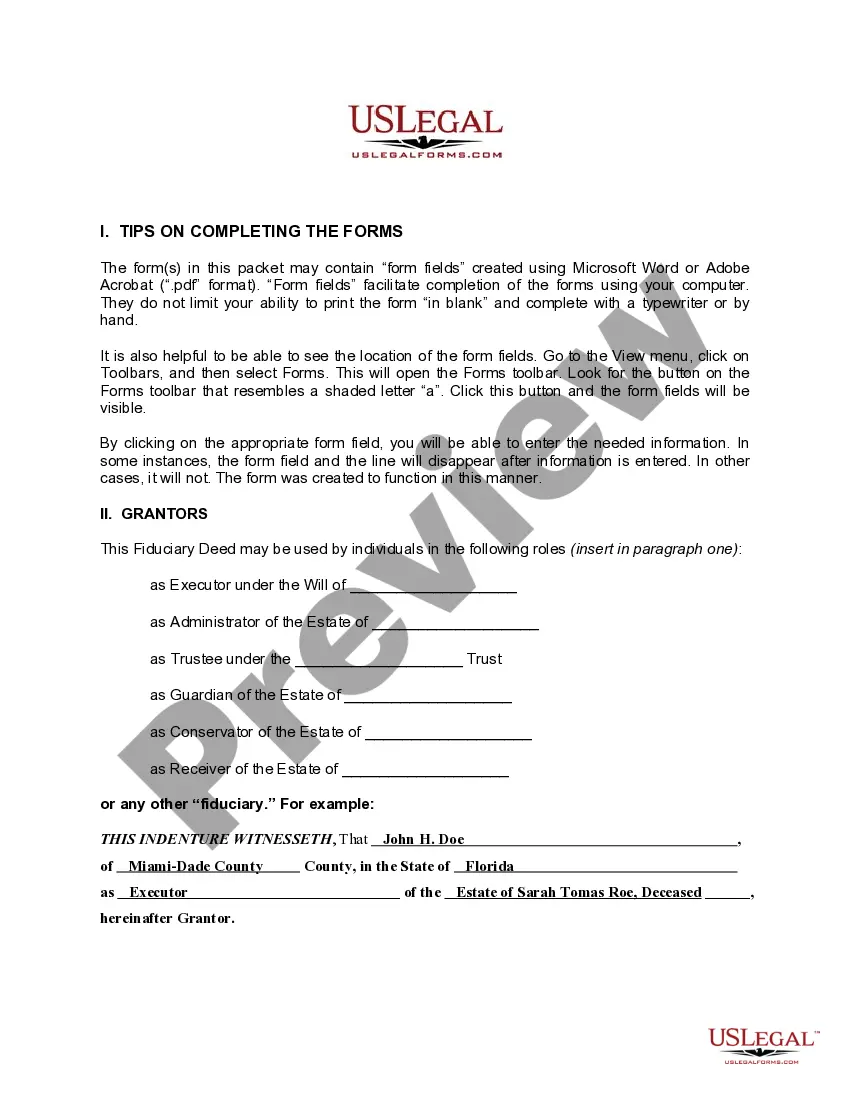

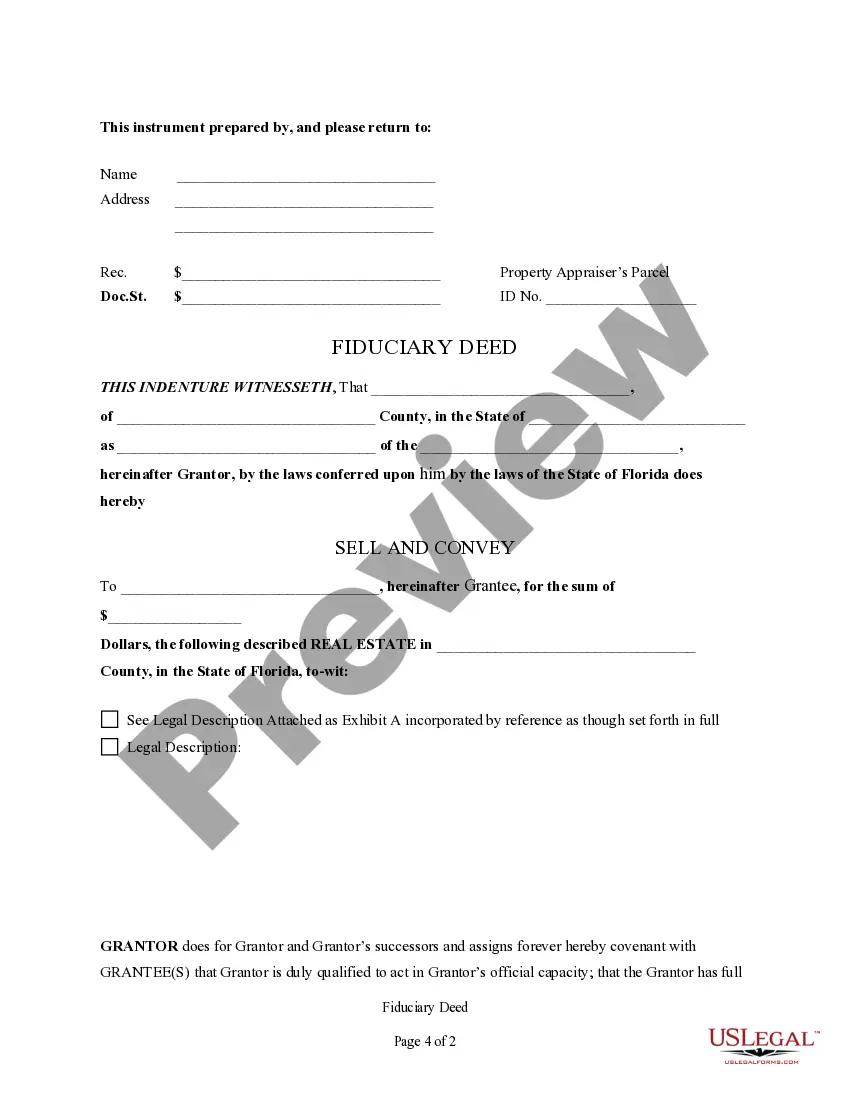

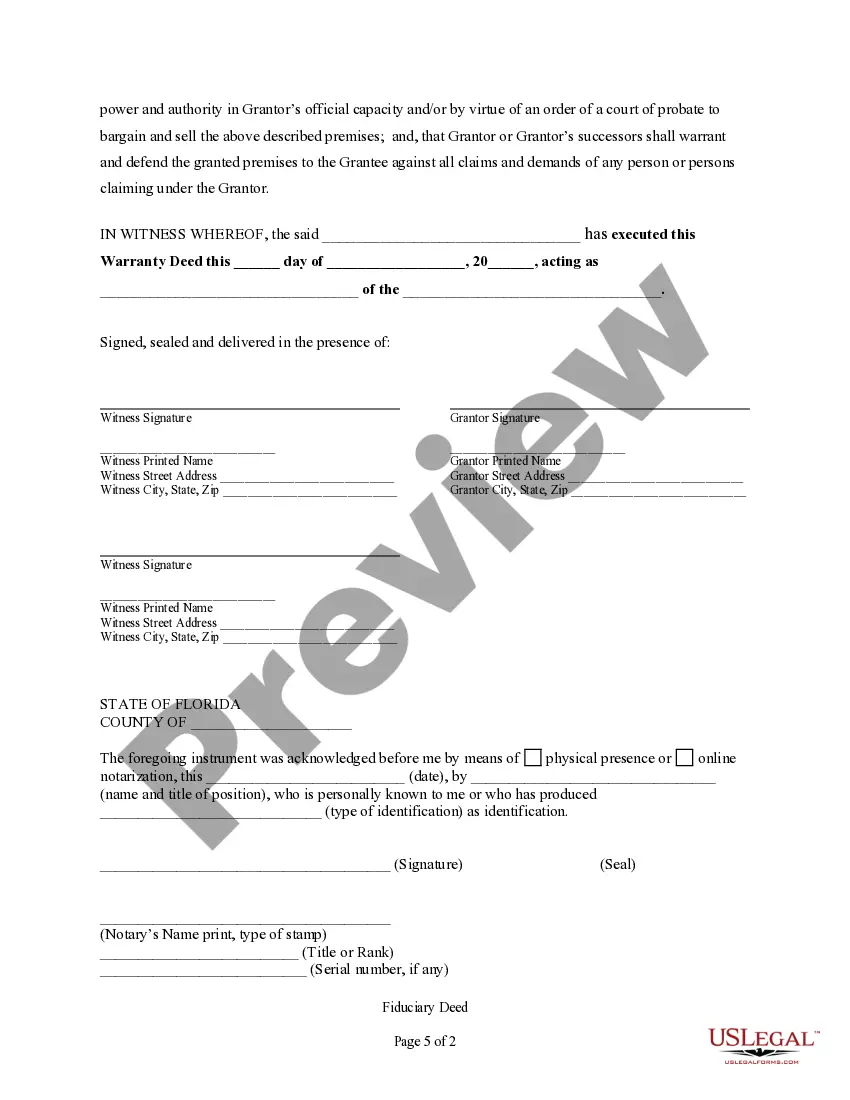

A Pembroke Pines Florida Fiduciary Deed is a legal document executed by individuals holding fiduciary roles, such as Executors, Trustees, Trustees, Administrators, and other Fiduciaries, to transfer or convey real estate assets. This detailed description will delve into the purpose, requirements, and different types of Pembroke Pines Florida Fiduciary Deeds available. Purpose: The Pembroke Pines Florida Fiduciary Deed serves to transfer ownership of real estate assets from a fiduciary to the designated recipients, ensuring a legal transfer of property. Executors, Trustees, Trustees, Administrators, and other Fiduciaries who are responsible for managing and distributing assets under the terms of a will, trust, or estate can utilize this deed to facilitate the transfer process. Requirements: To create a valid Pembroke Pines Florida Fiduciary Deed, certain requirements must be fulfilled. These include: 1. Legal Capacity: The fiduciary must have the legal authority to act on behalf of the estate, as granted by a court order or the terms of a valid will or trust document. 2. Accurate Information: The deed must contain accurate and complete details of the property, such as the legal description, parcel identification number, and any encumbrances or liens that may affect the property. 3. Proper Execution: The fiduciary must sign the deed in the presence of a notary public and any other witnesses required by Florida law. 4. Recording: The recorded deed should be filed with the Clerk of Court's office in the county where the property is located to establish public record of the transfer. Types: 1. Executor's Deed: This type of Fiduciary Deed is used by an Executor when distributing real estate assets according to the terms of a will. It enables the transfer of property from the deceased person's estate to the intended beneficiaries. 2. Trustee's Deed: Trustees appointed to manage assets held in a trust can employ this Fiduciary Deed to transfer real estate assets from the trust to beneficiaries in accordance with the trust's provisions. 3. Administrator's Deed: Administrators, typically appointed when there is no valid will in place, utilize this Fiduciary Deed to transfer real estate assets from the estate of a deceased person to the rightful heirs. 4. Fiduciary Deed in Lieu of Foreclosure: In cases where foreclosure is imminent, a Fiduciary Deed in Lieu of Foreclosure can be used by a Fiduciary to transfer the property back to the lender to satisfy outstanding debts, thus avoiding the full foreclosure process. In conclusion, a Pembroke Pines Florida Fiduciary Deed is a crucial legal instrument employed by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer ownership of real estate assets. Whether it is an Executor's Deed, Trustee's Deed, Administrator's Deed, or Fiduciary Deed in Lieu of Foreclosure, each serves a specific purpose in facilitating the proper distribution or transfer of property rights.

Pembroke Pines Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Pembroke Pines Florida Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Take advantage of the US Legal Forms and obtain immediate access to any form you want. Our beneficial platform with thousands of templates allows you to find and obtain virtually any document sample you want. It is possible to save, complete, and sign the Pembroke Pines Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries in a few minutes instead of browsing the web for several hours seeking the right template.

Using our collection is a great way to improve the safety of your form filing. Our experienced lawyers on a regular basis check all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you obtain the Pembroke Pines Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Find the form you require. Ensure that it is the template you were seeking: verify its name and description, and take take advantage of the Preview option if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the document. Choose the format to get the Pembroke Pines Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries and revise and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy document libraries on the web. We are always happy to assist you in any legal case, even if it is just downloading the Pembroke Pines Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.

Feel free to take advantage of our service and make your document experience as efficient as possible!