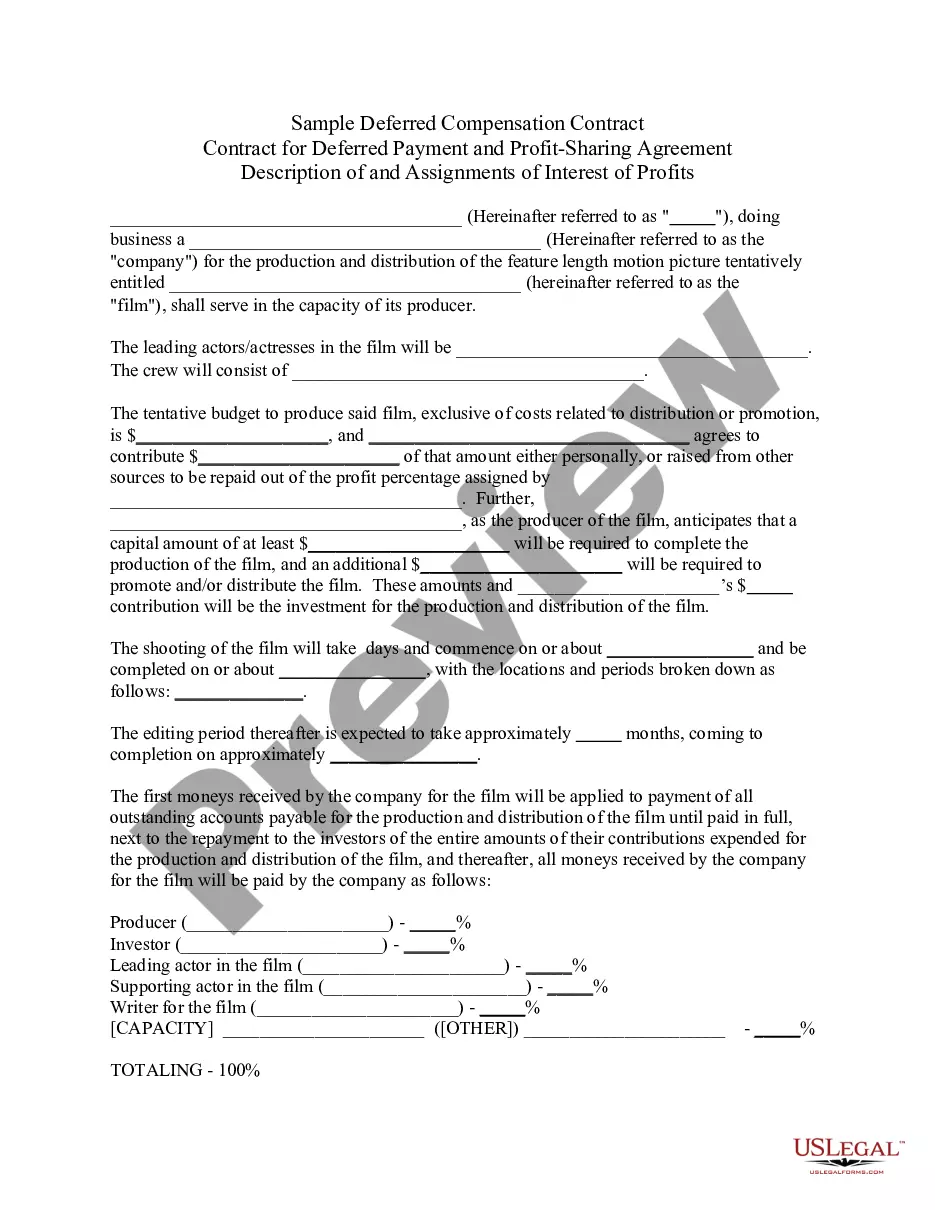

Hollywood, Florida Application for Self-Insurance: Explained If you're a resident or business owner in Hollywood, Florida, you might have come across the concept of self-insurance. Self-insurance is a unique approach where individuals, businesses, or organizations take on the responsibility of providing coverage for potential risks rather than relying on traditional insurance carriers. To facilitate the process, the Hollywood, Florida application for self-insurance was introduced. The Hollywood, Florida application for self-insurance serves as a comprehensive platform for individuals and businesses to apply and establish their own self-insurance program. This application allows interested parties to tailor their coverage, determine the level of risk they are willing to bear, and potentially save on insurance premium costs. By bypassing conventional insurance providers, self-insurance offers greater flexibility and control over coverage needs. One type of Hollywood, Florida application for self-insurance is designed for individual homeowners. This application allows homeowners to take charge of their property coverage, including health, liability, and property damage, by establishing a personalized self-insurance plan. Homeowners can assess their risks, choose adequate coverage limits, and develop strategies to handle any potential claims directly. Another type of Hollywood, Florida application for self-insurance targets businesses and organizations. These applications cater to small businesses, large corporations, and even nonprofit organizations. By opting for self-insurance, businesses can customize their coverage based on their industry-specific risks, financial capabilities, and risk management strategies. It empowers businesses to assume greater control over their risk exposure and claim handling processes. Key aspects covered in the Hollywood, Florida application for self-insurance include policy information, risk assessments, financial statements, and claims management strategies. Applicants must provide detailed information about their assets, liabilities, and potential risks they aim to cover through their self-insurance program. Additionally, applicants need to demonstrate their financial stability and ability to handle potential claims through proper documentation. When applying for the Hollywood, Florida application for self-insurance, it is essential to carefully consider the benefits, drawbacks, and legal requirements associated with self-insurance. While self-insurance brings flexibility and potential cost savings, it also calls for a meticulous understanding of the risks involved and the financial capacity to handle unexpected claims effectively. In conclusion, the Hollywood, Florida application for self-insurance offers a unique opportunity for individuals and businesses to take control of their coverage needs. By leveraging this application, residents and businesses in Hollywood, Florida can tailor their insurance plans, manage their risks more effectively, and potentially save on premiums. Whether it's for homeowners or businesses, self-insurance can be a viable option worth exploring.

Hollywood Florida Application for Self-Insurance

Description

How to fill out Hollywood Florida Application For Self-Insurance?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Hollywood Florida Application for Self-Insurance? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and county.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Hollywood Florida Application for Self-Insurance conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is intended for.

- Start the search over if the form isn’t good for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Hollywood Florida Application for Self-Insurance in any available format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal papers online once and for all.

Form popularity

FAQ

You can apply to be self-insured once you meet specific financial criteria established by Florida law. Generally, individuals must have sufficient assets to cover potential liabilities related to their vehicles. Completing the Hollywood Florida Application for Self-Insurance is the official step to take when you are ready to take on this responsibility.

Absolutely, you can be self-insured on your car by following the proper steps. Start by completing the Hollywood Florida Application for Self-Insurance to demonstrate to the state your ability to cover liabilities. This option is particularly appealing to those who have a substantial savings account and prefer to manage their own risk.

Self-insuring can be a wise decision, especially for those who have the financial means to cover potential expenses. If you carefully assess your risk and make a Hollywood Florida Application for Self-Insurance, you can benefit from lower costs and more control over your policy. However, it's crucial to be aware of your financial readiness and the potential for unexpected costs.

Yes, you can opt to insure your vehicle yourself through a self-insurance approach. By completing the Hollywood Florida Application for Self-Insurance, you take responsibility for your own losses rather than relying on traditional insurance. This method allows you to save on premiums but requires you to have sufficient funds to cover any damages or accidents.

To become self-insured in Florida, you should start by submitting a Hollywood Florida Application for Self-Insurance to the state's Department of Financial Services. You will need to demonstrate your financial capability to cover potential losses. Additionally, maintain proper documentation to support your application, and ensure that you meet all required criteria outlined by the state.

Self-insurance is often referred to as a risk management strategy. When you fill out the Hollywood Florida Application for Self-Insurance, you officially acknowledge this approach. It essentially means you are setting aside your own funds to cover potential losses instead of relying on an insurance provider. This method emphasizes personal accountability and financial stability.

In many cases, being self-insured can lead to overall savings compared to maintaining traditional insurance. The Hollywood Florida Application for Self-Insurance enables you to avoid premium payments, which can accumulate over time. However, you must consider potential financial risks effectively. Having a strategy in place for unexpected costs will also help you assess the long-term financial implications.

Yes, you can choose to self-insure specific assets while opting for traditional insurance on others, like your car. A Hollywood Florida Application for Self-Insurance allows you to manage risks for assets that may not require standard coverage. This flexibility can help you allocate your financial resources more effectively. Just ensure you carefully evaluate the risks involved in the decision.

Self-insurance can be a smart choice for many individuals and businesses, especially in Hollywood, Florida. By filling out the Hollywood Florida Application for Self-Insurance, you take control of your financial risk rather than relying on traditional insurance. This method allows you to save on premium costs while preparing funds for future needs. However, it's crucial to ensure you have sufficient savings and a clear understanding of your potential liabilities.

Homeowners insurance can provide peace of mind and financial security, even for those who fully own their homes. It protects against damages and liabilities that could lead to significant out-of-pocket expenses. While some may consider self-insuring, remember that having coverage offers an extra layer of protection. The Hollywood Florida Application for Self-Insurance can help you compare the benefits of both options.