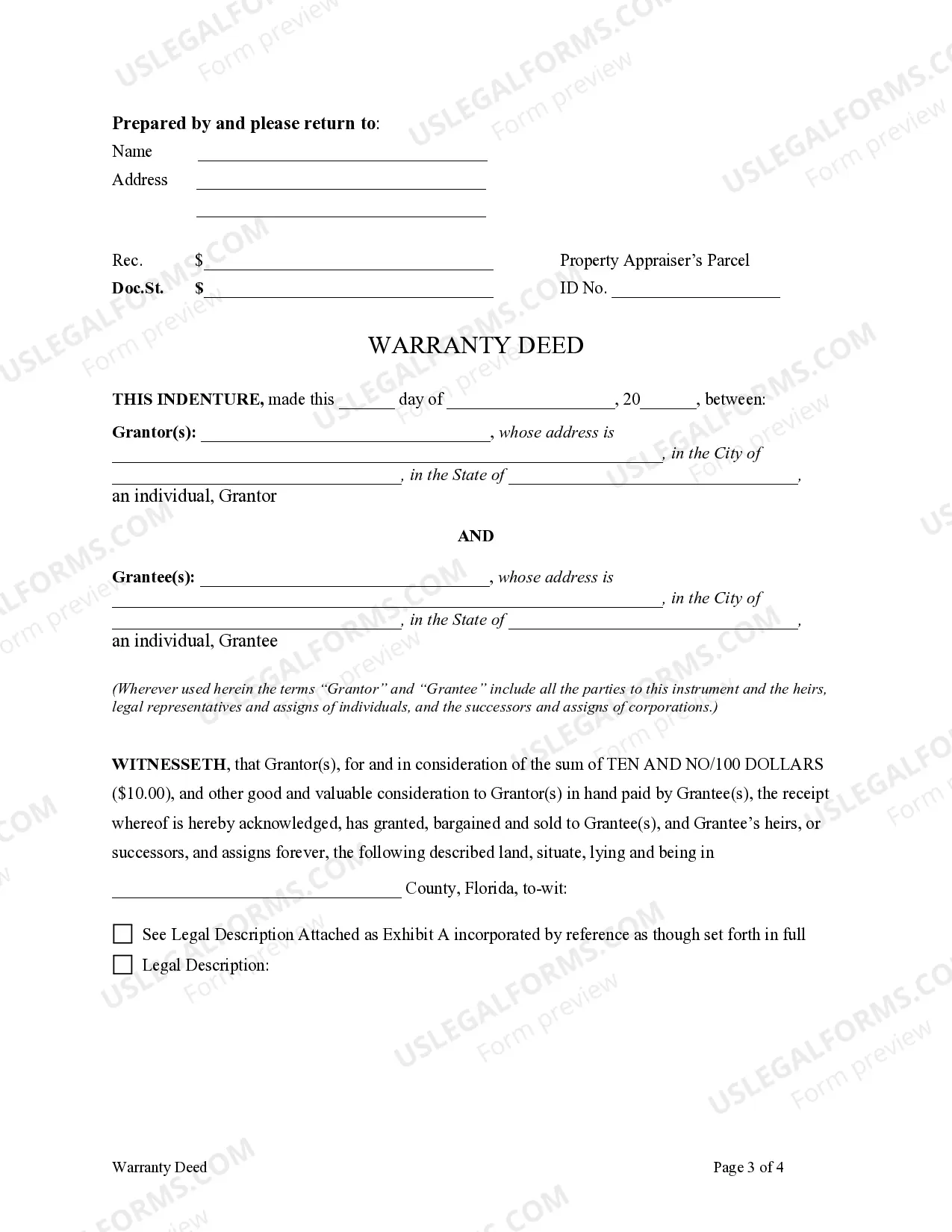

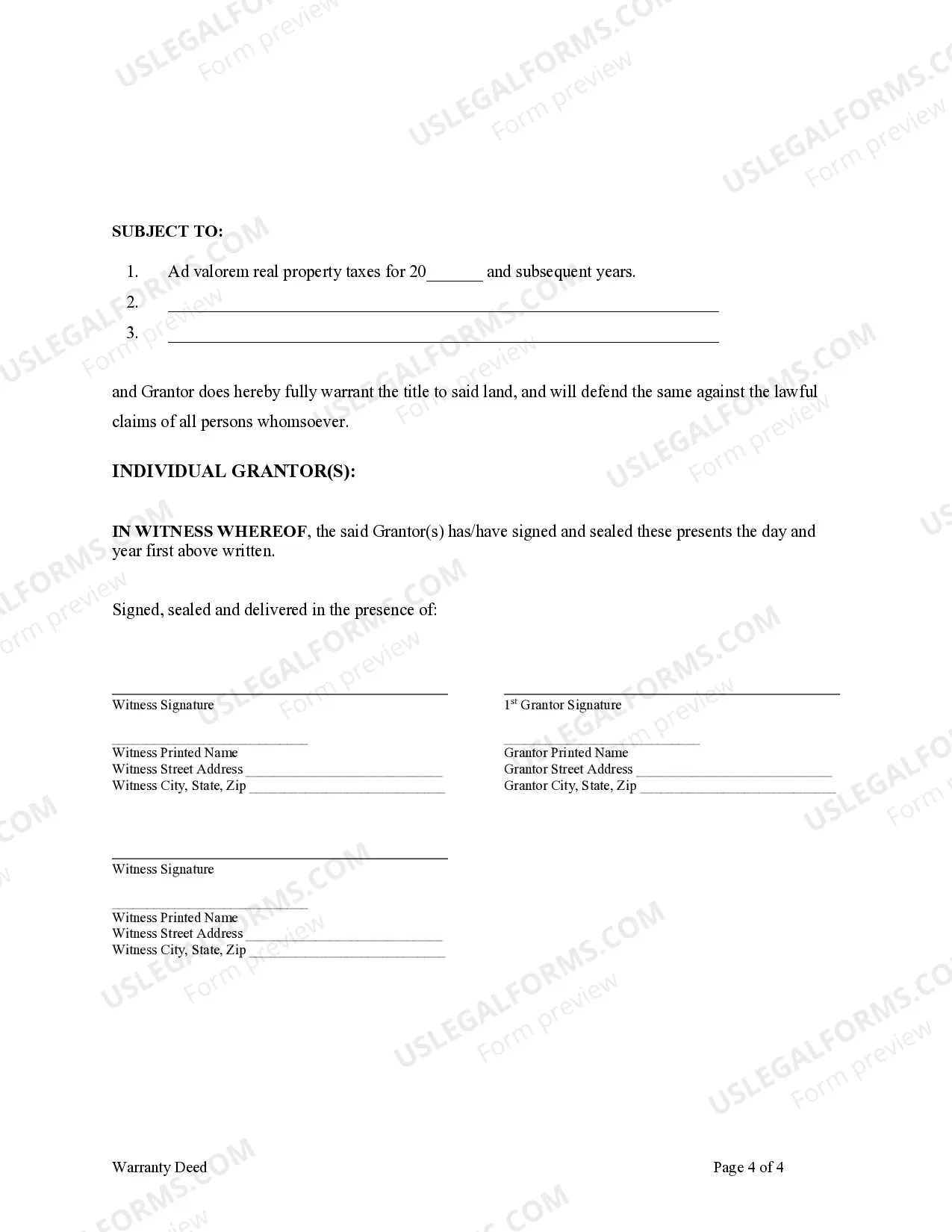

A Port St. Lucie Florida warranty deed from a limited partnership or LLC can greatly benefit those involved in real estate transactions. This legally binding document serves as proof of ownership transfer and guarantees that the property being sold is free from any encumbrances or title defects. Here is a detailed description of this important document, highlighting the roles of the Granter and Grantee, along with different types of warranty deeds commonly used. A warranty deed is a type of deed used in real estate transactions to convey ownership rights from one party to another. In the case of Port St. Lucie, Florida, when a limited partnership or LLC acts as the Granter or Grantee, the warranty deed helps establish a clear chain of title, protecting the interests of both parties involved. When an LLC is the Granter (the entity conveying the property), it signifies that the limited liability company is transferring the ownership rights to the Grantee. The LLC may have acquired the property through purchase, inheritance, or some other means. By using a warranty deed, the Granter guarantees that they have full authority to convey the property and that the title is clear of any liens, claims, or encumbrances. Conversely, when an LLC is the Grantee (the entity receiving the property), it indicates that the limited liability company is acquiring the ownership rights from the Granter. The warranty deed ensures that the Grantee is receiving the property with a valid and marketable title, free from any legal issues that could affect their future use or transfer of the property. It's important to note that there are different types of warranty deeds that can be used in Port St. Lucie, Florida. The two most common types are: 1. General Warranty Deed: This type of warranty deed offers the highest level of protection for the Grantee. It guarantees that the Granter holds clear title to the property and ensures that the Granter will defend against any claims that may arise based on the title. This type of warranty deed is highly recommended for buyers as it provides the most comprehensive protection. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed limits the Granter's liability and protection. It only guarantees that the Granter has not caused any defects in the title during their ownership. This means that the Granter may not be responsible for any issues that occurred before their ownership. Although it offers less protection than a general warranty deed, it still assures the Grantee that the Granter has not created any title problems while owning the property. In conclusion, a Port St. Lucie Florida warranty deed from a limited partnership or LLC serves as a crucial legal document in real estate transactions. It can be used when the limited partnership or LLC is either the Granter or Grantee, facilitating the transfer of property ownership rights. The two main types of warranty deeds used are the general warranty deed and the special warranty deed, with the former providing the highest level of protection for the Grantee.

Port St. Lucie Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee

Description

How to fill out Port St. Lucie Florida Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

Benefit from the US Legal Forms and obtain immediate access to any form you require. Our helpful platform with a huge number of templates allows you to find and get virtually any document sample you want. You are able to export, fill, and certify the Port St. Lucie Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee in just a matter of minutes instead of surfing the Net for many hours attempting to find a proper template.

Utilizing our library is a wonderful way to raise the safety of your document filing. Our experienced lawyers regularly review all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How can you get the Port St. Lucie Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you view. In addition, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instruction below:

- Open the page with the form you require. Ensure that it is the template you were looking for: verify its title and description, and take take advantage of the Preview option when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and select the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Save the file. Choose the format to obtain the Port St. Lucie Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee and edit and fill, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy template libraries on the internet. We are always ready to assist you in any legal procedure, even if it is just downloading the Port St. Lucie Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!