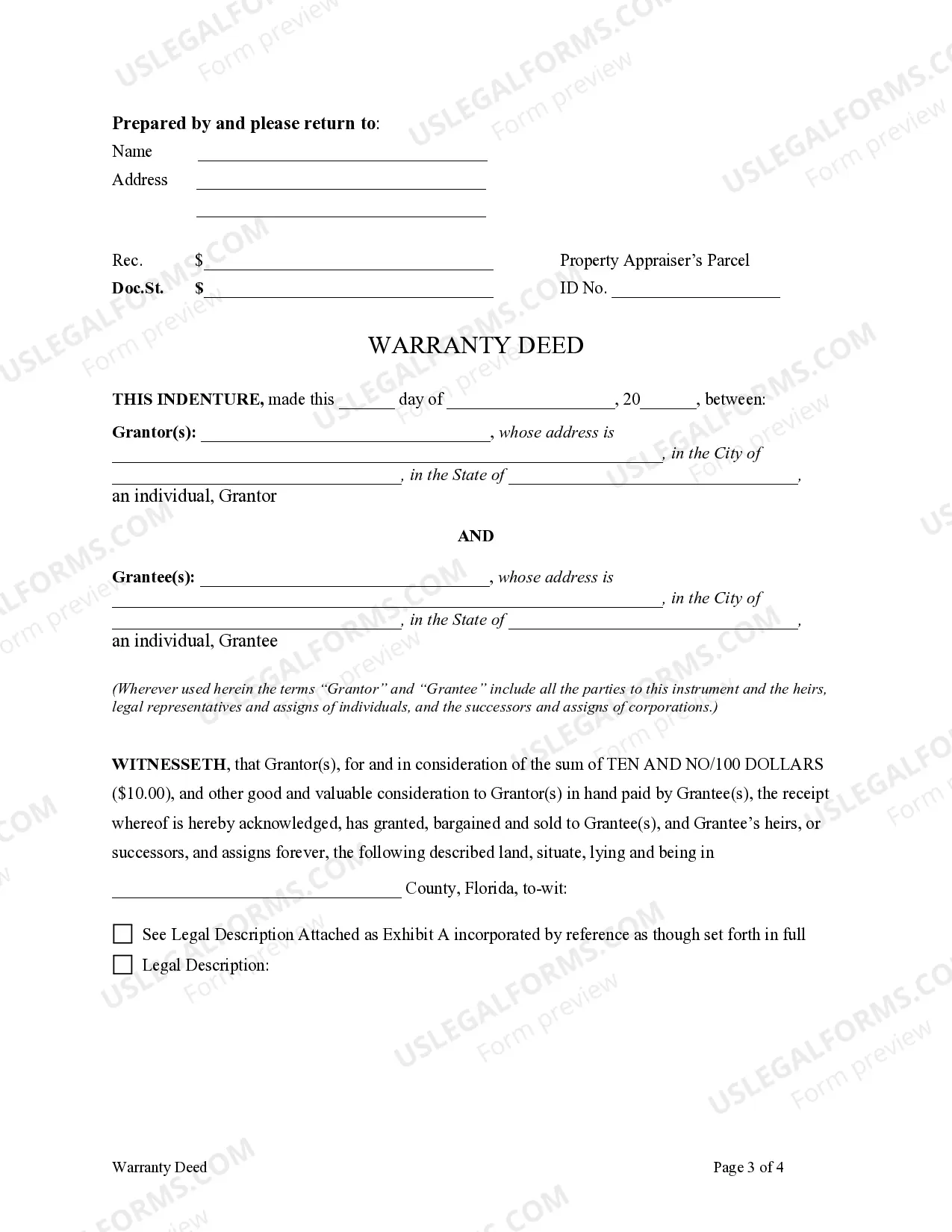

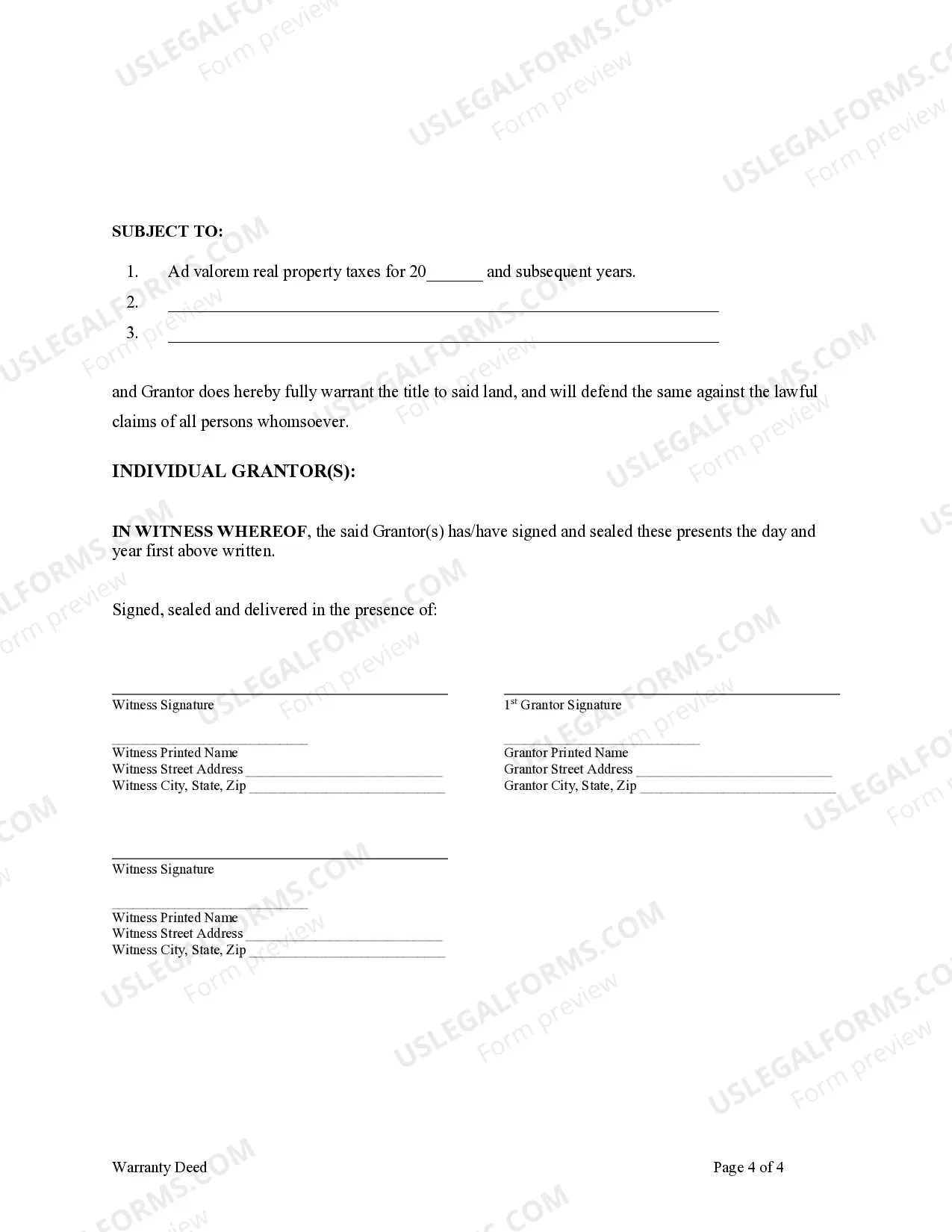

A Tallahassee Florida warranty deed from a limited partnership or LLC as the granter or grantee is a legally binding document used to transfer ownership of real property. This type of deed offers certain assurances and protections to the grantee, ensuring that the granter holds clear title to the property and will defend against any third-party claims that may arise. The Tallahassee Florida warranty deed from a limited partnership or LLC can be further categorized into the following types: 1. General Warranty Deed: This is the most common type of warranty deed. It provides the broadest scope of protection to the grantee by warranting the title against any defects, encumbrances, or claims, regardless of when they may have originated. 2. Special Warranty Deed: In this type of warranty deed, the granter warrants the title only against defects, encumbrances, or claims that arose during their ownership period. It does not cover any issues preceding their ownership. This limited protection is often utilized by limited partnerships or LCS. 3. Quitclaim Deed: This type of deed provides the least amount of protection to the grantee as it conveys whatever interest the granter has in the property without making any warranties regarding the title. It is typically used to transfer property between family members, in divorce proceedings, or to clarify uncertainties in ownership. When a limited partnership or LLC acts as the granter or grantee, the warranty deed should include specific language indicating the entity's name, address, and other pertinent identifying information. It is essential to accurately identify the entity involved to ensure the validity and enforceability of the deed. In Tallahassee, Florida, it is advisable to consult with a qualified real estate attorney or conveyance to draft and execute the warranty deed accurately. They can provide guidance specific to Florida laws and regulations, as well as ensure that all necessary steps are taken for a valid and binding transfer of property ownership.

Tallahassee Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee

Description

How to fill out Tallahassee Florida Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

If you are searching for a relevant form, it’s extremely hard to find a better service than the US Legal Forms site – one of the most comprehensive online libraries. With this library, you can find a huge number of document samples for organization and personal purposes by categories and states, or key phrases. With the advanced search function, discovering the latest Tallahassee Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee is as elementary as 1-2-3. Moreover, the relevance of each document is proved by a team of skilled attorneys that regularly review the templates on our platform and revise them according to the newest state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Tallahassee Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the sample you want. Check its information and make use of the Preview function (if available) to see its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to discover the appropriate document.

- Confirm your decision. Select the Buy now button. After that, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the template. Choose the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Tallahassee Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee.

Each template you add to your account does not have an expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you need to have an extra duplicate for modifying or creating a hard copy, you may come back and download it once more at any moment.

Make use of the US Legal Forms professional library to gain access to the Tallahassee Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee you were seeking and a huge number of other professional and state-specific samples on one platform!