A Jacksonville Florida Quitclaim Deed for Individual to a Trust is a legal document that allows an individual to transfer ownership of a property to a trust through a quitclaim deed. A quitclaim deed is a type of deed commonly used to transfer real estate ownership, where the granter (individual) relinquishes any claim they may have on the property to the grantee (trust). The purpose of a Jacksonville Florida Quitclaim Deed for Individual to a Trust is to facilitate the transfer of real estate ownership from an individual to a trust. This can often be beneficial for estate planning purposes, asset protection, or to ensure the smooth transfer of real estate after an individual passes away. The process of completing a Jacksonville Florida Quitclaim Deed for Individual to a Trust involves several steps. Firstly, the granter must obtain the appropriate quitclaim deed form, which can typically be obtained from a local county clerk's office, legal document service, or attorney. The form should specifically state that it is for the transfer of property to a trust. The granter must then fill out the quitclaim deed form accurately, providing information such as their full legal name, the legal description of the property being transferred, and the name of the trust to which the property is being conveyed. The granter's signature must be notarized by a notary public, who will verify their identity and witness the signing. Once the quitclaim deed form is completed and notarized, it should be filed with the appropriate county recorder's office in Jacksonville, Florida. This filing officially transfers ownership of the property from the individual to the trust, and the deed becomes a part of the public record. It is important to note that there may be different types or variations of a Jacksonville Florida Quitclaim Deed for Individual to a Trust, depending on specific circumstances or requirements. For example, there may be specific forms or additional documentation required if the property being transferred is subject to an existing mortgage or lien. Additionally, there may be variations in the requirements or procedures if the transfer involves a revocable or irrevocable trust. If an individual is unsure about the specific requirements or types of quitclaim deeds available for transferring property to a trust in Jacksonville, Florida, it is recommended to consult with a qualified real estate attorney or legal professional. They can provide guidance and ensure that the quitclaim deed is completed correctly and in compliance with the laws and regulations of the state.

Jacksonville Florida Quitclaim Deed for Individual to a Trust

Description

How to fill out Jacksonville Florida Quitclaim Deed For Individual To A Trust?

Do you require a reliable and affordable source for legal documents to obtain the Jacksonville Florida Quitclaim Deed for an Individual to a Trust? US Legal Forms is your ideal answer.

Whether you seek a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce in court, we have you covered. Our site features over 85,000 current legal template documents for personal and corporate purposes. All templates we provide are not generic but tailored to meet the needs of specific states and regions.

To acquire the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please be aware that you can access your previously bought form templates at any time in the My documents section.

Is this your first visit to our site? No need to worry. You can create an account with ease, but prior to that, ensure you do the following.

Now you can register your account. Then choose the subscription plan and proceed with the payment. After the payment is finalized, download the Jacksonville Florida Quitclaim Deed for an Individual to a Trust in any format available. You can revisit the site whenever needed and redownload the document at no extra cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting hours searching for legal documents online!

- Verify if the Jacksonville Florida Quitclaim Deed for an Individual to a Trust aligns with the laws of your state and locality.

- Review the form’s description (if available) to discern who and what the document is intended for.

- Restart the search if the form does not fit your legal needs.

Form popularity

FAQ

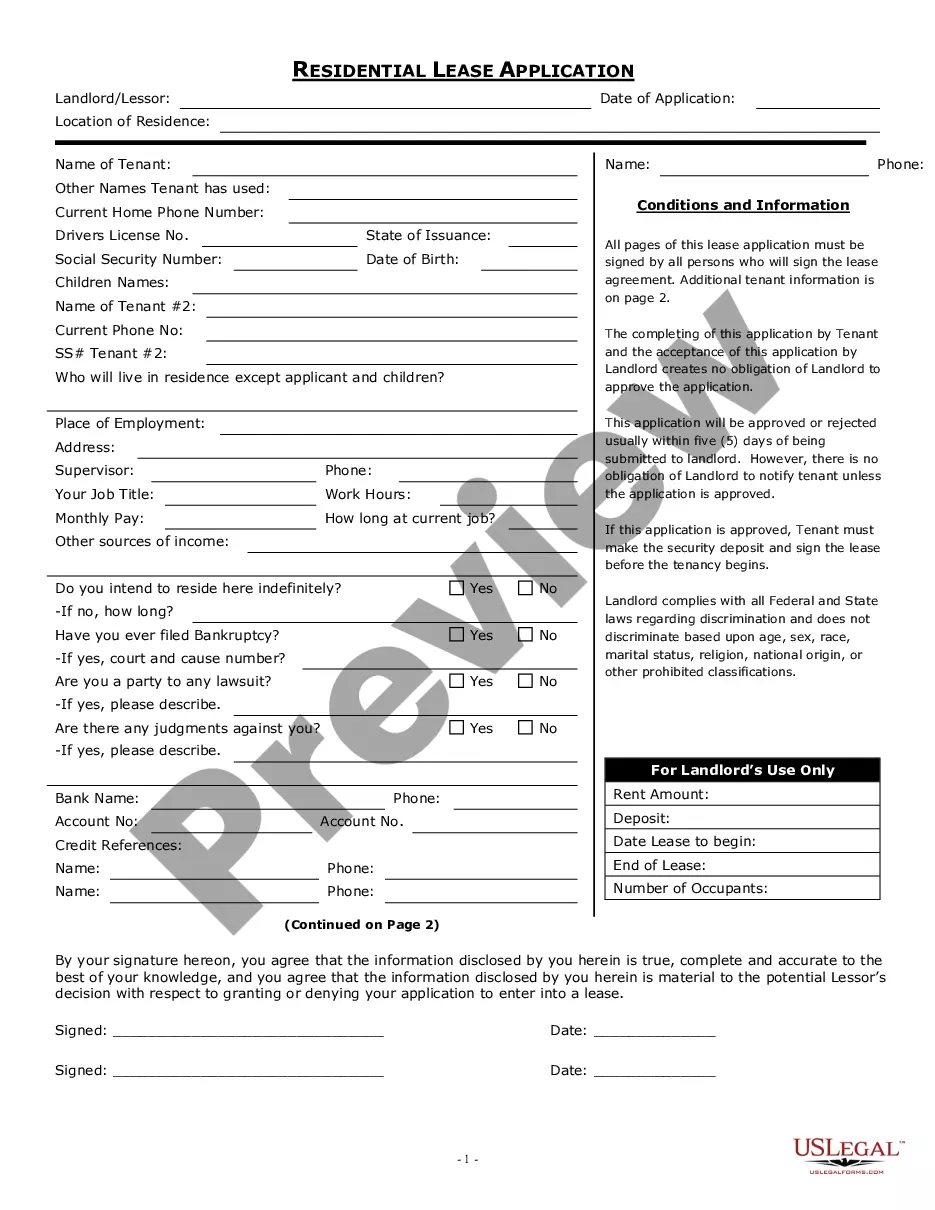

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.

Using a Quitclaim Deed in Florida Florida quit-claim deeds must be properly filed and the original document should be recorded in the county where the property is located. One of the parties will pay the transfer tax to the clerk of the court once the deed has been recorded.

A person filing a deed for transfer of Florida real estate ownership must do so through the county comptroller's office where the property is located. There is a small fee for filing and a document stamp tax, which is an excise tax on legal documents delivered, executed or recorded in the state.

Florida Quitclaim Deeds Should be Properly Filed To ensure the transfer of a quitclaim deed, the original document should be recorded with the county recorder for the county where the relevant property is located. Until the deed is recorded, it is not valid against third-party interests.

In fact, taxes may be due on a quit claim deed even when the property is transferred between spouses. With such transfers, if the property is mortgaged, then tax is generally due on half of the outstanding balance.

70 per $100 (or portion thereof) on documents that transfer interest in Florida real property, such as warranty deeds and quit claim deeds. This tax is based on the sale, consideration or transfer amount and is usually paid to the Clerk of Court when the document is recorded.

Florida law requires that the grantor must sign the deed in the presence of two witnesses and a notary public. The witnesses must also sign in the presence of the notary.

Filing With the Clerk A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk's office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.