Miami-Dade Florida Fiduciary Deed is a legal document used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer or convey property from an estate or trust to a beneficiary or a third party. This deed is specifically designed for use in Miami-Dade County, Florida, and ensures compliance with the local laws and regulations. Executors, Trustees, Trustees, Administrators, and other Fiduciaries use the Miami-Dade Florida Fiduciary Deed to effectively manage and distribute assets held in estates and trusts. With this deed, these individuals can transfer real estate, such as residential properties, commercial properties, or vacant land, to beneficiaries or buyers. The Miami-Dade Florida Fiduciary Deed provides a detailed description of the property being transferred, including its legal description, address, and any encumbrances or restrictions. This comprehensive description ensures clarity and avoids any confusion related to the property's ownership. There are several types of Miami-Dade Florida Fiduciary Deeds that may be used by different fiduciaries, depending on the specific circumstances: 1. Executor's Deed: This type of deed is used by the executor of an estate when transferring real estate from the deceased person's estate to a beneficiary or buyer. It ensures a smooth transfer of ownership and protects the interests of all parties involved. 2. Trustee's Deed: A trustee uses this type of fiduciary deed to transfer property held in a trust to a beneficiary or buyer. It is commonly used when the trust document directs the trustee to distribute the property or sell it on behalf of the trust. 3. Administrator's Deed: When there is no appointed executor or the deceased person did not leave a will, an administrator is appointed by the court to handle the estate. The administrator uses this type of deed to transfer property to beneficiaries or buyers, following the court's instructions. 4. Fiduciary Deed in lieu of Foreclosure: In cases where a fiduciary needs to transfer property from an estate or trust to satisfy outstanding debts or mortgages, this type of deed may be used instead of going through a formal foreclosure process. It allows for a quick transfer of the property to the mortgage lender or creditor. It is essential for Executors, Trustees, Trustees, Administrators, and other Fiduciaries to seek legal advice when dealing with the transfer of property through a Miami-Dade Florida Fiduciary Deed to ensure compliance with state laws and the proper execution of their fiduciary duties.

Miami-Dade Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

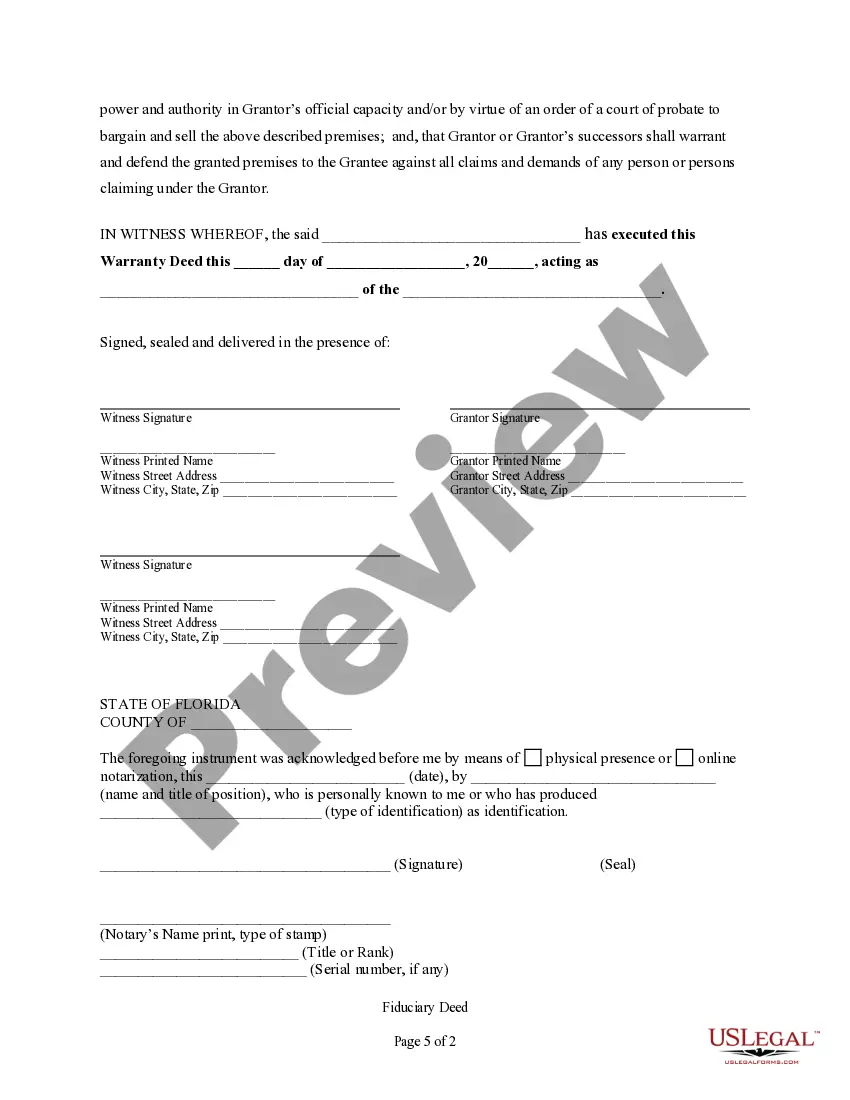

How to fill out Miami-Dade Florida Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

We always strive to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal services that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Miami-Dade Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Miami-Dade Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Miami-Dade Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is suitable for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!