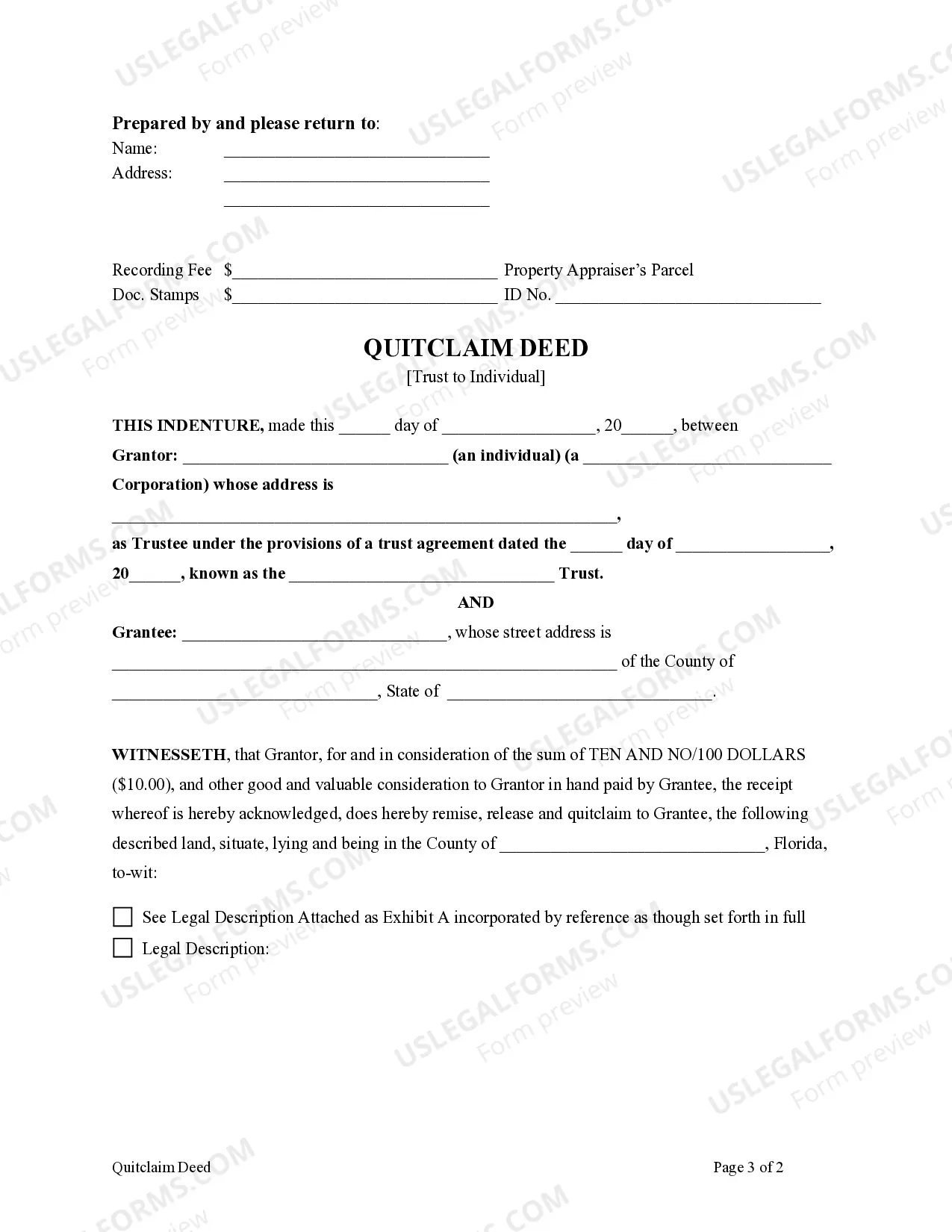

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual.

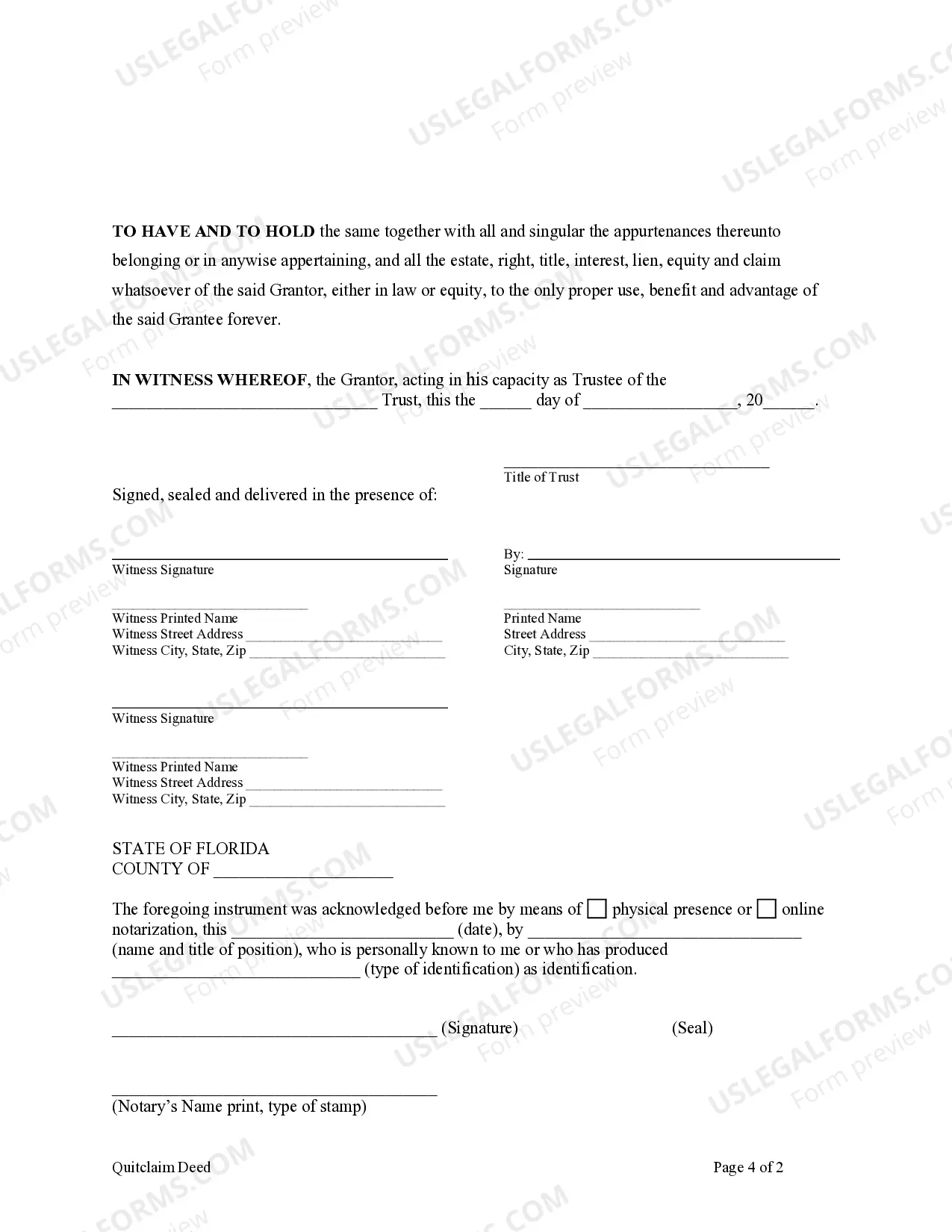

A Broward Florida Quitclaim Deed — Trust to Individual is a legal document used for transferring ownership of property from a trust to an individual in Broward County, Florida. This type of deed is often used when a property that was held in a trust is being transferred to an individual beneficiary or a new owner who is not part of the trust. A quitclaim deed is a legal instrument used to transfer the interest or claim that a person holds in a property, without offering any warranties or guarantees on the property title. When the property is held in a trust, the trustee has the authority to execute the quitclaim deed on behalf of the trust. There are different scenarios in which a Broward Florida Quitclaim Deed — Trust to Individual may be used. These include: 1. Trust Distribution: When a trust is being dissolved or terminated, a quitclaim deed may be used to distribute the trust's property to its beneficiaries individually. This could occur in cases of trust termination, when the trust purpose has been fulfilled, or when the trust is being dissolved for any other valid reason. 2. Beneficiary Buyout: In some cases, a beneficiary of a trust may wish to acquire the property held by the trust. A Broward Florida Quitclaim Deed — Trust to Individual can be used to officially transfer the property to the beneficiary, allowing them to become the sole owner. 3. Non-Trustee Sale: If a property held in a trust needs to be sold, the trustee may use a Broward Florida Quitclaim Deed — Trust to Individual to transfer the property to a buyer who is not part of the trust. This typically involves the trustee conveying the property to an individual buyer, who will then become the new owner. It is important to note that a quitclaim deed does not provide any warranties or guarantees on the property title. It simply transfers the interest or claim that the trustee holds in the property to the individual without making any assurances regarding its title status. Therefore, it is advisable for both parties involved to conduct a thorough title search before executing the quitclaim deed to ensure there are no title defects or encumbrances. In summary, a Broward Florida Quitclaim Deed — Trust to Individual is a legal document used for transferring ownership of a property from a trust to an individual beneficiary or a new owner. It is commonly used in cases of trust distribution, beneficiary buyouts, or non-trustee sales. However, it is important to proceed with caution and conduct proper due diligence to verify the title status of the property.