The St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant) is a comprehensive document that plays a vital role in the self-insurance process within the city. This report is primarily designed for new applicants seeking to establish self-insurance coverage in St. Petersburg, Florida. It aims to gather and analyze crucial statistical data necessary for evaluating and approving a new applicant's self-insurance eligibility. The St. Petersburg Florida Self-Insurance Unit Statistical Report aids in assessing the financial stability, risk potential, and overall self-insurance capacity of an applicant. It contains an array of pertinent information, ensuring a thorough evaluation of the applicant's ability to effectively handle potential claims and liabilities. The report acts as a foundation for decision-making regarding the applicant's eligibility for self-insurance. Key components of the St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant) may include: 1. Financial Statements: The report requires applicants to provide detailed financial statements, including balance sheets, income statements, and cash flow statements. These statements help assess the financial strength and sustainability of the applicant. 2. Historical Claims Data: Applicants need to submit historical claims data, including the number of claims filed, their types, and associated costs. This information enables the evaluation of the applicant's risk management history and its impact on self-insurance feasibility. 3. Risk Assessment: The report may include a comprehensive risk assessment, identifying potential risks and hazards specific to the applicant's industry or line of business. It helps determine whether the applicant has effective risk mitigation strategies in place. 4. Employee Information: The report may request detailed information about the applicant's workforce, such as employee count, job roles, and potential on-site hazards. This is essential for calculating the projected self-insurance premiums and understanding the nature of potential claims. 5. Loss Control Measures: The report may inquire about any loss control measures implemented by the applicant. These measures can include safety policies, training programs, and inspections designed to minimize workplace accidents and mitigate potential risks. 6. Insurance History: The applicant is required to provide information about their prior insurance coverage, including policy details and claims history. This helps evaluate the applicant's insurance track record and the likelihood of successful self-insurance implementation. Different types of St. Petersburg Florida Self-Insurance Unit Statistical Reports tailored for new applicants might include variations in data requirements or additional sections based on specific industries or risk profiles. It is crucial for applicants to carefully review the specific requirements outlined by the St. Petersburg Florida Self-Insurance Unit to ensure accurate and complete submission of information. Overall, the St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant) is a vital tool for assessing the suitability of new applicants for self-insurance coverage in the city. Its thorough analysis of financial, historical claims, risk management, and insurance-related information provides a comprehensive overview, enabling the evaluation of an applicant's eligibility, financial stability, and capacity to handle potential liabilities.

St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant)

Description

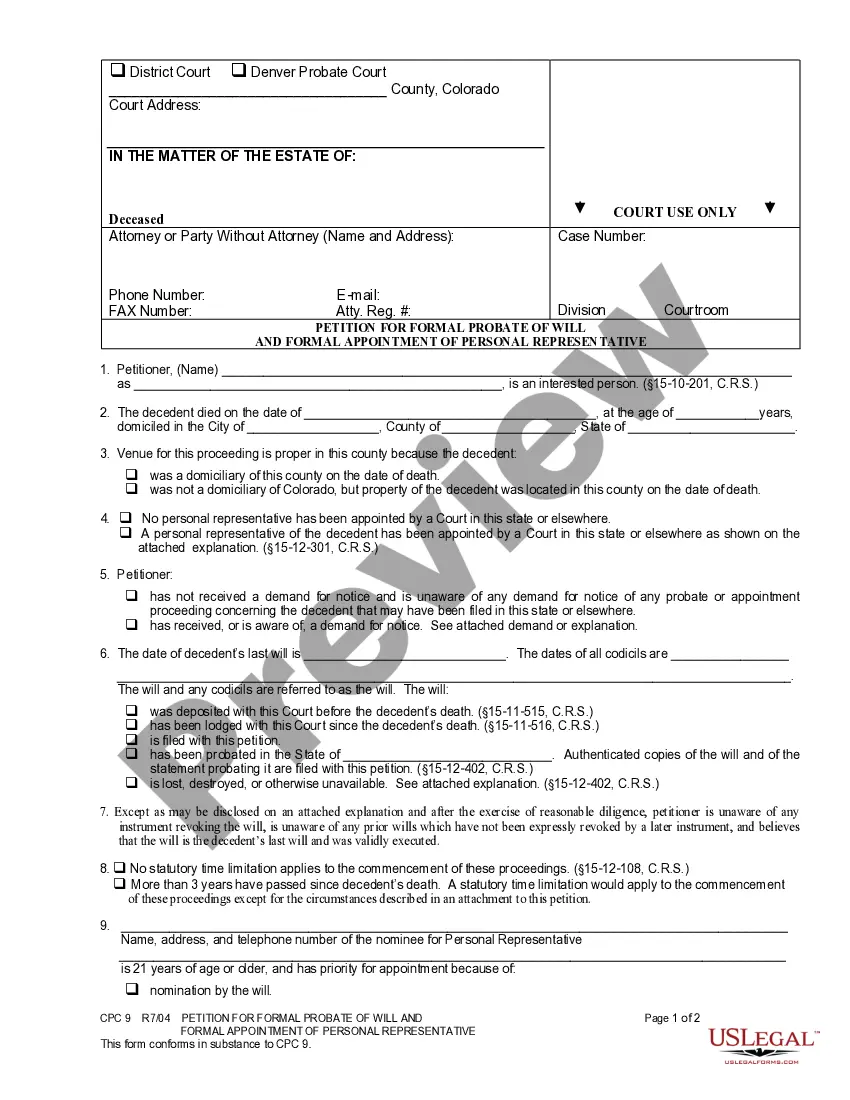

How to fill out St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant)?

If you are searching for a relevant form, it’s extremely hard to find a more convenient place than the US Legal Forms site – one of the most considerable libraries on the web. Here you can find a huge number of document samples for business and personal purposes by types and regions, or keywords. Using our high-quality search function, getting the most recent St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant) is as easy as 1-2-3. Moreover, the relevance of each record is confirmed by a team of expert lawyers that regularly review the templates on our website and revise them in accordance with the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to get the St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant) is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the form you want. Look at its description and make use of the Preview function (if available) to see its content. If it doesn’t suit your needs, use the Search option at the top of the screen to find the proper record.

- Affirm your selection. Select the Buy now option. Following that, choose the preferred subscription plan and provide credentials to register an account.

- Make the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant).

Each and every form you add to your account has no expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you want to get an additional copy for editing or printing, feel free to return and export it once again at any time.

Make use of the US Legal Forms professional catalogue to gain access to the St. Petersburg Florida Self-Insurance Unit Statistical Report (New Applicant) you were seeking and a huge number of other professional and state-specific templates on one website!