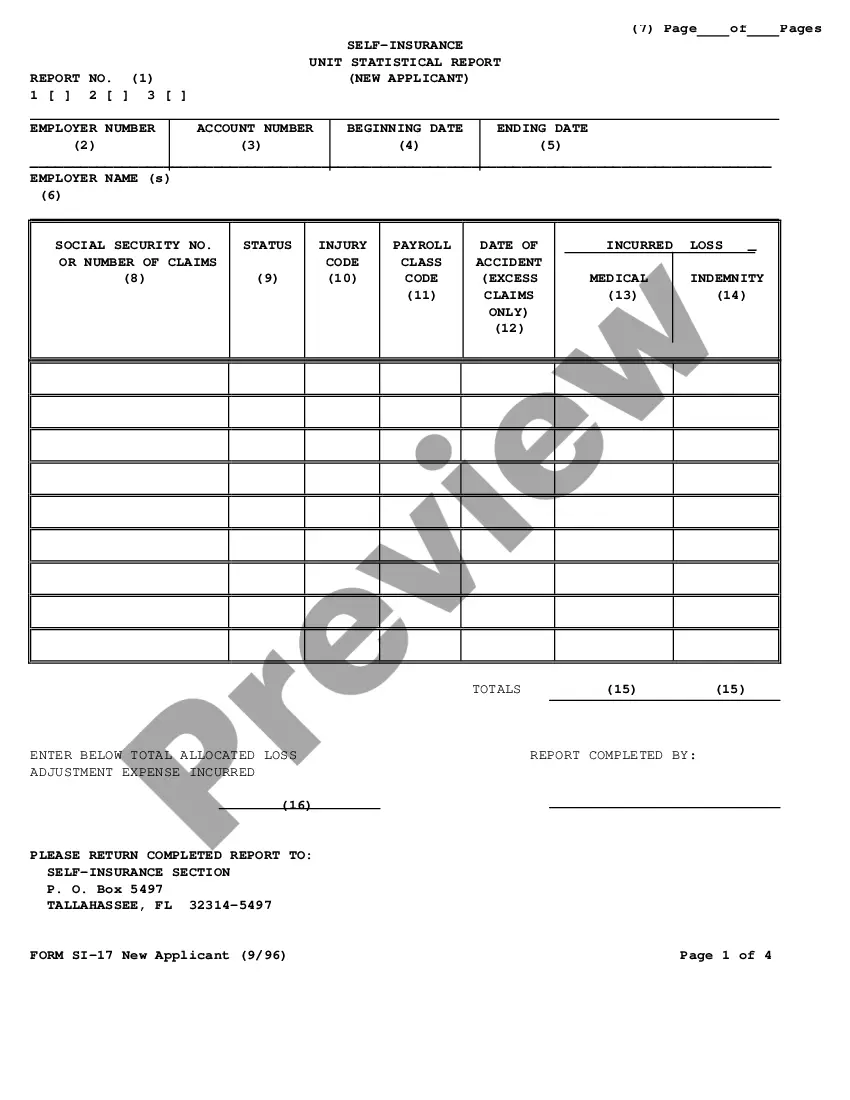

The Hillsborough Florida Self-Insurance Unit Statistical Report is a comprehensive document that provides detailed information and analysis regarding the self-insurance practices within Hillsborough County, Florida. This report plays a vital role in understanding and evaluating the insurance landscape within the county. The Statistical Report encompasses various aspects of self-insurance, including coverage types, claim frequency and severity, premium rates, financial analysis, and trends over time. It is a valuable resource for insurance companies, policymakers, and other stakeholders operating in the insurance industry. Different types of Hillsborough Florida Self-Insurance Unit Statistical Reports can be categorized based on specific aspects or areas of focus. Some of these reports may include: 1. Coverage Type Report: This report highlights the different types of self-insurance coverage prevalent within Hillsborough County. It provides insights into the various areas where self-insurance is commonly employed, such as workers' compensation, general liability, property, or automobile insurance. 2. Claims Report: This report focuses on claim-related data and statistics, including claim frequency and severity. It examines the number of claims filed, the types of losses incurred, and the average cost per claim. This information helps identify trends and patterns, enabling insurance companies to assess risk and adjust premiums accordingly. 3. Premium Rate Report: This report presents an analysis of premium rates charged for self-insurance coverage in Hillsborough County. It examines the factors influencing premium calculations and provides insights into market trends, allowing companies to benchmark their rates against industry standards. 4. Financial Analysis Report: This report delves into the monetary aspects of self-insurance within the county. It examines the financial performance of self-insured entities, including their assets, liabilities, and reserves. By evaluating the financial strength, solvency, and liquidity of self-insured entities, this report helps ensure that they can fulfill their obligations in case of claims. 5. Trend Analysis Report: This report focuses on identifying and analyzing long-term trends within Hillsborough County's self-insurance sector. It examines patterns in claims, premiums, coverage types, and other relevant factors over multiple years. Trend analysis aids in forecasting future developments and assists insurance companies in making informed decisions based on historical data. In conclusion, the Hillsborough Florida Self-Insurance Unit Statistical Report is a comprehensive document that provides detailed insights into the self-insurance practices within the county. By offering extensive information on various aspects of self-insurance, these reports facilitate effective decision-making and risk management within the insurance industry.

The Hillsborough Florida Self-Insurance Unit Statistical Report is a comprehensive document that provides detailed information and analysis regarding the self-insurance practices within Hillsborough County, Florida. This report plays a vital role in understanding and evaluating the insurance landscape within the county. The Statistical Report encompasses various aspects of self-insurance, including coverage types, claim frequency and severity, premium rates, financial analysis, and trends over time. It is a valuable resource for insurance companies, policymakers, and other stakeholders operating in the insurance industry. Different types of Hillsborough Florida Self-Insurance Unit Statistical Reports can be categorized based on specific aspects or areas of focus. Some of these reports may include: 1. Coverage Type Report: This report highlights the different types of self-insurance coverage prevalent within Hillsborough County. It provides insights into the various areas where self-insurance is commonly employed, such as workers' compensation, general liability, property, or automobile insurance. 2. Claims Report: This report focuses on claim-related data and statistics, including claim frequency and severity. It examines the number of claims filed, the types of losses incurred, and the average cost per claim. This information helps identify trends and patterns, enabling insurance companies to assess risk and adjust premiums accordingly. 3. Premium Rate Report: This report presents an analysis of premium rates charged for self-insurance coverage in Hillsborough County. It examines the factors influencing premium calculations and provides insights into market trends, allowing companies to benchmark their rates against industry standards. 4. Financial Analysis Report: This report delves into the monetary aspects of self-insurance within the county. It examines the financial performance of self-insured entities, including their assets, liabilities, and reserves. By evaluating the financial strength, solvency, and liquidity of self-insured entities, this report helps ensure that they can fulfill their obligations in case of claims. 5. Trend Analysis Report: This report focuses on identifying and analyzing long-term trends within Hillsborough County's self-insurance sector. It examines patterns in claims, premiums, coverage types, and other relevant factors over multiple years. Trend analysis aids in forecasting future developments and assists insurance companies in making informed decisions based on historical data. In conclusion, the Hillsborough Florida Self-Insurance Unit Statistical Report is a comprehensive document that provides detailed insights into the self-insurance practices within the county. By offering extensive information on various aspects of self-insurance, these reports facilitate effective decision-making and risk management within the insurance industry.