Orlando Florida Certification of Servicing for Self-Insurers is a vital legal requirement for businesses operating as self-insurers in the state of Florida. This certification ensures that the self-insured entity is complying with all state laws and regulations pertaining to workers' compensation and self-insurance. The Orlando Florida Certification of Servicing for Self-Insurers establishes that the self-insured entity possesses the financial stability, resources, and expertise to effectively manage and administer workers' compensation claims within the state. This certification serves as a guarantee that the self-insurer can promptly provide necessary medical treatment, wage replacement, and other benefits to injured employees. There are several types of Orlando Florida Certification of Servicing for Self-Insurers, each catering to specific industry sectors or business types. Some notable certifications are: 1. Industrial Self-Insurer Certification: This type of certification is designed for companies operating in industrial sectors such as manufacturing, construction, mining, or energy. It ensures that these self-insured entities are capable of managing the unique risks and complexities associated with these industries. 2. Healthcare Self-Insurer Certification: Healthcare providers, including hospitals, clinics, and medical practices, can obtain this certification. It focuses on their ability to handle workers' compensation claims related to healthcare workers and medical professionals, ensuring the provision of quality medical care and suitable compensation in case of workplace injuries. 3. Hospitality Self-Insurer Certification: Catering to the hospitality industry, encompassing hotels, resorts, restaurants, and tourism-related businesses, this certification ensures that self-insurers within this sector are adequately prepared to address the specific risks faced by their employees, such as slips and falls or ergonomic injuries. 4. Retail Self-Insurer Certification: Retailers, including malls, supermarkets, and department stores, can obtain this certification to demonstrate their ability to manage workers' compensation claims related to retail-specific risks, such as customer interactions and repetitive motion injuries. In conclusion, the Orlando Florida Certification of Servicing for Self-Insurers is a crucial requirement for self-insured businesses in the state. It ensures that self-insurers possess the necessary capabilities and resources to manage and administer workers' compensation claims effectively. With various types of certification tailored to different industry sectors, businesses can demonstrate their compliance with state laws and commitment to providing appropriate compensation and support to their injured employees.

Orlando Florida Certification of Servicing for Self-Insurers

Description

How to fill out Orlando Florida Certification Of Servicing For Self-Insurers?

We continually aim to diminish or avert legal harm when handling intricate legal or financial issues.

To achieve this, we enroll in legal services that are, generally, quite expensive.

Nonetheless, not every legal challenge is equally intricate.

Many of these can be managed independently.

Utilize US Legal Forms whenever you need to acquire and download the Orlando Florida Certification of Servicing for Self-Insurers or any other document effortlessly and securely.

- US Legal Forms is an online repository of current do-it-yourself legal templates covering everything from wills and power of attorneys to incorporation articles and dissolution petitions.

- Our collection enables you to manage your affairs autonomously without hiring a lawyer.

- We provide access to legal document templates that are not always publicly available.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

Form popularity

FAQ

Type of plan usually present in larger companies where the employer itself collects premiums from enrollees and takes on the responsibility of paying employees' and dependents' medical claims.

Anytime you don't have an insurance policy to cover a risk, you're self-insured. People should self-insure when they have enough money to cover a potential loss. If you can't completely self-insure, consider saving enough to have a higher deductible on home or auto insurance, which lowers your premiums.

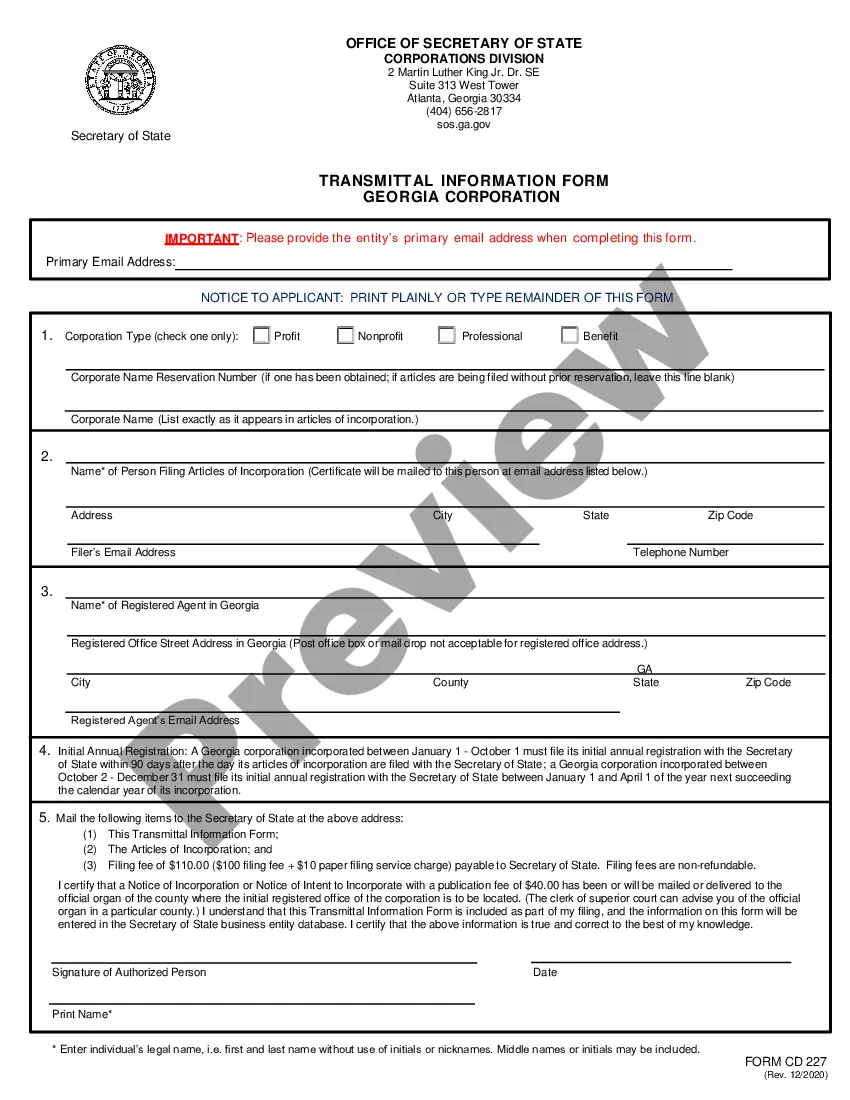

Florida's Rules Regarding Self-Insurance To qualify for self-insurance, a Florida motorist must provide a notarized financial statement confirming that their net worth is no less than $40,000. The Florida motorist must have both a social security number and a driver's license, and both must be current and active.

Self-insurance is also called a self-funded plan. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The insurance company manages the payments, but the employer is the one who pays the claims.

Self-insurance reduces claims and premium expenses and costs factored into third party claims administration including policy overheads, assumption of risk and underwriting profit. As the self-insured company pays its own claims, claims can be settled and reduce financial loss to business earnings.

For example, a driver might elect to self-insure a minor fender-bender with a $500 deductible on auto insurance collision coverage, but carry $300,000 of liability coverage (or even a $1 million umbrella policy) in the event of a lawsuit resulting from an accident.

Self-insurance involves setting aside your own money to pay for a possible loss instead of purchasing insurance and expecting an insurance company to reimburse you.

Current regulatory financial requirements for an organization desiring entry into self-insurance are: Three calendar years in business in a legally authorized business form. Three years of certified, independently audited financial statements. Acceptable credit rating for three full calendar years prior to application.

SELF-INSURANCE CERTIFICATE (BASED ON NET WORTH) A notarized copy of a financial statement (balance sheet indicating assets and liabilities) showing a net unencumbered worth of at least $40,000, form attached.Provide the driver license and social security number of the certificate holder(s).

Any vehicle with a current Florida registration must: be insured with PIP and PDL insurance at the time of vehicle registration. have a minimum of $10,000 in PIP AND a minimum of $10,000 in PDL.