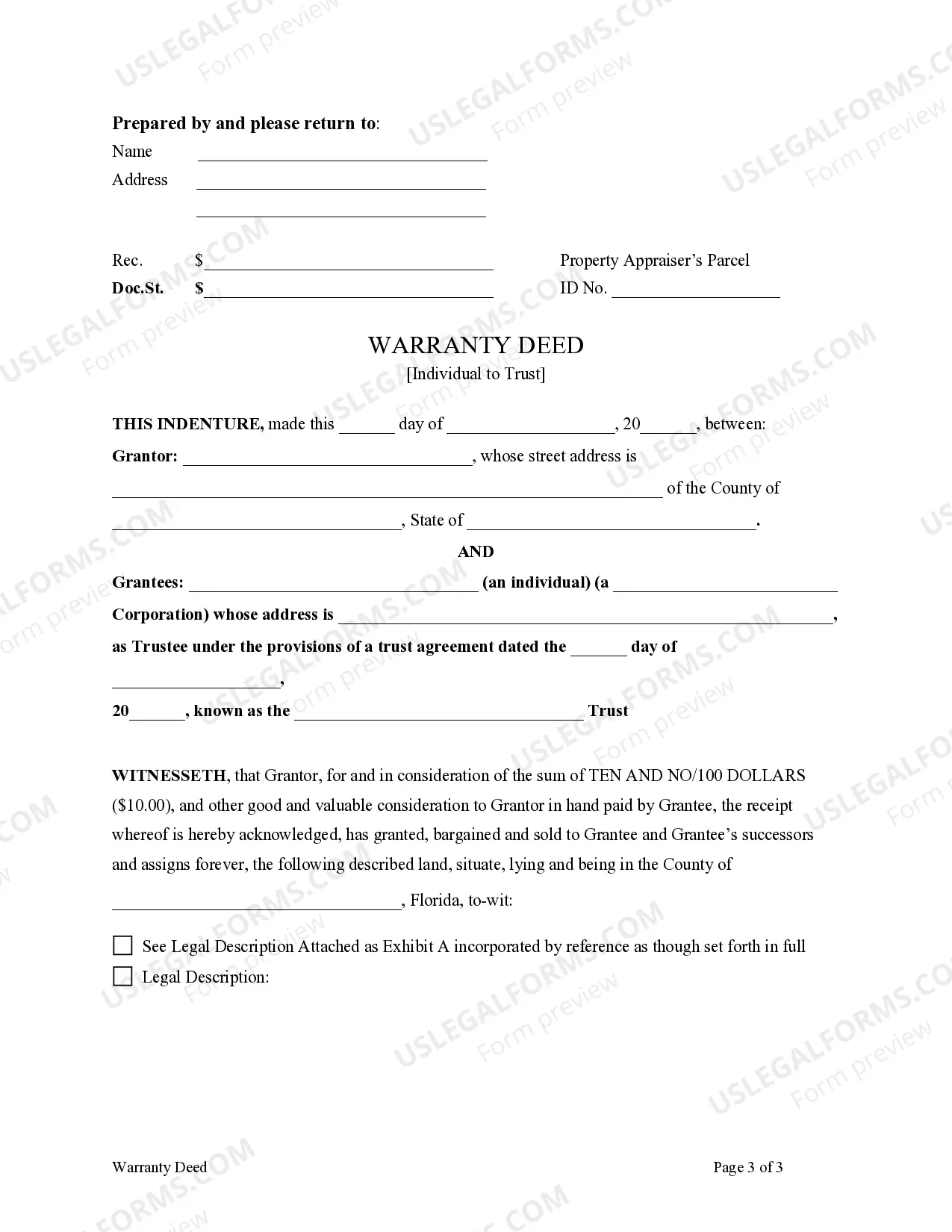

Jacksonville Florida Warranty Deed from Individual to a Trust

Description

How to fill out Florida Warranty Deed From Individual To A Trust?

If you are searching for an appropriate form, it’s incredibly challenging to discover a superior service than the US Legal Forms website – one of the largest collections on the web.

With this collection, you can obtain a vast array of document templates for both business and personal purposes by categories and regions, or keywords.

Using our enhanced search feature, locating the latest Jacksonville Florida Warranty Deed from Individual to a Trust is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Receive the form. Choose the file format and download it to your device.

- Furthermore, the relevance of every single document is confirmed by a team of expert attorneys who routinely review the templates on our site and refresh them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Jacksonville Florida Warranty Deed from Individual to a Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

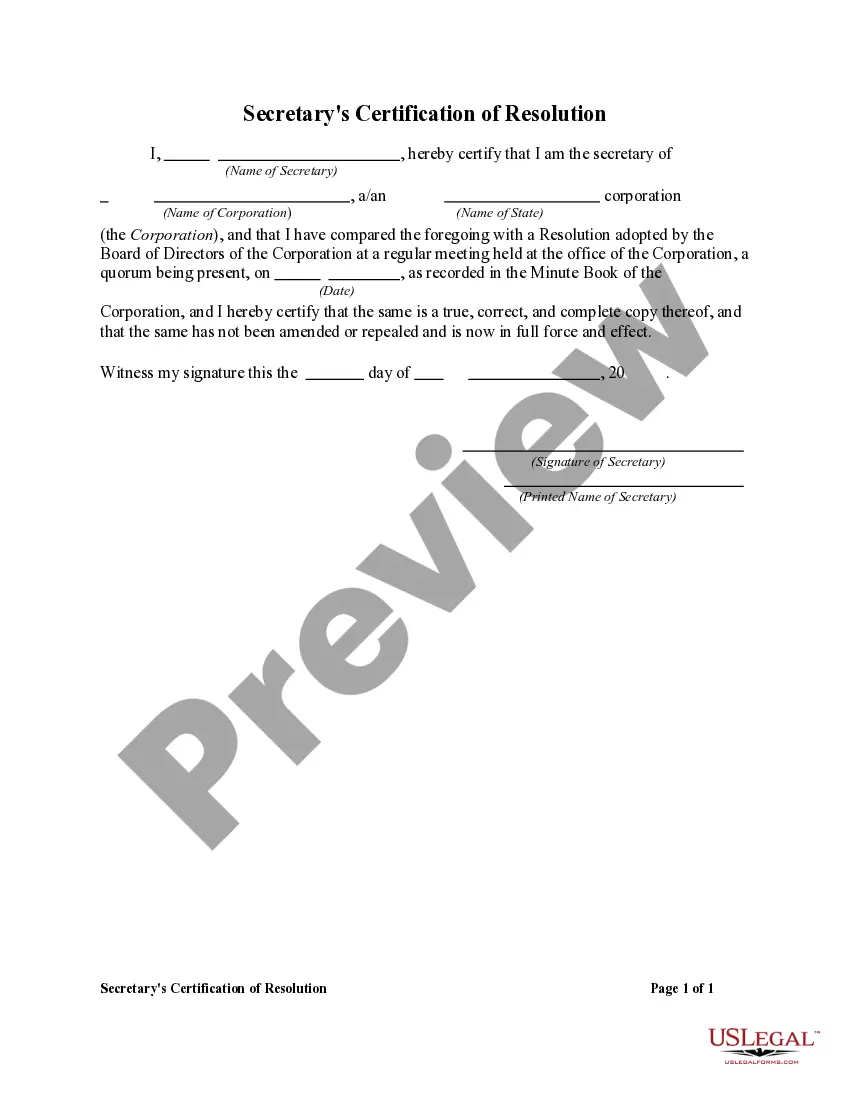

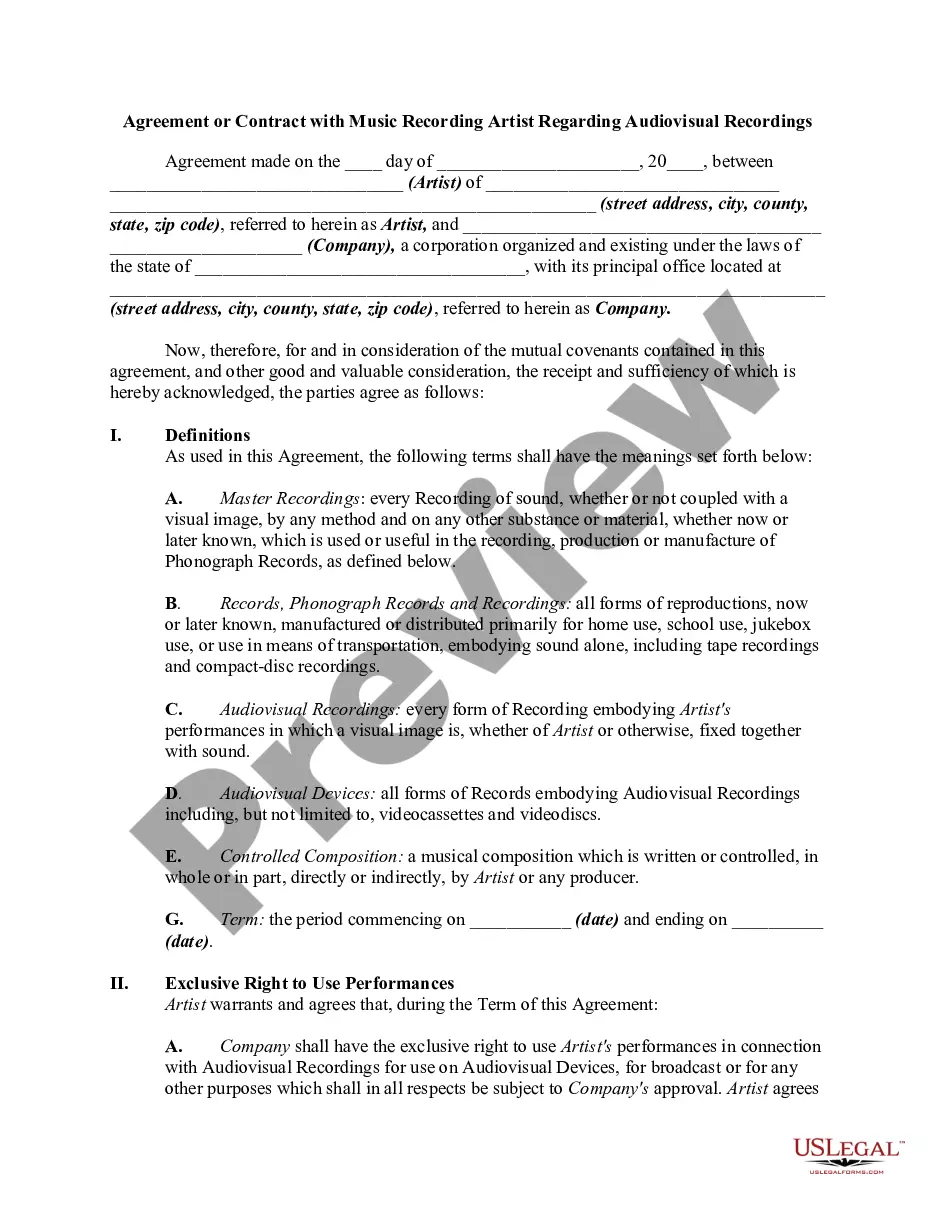

- Ensure you have located the form you need. Review its details and take advantage of the Preview function to inspect its contents. If it does not meet your requirements, utilize the Search feature at the top of the page to find the correct document.

- Validate your choice. Click the Buy now button. Next, choose the desired pricing plan and enter your information to create an account.

Form popularity

FAQ

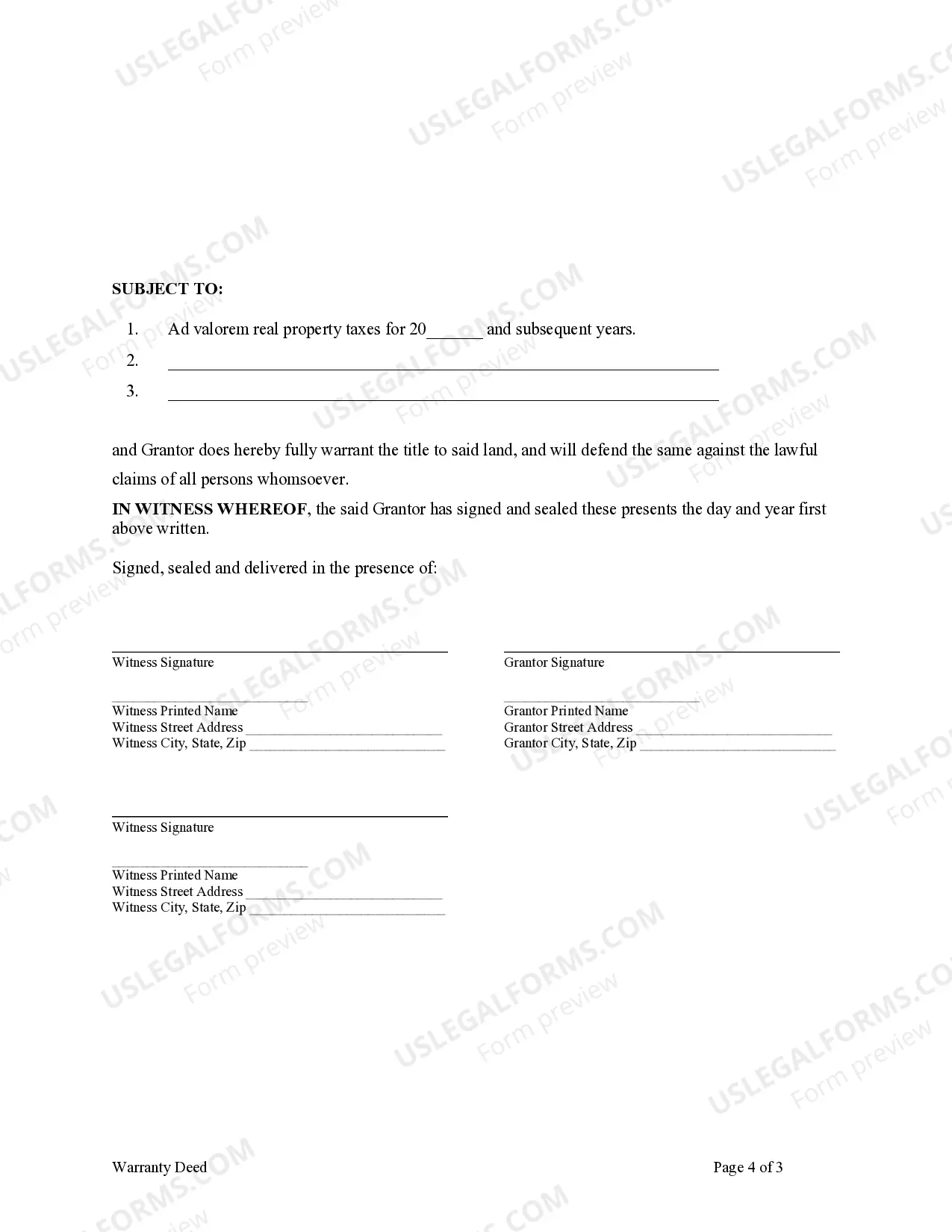

Filing a Deed in Florida The comptroller's office charges a small fee for the deed's filing in the form of a documentary stamp tax, levied at 70 cents per $100 of the sale or transfer amount. There will also be a $10 fee for the first page of the document and $8.50 for each additional page.

No, a warranty deed does not prove ownership. A title search is the best way to prove that a grantor rightfully owns a property. The warranty deed is a legal document that offers the buyer protection. In other words, the property title and warranty deed work in tandem together.

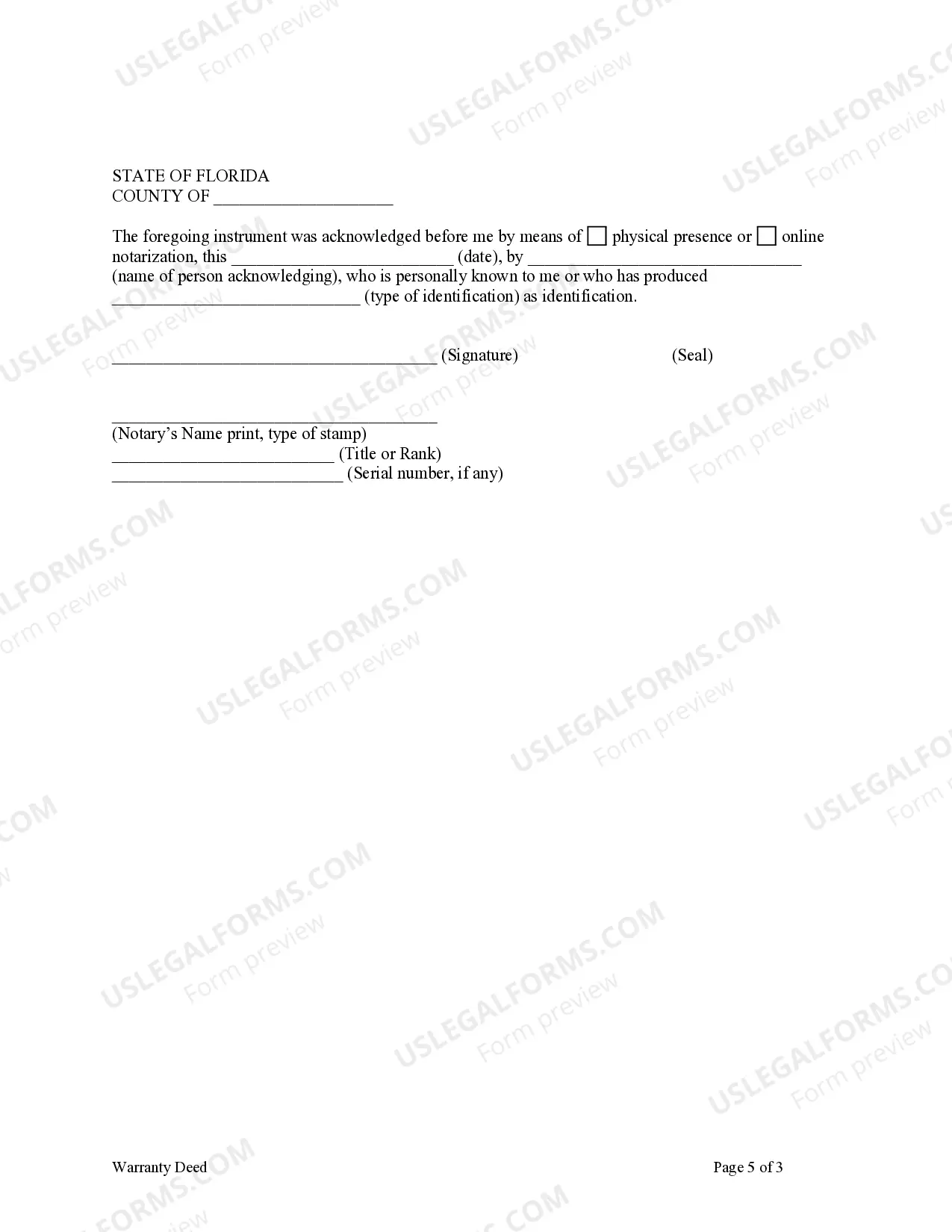

The deed must be in writing; The deed must be signed by the transferor (the current owner) of the property or his or her duly authorized agent or representative; The deed must be signed in the presence of two witnesses, each of whom must also sign the deed.

When you transfer title and ownership of real estate in Florida, you sign a deed conveying or transferring the property to the new owner. In most real estate closings, the seller is responsible for providing the deed that is signed at closing.

The process of transferring ownership of a property to a trust requires the owner of the property to prepare and sign a new deed. Although you are not required to seek professional guidance to fill out the necessary forms, the best way to prepare a deed is to work with an expert legal counselor.

The Florida Land Trust Act allows a revocable trust to own real property. The trust, then, is owned by its beneficiaries. In fact, the beneficiary or beneficiaries have full control of the property and may even add additional property to the trust. There's no firm deadline for when the trust ends.