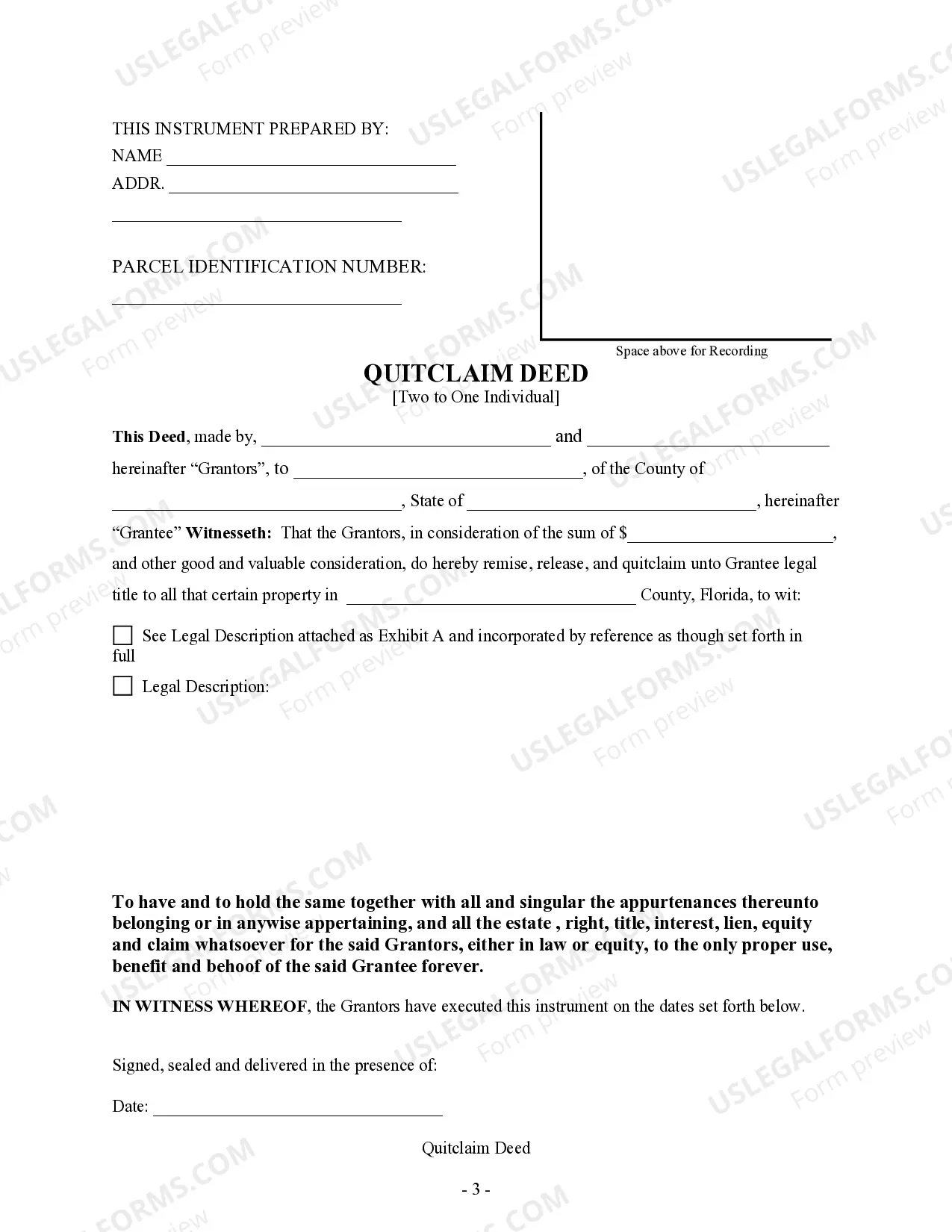

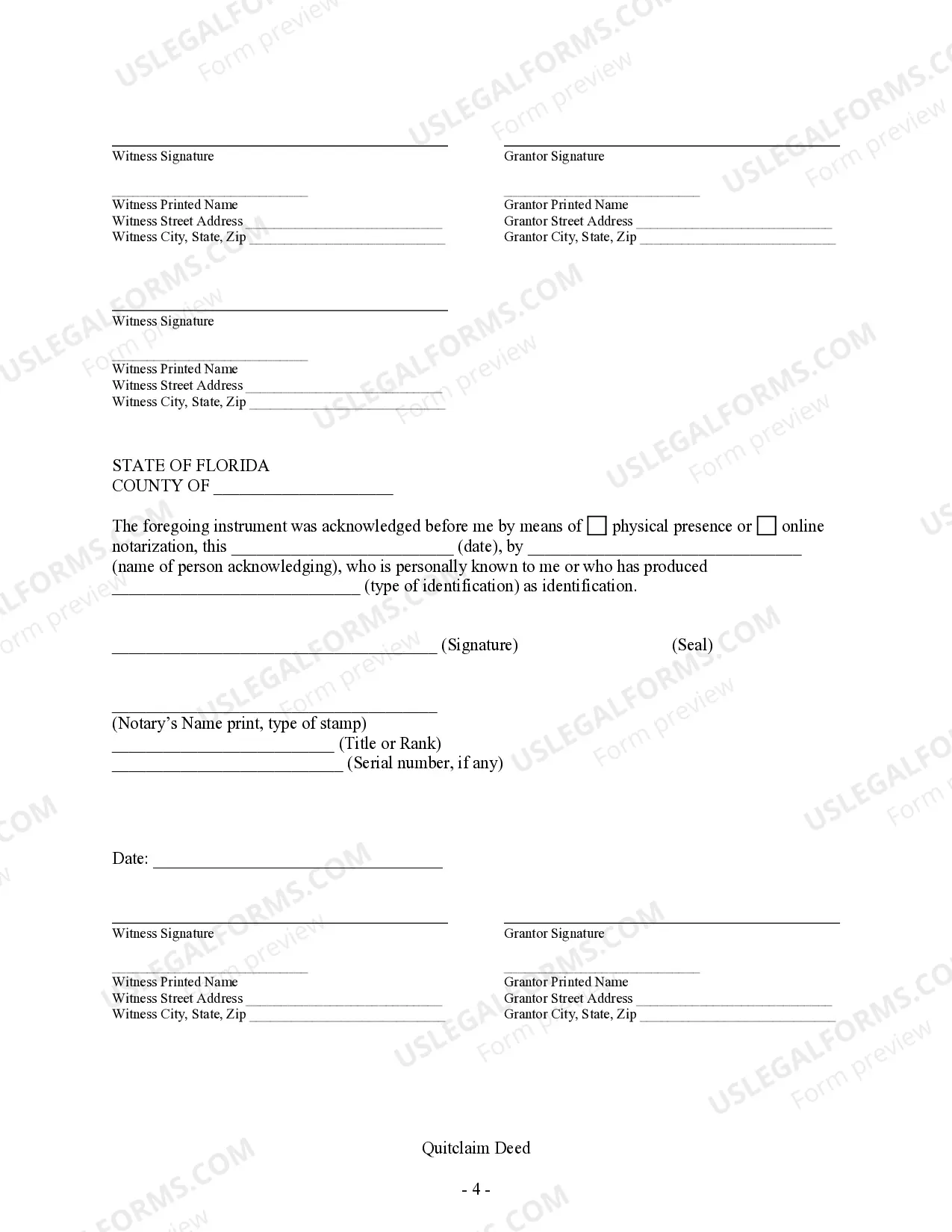

A quitclaim deed is a legal document used to transfer ownership of a property. In the case of Orange, Florida, a quitclaim deed from two individuals to one individual involves the transfer of property from two owners to a single owner. This type of deed is commonly used when transferring property between family members, divorcing couples, or business partners. The Orange, Florida quitclaim deed from two individuals to one individual is a straightforward process that requires specific information and adherence to state laws. The deed itself serves as evidence of the transfer, ensuring that the new owner has a legal right to the property. There are different variations of the Orange, Florida quitclaim deed from two individuals to one individual, including: 1. Married Couples: When a married couple jointly owns a property, they may choose to transfer their ownership to only one spouse, typically due to divorce, separation, or other personal circumstances. In this case, the quitclaim deed releases one spouse's interest in the property to the other spouse solely. 2. Business Partners: If two individuals co-own a property as business partners and one partner decides to buy out the other partner's ownership interest, a quitclaim deed can be used to transfer the property solely to the buying partner. This type of quitclaim deed ensures a smooth transition of property ownership within the business. 3. Inheritance: When property is inherited by multiple siblings or family members, they may decide to transfer their shares to one individual. The Orange, Florida quitclaim deed allows for the transfer of property from multiple heirs to a single heir, simplifying the ownership structure. In any case, the Orange, Florida quitclaim deed from two individuals to one individual should include important details such as the legal description of the property, the names of the granters (individuals transferring the property), the name of the grantee (individual receiving the property), the date of the transfer, and a notary acknowledgment. It is crucial to ensure that the quitclaim deed follows the guidelines and requirements set by the Orange, Florida jurisdiction to ensure its validity.

Orange Florida Quitclaim Deed from two Individuals to One Individual

Description

How to fill out Orange Florida Quitclaim Deed From Two Individuals To One Individual?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, as a rule, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Orange Florida Quitclaim Deed from two Individuals to One Individual or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Orange Florida Quitclaim Deed from two Individuals to One Individual complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Orange Florida Quitclaim Deed from two Individuals to One Individual is proper for you, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!

Form popularity

FAQ

When you transfer title and ownership of real estate in Florida, you sign a deed conveying or transferring the property to the new owner. In most real estate closings, the seller is responsible for providing the deed that is signed at closing.

Filing With the Clerk A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk's office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

Most often, a copy of the deceased spouse's death certificate, the notarized death affidavit, and a legal description of the property are required. Once these steps are complete, your deceased spouse will have been removed and you will be the sole owner on the deed.

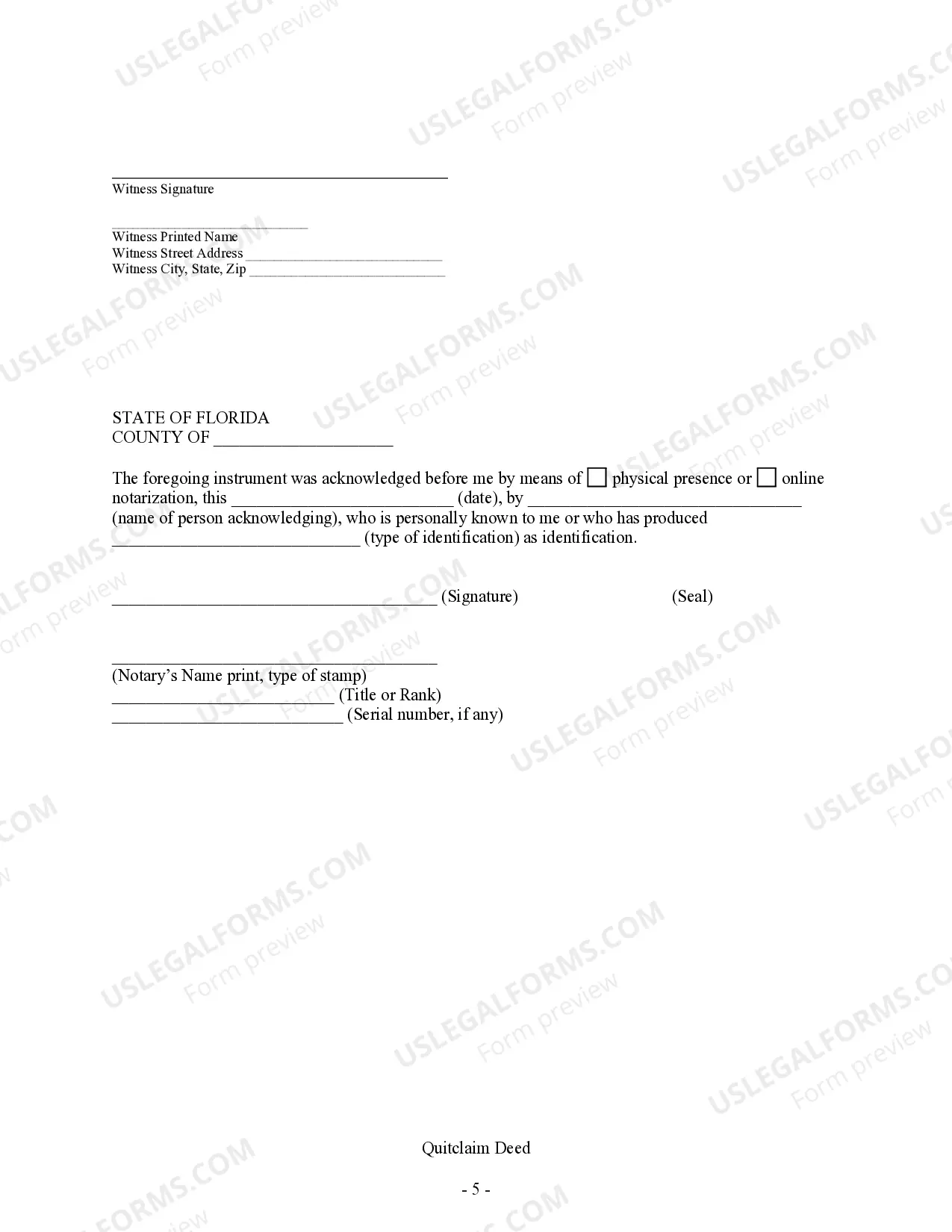

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.

There are 5 steps to remove a name from the property deed: Discuss property ownership interests.Access a copy of your title deed.Complete, review and sign the quitclaim or warranty form.Submit the quitclaim or warranty form.Request a certified copy of your quitclaim or warranty deed.

A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk's office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

If you need to remove a name from a title deed for a property with a mortgage on it, you will need written consent to do so from the lender. Generally, it is easier to obtain this if the person(s) left on the title deed is (are) sufficiently financially secure.

A new deed must be filed with the local clerk of court's office in order to change the name on a Florida deed, no matter the circumstances leading to the change. Marriages and divorces are some of the most common reasons to alter a deed in Florida. A death in the family may also necessitate a name change to a deed.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

In the case of divorce and gifting, the party who has legal rights of ownership to the property will file a deed transfer or a quitclaim deed, granting full ownership to another party. This will effectively remove the prior owner from the deed and deny him or her any additional rights to the property.