Coral Springs, Florida is home to the Self-Insurance Unit Statistical Report, an important tool used by insurance professionals and policymakers to assess the effectiveness of self-insurance programs in the area. This comprehensive report provides detailed insights and data analysis on various aspects of self-insurance and its impact on the local insurance market. The Coral Springs Florida Self-Insurance Unit Statistical Report offers a range of statistical indicators and metrics that help interested parties understand self-insurance trends, costs, claims, and risk management strategies. By examining this report, insurance companies, self-insured employers, and regulatory authorities can gain a comprehensive understanding of the self-insurance landscape in Coral Springs, Florida. The report includes key information such as the number of self-insured entities, their industry sectors, and the size of their self-insurance programs. It also provides statistical data on policies, premiums, claims, and the overall financial performance of self-insured entities within the area. This in-depth analysis assists stakeholders in assessing the financial stability and viability of the self-insurance market in Coral Springs, Florida. Given the complexity and diversity of self-insurance programs, the Coral Springs Florida Self-Insurance Unit Statistical Report further categorizes different types of self-insured entities. These categories may include various industries such as healthcare, construction, manufacturing, and more. By segmenting the data, the report enables a more detailed analysis of how different sectors within the Coral Springs community implement and manage their self-insurance programs. Moreover, for those interested in specific aspects of self-insurance, the Coral Springs Florida Self-Insurance Unit Statistical Report may have additional sub-reports or sections that specialize in particular areas. For example, there might be specific reports focusing on the cost dynamics of self-insuring medical practices or the risk management strategies employed by construction companies in the Coral Springs area. In conclusion, the Coral Springs Florida Self-Insurance Unit Statistical Report is a comprehensive resource providing detailed insights into the self-insurance landscape in the region. With its various statistical indicators, segmented data, and potentially specialized subsections, this report serves as a valuable tool for insurance professionals, self-insured employers, and policymakers in assessing and understanding the self-insurance market in Coral Springs, Florida.

Coral Springs Florida Self-Insurance Unit Statistical Report

Description

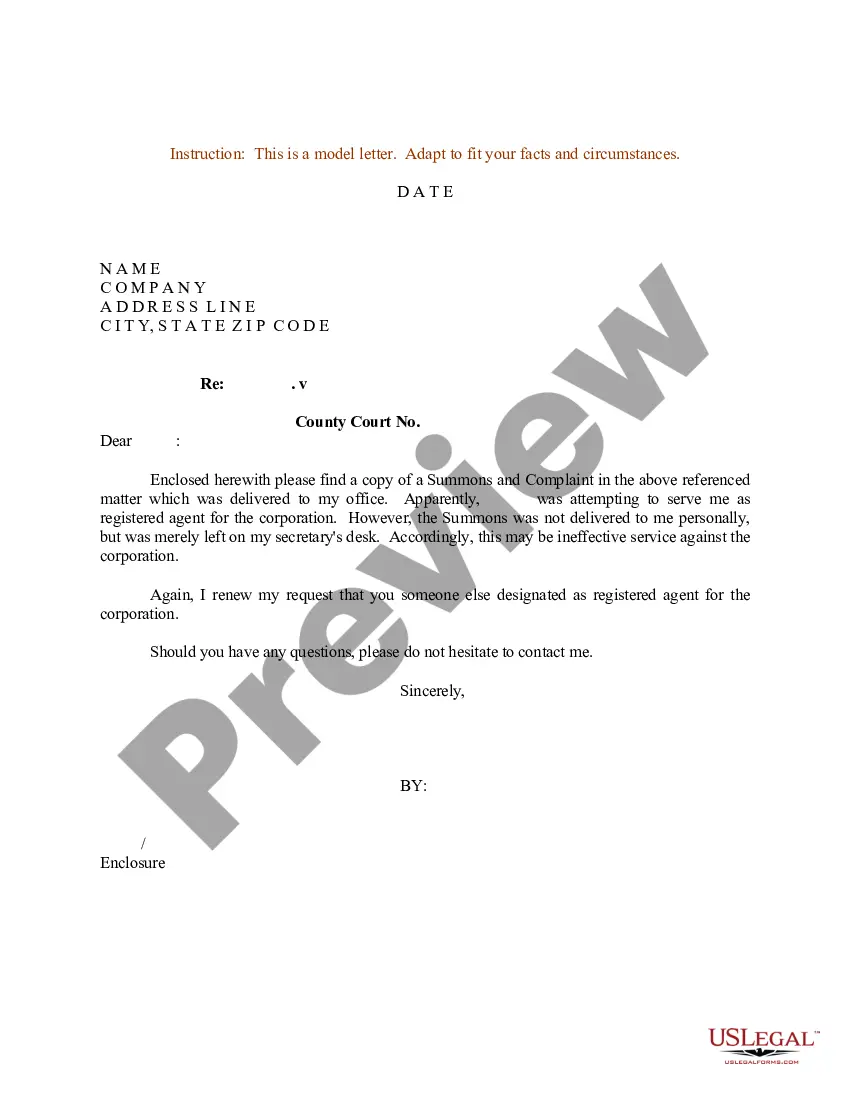

How to fill out Coral Springs Florida Self-Insurance Unit Statistical Report?

Make use of the US Legal Forms and have instant access to any form you require. Our useful platform with a huge number of documents simplifies the way to find and get almost any document sample you need. It is possible to download, complete, and sign the Coral Springs Florida Self-Insurance Unit Statistical Report in a couple of minutes instead of browsing the web for several hours seeking the right template.

Using our catalog is a wonderful way to improve the safety of your document submissions. Our experienced legal professionals on a regular basis review all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and polices.

How do you obtain the Coral Springs Florida Self-Insurance Unit Statistical Report? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the instructions listed below:

- Open the page with the template you need. Make certain that it is the form you were looking for: check its name and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Choose the format to obtain the Coral Springs Florida Self-Insurance Unit Statistical Report and change and complete, or sign it for your needs.

US Legal Forms is probably the most extensive and reliable document libraries on the web. Our company is always happy to help you in any legal process, even if it is just downloading the Coral Springs Florida Self-Insurance Unit Statistical Report.

Feel free to benefit from our service and make your document experience as straightforward as possible!