- US Legal Forms

- Localized Forms

- Florida

- Tampa

-

Florida Satisfaction...

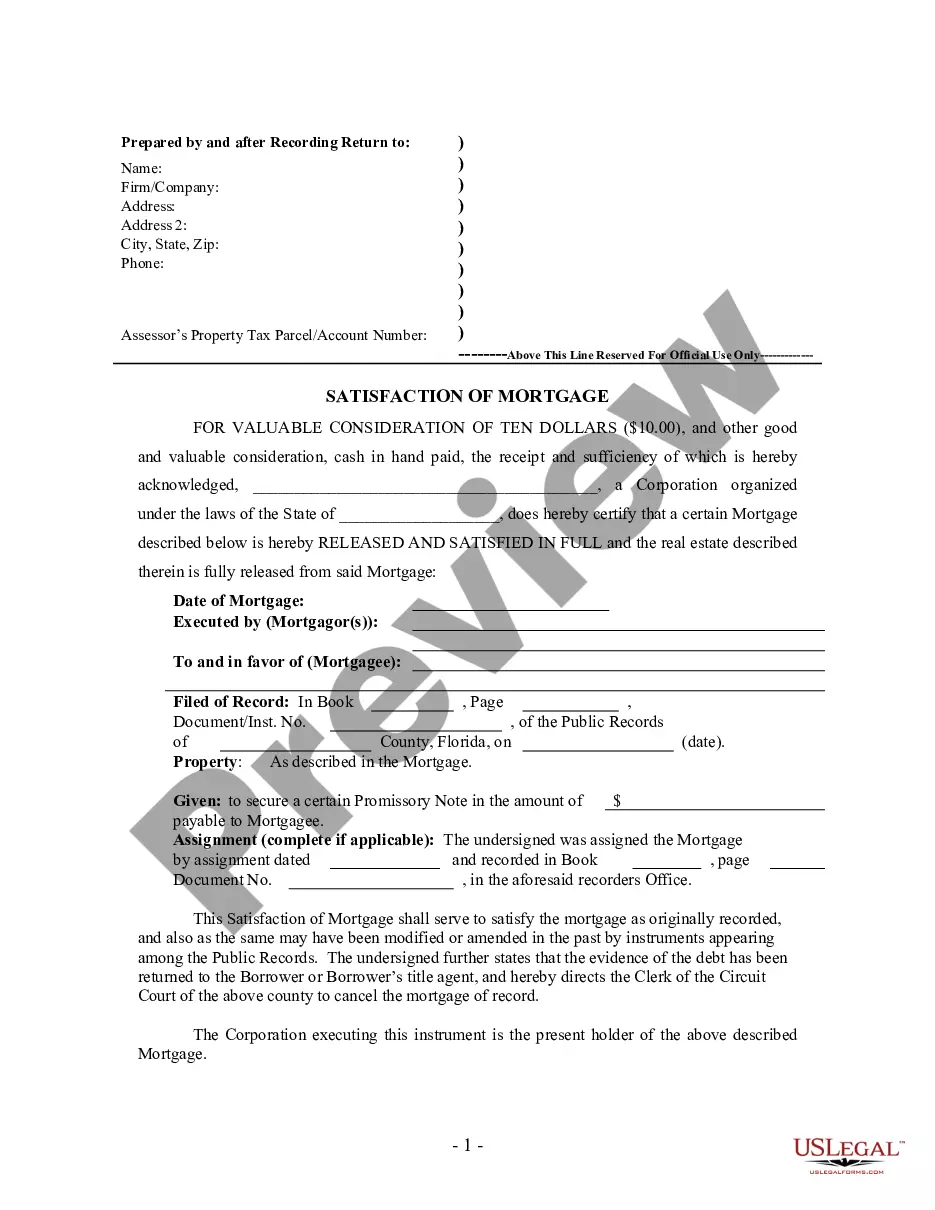

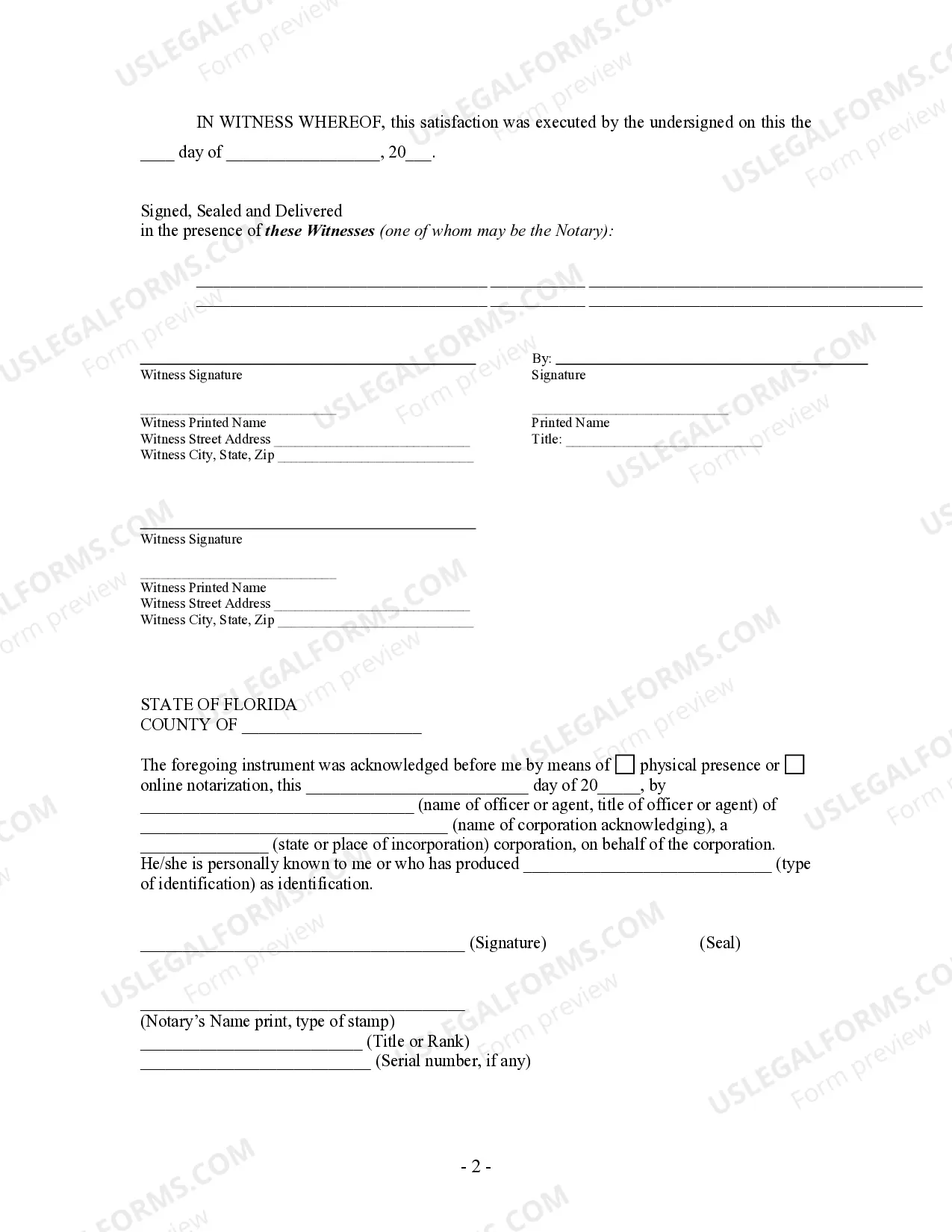

Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

Related Forms

Satisfaction, Release or Cancellation of Mortgage by Individual

View Provo

View Provo

View Provo

View Provo

View Provo

How to fill out Tampa Florida Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law background to draft such papers cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our service offers a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Corporation or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Corporation in minutes employing our reliable service. In case you are presently an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Corporation:

- Ensure the template you have found is suitable for your location since the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick description (if available) of scenarios the paper can be used for.

- If the one you selected doesn’t meet your requirements, you can start again and search for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Pick the payment method and proceed to download the Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Corporation once the payment is completed.

You’re all set! Now you can go on and print out the form or complete it online. In case you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form Rating

Form popularity

FAQ

How do I discharge a mortgage? Notify your lender: Reach out to your lender and discuss your plans to release the mortgage with them.Complete and return the Discharge Authority form:Register your discharge and Certificate of Title:

Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.

If the mortgagee fails to execute and record a Satisfaction of Mortgage within the 60-day period afforded by statute, the mortgagor (property owner) may file suit and seek a court order directing the mortgagee to execute a satisfaction of mortgage or an order extinguishing the lien against the property.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

Once the loan is paid off and all the terms of the mortgage are satisfied, a mortgage deed of release is created. Until then, the lender holds the title of the property and after the final payment is made, the title of the property is transferred to the borrower of the mortgage.

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

In general, it takes 30 days to receive a satisfaction of mortgage, but it can depend on your state's laws. In Florida, for example, lenders have 60 days from the time the borrower pays off the mortgage to prepare and record the documentation. For Sheldon's own mortgage, the process took about three weeks.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

Upon receiving your final payment, the lender must execute and file a written, notarized document (typically referred to as a release or satisfaction of mortgage) that acknowledges the mortgage is satisfied or paid in full. They must also file the document with the clerk of the county where your property is located.

How do I discharge a mortgage? Notify your lender: Reach out to your lender and discuss your plans to release the mortgage with them.Complete and return the Discharge Authority form:Register your discharge and Certificate of Title:

Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.

If the mortgagee fails to execute and record a Satisfaction of Mortgage within the 60-day period afforded by statute, the mortgagor (property owner) may file suit and seek a court order directing the mortgagee to execute a satisfaction of mortgage or an order extinguishing the lien against the property.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

Once the loan is paid off and all the terms of the mortgage are satisfied, a mortgage deed of release is created. Until then, the lender holds the title of the property and after the final payment is made, the title of the property is transferred to the borrower of the mortgage.

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

In general, it takes 30 days to receive a satisfaction of mortgage, but it can depend on your state's laws. In Florida, for example, lenders have 60 days from the time the borrower pays off the mortgage to prepare and record the documentation. For Sheldon's own mortgage, the process took about three weeks.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

Upon receiving your final payment, the lender must execute and file a written, notarized document (typically referred to as a release or satisfaction of mortgage) that acknowledges the mortgage is satisfied or paid in full. They must also file the document with the clerk of the county where your property is located.

How do I discharge a mortgage? Notify your lender: Reach out to your lender and discuss your plans to release the mortgage with them.Complete and return the Discharge Authority form:Register your discharge and Certificate of Title:

Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.

If the mortgagee fails to execute and record a Satisfaction of Mortgage within the 60-day period afforded by statute, the mortgagor (property owner) may file suit and seek a court order directing the mortgagee to execute a satisfaction of mortgage or an order extinguishing the lien against the property.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

Once the loan is paid off and all the terms of the mortgage are satisfied, a mortgage deed of release is created. Until then, the lender holds the title of the property and after the final payment is made, the title of the property is transferred to the borrower of the mortgage.

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

In general, it takes 30 days to receive a satisfaction of mortgage, but it can depend on your state's laws. In Florida, for example, lenders have 60 days from the time the borrower pays off the mortgage to prepare and record the documentation. For Sheldon's own mortgage, the process took about three weeks.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

Upon receiving your final payment, the lender must execute and file a written, notarized document (typically referred to as a release or satisfaction of mortgage) that acknowledges the mortgage is satisfied or paid in full. They must also file the document with the clerk of the county where your property is located.

Tampa Florida Satisfaction, Release or Cancellation of Mortgage by Corporation Related Searches

-

florida satisfaction of mortgage witness requirements

-

satisfaction of mortgage florida pdf

-

release of mortgage sample

-

florida satisfaction of mortgage form

-

florida release of mortgage form

-

how to get a copy of satisfaction of mortgage

-

who files satisfaction of mortgage

-

satisfaction of mortgage broward county florida

-

florida satisfaction of mortgage witness requirements

-

how do i get a mortgage lien release from a company that no longer exists

Interesting Questions

Tampa Satisfaction, Release, or Cancellation of Mortgage by Corporation51583 refers to the legal process through which a corporation cancels or releases a mortgage on a property located in Tampa. This action eliminates the mortgage lien on the property, giving the owner full ownership and removing any financial obligation.

You should consider requesting Tampa Satisfaction, Release, or Cancellation of Mortgage by Corporation51583 when you have fully repaid your mortgage or when you need clear ownership of the property. This process ensures that the mortgage lien is officially removed from public records.

To request Tampa Satisfaction, Release, or Cancellation of Mortgage by Corporation51583, you need to contact Corporation51583, which holds the mortgage on your property. They will provide you with the necessary forms and instructions to initiate the process. Remember to provide all required documents and follow the specified procedures to ensure a smooth cancellation.

Yes, there may be fees associated with Tampa Satisfaction, Release, or Cancellation of Mortgage by Corporation51583. The exact fees and requirements can vary depending on the corporation and the terms of your mortgage agreement. It is crucial to review your mortgage contract or contact Corporation51583 directly to determine the applicable fees.

The time required to complete Tampa Satisfaction, Release, or Cancellation of Mortgage by Corporation51583 can vary. It depends on several factors, including the responsiveness of Corporation51583 and the complexity of your case. Typically, the process takes a few weeks to several months. It is advisable to initiate the process well in advance to allow for any potential delays.

Once Tampa Satisfaction, Release, or Cancellation of Mortgage by Corporation51583 is approved, Corporation51583 will provide you and the relevant authorities with the necessary documentation proving the cancellation of the mortgage lien. This documentation should be recorded in public records to ensure the property's title reflects the updated ownership status. You will then have clear ownership of the property without any outstanding mortgage obligations.

More info

The original mortgagee has withdrawn from title insurance. The new mortgagee, the mortgage lender, or another person, agency or entity that is the new mortgagee, is the new mortgagee. NOTE: If you signed up for the mortgage directly from this Website, the mortgagee will no longer be listed as the mortgagee. Your new mortgagee can contact you about the mortgage to make arrangements. The mortgagee should also contact you. The new mortgagee (the original loan originator) was the current owner, except in the case of foreclosure. In this case, a foreclosure release form must be completed by the transfer agent or receiver of title. The bank, deed-in-lieu, or mortgage institution that purchased the mortgage may also contact you if you are still the owner of the property. If you were the original mortgagee and were not the current owner, we will still allow you to contact us in an emergency, but please read the warning at the bottom of this page before contacting us in this manner.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Florida

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Real Property - Mortgage Satisfaction - Florida

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Florida Law

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: No assignment of a mortgage upon real property or of any interest therein, shall be good or effectual in law or equity, against creditors or subsequent purchasers, for a valuable consideration, and without notice, unless the assignment is contained in a document which, in its title, indicates an assignment of mortgage and is recorded according to law.

Demand to Satisfy: Upon full payoff of the mortgage, the mortgagor may demand of the mortgagee that satisfaction be recorded. The mortgagee then has 60 days to comply, or face liability.

Recording Satisfaction: Within 60 days of the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

Marginal Satisfaction: Not allowed.

Penalty: In the case of a civil action arising out of the failure of the mortgagee to properly record, within 30 days of demand, a satisfied mortgage, the prevailing party shall be entitled to attorney's fees and costs, and shall be guilty of a misdemeanor of the second degree.

Acknowledgment: An assignment or satisfaction must contain a proper Florida acknowledgment, or other acknowledgment approved by Statute.

Florida Statutes

701.01 Assignment. Any mortgagee may assign and transfer any mortgage made to her or him, and the person to whom any mortgage may be assigned or transferred may also assign and transfer it, and that person or her or his assigns or subsequent assignees may lawfully have, take and pursue the same means and remedies which the mortgagee may lawfully have, take or pursue for the foreclosure of a mortgage and for the recovery of the money secured thereby.

701.02 Assignment not effectual against creditors unless recorded and indicated in title of document; applicability.

(1) An assignment of a mortgage upon real property or of any interest therein, is not good or effectual in law or equity, against creditors or subsequent purchasers, for a valuable consideration, and without notice, unless the assignment is contained in a document that, in its title, indicates an assignment of mortgage and is recorded according to law.(2) This section also applies to assignments of mortgages resulting from transfers of all or any part or parts of the debt, note or notes secured by mortgage, and none of same is effectual in law or in equity against creditors or subsequent purchasers for a valuable consideration without notice, unless a duly executed assignment be recorded according to law.

(3) Any assignment of a mortgage, duly executed and recorded according to law, purporting to assign the principal of the mortgage debt or the unpaid balance of such principal, shall, as against subsequent purchasers and creditors for value and without notice, be held and deemed to assign any and all accrued and unpaid interest secured by such mortgage, unless such interest is specifically and affirmatively reserved in such an assignment by the assignor, and a reservation of such interest or any part thereof may not be implied.

(4) Notwithstanding subsections (1), (2), and (3) governing the assignment of mortgages, chapters 670-680 of the Uniform Commercial Code of this state govern the attachment and perfection of a security interest in a mortgage upon real property and in a promissory note or other right to payment or performance secured by that mortgage. The assignment of such a mortgage need not be recorded under this section for purposes of attachment or perfection of a security interest in the mortgage under the Uniform Commercial Code.

(5) Notwithstanding subsection (4), a creditor or subsequent purchaser of real property or any interest therein, for valuable consideration and without notice, is entitled to rely on a full or partial release, discharge, consent, joinder, subordination, satisfaction, or assignment of a mortgage upon such property made by the mortgagee of record, without regard to the filing of any Uniform Commercial Code financing statement that purports to perfect a security interest in the mortgage or in a promissory note or other right to payment or performance secured by the mortgage, and the filing of any such financing statement does not constitute notice for the purposes of this section. For the purposes of this subsection, the term "mortgagee of record" means the person named as the mortgagee in the recorded mortgage or, if an assignment of the mortgage has been recorded in accordance with this section, the term "mortgagee of record" means the assignee named in the recorded assignment.

701.04 Cancellation of mortgages, liens, and judgments. (1) Within 14 days after receipt of the written request of a mortgagor, a record title owner of the property, a fiduciary or trustee lawfully acting on behalf of a record title owner, or any other person lawfully authorized to act on behalf of a mortgagor or record title owner of the property, the holder of a mortgage shall deliver or cause the servicer of the mortgage to deliver to the person making the request at a place designated in the written request an estoppel letter setting forth the unpaid balance of the loan secured by the mortgage.

(a) If the mortgagor, or any person lawfully authorized to act on behalf of the mortgagor, makes the request, the estoppel letter must include an itemization of the principal, interest, and any other charges properly due under or secured by the mortgage and interest on a per-day basis for the unpaid balance.(b) If a record title owner of the property, or any person lawfully authorized to act on behalf of a mortgagor or record title owner of the property, makes the request:

1. The request must include a copy of the instrument showing title in the property or lawful authorization.

2. The estoppel letter may include the itemization of information required under paragraph (a), but must at a minimum include the total unpaid balance due under or secured by the mortgage on a per-day basis.

3. The mortgagee or servicer of the mortgagee acting in accordance with a request in substantial compliance with this paragraph is expressly discharged from any obligation or liability to any person on account of the release of the requested information, other than the obligation to comply with the terms of the estoppel letter.

(c) A mortgage holder may provide the financial information required under this subsection to a person authorized under this subsection to request the financial information notwithstanding s. 655.059.

(2) Whenever the amount of money due on any mortgage, lien, or judgment has been fully paid to the person or party entitled to the payment thereof, the mortgagee, creditor, or assignee, or the attorney of record in the case of a judgment, to whom the payment was made, shall execute in writing an instrument acknowledging satisfaction of the mortgage, lien, or judgment and have the instrument acknowledged, or proven, and duly entered in the official records of the proper county. Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment. In the case of a civil action arising out of this section, the prevailing party is entitled to attorney fees and costs.

(3) Whenever a writ of execution has been issued, docketed, and indexed with a sheriff and the judgment upon which it was issued has been fully paid, it is the responsibility of the party receiving payment to request, in writing, addressed to the sheriff, return of the writ of execution as fully satisfied.

701.06 Certain cancellations and satisfactions of mortgages validated.

All cancellations or satisfactions of mortgages made prior to the enactment of chapter 4138, Acts of 1893, by the mortgagee or assignee of record of such mortgage entering same on the margin of the record of such mortgage in the presence of the custodian of such record and attested by the said custodian and signed by said mortgagee or assignee of record of such mortgage, shall be valid and effectual for every purpose as if the same had been done subsequent to the enactment of chapter 4138, Acts of 1893.

Real Property - Mortgage Satisfaction - Florida

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Florida Law

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: No assignment of a mortgage upon real property or of any interest therein, shall be good or effectual in law or equity, against creditors or subsequent purchasers, for a valuable consideration, and without notice, unless the assignment is contained in a document which, in its title, indicates an assignment of mortgage and is recorded according to law.

Demand to Satisfy: Upon full payoff of the mortgage, the mortgagor may demand of the mortgagee that satisfaction be recorded. The mortgagee then has 60 days to comply, or face liability.

Recording Satisfaction: Within 60 days of the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

Marginal Satisfaction: Not allowed.

Penalty: In the case of a civil action arising out of the failure of the mortgagee to properly record, within 30 days of demand, a satisfied mortgage, the prevailing party shall be entitled to attorney's fees and costs, and shall be guilty of a misdemeanor of the second degree.

Acknowledgment: An assignment or satisfaction must contain a proper Florida acknowledgment, or other acknowledgment approved by Statute.

Florida Statutes

701.01 Assignment. Any mortgagee may assign and transfer any mortgage made to her or him, and the person to whom any mortgage may be assigned or transferred may also assign and transfer it, and that person or her or his assigns or subsequent assignees may lawfully have, take and pursue the same means and remedies which the mortgagee may lawfully have, take or pursue for the foreclosure of a mortgage and for the recovery of the money secured thereby.

701.02 Assignment not effectual against creditors unless recorded and indicated in title of document; applicability.

(1) An assignment of a mortgage upon real property or of any interest therein, is not good or effectual in law or equity, against creditors or subsequent purchasers, for a valuable consideration, and without notice, unless the assignment is contained in a document that, in its title, indicates an assignment of mortgage and is recorded according to law.(2) This section also applies to assignments of mortgages resulting from transfers of all or any part or parts of the debt, note or notes secured by mortgage, and none of same is effectual in law or in equity against creditors or subsequent purchasers for a valuable consideration without notice, unless a duly executed assignment be recorded according to law.

(3) Any assignment of a mortgage, duly executed and recorded according to law, purporting to assign the principal of the mortgage debt or the unpaid balance of such principal, shall, as against subsequent purchasers and creditors for value and without notice, be held and deemed to assign any and all accrued and unpaid interest secured by such mortgage, unless such interest is specifically and affirmatively reserved in such an assignment by the assignor, and a reservation of such interest or any part thereof may not be implied.

(4) Notwithstanding subsections (1), (2), and (3) governing the assignment of mortgages, chapters 670-680 of the Uniform Commercial Code of this state govern the attachment and perfection of a security interest in a mortgage upon real property and in a promissory note or other right to payment or performance secured by that mortgage. The assignment of such a mortgage need not be recorded under this section for purposes of attachment or perfection of a security interest in the mortgage under the Uniform Commercial Code.

(5) Notwithstanding subsection (4), a creditor or subsequent purchaser of real property or any interest therein, for valuable consideration and without notice, is entitled to rely on a full or partial release, discharge, consent, joinder, subordination, satisfaction, or assignment of a mortgage upon such property made by the mortgagee of record, without regard to the filing of any Uniform Commercial Code financing statement that purports to perfect a security interest in the mortgage or in a promissory note or other right to payment or performance secured by the mortgage, and the filing of any such financing statement does not constitute notice for the purposes of this section. For the purposes of this subsection, the term "mortgagee of record" means the person named as the mortgagee in the recorded mortgage or, if an assignment of the mortgage has been recorded in accordance with this section, the term "mortgagee of record" means the assignee named in the recorded assignment.

701.04 Cancellation of mortgages, liens, and judgments. (1) Within 14 days after receipt of the written request of a mortgagor, a record title owner of the property, a fiduciary or trustee lawfully acting on behalf of a record title owner, or any other person lawfully authorized to act on behalf of a mortgagor or record title owner of the property, the holder of a mortgage shall deliver or cause the servicer of the mortgage to deliver to the person making the request at a place designated in the written request an estoppel letter setting forth the unpaid balance of the loan secured by the mortgage.

(a) If the mortgagor, or any person lawfully authorized to act on behalf of the mortgagor, makes the request, the estoppel letter must include an itemization of the principal, interest, and any other charges properly due under or secured by the mortgage and interest on a per-day basis for the unpaid balance.(b) If a record title owner of the property, or any person lawfully authorized to act on behalf of a mortgagor or record title owner of the property, makes the request:

1. The request must include a copy of the instrument showing title in the property or lawful authorization.

2. The estoppel letter may include the itemization of information required under paragraph (a), but must at a minimum include the total unpaid balance due under or secured by the mortgage on a per-day basis.

3. The mortgagee or servicer of the mortgagee acting in accordance with a request in substantial compliance with this paragraph is expressly discharged from any obligation or liability to any person on account of the release of the requested information, other than the obligation to comply with the terms of the estoppel letter.

(c) A mortgage holder may provide the financial information required under this subsection to a person authorized under this subsection to request the financial information notwithstanding s. 655.059.

(2) Whenever the amount of money due on any mortgage, lien, or judgment has been fully paid to the person or party entitled to the payment thereof, the mortgagee, creditor, or assignee, or the attorney of record in the case of a judgment, to whom the payment was made, shall execute in writing an instrument acknowledging satisfaction of the mortgage, lien, or judgment and have the instrument acknowledged, or proven, and duly entered in the official records of the proper county. Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment. In the case of a civil action arising out of this section, the prevailing party is entitled to attorney fees and costs.

(3) Whenever a writ of execution has been issued, docketed, and indexed with a sheriff and the judgment upon which it was issued has been fully paid, it is the responsibility of the party receiving payment to request, in writing, addressed to the sheriff, return of the writ of execution as fully satisfied.

701.06 Certain cancellations and satisfactions of mortgages validated.

All cancellations or satisfactions of mortgages made prior to the enactment of chapter 4138, Acts of 1893, by the mortgagee or assignee of record of such mortgage entering same on the margin of the record of such mortgage in the presence of the custodian of such record and attested by the said custodian and signed by said mortgagee or assignee of record of such mortgage, shall be valid and effectual for every purpose as if the same had been done subsequent to the enactment of chapter 4138, Acts of 1893.