Tampa, Florida offers an Application for Self-Insurance that allows individuals and businesses to take control of their insurance coverage. This application provides an opportunity for Tampa residents to assume the role of an insurer, managing their own risks and avoiding the traditional route of relying on external insurance providers. The Tampa Florida Application for Self-Insurance is a comprehensive tool that enables applicants to evaluate their specific insurance needs and design customized coverage plans. By self-insuring, individuals and businesses have the flexibility to tailor coverage to their unique requirements, without being bound by the restrictions and limitations of standard insurance policies. Benefits of the Tampa Florida Application for Self-Insurance include cost savings, increased control over claims management, and the ability to retain any unused premiums. Being self-insured allows applicants to eliminate the overhead costs associated with external insurance providers, potentially resulting in significant financial savings. Moreover, self-insured individuals and businesses can directly oversee the claims process and quickly address any issues or concerns, leading to faster and more efficient resolutions. There are various types of Tampa Florida Applications for Self-Insurance to cater to different needs and industries, including: 1. Tampa Florida Personal Self-Insurance Application: This type of application is designed for individuals seeking self-insurance options for personal assets, such as homes, vehicles, and personal belongings. It offers a way to manage risks associated with potential damages, theft, or accidents. 2. Tampa Florida Business Self-Insurance Application: Designed for businesses of all sizes, this application allows organizations to assume control over their insurance coverage. It is suitable for managing risks related to property, liability, workers' compensation, and other business-specific risks. 3. Tampa Florida Healthcare Self-Insurance Application: This specialized application caters to healthcare providers, enabling them to self-insure against professional liabilities, medical malpractice, and other industry-specific risks. 4. Tampa Florida Workers' Compensation Self-Insurance Application: Aimed at employers, this application allows businesses to self-insure against work-related injuries and occupational illnesses, providing an alternative to traditional workers' compensation insurance. In summary, the Tampa Florida Application for Self-Insurance empowers both individuals and businesses to take charge of their insurance needs. With various types of applications available, Tampa residents can find customized solutions tailored to their specific requirements and industry risks. By choosing self-insurance, applicants can enjoy cost savings, enhanced control over claims management, and a more tailored approach to risk mitigation.

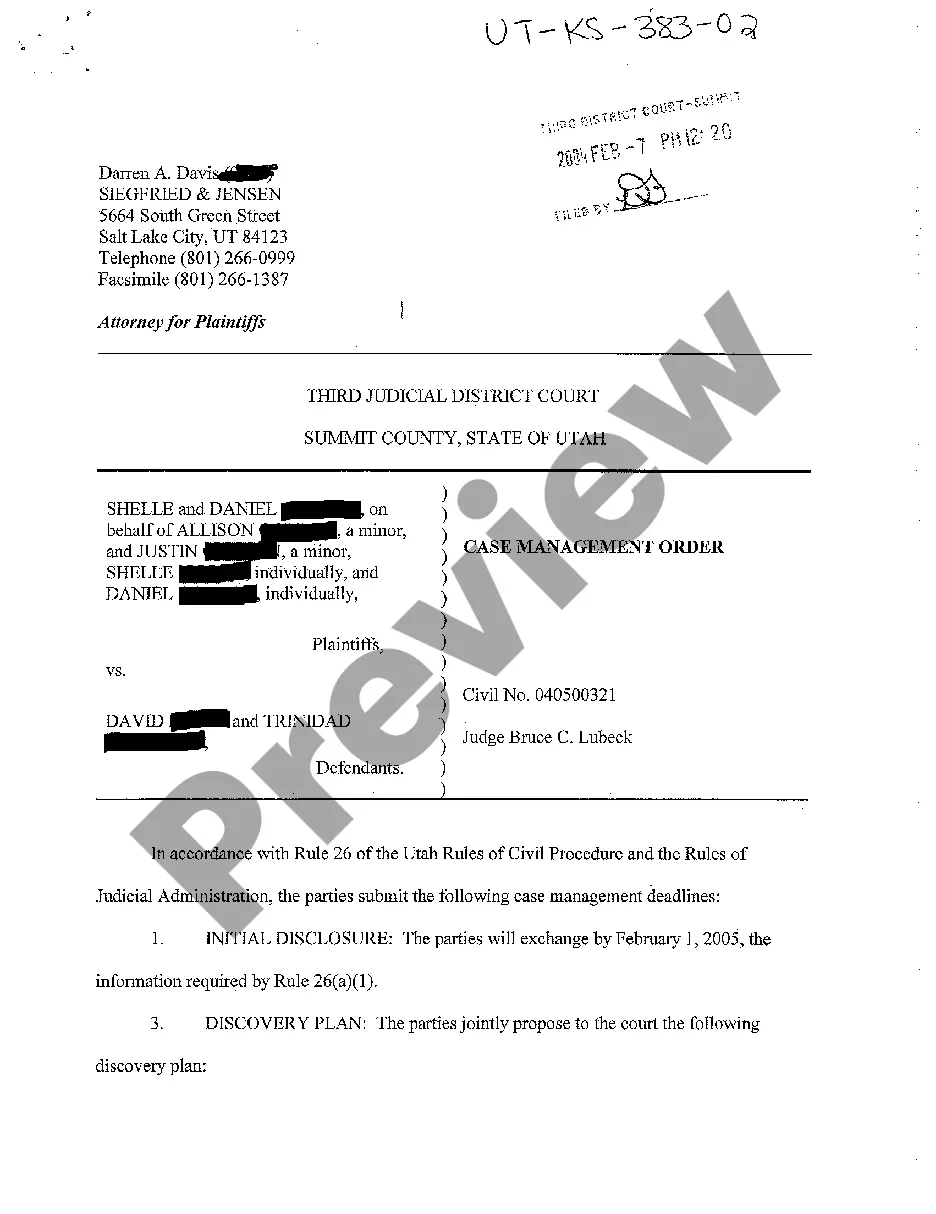

Tampa Florida Application for Self-Insurance

Description

How to fill out Tampa Florida Application For Self-Insurance?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Tampa Florida Application for Self-Insurance or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Tampa Florida Application for Self-Insurance adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Tampa Florida Application for Self-Insurance is proper for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!