Orange Florida Warranty Deed from Individual to a Trust

Description

How to fill out Florida Warranty Deed From Individual To A Trust?

Regardless of social or occupational position, filling out legal forms is an unfortunate obligation in the modern world.

Frequently, it’s nearly unfeasible for someone lacking legal training to create these types of documents from the ground up, primarily due to the intricate terminology and legal nuances they encompass.

This is where US Legal Forms proves to be invaluable.

Make sure the template you have located is tailored to your area as the regulations of one state or region do not apply to another state or region.

Preview the document and read a brief overview (if available) of the contexts the form is applicable to.

- Our service offers an extensive library featuring over 85,000 ready-to-use state-specific documents applicable to nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to enhance their time efficiency through our DIY papers.

- Irrespective of whether you need the Orange Florida Warranty Deed from Individual to a Trust or any other document suitable for your locality, US Legal Forms places everything at your disposal.

- Here’s how you can obtain the Orange Florida Warranty Deed from Individual to a Trust in minutes using our trustworthy service.

- If you are an existing customer, you can simply Log In to your account to access the relevant form.

- However, if you are new to our platform, ensure you follow these steps before downloading the Orange Florida Warranty Deed from Individual to a Trust.

Form popularity

FAQ

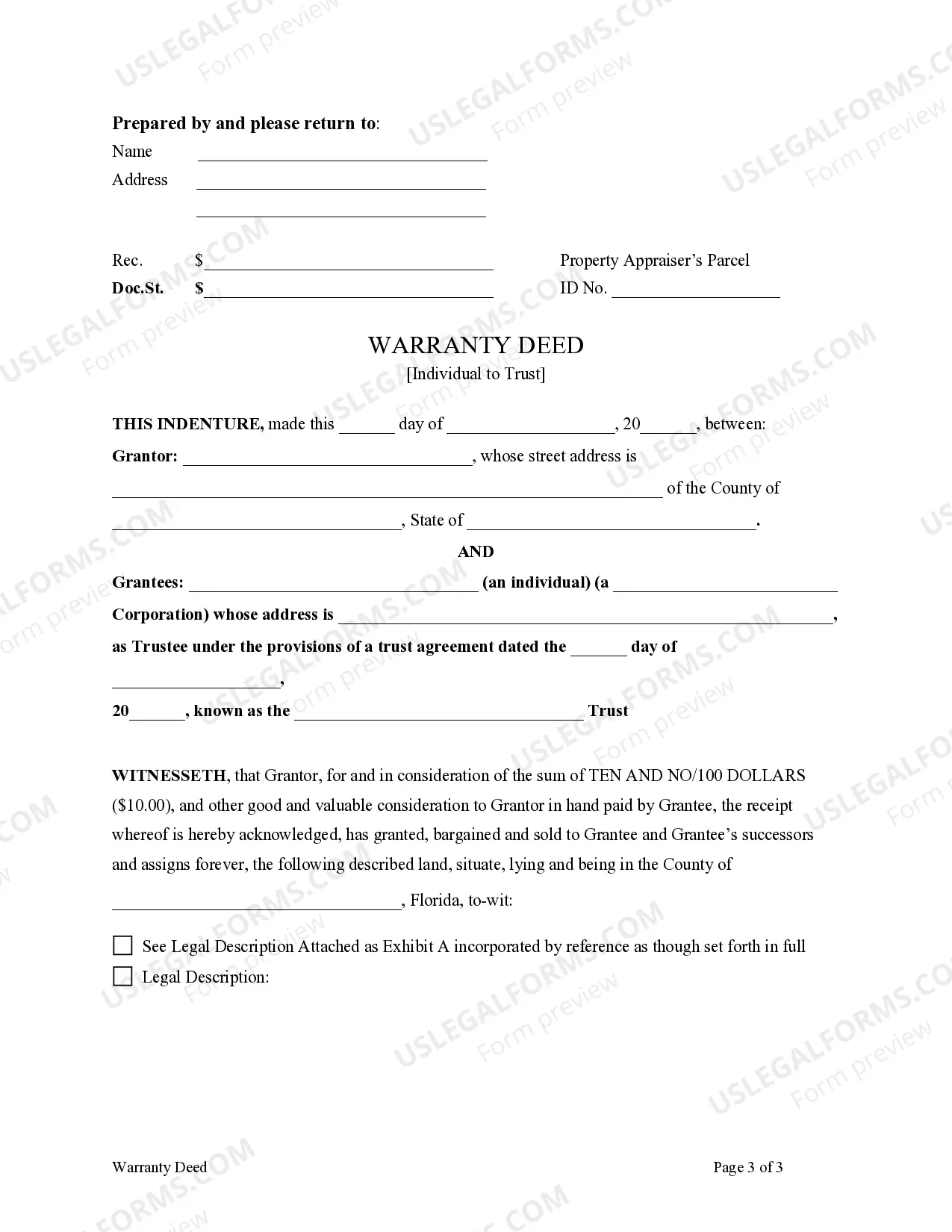

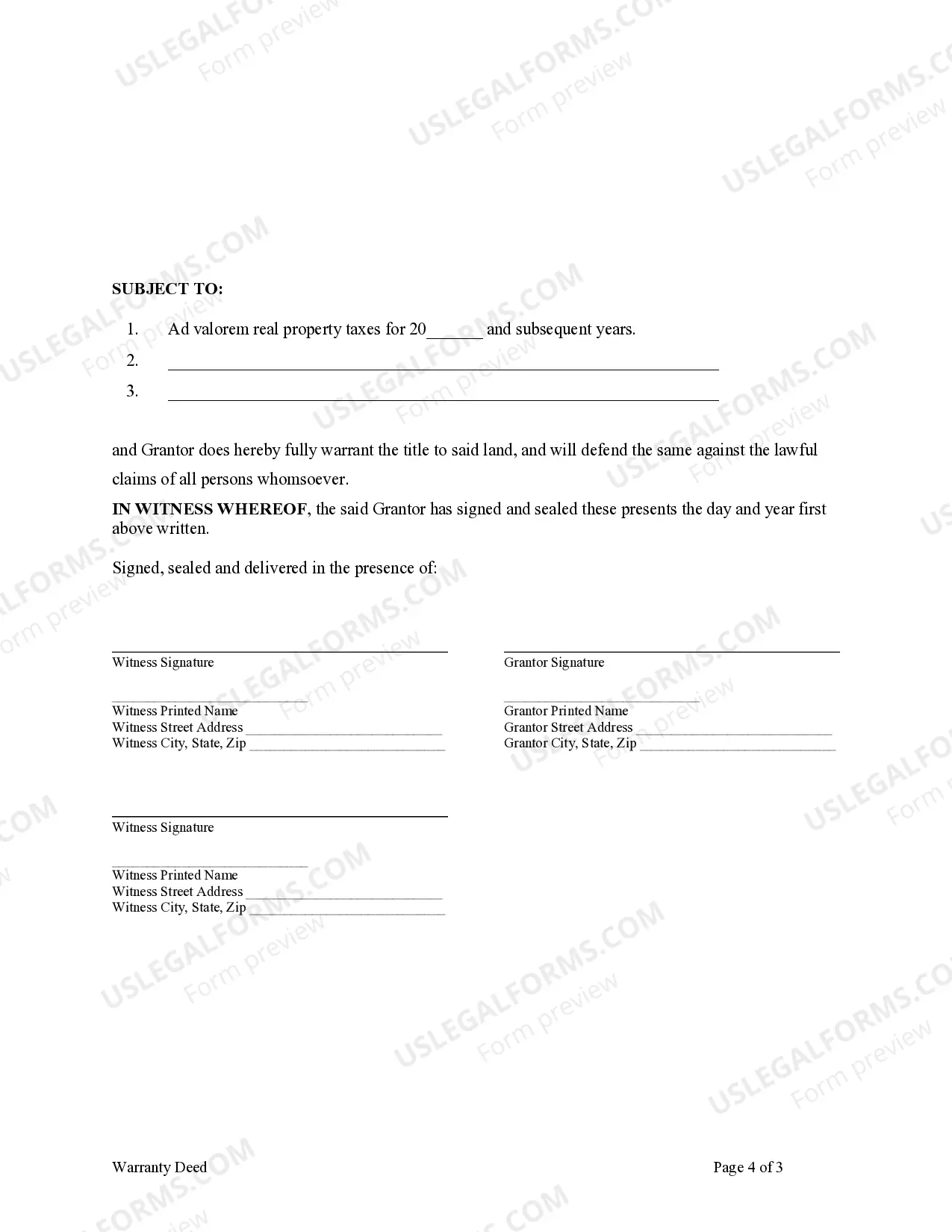

To transfer a deed to a trust in Florida, start by drafting an Orange Florida Warranty Deed from Individual to a Trust. You must sign the deed and have it notarized before recording it with the county clerk's office. Consulting the US Legal Forms platform can simplify this process, providing templates and guidance tailored to your needs, ensuring a smooth and compliant transition.

Some disadvantages of putting your house in a trust in Florida include the initial costs of creating the trust and potential ongoing management fees. Furthermore, transferring an Orange Florida Warranty Deed from Individual to a Trust could complicate matters during a sale or refinancing. It is essential to weigh these factors carefully and consider how they align with your overall estate planning goals.

To put your house in a trust in Florida, you need to create the trust document that outlines the terms and conditions of the trust. Then, you will execute an Orange Florida Warranty Deed from Individual to a Trust, which transfers the property title to the trust. It is also wise to consult with a legal professional to ensure all requirements are met and to understand the implications of your decision.

One of the biggest mistakes parents often make when establishing a trust fund is failing to properly fund it. Without the right assets assigned to the trust, it cannot serve its intended purpose. For those in Orange, Florida, utilizing an Orange Florida Warranty Deed from Individual to a Trust can prove essential in transferring property into the trust effectively. Ensuring that the trust is adequately funded and includes your real estate can better protect your family’s future.

When you transfer your home using an Orange Florida Warranty Deed from Individual to a Trust, some potential disadvantages arise. First, there may be costs associated with setting up and maintaining the trust. Additionally, transferring property to a trust could affect your eligibility for certain financial assistance programs. Lastly, if not managed properly, trusts can lead to complications in estate management, making it essential to consult with a legal professional.

Yes, you can transfer a warranty deed to another party. When transferring property using the Orange Florida Warranty Deed from Individual to a Trust, make sure to follow the proper legal protocols. This ensures that the deed is legally binding and that ownership is transferred without complications.

While a warranty deed offers many benefits, there are some disadvantages to consider. If you use the Orange Florida Warranty Deed from Individual to a Trust, you might be held liable for any issues that arise with the property’s title. Furthermore, this type of deed may require additional paperwork and expense, compared to other deed types.

A warranty deed can indeed be transferred, allowing the property to change hands securely. Using the Orange Florida Warranty Deed from Individual to a Trust provides a clear and legal way to effectuate ownership transfer while ensuring that previous claims are cleared. This method protects both parties involved in the transaction.

Yes, a trustee can issue a warranty deed. When acting on behalf of the trust, the trustee can utilize the Orange Florida Warranty Deed from Individual to a Trust to transfer property. This ensures that the property title is conveyed with the same protection and assurances as it would from an individual.

To transfer a deed to a trust in Florida, you will need to execute the Orange Florida Warranty Deed from Individual to a Trust. This deed must be properly filled out and signed, then recorded with your local county clerk's office. This process legally changes the ownership of the property into the trust.