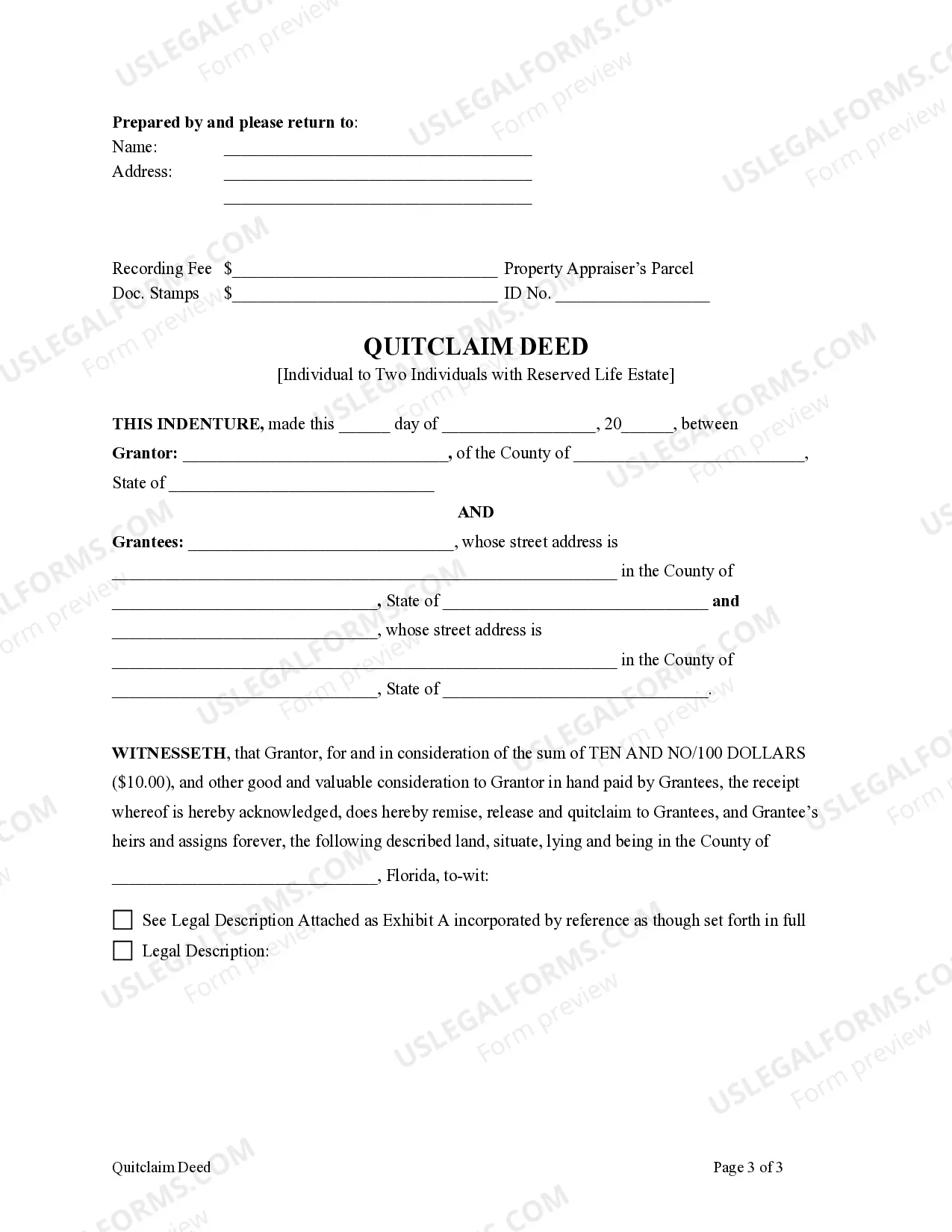

This form is a Quitclaim Deed where the grantor is an individual and the grantees are two individuals. Grantor conveys and quitclaims the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party (Granter) to another party/parties (Grantee/s). In Miramar, Florida, there are specific variations of Quitclaim Deed that involve the transfer of property from one individual to two individuals as Joint Tenants or Tenants in Common with the Granter reserving a Life Estate. Let's delve into the details of this kind of deed and explore the potential types within this category. Miramar Florida Quitclaim Deed from One Individual to Two Individuals as Joint Tenants or Tenants in Common Granter Reserves Life Estate: A Quitclaim Deed is a commonly used legal instrument that facilitates the transfer of ownership rights of a property. In the specific scenario of transferring property from one individual (the Granter) to two individuals (the Grantees), as Joint Tenants or Tenants in Common, while the Granter retains a Life Estate, there are key considerations to understand. 1. Joint Tenancy: When the deed transfers the property as Joint Tenants, it means that both grantees have an equal, undivided ownership interest in the property. Should one of the joint tenants pass away, their share automatically transfers to the surviving joint tenant(s), without going through probate. This type of ownership offers the right of survivorship. For example, if John and Mary jointly own a property as Joint Tenants and John passes away, Mary will automatically become the sole owner of the property. 2. Tenants in Common: On the other hand, if the deed transfers the property as Tenants in Common, each grantee has a distinct and divided share of ownership in the property. The shares may not be equal, and if a tenant in common passes away, their share does not automatically transfer to the other owner(s) but becomes a part of their probate estate. This type of ownership doesn't provide the right of survivorship. For example, if John and Mary own a property as Tenants in Common, with John having a 60% share and Mary a 40% share, John's 60% will be passed on according to his will or state laws after his passing, whereas Mary's 40% will be under her control. 3. Granter Reserves Life Estate: In this situation, the Granter retains the right to live on and use the property for the remainder of their life, even after transferring ownership to the Grantees. This allows the Granter to maintain possession and use of the property throughout their lifetime, while providing future rights to the Grantees. Upon the Granter's passing, the Grantees will assume full ownership of the property according to the specified ownership type (Joint Tenants or Tenants in Common). Different Types of Miramar Florida Quitclaim Deeds from One Individual to Two Individuals as Joint Tenants or Tenants in Common Granter Reserves Life Estate: The specific type of Quitclaim Deed used in these circumstances may vary based on the specific intentions or agreements between the parties involved. While the essential elements mentioned above remain consistent, the deed might be further classified based on additional details, such as: 1. Miramar Florida Quitclaim Deed — Joint Tenancy witGranteror Reserving Life Estate 2. Miramar Florida Quitclaim Deed — Tenants in Common witGranteror Reserving Life Estate 3. Miramar Florida Quitclaim Deed — Joint Tenancy with Unequal SharesGranteror Reserving Life Estate 4. Miramar Florida Quitclaim Deed — Tenants in Common with Unequal Shares, Granter Reserving Life Estate These variations in the deed's nomenclature imply slight differences in ownership structure and share distribution. It is essential to consult with legal professionals or experts experienced in real estate law to ensure the correct preparation and execution of the Quitclaim Deed, meeting the specific requirements and objectives of all parties involved. Note: The information provided above is a general overview and should not be considered as legal advice. It is advisable to consult a qualified attorney or real estate professional for personalized guidance in any real estate transaction.A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party (Granter) to another party/parties (Grantee/s). In Miramar, Florida, there are specific variations of Quitclaim Deed that involve the transfer of property from one individual to two individuals as Joint Tenants or Tenants in Common with the Granter reserving a Life Estate. Let's delve into the details of this kind of deed and explore the potential types within this category. Miramar Florida Quitclaim Deed from One Individual to Two Individuals as Joint Tenants or Tenants in Common Granter Reserves Life Estate: A Quitclaim Deed is a commonly used legal instrument that facilitates the transfer of ownership rights of a property. In the specific scenario of transferring property from one individual (the Granter) to two individuals (the Grantees), as Joint Tenants or Tenants in Common, while the Granter retains a Life Estate, there are key considerations to understand. 1. Joint Tenancy: When the deed transfers the property as Joint Tenants, it means that both grantees have an equal, undivided ownership interest in the property. Should one of the joint tenants pass away, their share automatically transfers to the surviving joint tenant(s), without going through probate. This type of ownership offers the right of survivorship. For example, if John and Mary jointly own a property as Joint Tenants and John passes away, Mary will automatically become the sole owner of the property. 2. Tenants in Common: On the other hand, if the deed transfers the property as Tenants in Common, each grantee has a distinct and divided share of ownership in the property. The shares may not be equal, and if a tenant in common passes away, their share does not automatically transfer to the other owner(s) but becomes a part of their probate estate. This type of ownership doesn't provide the right of survivorship. For example, if John and Mary own a property as Tenants in Common, with John having a 60% share and Mary a 40% share, John's 60% will be passed on according to his will or state laws after his passing, whereas Mary's 40% will be under her control. 3. Granter Reserves Life Estate: In this situation, the Granter retains the right to live on and use the property for the remainder of their life, even after transferring ownership to the Grantees. This allows the Granter to maintain possession and use of the property throughout their lifetime, while providing future rights to the Grantees. Upon the Granter's passing, the Grantees will assume full ownership of the property according to the specified ownership type (Joint Tenants or Tenants in Common). Different Types of Miramar Florida Quitclaim Deeds from One Individual to Two Individuals as Joint Tenants or Tenants in Common Granter Reserves Life Estate: The specific type of Quitclaim Deed used in these circumstances may vary based on the specific intentions or agreements between the parties involved. While the essential elements mentioned above remain consistent, the deed might be further classified based on additional details, such as: 1. Miramar Florida Quitclaim Deed — Joint Tenancy witGranteror Reserving Life Estate 2. Miramar Florida Quitclaim Deed — Tenants in Common witGranteror Reserving Life Estate 3. Miramar Florida Quitclaim Deed — Joint Tenancy with Unequal SharesGranteror Reserving Life Estate 4. Miramar Florida Quitclaim Deed — Tenants in Common with Unequal Shares, Granter Reserving Life Estate These variations in the deed's nomenclature imply slight differences in ownership structure and share distribution. It is essential to consult with legal professionals or experts experienced in real estate law to ensure the correct preparation and execution of the Quitclaim Deed, meeting the specific requirements and objectives of all parties involved. Note: The information provided above is a general overview and should not be considered as legal advice. It is advisable to consult a qualified attorney or real estate professional for personalized guidance in any real estate transaction.