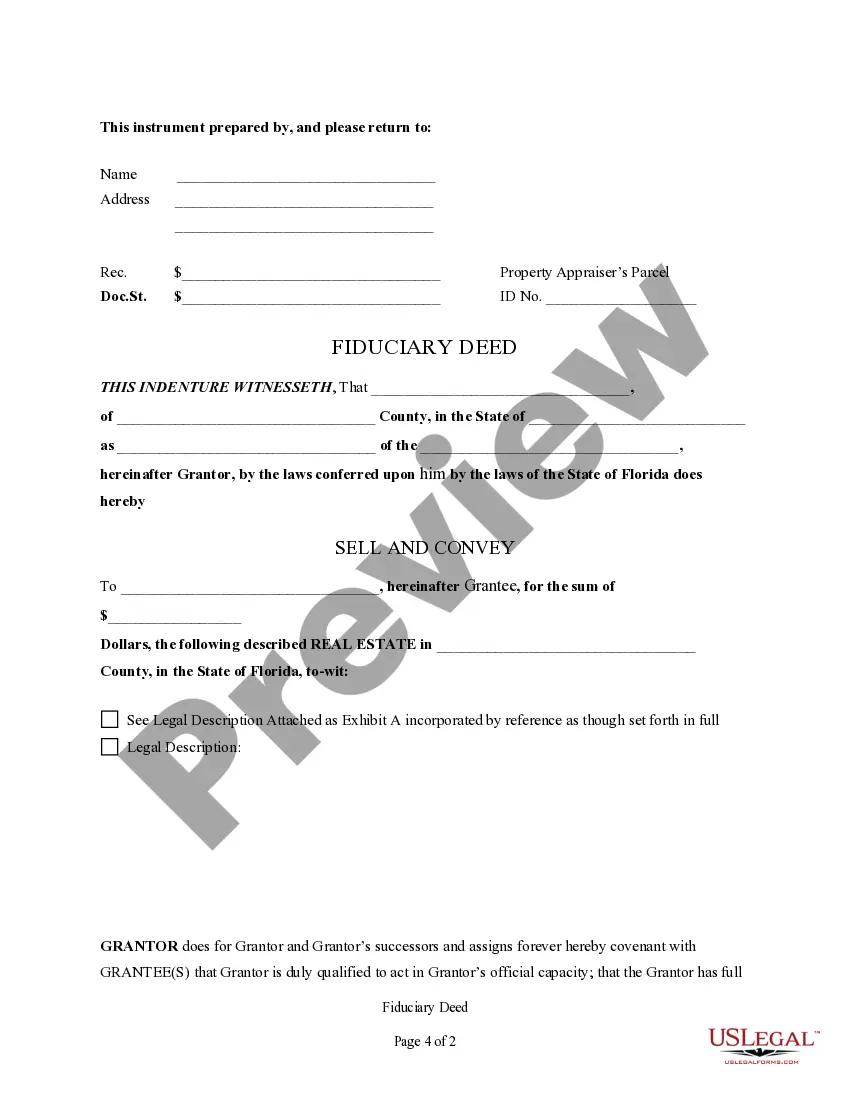

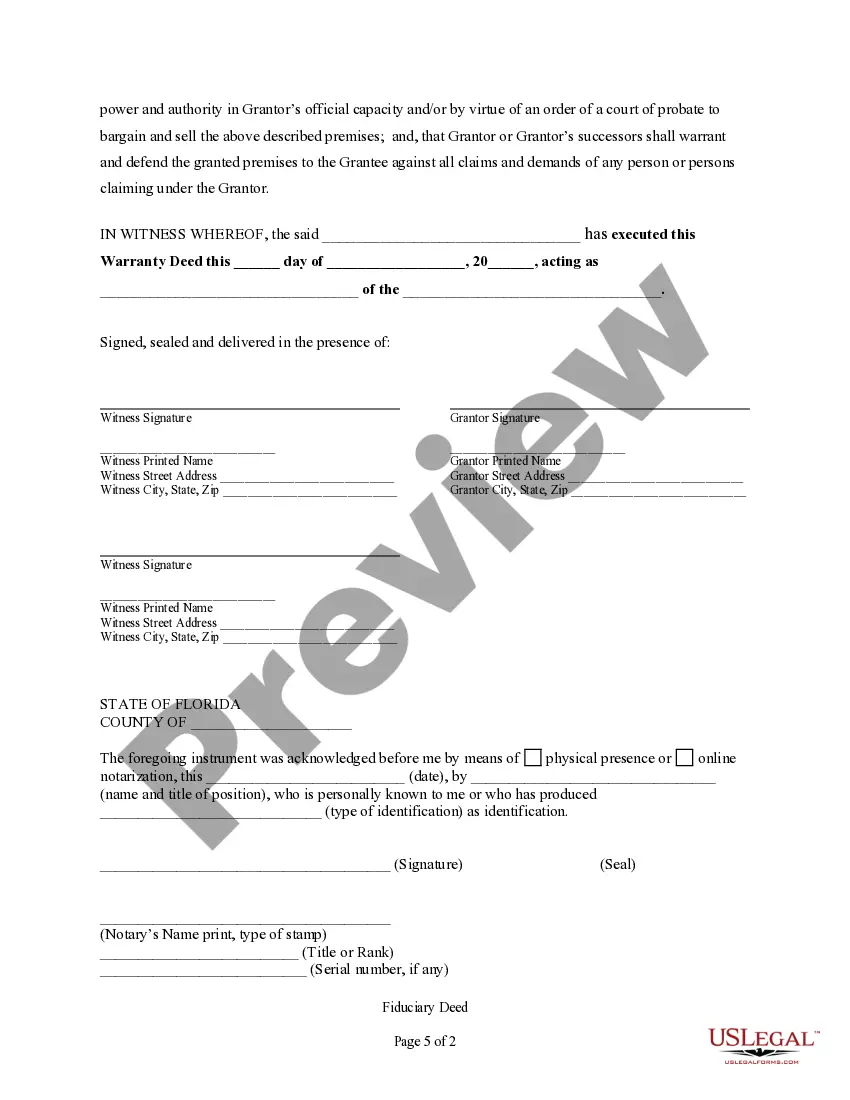

Broward Florida Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in property transactions within Broward County, Florida. This deed serves as a crucial instrument in transferring property ownership from the estate or trust to the designated beneficiary or buyer. Executors and Administrators, appointed by the court to manage the affairs of a deceased person's estate, often utilize the Broward Florida Fiduciary Deed to fulfill their fiduciary duty of distributing the property assets. On the other hand, Trustees, acting on behalf of a trust established by the granter (Trust or), may use this deed to transfer property ownership according to trust terms and beneficiaries' interests. Types of Broward Florida Fiduciary Deed Include: 1. Executor's Deed: This type of fiduciary deed is used when an Executor, appointed in a decedent's will, is responsible for transferring property ownership to the intended beneficiaries or selling it to satisfy estate debts. It ensures a smooth and legal transfer of property assets in alignment with the decedent's wishes. 2. Administrator's Deed: When someone passes away without a valid will (intestate), the court appoints an Administrator to oversee the estate settlement. The Administrator's Deed is employed in such situations to convey property to the rightful heirs based on the laws of intestacy. This deed ensures a proper transfer of ownership to the deserving heirs. 3. Trustee's Deed: Trustees play a crucial role in managing trust assets. A Trustee's Deed is utilized when a trust agreement instructs the Trustee to transfer property to beneficiaries or sell it for the trust's benefit. This deed ensures compliance with the trust's terms and allows for a smooth transfer of property ownership. Regardless of the specific type of fiduciary deed, it is essential that the Broward Florida Fiduciary Deed adheres to the legal requirements of the state. This includes proper identification of the property, accurate description of the parties involved, and compliance with statutory formalities. Executors, Trustees, Trustees, Administrators, and other Fiduciaries are advised to consult with legal professionals experienced in real estate and estate planning matters to ensure the deed's accuracy and legality.

Broward Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Broward Florida Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

If you are looking for a relevant form, it’s impossible to choose a more convenient platform than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can get a large number of templates for business and individual purposes by types and states, or key phrases. With our advanced search option, finding the most recent Broward Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is as easy as 1-2-3. Furthermore, the relevance of each file is proved by a group of professional attorneys that regularly check the templates on our website and revise them in accordance with the newest state and county laws.

If you already know about our system and have an account, all you should do to get the Broward Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have opened the form you need. Read its description and make use of the Preview option to see its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to get the needed document.

- Confirm your selection. Click the Buy now option. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the file format and save it on your device.

- Make changes. Fill out, modify, print, and sign the obtained Broward Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.

Each template you save in your account does not have an expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to get an extra copy for editing or printing, you can return and download it once more whenever you want.

Take advantage of the US Legal Forms professional catalogue to get access to the Broward Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries you were seeking and a large number of other professional and state-specific samples on one platform!

Form popularity

FAQ

Specifically, fiduciary duties may include the duties of care, confidentiality, loyalty, obedience, and accounting.

Three Key Fiduciary Duties Duty of Care. Duty of care describes the level of competence and business judgment expected of a board member.Duty of Loyalty. Duty of loyalty revolves primarily around board members' financial self-interest and the potential conflict this can create.Duty of Obedience.

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

Upon the death of a beneficiary who has a valid will or heirs, the fiduciary must hold the remaining funds under management in trust for the deceased beneficiary's estate until the will is probated or heirs are ascertained, and disburse the funds according to applicable state law.

An individual named as a trust or estate trustee is the fiduciary, and the beneficiary is the principal. Under a trustee/beneficiary duty, the fiduciary has legal ownership of the property or assets and holds the power necessary to handle assets held in the name of the trust.

A breach of fiduciary duty occurs when the fiduciary acts in his or her own self-interest rather than in the best interests of those to whom they owe the duty.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

When someone has a fiduciary duty to someone else, the person with the duty must act in a way that will benefit someone else, usually financially. The person who has a fiduciary duty is called the fiduciary, and the person to whom the duty is owed is called the principal or the beneficiary.

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.

Interesting Questions

More info

However, they are entitled to a share of the value of the estate in the event of a successful lawsuit, settlement, or judgment. In general, the Executor and Administrator will not perform any of the duties of the Will if the Trustee is named by the Court or the Will directs the Executor to do so. If You Need Help If you need assistance interpreting this document please contact us at or email us at Maricopa County will not perform services, or give legal advice to you, without receiving or having an order to effect that service. This is a public document and may be viewed at all Maricopa County courthouses, online on the Maricopa County Court website, or in the County Clerk's Office, located at 909 W. Washington Blvd., Suite 300, Phoenix, AZ 85034.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.