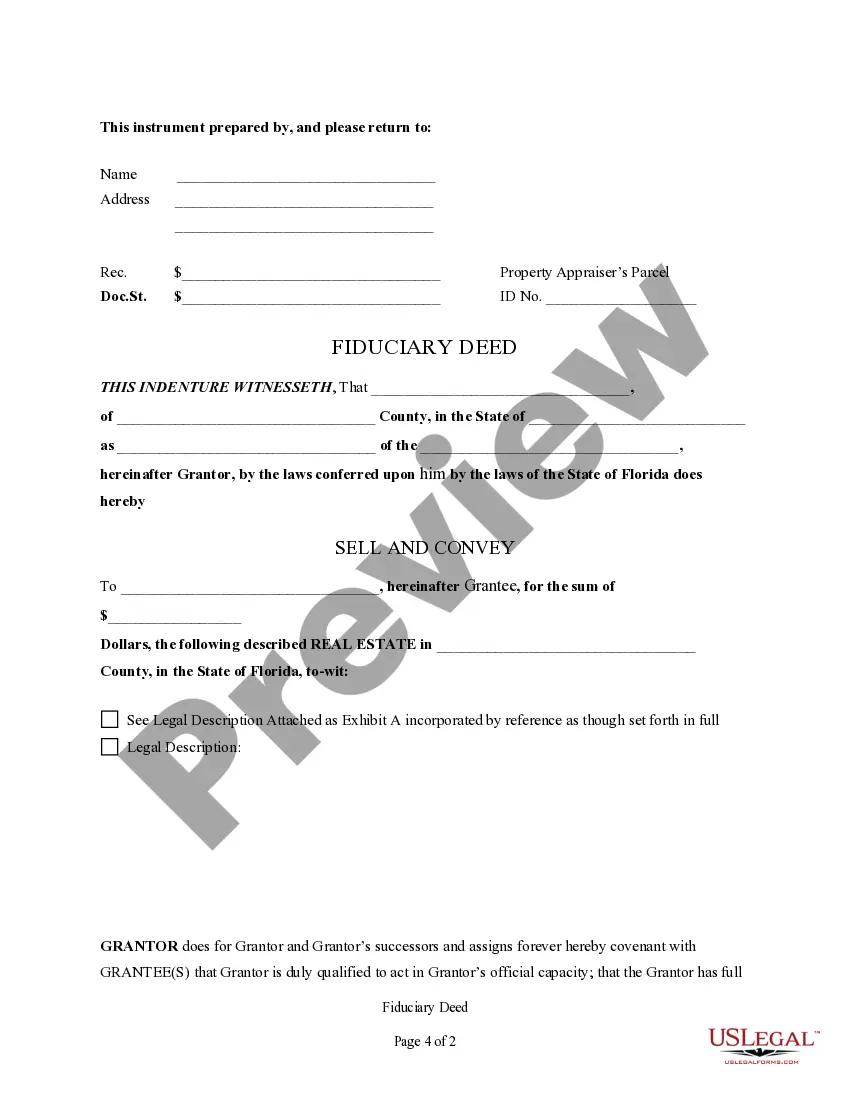

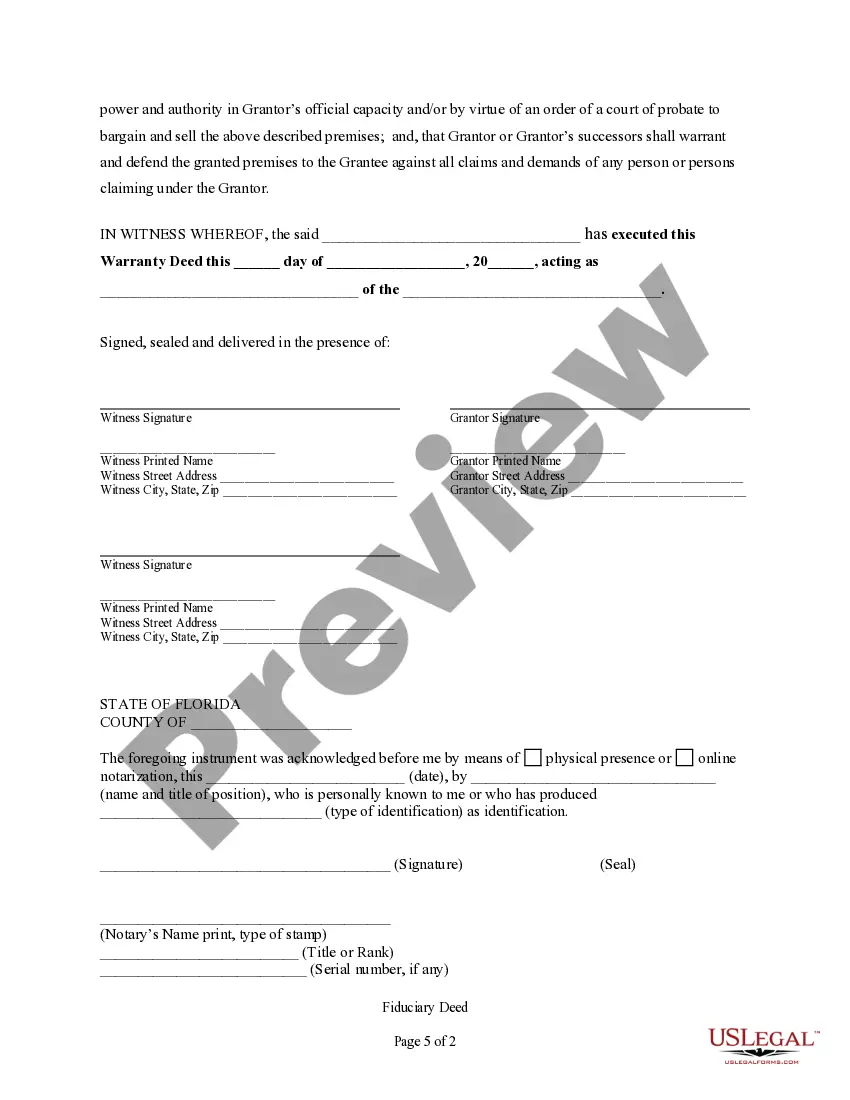

Fort Lauderdale Florida Fiduciary Deed: A Comprehensive Guide for Executors, Trustees, Trustees, Administrators, and other Fiduciaries Introduction: In the realm of estate planning and probate law, Fort Lauderdale, Florida has specific guidelines and legal requirements for transferring property ownership through a fiduciary deed. Fiduciaries such as executors, trustees, trustees, administrators, and other individuals entrusted with managing estates or trusts must adhere to specific procedures and documentation to ensure a smooth and legally valid transfer of property. Types of Fort Lauderdale Florida Fiduciary Deed: 1. Executor's Fiduciary Deed: In cases where an individual is named as an executor in a deceased person's will, the executor's fiduciary deed comes into play. This document allows the executor to transfer ownership of real property from the deceased person's estate to the beneficiaries mentioned in the will. It is essential for the executor to comply with all legal requirements and follow the instructions outlined in the deceased's will. 2. Trustee's Fiduciary Deed: A trustee's fiduciary deed is utilized when transferring real estate holdings from a trust to its beneficiaries. A trust is a legal entity created by a trust or, allowing a trustee to hold and manage assets. Upon specific conditions being met, the trustee distributes the property to the beneficiaries according to the trust's provisions. The trustee must adhere to the terms of the trust and complete the transfer using a fiduciary deed. 3. Trust or's Fiduciary Deed: In certain situations, a trust or (also known as a settler or granter) may act as a fiduciary and require a fiduciary deed to convey real property held within their trust. Trustees can transfer ownership of their property to a trust they create for their beneficiaries' benefit. When the trust or decides to sell or transfer the property, they can use a fiduciary deed to execute the transfer as outlined in the trust document. 4. Administrator's Fiduciary Deed: When someone passes away without a will or trust, the court appoints an administrator to manage and distribute the decedent's estate through the process of probate. An administrator's fiduciary deed is used to transfer the real property to the rightful heirs following the court's approval. The administrator must follow the laws of intestate succession, which determine the distribution of assets if no will or trust exists. Key Considerations for Fort Lauderdale Florida Fiduciary Deeds: 1. Legal Compliance: Fiduciaries must ensure compliance with all relevant Florida laws and regulations regarding the transfer of property ownership via fiduciary deeds. Consulting with an experienced probate attorney is crucial to ensure proper compliance. 2. Deed Preparation: Fiduciaries must undertake precise preparation of the fiduciary deed, including accurate property descriptions, legal descriptions, and the identification of beneficiaries or other parties involved in the transfer. 3. Required Signatures: Fiduciary deeds require signatures from both the fiduciary and the interested parties involved in the transaction. Careful attention should be given to verifying the authority and capacity of the fiduciary and obtaining the necessary signatures to ensure the deed's validity. 4. Recording and Filing: Once executed, the fiduciary deed must be recorded with the appropriate county clerk's office in Fort Lauderdale, Florida, to establish a public record of the property transfer. The filing fees required by the county must also be paid. Conclusion: Fort Lauderdale, Florida fiduciary deeds serve as crucial legal documents for executors, trustees, trustees, administrators, and other fiduciaries overseeing property transfers. The specific type of fiduciary deed required depends on the nature of the fiduciary's role and the circumstances of the property transfer. Adhering to legal requirements, accurately preparing the fiduciary deed, obtaining necessary signatures, and filing with the county clerk's office are vital steps to ensure a proper and legally valid transfer of property ownership.

Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Fort Lauderdale Florida Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Finding authenticated templates tailored to your local regulations can be difficult unless you access the US Legal Forms collection.

It’s an online repository of over 85,000 legal documents catering to both personal and business requirements, along with various real-world situations.

All the files are accurately categorized by field of application and jurisdiction areas, making it a breeze to search for the Fort Lauderdale Florida Fiduciary Deed intended for Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Complete the transaction for the document. Click on the Buy Now button and select the subscription option you desire. You will need to create an account to gain access to the library’s resources. Finalize your purchase. Enter your credit card information or utilize your PayPal account to complete the payment. Retrieve the Fort Lauderdale Florida Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries. Store the template on your device to continue its completion and have access to it in the My documents section of your profile whenever you need it again. Maintaining organized paperwork and ensuring compliance with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates for any requirements right at your fingertips!

- For those already familiar with our inventory and have utilized it previously, acquiring the Fort Lauderdale Florida Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries takes merely a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- The procedure will require just a couple more steps for new users.

- Review the Preview mode and form description. Ensure you’ve selected the correct one that fulfills your needs and thoroughly aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary. If you detect any discrepancies, use the Search tab above to locate the appropriate one. If it fits your needs, proceed to the following step.

Form popularity

FAQ

The best deed to transfer property largely depends on your specific situation and needs. Generally, warranty deeds are preferred for their comprehensive protection against title issues. However, in contexts involving fiduciaries, a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is a practical choice to ensure all legalities are meticulously observed in property transfers.

A fiduciary deed in Pennsylvania is a conveyance document executed by a fiduciary, like an executor or trustee, for the purpose of transferring real estate as part of estate administration. This deed emphasizes the fiduciary’s legal authority to act on behalf of the estate. To facilitate a smooth transaction, using a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries can be beneficial.

In Massachusetts, various types of deeds exist, including warranty deeds, quitclaim deeds, and fiduciary deeds. Each of these deeds serves distinct purposes and provides different levels of protection to the parties involved. If you are executing a property transfer, consider a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries to align with effective estate management practices.

A fiduciary of an estate is an individual or entity appointed to manage the affairs of a deceased person’s estate. This role includes following the directives of the will and ensuring that assets are distributed correctly. Utilizing a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries can streamline this process and assure compliance with all legal obligations.

The strongest form of deed is typically considered to be a warranty deed. This type of deed provides the highest level of protection for the grantee, as it guarantees that the grantor holds clear title to the property and has the right to convey it. By employing a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, you can ensure a robust legal framework for property transactions.

A personal representative deed in Florida is issued by the personal representative of a deceased individual's estate to transfer real property. This deed allows the personal representative to convey the property to the heirs or beneficiaries named in the will. When utilizing a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, it simplifies the transfer process while maintaining compliance with state laws.

In Florida, a trustee's deed is a legal instrument used by a trustee to transfer property held in a trust. This deed signifies that the trustee has the authority to act, based on the terms of the trust agreement. Utilizing a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries ensures that property is conveyed properly, honoring the intentions of the trust.

A fiduciary deed in Massachusetts is a legal document that allows a fiduciary, such as an executor or trustee, to transfer real estate on behalf of a deceased person’s estate. This deed ensures that the property is transferred according to the terms of the will or the laws of intestacy. By using a fiduciary deed in Massachusetts, you facilitate clear title transfer while adhering to the state's regulations.

A fiduciary deed in Pennsylvania facilitates the transfer of property from an estate or trust to an heir or beneficiary. This type of deed ensures that the transfer is carried out by a designated fiduciary, such as an executor or trustee, who acts on behalf of others. Utilizing a Fort Lauderdale Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can streamline the process, providing a legally compliant means to manage property during estate administration.