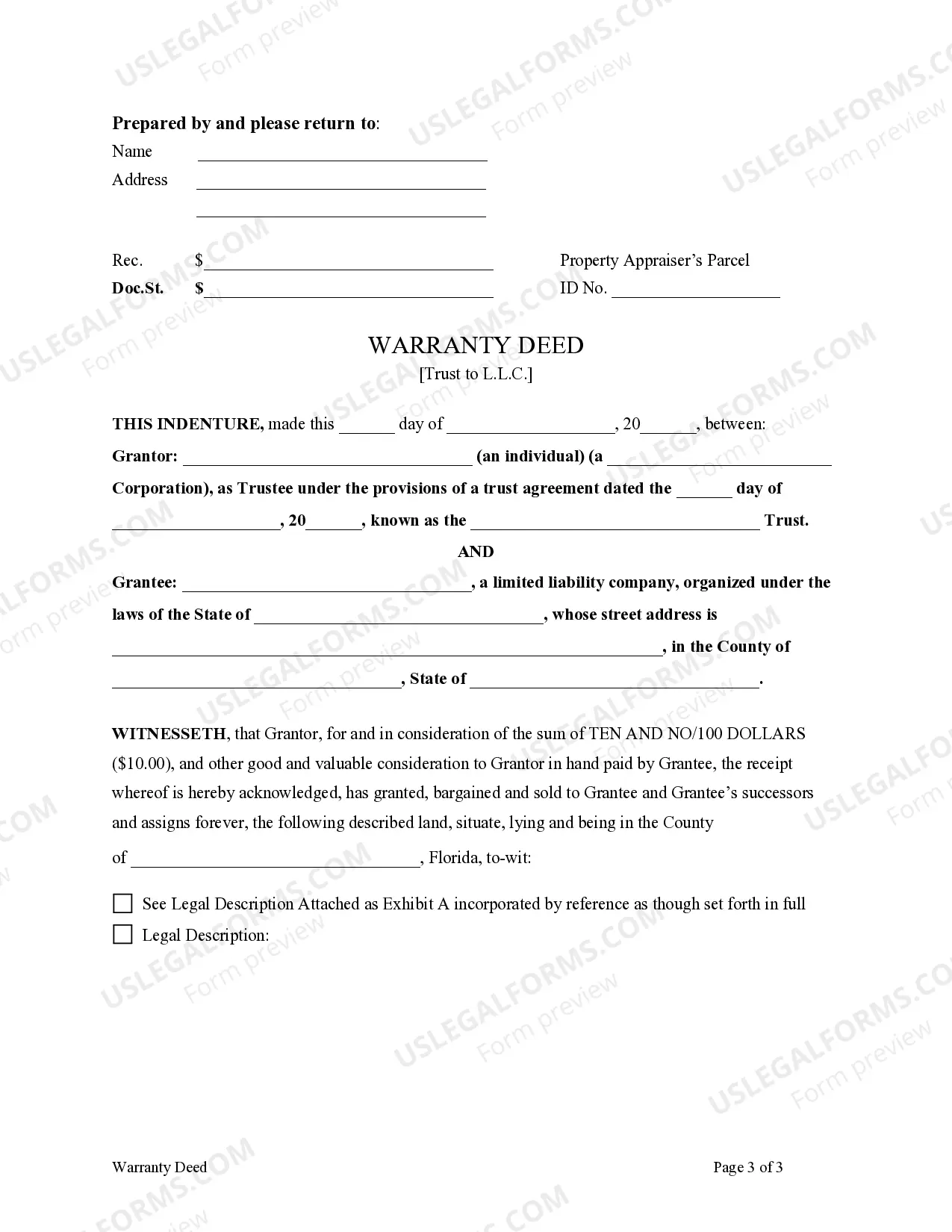

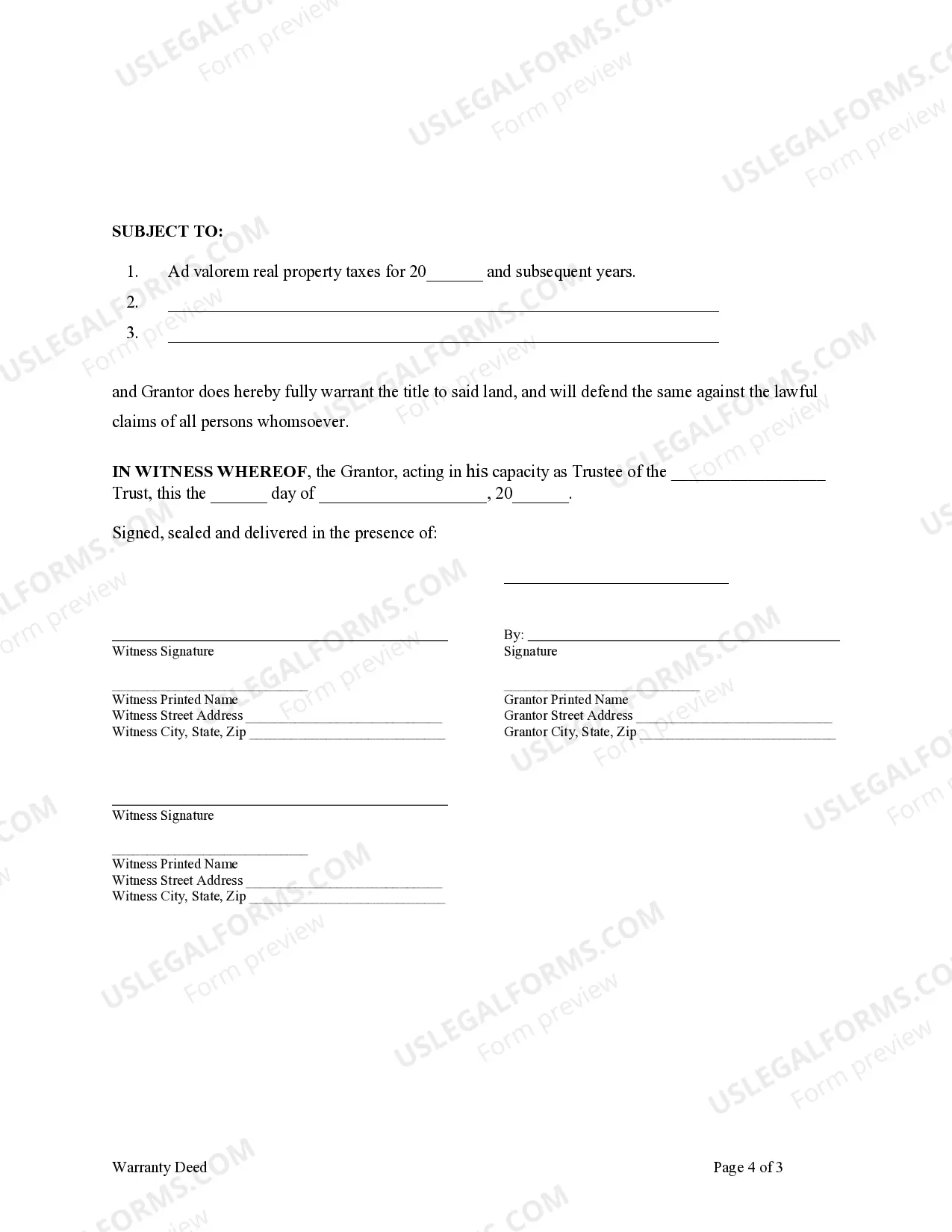

A Lakeland Florida Warranty Deed from Trust to LLC is a legal document that transfers real estate ownership from a trust to a limited liability company (LLC), ensuring a warranty or guarantee of a clear title. This type of transaction commonly occurs when a property held within a trust needs to be transferred to an LLC for various reasons, such as business purposes, asset protection, or tax advantages. In this process, the trustee of the trust acts as the granter, transferring the property to the LLC as the grantee. The warranty deed serves as evidence of the transfer and provides assurances to the new LLC owner that the property is free from any encumbrances, liens, or claims that may arise prior to the transfer. It is worth mentioning that there are two main types of Lakeland Florida Warranty Deed from Trust to LLC: the General Warranty Deed and the Quitclaim Deed. 1. General Warranty Deed: This type of deed provides the highest level of protection for the buyer (LLC) and offers numerous warranties from the granter (trustee). These warranties, also known as covenants, guarantee that the granter holds clear title, has the right to transfer the property, and will defend the title against any claims. The LLC is fully protected against any unforeseen legal issues that may arise from the previous ownership of the property. 2. Quitclaim Deed: In contrast to the General Warranty Deed, a Quitclaim Deed offers no warranties or guarantees to the buyer (LLC). It simply transfers the granter's interest in the property without confirming or ensuring the absence of any legal claims or defects in the title. This type of deed is typically used in situations where the granter is not willing to provide warranties or when the transfer is between parties with an established relationship and trust. It is essential to consult with a real estate attorney or a knowledgeable professional in Lakeland, Florida, to determine which type of warranty deed is most suitable for your specific situation. The attorney will guide you through the legalities, review the trust agreement, and facilitate the proper transfer of ownership from trust to LLC, ensuring a smooth and secure transition.

Lakeland Florida Warranty Deed from Trust to LLC

Description

How to fill out Lakeland Florida Warranty Deed From Trust To LLC?

Make use of the US Legal Forms and get instant access to any form you require. Our useful website with thousands of documents makes it easy to find and obtain virtually any document sample you require. It is possible to download, complete, and certify the Lakeland Florida Warranty Deed from Trust to LLC in just a few minutes instead of surfing the Net for many hours seeking the right template.

Using our collection is a wonderful way to improve the safety of your record filing. Our experienced lawyers regularly review all the records to ensure that the templates are relevant for a particular state and compliant with new acts and polices.

How can you obtain the Lakeland Florida Warranty Deed from Trust to LLC? If you have a profile, just log in to the account. The Download option will appear on all the documents you view. Furthermore, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instruction below:

- Find the template you need. Ensure that it is the template you were seeking: examine its name and description, and take take advantage of the Preview option when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading process. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the document. Indicate the format to get the Lakeland Florida Warranty Deed from Trust to LLC and edit and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and trustworthy form libraries on the internet. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Lakeland Florida Warranty Deed from Trust to LLC.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!