The Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant) is a critical document that provides essential information about self-insurance applicants in the city of Lakeland, Florida. This report is designed to track and analyze the statistical data pertaining to new applicants seeking self-insurance coverage. Self-insurance refers to a risk management strategy where an individual or organization assumes the financial responsibility for potential losses instead of relying on traditional insurance policies. In Lakeland, Florida, the self-insurance unit works diligently to assess and evaluate new applicants intending to embrace this alternative approach. The Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant) encompasses various types of information and data, providing invaluable insights for both the applicants and the governing bodies involved. Some key areas covered in this report may include: 1. Applicant Details: The report contains comprehensive information on the new applicant's identity, contact details, and nature of their business or personal venture. 2. Insurance Coverage Sought: This section outlines the specific type of insurance coverage that the applicant is seeking. It may include general liability insurance, workers' compensation, auto insurance, property insurance, or any other self-insurance category relevant to their needs. 3. Financial Assessments: The report assesses the financial stability of the applicant by analyzing their financial statements, credit scores, and any applicable debt obligations. This helps in determining the applicant's ability to meet potential claim payments if self-insurance is granted. 4. Risk Assessment: A crucial aspect of the report involves assessing the risks associated with the new applicant's business operations or personal activities. Factors such as past claims history, potential hazards, industry risks, and safety measures are evaluated to determine the applicant's eligibility and potential self-insurance premiums. 5. Claim History: The report reviews the applicant's prior claim history, including the number of claims filed, the severity of those claims, and the related costs. This information gives insights into the applicant's risk management practices and helps establish premium rates. 6. Compliance with Regulations: The report also examines the applicant's adherence to state and federal regulations regarding self-insurance. This ensures that all legal requirements are met, and the applicant can lawfully operate under the self-insurance framework. It's important to note that the Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant) may have different variations or subcategories depending on the unique needs and requirements of different industries or sectors. Examples of specialized reports could include the construction sector self-insurance statistical report, healthcare industry self-insurance statistical report, or transportation industry self-insurance statistical report. These variations tailor the statistical report to match the specific risks and challenges associated with each industry, allowing for a more accurate assessment of applicants and better serving the local self-insurance regulatory framework. In conclusion, the Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant) serves as a comprehensive tool for evaluating and processing new self-insurance applicants. It assists both applicants and regulatory bodies in making informed decisions about self-insurance coverage, considering factors such as financial stability, risk assessment, past claim history, and regulatory compliance.

Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant)

Description

How to fill out Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant)?

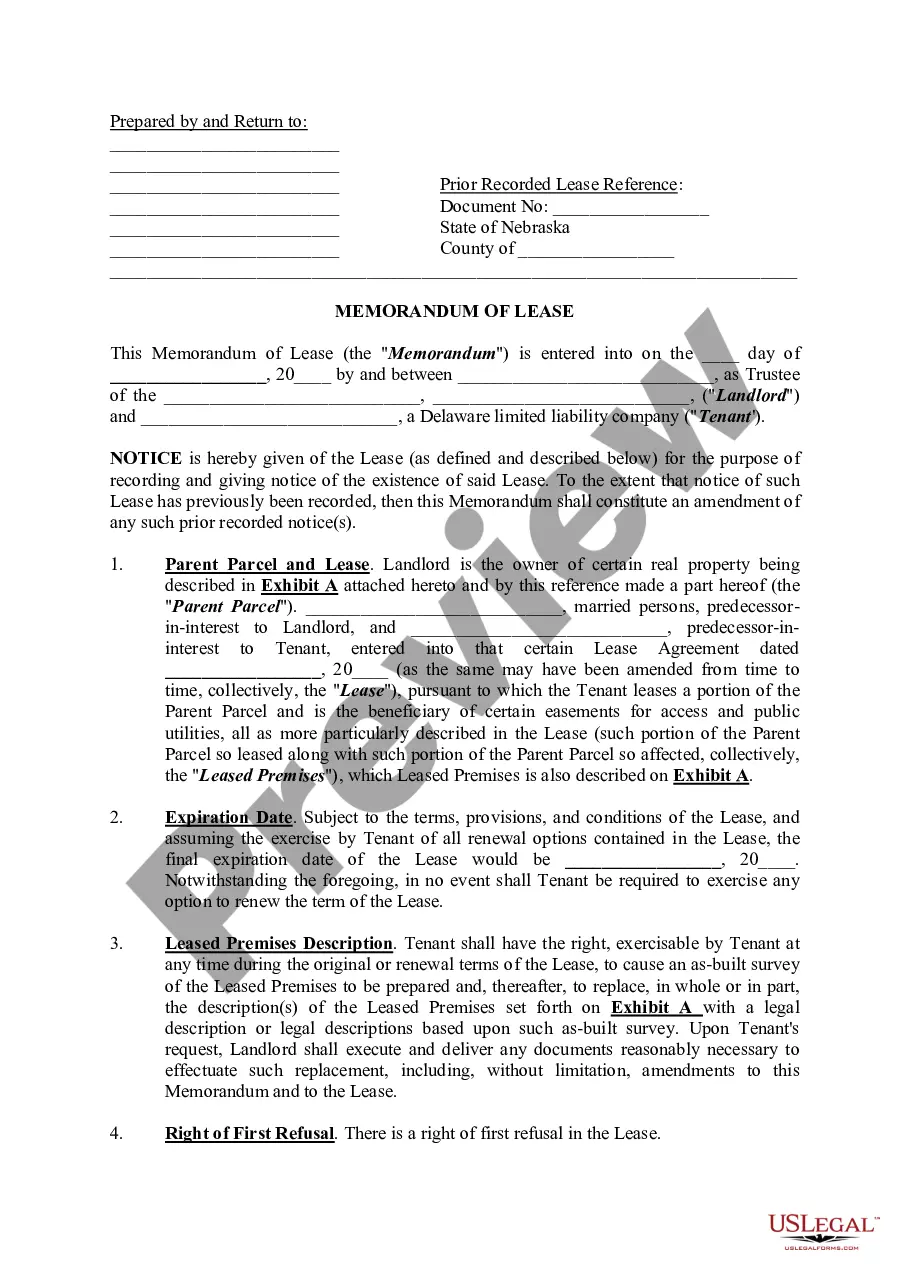

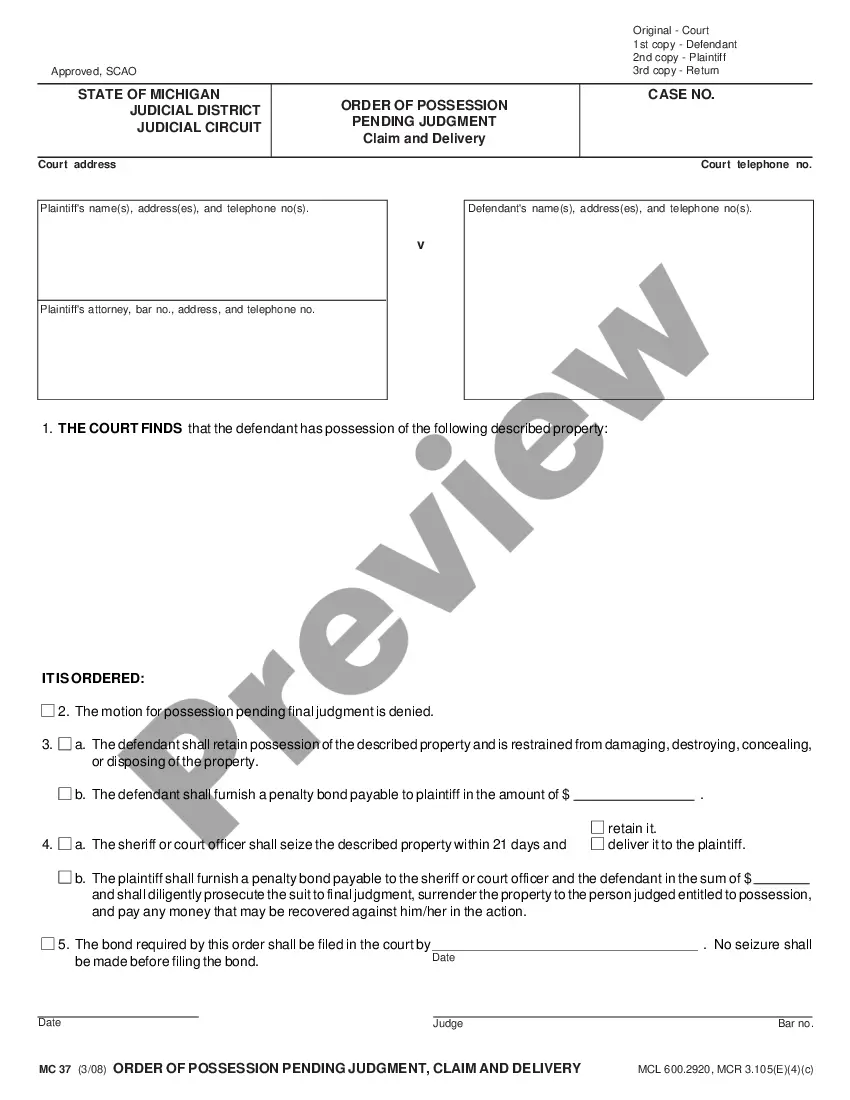

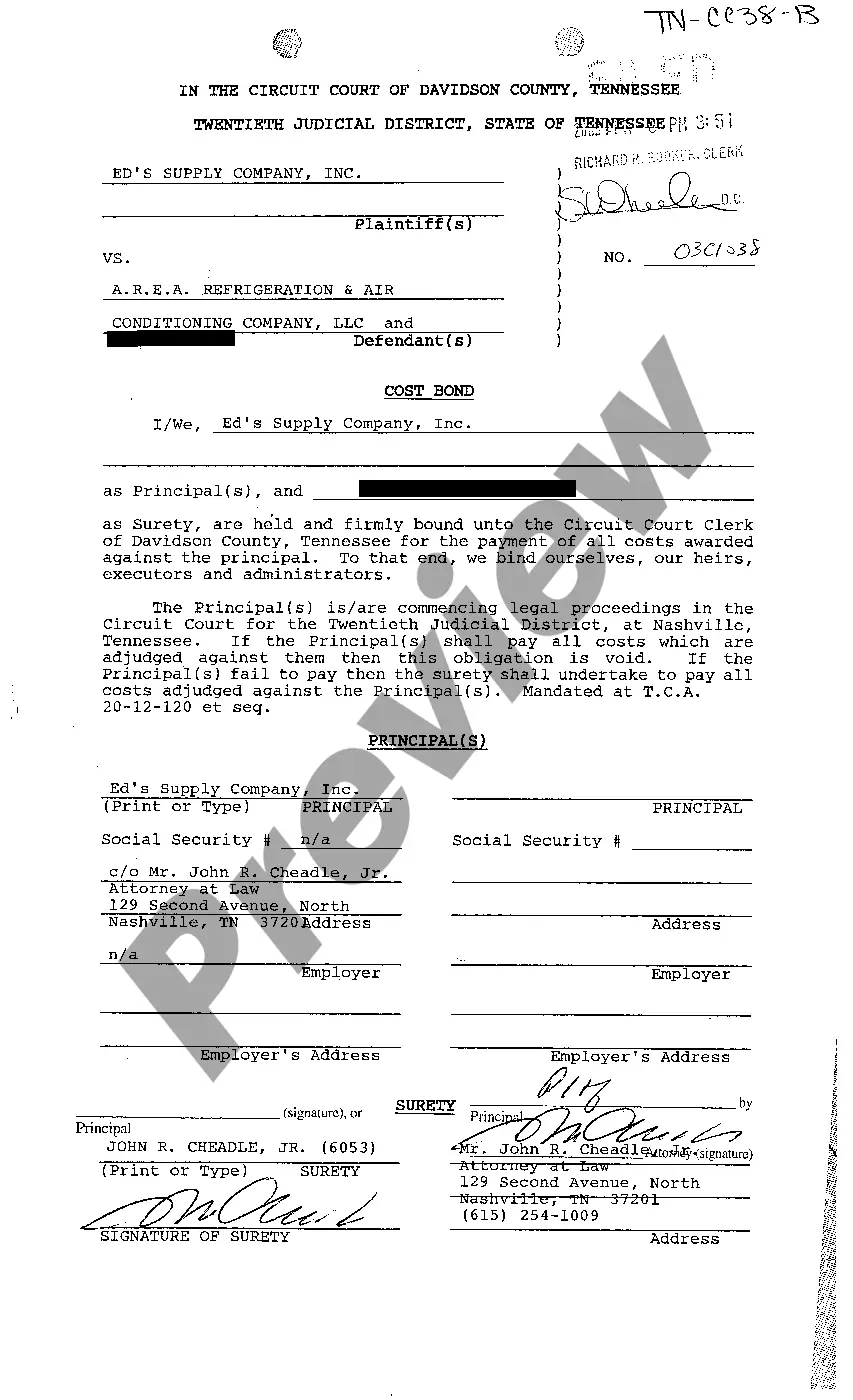

If you are looking for a relevant form, it’s impossible to find a better service than the US Legal Forms website – probably the most extensive libraries on the web. With this library, you can find thousands of form samples for company and personal purposes by categories and regions, or key phrases. With the advanced search feature, discovering the most up-to-date Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant) is as elementary as 1-2-3. Additionally, the relevance of each and every document is confirmed by a team of expert attorneys that on a regular basis check the templates on our website and update them in accordance with the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant) is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have discovered the form you require. Check its description and utilize the Preview option (if available) to see its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to find the needed record.

- Affirm your selection. Choose the Buy now option. After that, choose the preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the acquired Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant).

Each template you save in your account has no expiry date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to have an extra duplicate for modifying or creating a hard copy, you may return and save it once again anytime.

Make use of the US Legal Forms extensive library to get access to the Lakeland Florida Self-Insurance Unit Statistical Report (New Applicant) you were seeking and thousands of other professional and state-specific templates on one platform!

Form popularity

FAQ

Injury/illness report. Employers typically request that employees report occupational injuries/illnesses immediately but no later than 24 to 48 hours after the incident. This allows an employer to timely investigate the matter and take safety measures to avoid further incidents.

Technically, one does not have to hire an attorney for a Florida Workers Compensation accident. However, what we would advise is that you can anticipate the insurance carrier has panel of attorneys that they're consulting with on a regular basis.

SELF-INSURANCE CERTIFICATE (BASED ON NET WORTH) A notarized copy of a financial statement (balance sheet indicating assets and liabilities) showing a net unencumbered worth of at least $40,000, form attached.Provide the driver license and social security number of the certificate holder(s).

Steps to File a Workers' Compensation Claim in Florida Write Down Details of What Happened and Obtain Available Evidence.Get Medical Treatment.Report Your Injury to Your Employer.Follow Up.Document Everything.Be Careful when Talking to the Insurance Company.Try to Resolve Any Disputes, Then File a Petition.

Florida's Rules Regarding Self-Insurance To qualify for self-insurance, a Florida motorist must provide a notarized financial statement confirming that their net worth is no less than $40,000. The Florida motorist must have both a social security number and a driver's license, and both must be current and active.

Florida's Rules Regarding Self-Insurance To qualify for self-insurance, a Florida motorist must provide a notarized financial statement confirming that their net worth is no less than $40,000. The Florida motorist must have both a social security number and a driver's license, and both must be current and active.

Self-insurance involves setting aside your own money to pay for a possible loss instead of purchasing insurance and expecting an insurance company to reimburse you.

Workers' comp pays for all medical care that's necessary to treat a work-related injury or illness, as long as your treatment is prescribed by the treating doctor and authorized by the insurance company. You're also entitled to the cost of traveling to and from doctor's appointments and to get prescribed medicine.

In most Florida workers compensation claims, injured workers have two (2) years from the date of accident to file a Petition for Benefits. However, this two year limitation can be extended one (1) year everytime an injured worker receives a medical or indemnity benefit from the workers compensation insurance company.

Any vehicle with a current Florida registration must: be insured with PIP and PDL insurance at the time of vehicle registration. have a minimum of $10,000 in PIP AND a minimum of $10,000 in PDL.