legal process that involves the termination of a mortgage by a corporation in Cape Coral, Florida. This action signifies the fulfillment of the mortgage terms, resulting in the release of the property from the encumbrance of the mortgage loan. Corporations engaging in the Satisfaction, Release, or Cancellation of Mortgage in Cape Coral, Florida, must abide by the applicable state laws and regulations. The process usually involves the following steps: 1. Documentation: The corporation must gather and organize all relevant documents related to the mortgage, including the initial loan agreement, promissory note, and any subsequent modifications or assignments. 2. Verification: The corporation should verify that all mortgage obligations, such as regular payments, interest, and penalties, have been duly fulfilled according to the terms specified. This step may involve reviewing the payment history, outstanding balances, or any additional agreements made. 3. Preparation of Satisfaction, Release, or Cancellation of Mortgage: Once the verification process is completed, the corporation must prepare the necessary paperwork to officially release the property from the mortgage's lien. This document is commonly known as the Satisfaction, Release, or Cancellation of Mortgage by Corporation. 4. Notarization: In Cape Coral, Florida, it is generally required that the Satisfaction, Release, or Cancellation of Mortgage by Corporation be notarized by a duly authorized notary public. Hence, the corporation must schedule an appointment with a qualified notary to witness the signing of the document. 5. Recording: After notarization, the corporation must file the Satisfaction, Release, or Cancellation of Mortgage by Corporation with the appropriate government office responsible for recording real estate documents. In Cape Coral, Florida, this is usually the county recorder's office. By recording this document, the public and potential lenders will be aware that the mortgage has been satisfied, the lien released, and the property is no longer encumbered by the mortgage loan. Different variations or types of Cape Coral Florida Satisfaction, Release, or Cancellation of Mortgage by Corporation may include: 1. Full Satisfaction: A corporation successfully meets all the mortgage obligations, fulfills the loan terms, and pays off the entire mortgage balance, resulting in the complete release of the mortgage lien on the property. 2. Partial Satisfaction: In some cases, corporations may decide to partially satisfy a mortgage. This occurs when a portion of the mortgage balance is paid off, resulting in the release of the lien on a specific portion or property interest, while the remaining balance remains outstanding. 3. Conditional Satisfaction: This type of Satisfaction, Release, or Cancellation of Mortgage by Corporation occurs when certain conditions or requirements specified in the mortgage agreement are met. For example, the mortgage may stipulate the payment of a specified amount within a certain timeframe or the completion of certain property improvements before the mortgage can be released. In conclusion, the Satisfaction, Release, or Cancellation of Mortgage by Corporation in Cape Coral, Florida, is a crucial legal process that permanently removes the mortgage lien from a property. Corporations must comply with the applicable procedures and requirements to ensure a smooth and lawful termination of the mortgage, resulting in the satisfaction and release of the property from the encumbrance of the mortgage loan.

Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Cape Coral Florida Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Are you seeking a trustworthy and economical legal forms provider to obtain the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation? US Legal Forms is your preferred option.

Whether you require a straightforward arrangement to establish guidelines for living together with your partner or a collection of documents to proceed with your separation or divorce through the judicial system, we have you covered. Our website offers over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored to meet the needs of specific states and counties.

To obtain the document, you must Log In to your account, locate the necessary template, and click the Download button beside it. Please remember that you can access your previously purchased form templates at any time in the My documents section.

Are you unfamiliar with our platform? No problem. You can set up an account with great ease, but prior to that, ensure you do the following.

Now you can establish your account. Then choose the subscription plan and continue to payment. Once the payment is completed, download the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation in any available format. You can revisit the website whenever needed and redownload the document at no extra cost.

Obtaining up-to-date legal documents has never been simpler. Try US Legal Forms now, and say goodbye to spending countless hours searching for legal paperwork online.

- Confirm if the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation adheres to the laws of your state and local jurisdiction.

- Review the description of the form (if accessible) to understand who and what the document is meant for.

- Restart your search if the template does not suit your legal circumstance.

Form popularity

FAQ

To file a mortgage release in Cape Coral, Florida, you need to gather the necessary documents, including the original mortgage agreement and a satisfaction of mortgage form. It’s crucial to complete this form correctly, as errors can delay the process. After you have filled out the form, you can file it with the county clerk's office in your area. Utilizing US Legal Forms can simplify this process, as it provides the required documentation and instructions tailored for the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

Mortgage lenders in Florida are overseen by the Office of Financial Regulation within the Department of Financial Services. This body ensures that lenders comply with state laws and regulations, thus protecting consumers. If you encounter issues related to your mortgage, understanding this oversight can help streamline your path towards Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

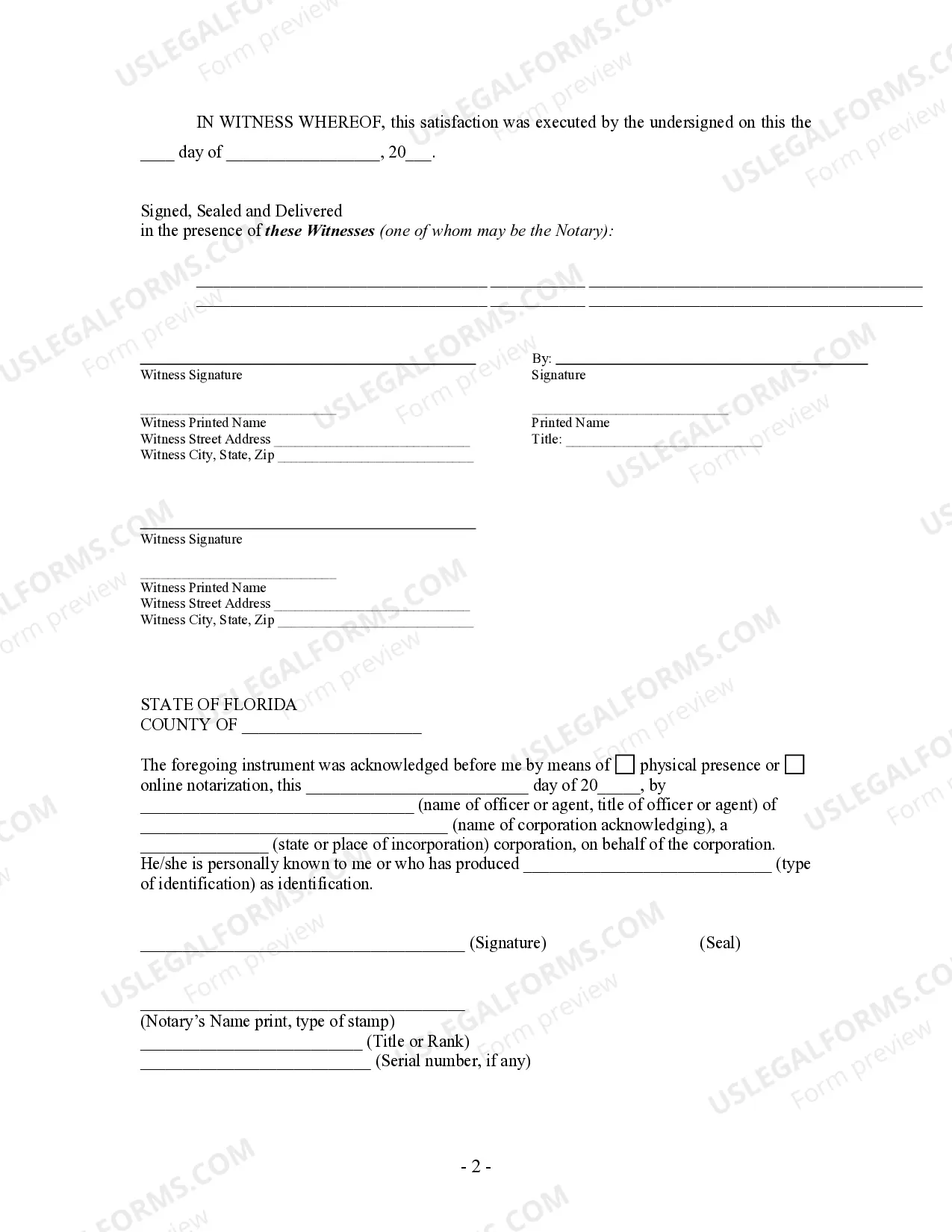

In Florida, a satisfaction of mortgage requires the signature of the lender or their authorized agent, along with proper notarization. Additionally, the document must contain specific information, such as the mortgage date, book and page numbers where it is recorded, and the property’s legal description. Meeting these requirements will assist in achieving your Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

If you need to file a complaint against a mortgage company in Florida, you can start by contacting the Florida Department of Financial Services. They handle complaints related to mortgage lenders and can guide you through the process. Additionally, consider documenting all interactions and agreements to support your case, ensuring that your concerns related to Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation are thoroughly addressed.

To file a satisfaction of mortgage in Florida, first, obtain the satisfaction document from your lender. Then, you will need to submit this document to the county Clerk of Court where the mortgage was recorded. This step is crucial in ensuring your Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation is recognized officially.

Yes, a satisfaction of mortgage in Florida must be notarized to be valid. This notarization serves as a confirmation of the authenticity of the document and the signatures involved. By ensuring the proper notarization, you protect your Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, making it easier to process with local authorities.

The statute of limitations for mortgage foreclosure in Florida is five years. This means that a lender must initiate foreclosure proceedings within this period after a payment default. Understanding this timeline is crucial for homeowners facing financial difficulties, as it impacts your rights and options regarding your Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

Exiting a mortgage can happen through several means, such as paying it off in full, selling the property, or refinancing. Each option requires careful consideration of your financial situation. In Cape Coral, Florida, using USLegalForms can provide you with the right resources to understand your options better and help in preparing necessary documents for a seamless exit strategy.

Discharging a mortgage in Cape Coral, Florida, typically involves obtaining a discharge document from your lender. This document states that your mortgage obligations are fulfilled. After acquiring the document, file it with the local county clerk to officially discharge the mortgage. Consider using USLegalForms to find the right forms and instructions tailored to your needs.

After you submit all necessary documentation to your lender, the process of releasing mortgage funds can take anywhere from a few days to several weeks. Factors affecting this timeline include the efficiency of the lender and local recording office. To ensure a smooth process, you might want to utilize services like USLegalForms, which can assist in preparing the required documents accurately and quickly.