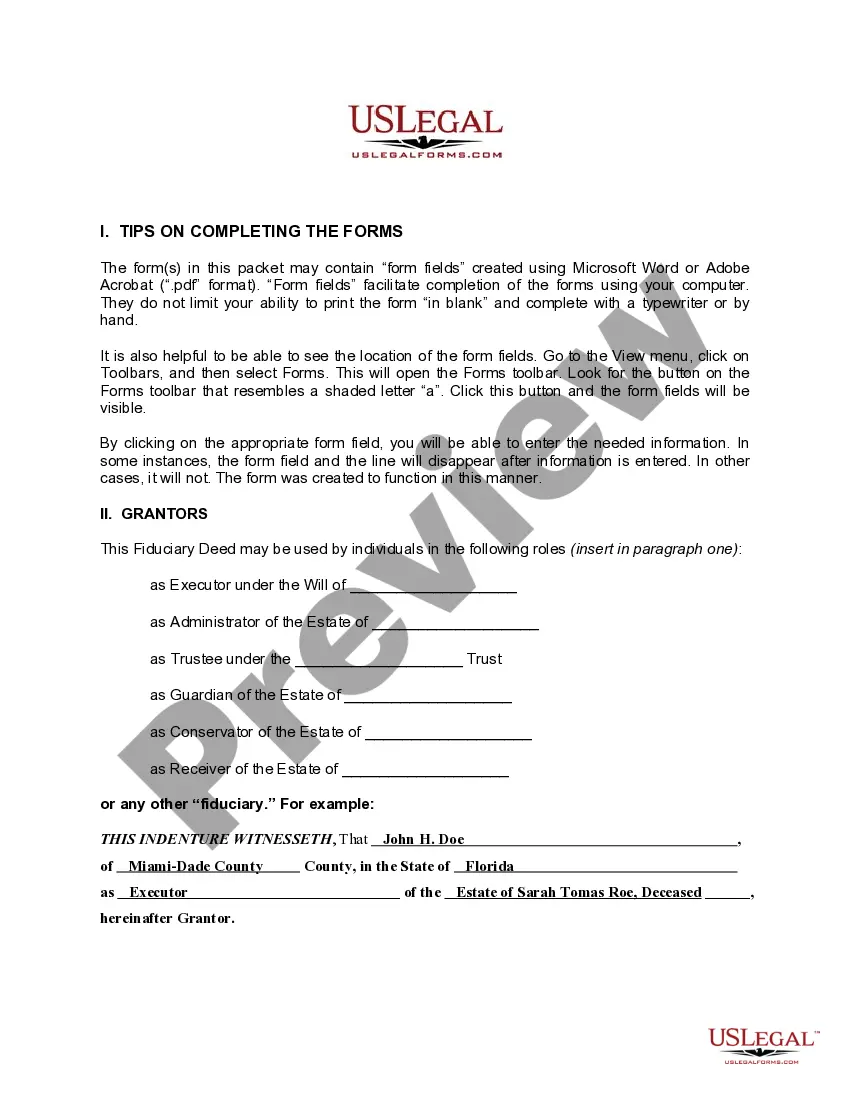

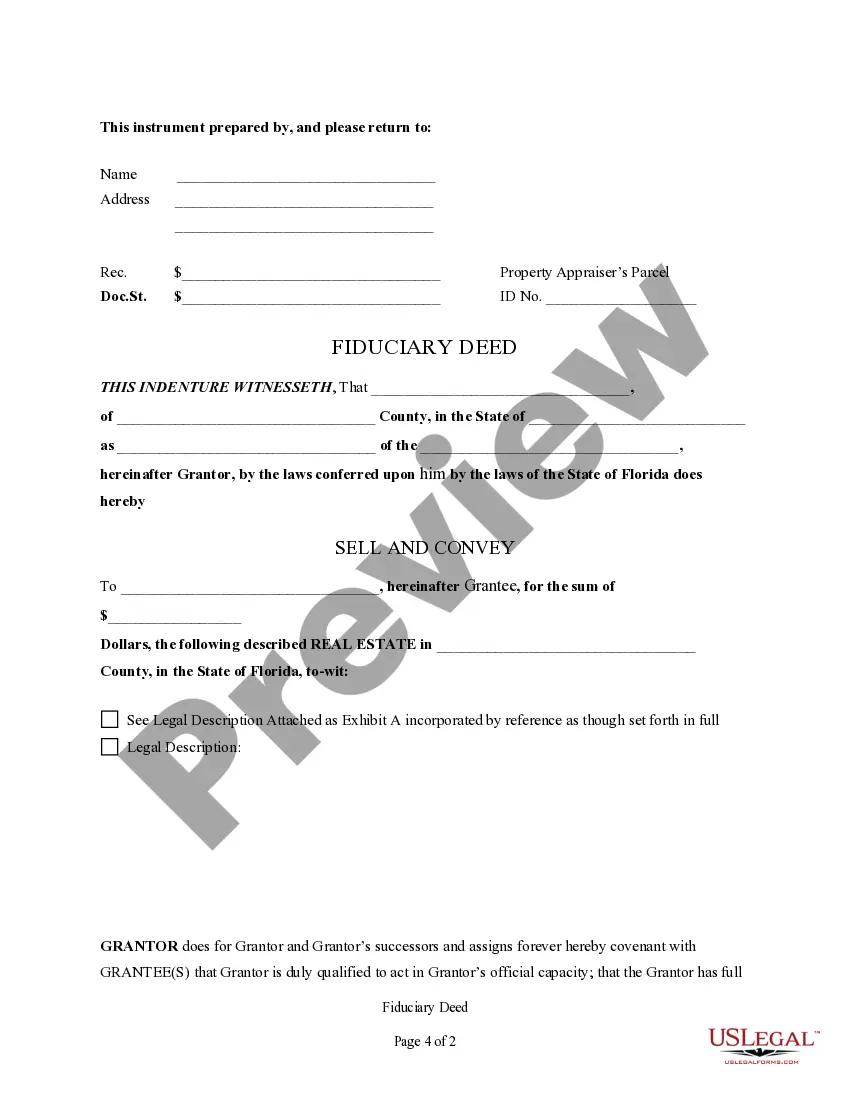

Coral Springs Florida Fiduciary Deed: A comprehensive guide for Executors, Trustees, Trustees, Administrators, and other Fiduciaries. Keywords: Coral Springs Florida, Fiduciary Deed, Executors, Trustees, Trustees, Administrators, Fiduciaries. Introduction: The Coral Springs Florida Fiduciary Deed is a legal document used by various fiduciaries, including Executors, Trustees, Trustees, Administrators, and other Fiduciaries, to transfer real estate ownership from the estate of a deceased individual to its rightful beneficiaries or to fulfill specific purposes outlined in a trust agreement. This detailed description will provide an overview of the Coral Springs Florida Fiduciary Deed, its purpose, and the different types available. 1. Definition and Purpose: The Coral Springs Florida Fiduciary Deed is a legally binding document that allows fiduciaries to facilitate the transfer of property ownership. Fiduciaries, such as Executors, Trustees, Trustees, Administrators, and other designated individuals, use this deed to carry out their responsibilities regarding the disposal, sale, or distribution of real estate holdings as specified in a last will and testament, trust agreement, or court order. 2. Types of Coral Springs Florida Fiduciary Deeds: a) Executor's Fiduciary Deed: This type of fiduciary deed is utilized by Executors to transfer real estate ownership from the estate of a deceased individual to its designated beneficiaries or to fulfill specific purposes outlined in the will. b) Trustee's Fiduciary Deed: Trustees use this deed to transfer property ownership from a trust to the intended beneficiaries as per the trust agreement's terms and conditions. c) Trust or's Fiduciary Deed: Primarily used in cases where the trust or wishes to transfer property to the trust they have established, this deed allows the trust or to legally transfer ownership while maintaining the fiduciary obligations and responsibilities. d) Administrator's Fiduciary Deed: In situations where there is no will or trust in place, administrators appointed by the court use this deed to distribute the decedent's property to the rightful heirs according to the rules of intestate succession. 3. Fiduciary Duties: When using the Coral Springs Florida Fiduciary Deed, fiduciaries have certain obligations they must fulfill while handling the property transfer process. These duties include acting in the best interest of the beneficiaries or the estate, ensuring full transparency throughout the process, providing accurate accounting of the assets, managing the property responsibly, and avoiding any conflicts of interest or self-dealing. 4. Legal Requirements and Process: The Coral Springs Florida Fiduciary Deed must meet specific legal requirements to ensure its validity. These typically include the fiduciary's identification, a proper legal description of the property being transferred, the recorded date of the deceased individual's death, and the authorization from a probate court or trust agreement. To begin the process, fiduciaries should consult with an attorney or legal professional to ensure compliance with all necessary procedures and requirements. They should gather all relevant documentation, such as the deceased individual's will, trust agreement, or court order, as well as any supporting evidence or beneficiary information. Fiduciaries are advised to maintain accurate records and documentation throughout the process. Conclusion: The Coral Springs Florida Fiduciary Deed is a crucial legal document that enables Executors, Trustees, Trustees, Administrators, and other Fiduciaries to fulfill their obligations in regard to property transfer and distribution. By understanding the different types of fiduciary deeds available and meeting all legal requirements, fiduciaries can ensure proper and lawful transfer of property ownership, preserving the interests of the beneficiaries and complying with the fiduciary duties entrusted to them.

Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Coral Springs Florida Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Leverage the US Legal Forms and gain swift access to any document you need.

Our user-friendly site, featuring thousands of documents, simplifies the process of locating and obtaining nearly any document sample you require.

You can download, fill out, and validate the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries in just a few minutes, rather than spending hours scouring the internet for an appropriate template.

Utilizing our repository is an excellent method to enhance the security of your record filings. Our skilled legal experts routinely evaluate all documents to ensure that the forms are suitable for a specific state and meet current laws and regulations.

If you haven’t created an account yet, follow the instructions provided below.

Locate the document you require. Confirm that it is the form you are seeking: check its title and description, and use the Preview function if it’s available. Otherwise, utilize the Search option to identify the necessary one.

- How do you acquire the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

- If you already possess an account, simply Log In to your profile. The Download button will display on all document samples you access.

- Additionally, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

Fiduciary duty in real estate is often referred to as a duty of care. This duty requires agents and fiduciaries to act in the best interest of their clients and manage their property responsibly. By engaging with the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, you can ensure adherence to these responsibilities while executing property transactions effectively.

A fiduciary deed is a specific type of deed used by individuals acting in a fiduciary capacity, such as Executors or Trustees. This deed certifies that the fiduciary is authorized to transfer the property on behalf of another person or entity. When utilizing a Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, it simplifies the process of property management and ensures compliance with legal obligations.

A trust deed is also commonly referred to as a deed of trust. This legal document involves a borrower, lender, and a third party, often a trustee. Utilizing the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can help establish proper trust arrangements and ensure smooth property transfers.

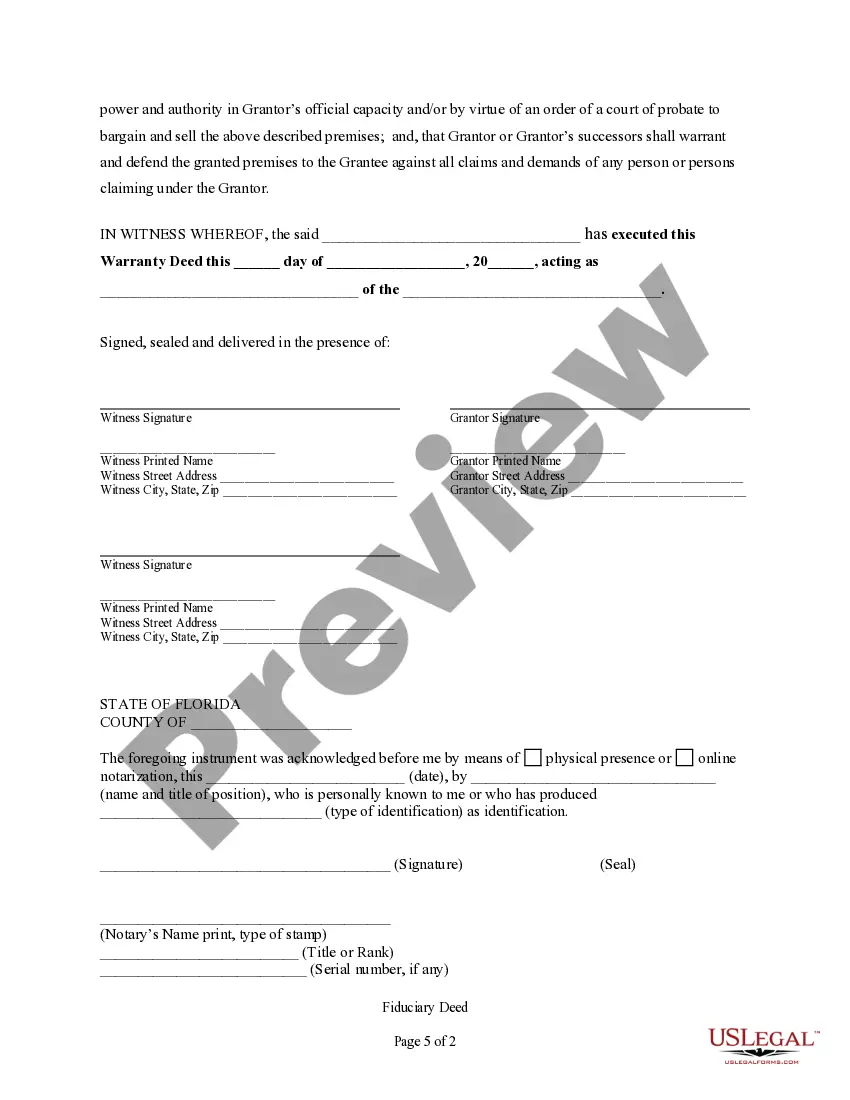

In Florida, a deed must be in writing, signed by the grantor, and include a legal description of the property. Additionally, it should be witnessed by two individuals who are not parties to the deed. When using the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, ensure these elements are present for the deed to be considered valid.

The purpose of a fiduciary deed is to facilitate the transfer of property under the authority of a fiduciary. This deed protects the interests of various parties, including heirs and beneficiaries, by providing a clear legal framework for the transaction. Using the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries helps ensure that all legal requirements are met, safeguarding the integrity of the property transfer.

Sellers often prefer a warranty deed because it provides the highest level of protection against title defects. However, when sellers are acting as fiduciaries, the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries strikes the right balance of protection for all parties involved. It adds clarity to the transaction while fulfilling fiduciary responsibilities.

The most popular type of deed in Florida is still the warranty deed, but the fiduciary deed is essential in unique cases. When dealing with estate matters or trust property, the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries becomes invaluable. It enables fiduciaries to fulfill their responsibilities and ensure smooth property transfers.

The warranty deed is typically considered the most widely used type of deed in Florida, ensuring that the title is clear of any claims. That said, the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries addresses unique circumstances for those in fiduciary roles. This deed provides specific protections that cater to the needs of both the fiduciary and the beneficiaries.

A trustees deed in Florida is used specifically for transferring property held in a trust. This deed allows the trustee to convey the property to a beneficiary or a third party on behalf of the trust. Utilizing the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries ensures the legal transfer is handled correctly and upholds the trust's intent.

In Florida, the most commonly used deed is the warranty deed. This deed provides a guarantee from the seller to the buyer regarding the title's validity. However, when it comes to fiduciaries, the Coral Springs Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries serves a crucial role in transferring property with added protections.