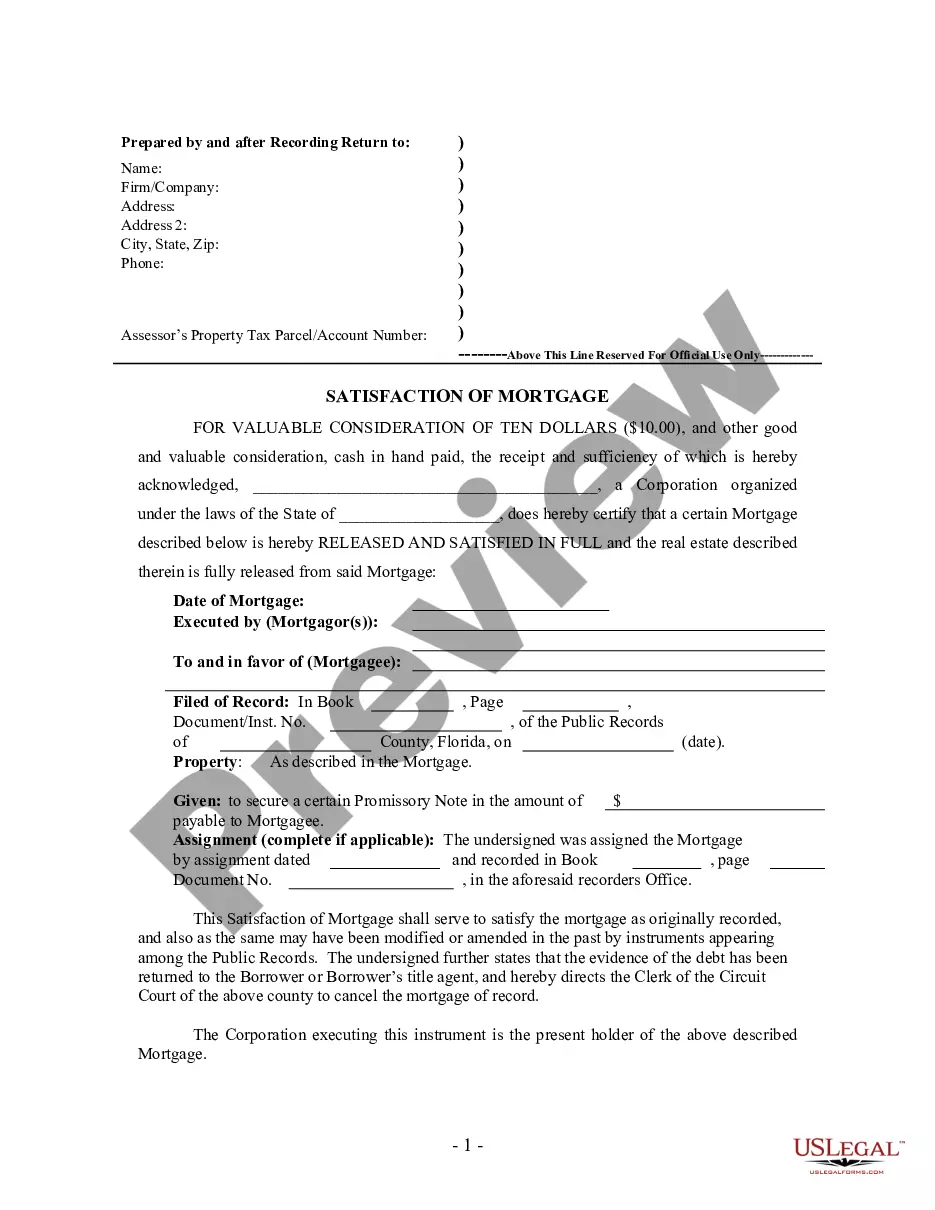

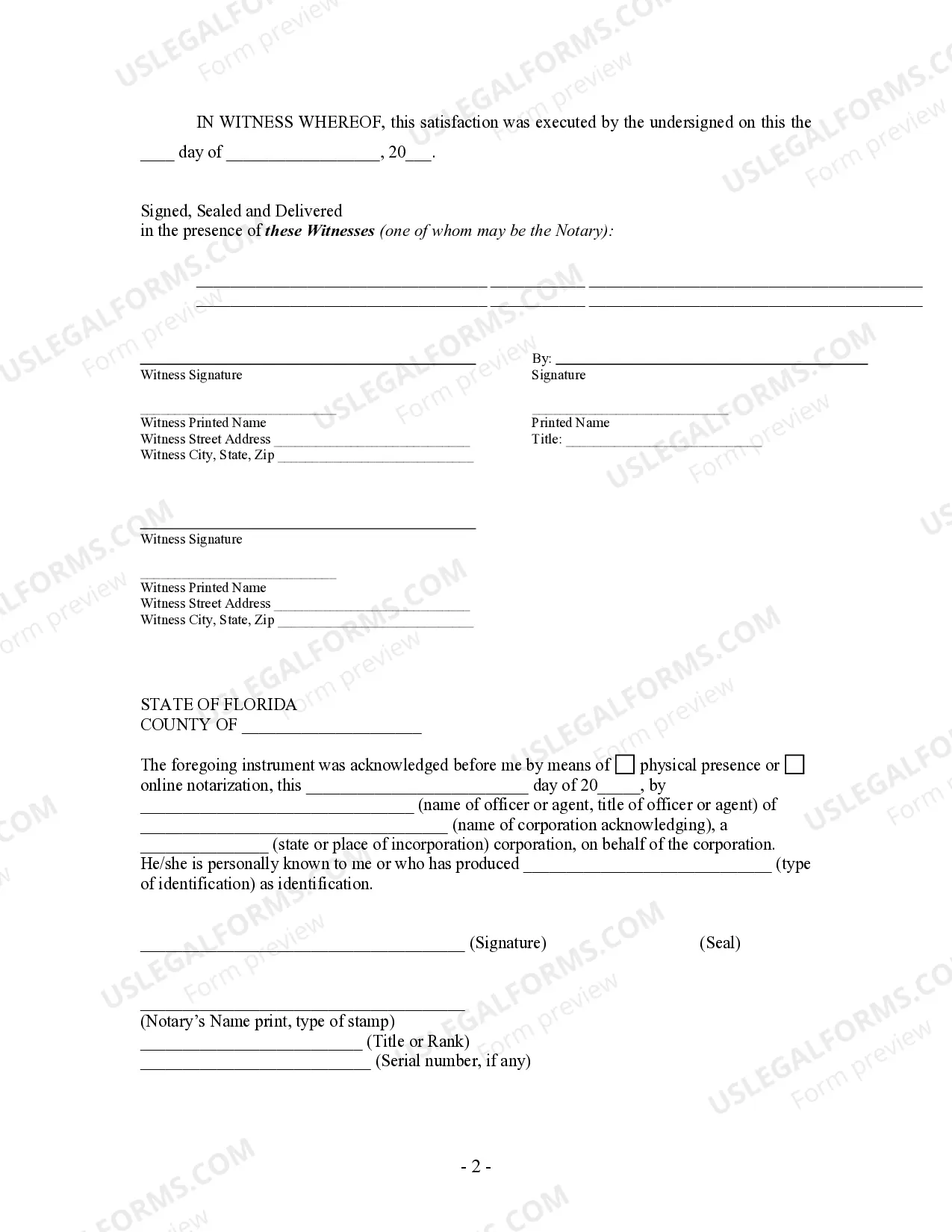

Title: Understanding Miramar Florida Satisfaction, Release, and Cancellation of Mortgage by Corporation: A Detailed Overview Introduction: In the realm of real estate transactions, the satisfaction, release, or cancellation of a mortgage signifies the completion of a loan or debt obligation. Miramar, Florida, like many other cities, follows specific procedures and requirements for this process. In this article, we will provide an in-depth exploration of Miramar Florida Satisfaction, Release, or Cancellation of Mortgage specifically related to corporations. We will also highlight different types of satisfaction, release, or cancellation documents commonly encountered in Miramar. Keywords: Miramar Florida Satisfaction of Mortgage, Miramar Florida Release of Mortgage, Miramar Florida Cancellation of Mortgage, Corporation 1. Miramar Florida Satisfaction of Mortgage by Corporation: The satisfaction of mortgage by a corporation refers to the process of acknowledging that a loan has been fully paid off by the corporate entity. This document releases the property from the mortgage lien, providing evidence that the debt has been satisfied. 2. Miramar Florida Release of Mortgage by Corporation: The release of mortgage by a corporation involves the complete removal of a mortgage lien from a property owned by the corporate entity. This legal document is typically recorded to ensure the property's title is clear and to inform any future buyers or lenders that the debt has been discharged. 3. Miramar Florida Cancellation of Mortgage by Corporation: The cancellation of mortgage by a corporation annuls the initial contract or agreement between the corporate entity and the lender. This document states that the mortgage is no longer valid or enforceable, effectively freeing the property from any encumbrances associated with the loan. Types of Miramar Florida Satisfaction, Release, or Cancellation Documents: a. Partial Satisfaction of Mortgage by Corporation: In cases where a corporation partially settles a mortgage debt, a partial satisfaction of mortgage document is prepared. This signifies that a portion of the loan has been fulfilled while the remaining balance still exists. b. Full Satisfaction of Mortgage by Corporation: When the corporation completely pays off a mortgage, a full satisfaction of mortgage document is issued. This document confirms that the loan is entirely settled, and the property is no longer encumbered by the mortgage. c. Cancellation of Mortgage After a Transfer of Ownership: If a corporation transfers property ownership to another party, a cancellation of mortgage document is executed to remove any mortgage liens previously held by the corporation. This action ensures that the new owner receives a property free from encumbrances. d. Release of Mortgage After a Refinancing: When a corporation refinances an existing mortgage, a release of mortgage document is typically used. This releases the original mortgage lien, replacing it with a new one under revised terms. Conclusion: The satisfaction, release, or cancellation of a mortgage by a corporation in Miramar, Florida, plays a pivotal role in ensuring the completion of loan obligations and the release of property liens. Understanding the purpose and types of these documents is essential for both corporations and individuals involved in real estate transactions. By adhering to the specific requirements set forth by Miramar, corporations can guarantee the legal and financial integrity of their properties.

Miramar Florida Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Miramar Florida Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Miramar Florida Satisfaction, Release or Cancellation of Mortgage by Corporation gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Miramar Florida Satisfaction, Release or Cancellation of Mortgage by Corporation takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Miramar Florida Satisfaction, Release or Cancellation of Mortgage by Corporation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!