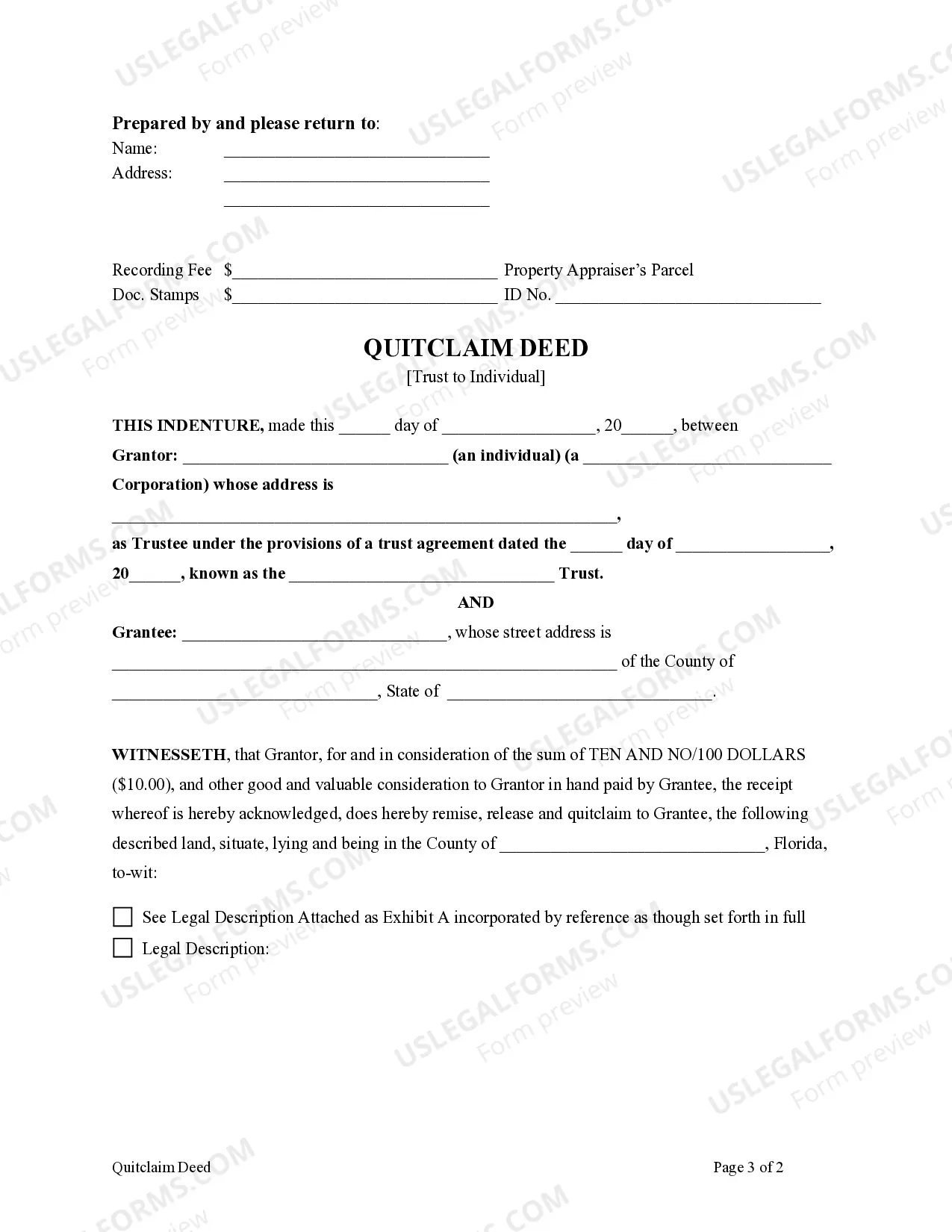

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual.

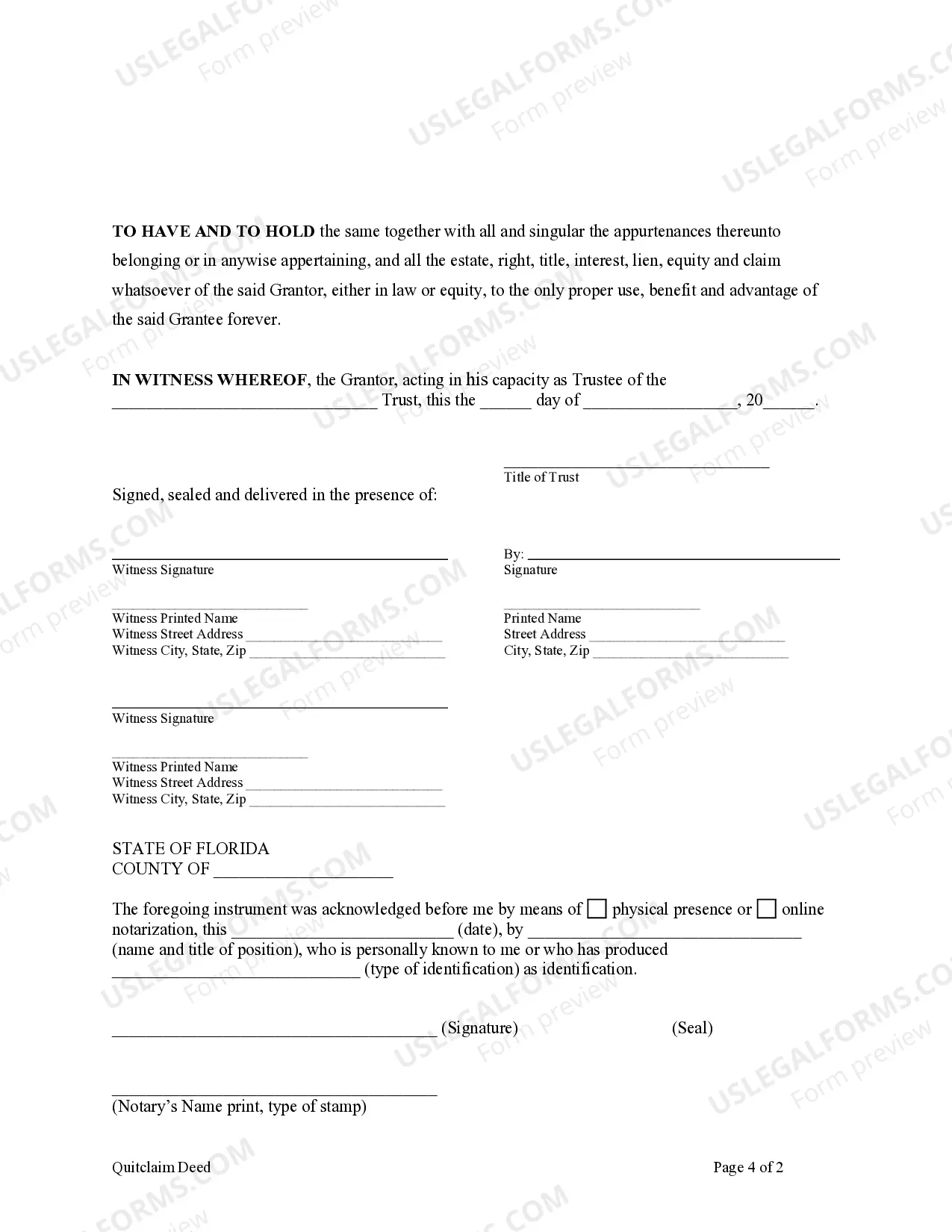

A Palm Beach Florida Quitclaim Deed — Trust to Individual is a legal document that transfers ownership of real estate from a trust to an individual. This type of deed is commonly used when a property is held in a trust and the trustee wants to transfer ownership to a beneficiary or a new owner. A quitclaim deed is a simple and straightforward method of transferring property without warranty or guarantee of clear title, making it important for parties involved to conduct thorough due diligence before proceeding. There are several variations of the Palm Beach Florida Quitclaim Deed — Trust to Individual, each designed to cater to specific situations. Some commonly used types include: 1. Trustee-to-Individual Quitclaim Deed: This type of deed is used when the trustee of a trust, acting on behalf of the trust, transfers the property to an individual beneficiary or a new owner. 2. Revocable Living Trust-to-Individual Quitclaim Deed: This deed is utilized when the property is held in a revocable living trust and the granter (creator) of the trust wants to transfer ownership to an individual, either during their lifetime or upon their death. 3. Irrevocable Trust-to-Individual Quitclaim Deed: If the property is held in an irrevocable trust, this type of quitclaim deed is employed to transfer ownership to an individual. Irrevocable trusts typically have strict guidelines and may involve complex legal considerations. 4. Testamentary Trust-to-Individual Quitclaim Deed: This deed is used when property transfers from a testamentary trust, which is established through a will, to an individual. These types of trusts take effect only after the granter's death. It's crucial to consult with legal professionals, such as real estate attorneys or estate planning attorneys, when dealing with a Palm Beach Florida Quitclaim Deed — Trust to Individual. They can provide accurate guidance, review the deed, and ensure all necessary requirements and legal obligations are met to protect all parties involved. Conducting a title search is also highly recommended ensuring the property's ownership and boundaries are accurately reflected in the deed.