West Palm Beach Florida Surety Bond is a type of legally binding contract that provides financial protection to individuals or businesses involved in various industries within West Palm Beach, Florida. It is a necessary requirement for certain professions or activities as mandated by local and state laws. A West Palm Beach Florida Surety Bond acts as a guarantee that the bonded party will adhere to all regulations, laws, and contractual agreements associated with their profession or project. It ensures that in case of any negligence, fraud, default, or non-performance, the affected party will receive financial compensation. There are several types of West Palm Beach Florida Surety Bonds that cater to the specific needs of different industries and professions. Some key types include: 1. Contractor Surety Bonds: These bonds are required for construction companies, contractors, and subcontractors involved in building projects. It ensures that they fulfill their obligations, including payment to suppliers, employees, subcontractors, and complying with project specifications. 2. License and Permit Bonds: This type of surety bond is necessary for professionals and businesses who need licenses or permits operating legally in West Palm Beach. Examples include contractors, auto dealers, health clubs, insurance brokers, and notaries. 3. Court Surety Bonds: These bonds are often required by the court system to secure court proceedings, appeals, or litigation. They may include appeal bonds, fiduciary bonds, probate bonds, and injunction bonds, among others. 4. Fidelity Surety Bonds: These bonds provide protection against employee dishonesty, such as fraud, theft, or embezzlement, within a business or organization. 5. Public Official Surety Bonds: These bonds are designed to ensure that public officials in West Palm Beach perform their duties faithfully, honestly, and in compliance with the law. 6. Motor Vehicle Dealer Bonds: This bond is specifically for auto dealerships to guarantee ethical business practices, including proper title transfers, accurate vehicle representation, and timely payment to third parties. 7. Wage and Welfare Surety Bond: This bond is required for businesses engaged in public works projects to protect employees' wages and benefits, ensuring they are paid their rightful compensation. It's important for individuals and businesses in West Palm Beach, Florida, to understand the specific type of surety bond they need to fulfill legal and contractual requirements. Consulting with a reputable surety bond provider or an attorney can help in determining the appropriate bond type and coverage limits required for each industry or profession.

West Palm Beach Florida Surety Bond

Description

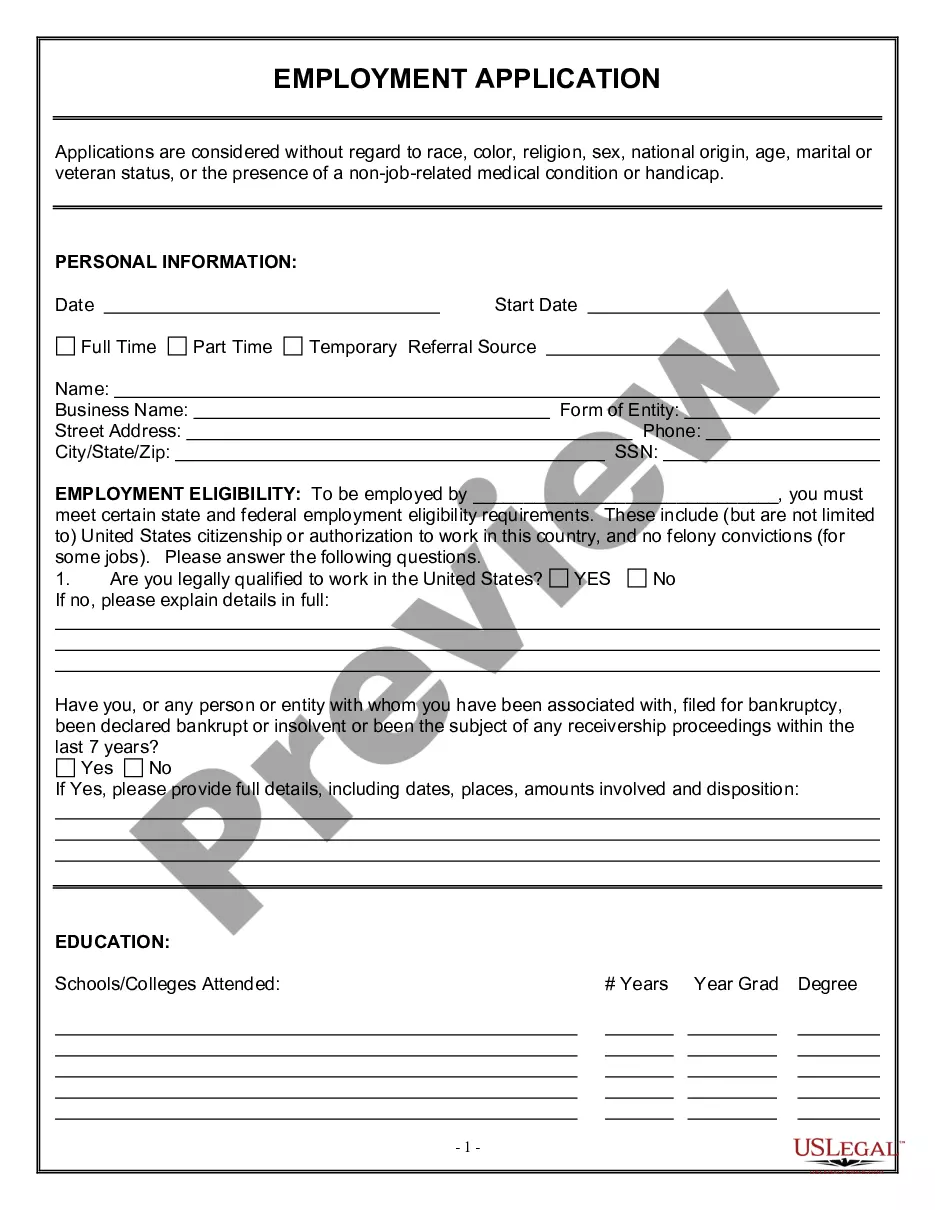

How to fill out West Palm Beach Florida Surety Bond?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the West Palm Beach Florida Surety Bond becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the West Palm Beach Florida Surety Bond takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the West Palm Beach Florida Surety Bond. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

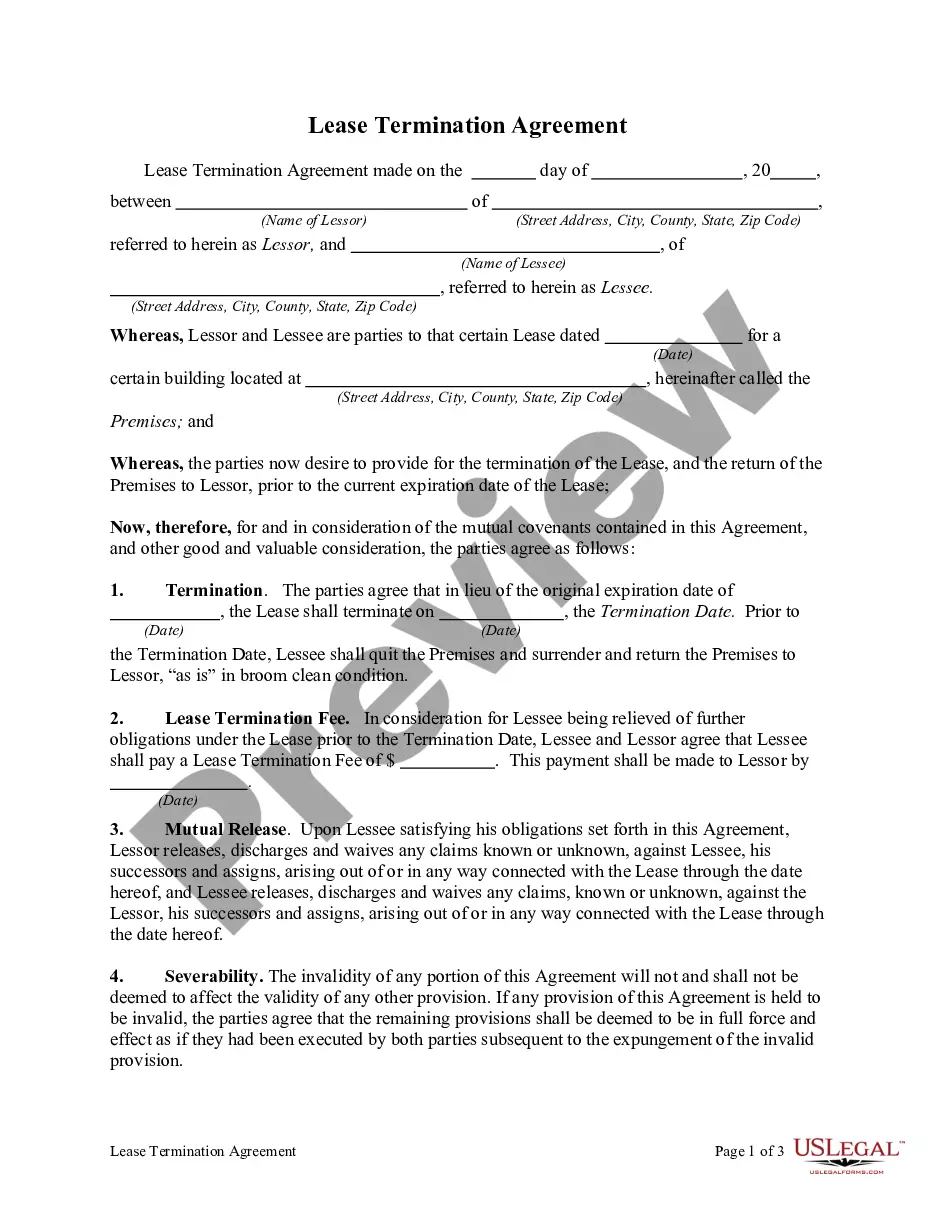

A signed $10,000 surety bond is a legal document that guarantees a specific obligation up to $10,000. This bond means that if the principal fails to meet their contractual duties, the surety company will cover the loss for the obligee, up to that amount. In locations like West Palm Beach, Florida, these bonds are common in construction, licensing, and various business activities. Understanding the implications of a surety bond is crucial, and resources like US Legal Forms can assist you in navigating the details.

To fill out a surety bond form, start by gathering the necessary information about the parties involved, including their names and addresses. Next, clearly define the purpose of the bond and the specific amount required. Ensure you double-check the information for accuracy before submitting the form to the surety company. If you need assistance, platforms like US Legal Forms can provide templates and guidance to simplify the process, especially for a West Palm Beach Florida Surety Bond.

A surety bond in Florida acts as a guarantee between three parties: the principal, the obligee, and the surety. For example, if you are a contractor in West Palm Beach, Florida, a surety bond may assure your clients that you will complete a project according to the agreed terms. This type of bond protects your clients from any failure to comply with legal or contractual obligations. Consequently, having a surety bond can enhance your credibility and reliability in business dealings.

To obtain a surety bond in Florida, start by determining the type of bond required for your specific situation. You will then need to find a licensed surety provider who operates in your area, including options for West Palm Beach Florida Surety Bond. Submit your application along with any necessary financial information, and once approved, you will receive your bond. Services like US Legal Forms can help streamline the application process and ensure you meet all requirements.

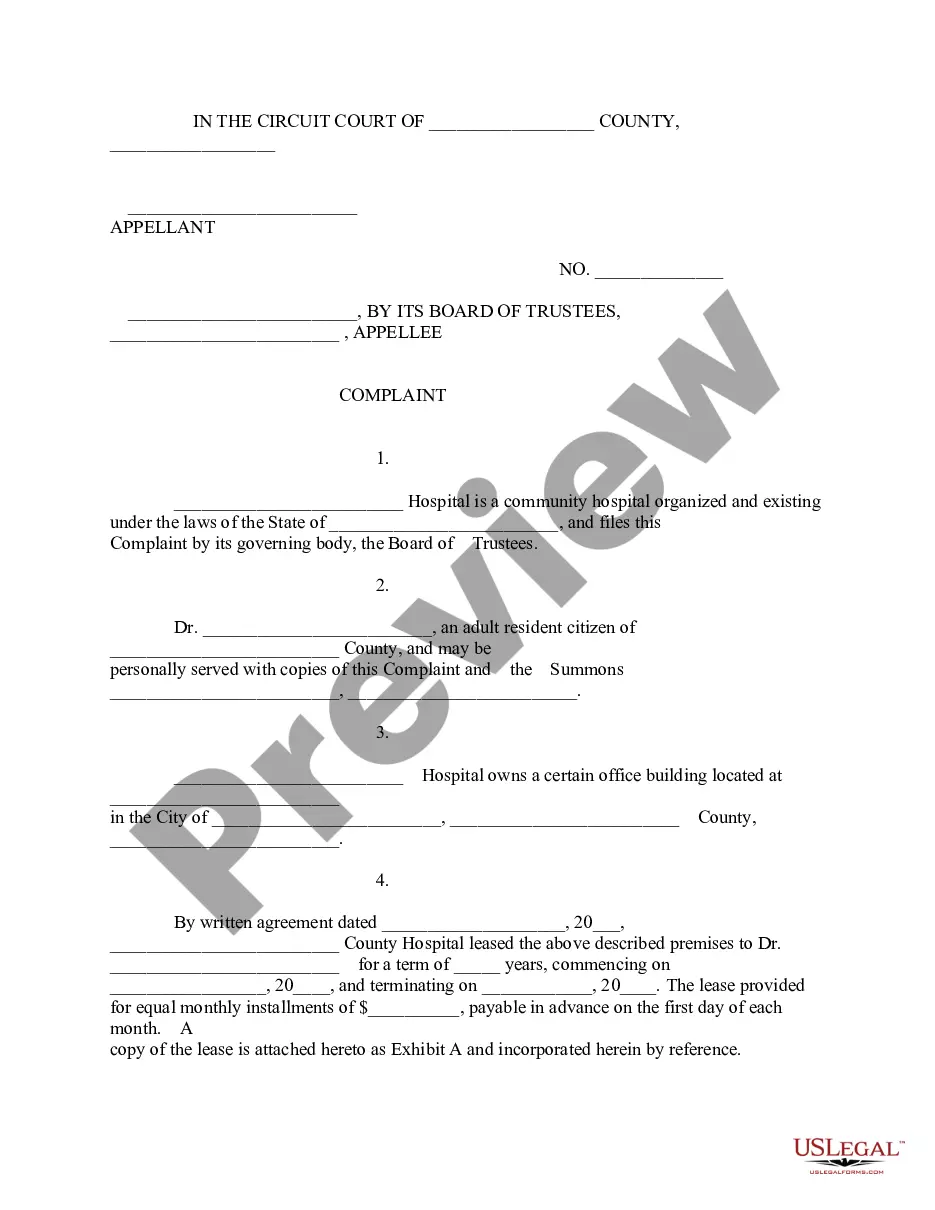

To file a bond claim in Florida, you must first gather all relevant documentation related to the claim. This typically includes proof of the obligation and evidence of the breach. Next, reach out to the surety company that issued your West Palm Beach Florida Surety Bond, and follow their specific claim filing procedures. Utilizing platforms like US Legal Forms can simplify this process by providing templates and guidance tailored to bond claims.

Florida certificate of title bonds up to $6,000 cost just $100 and are issued instantly, while bonds between $6,000 and $50,000 are issued instantly at a rate of $15 per thousand dollars of coverage.

How to File a Bond Claim in Florida Step 1: Obtain a Copy of the Payment Bond.Step 2: Send Notice to Contractor.Step 3: Send Florida Notice of Nonpayment.Step 4: Enforce Your Florida Payment Bond Claim.

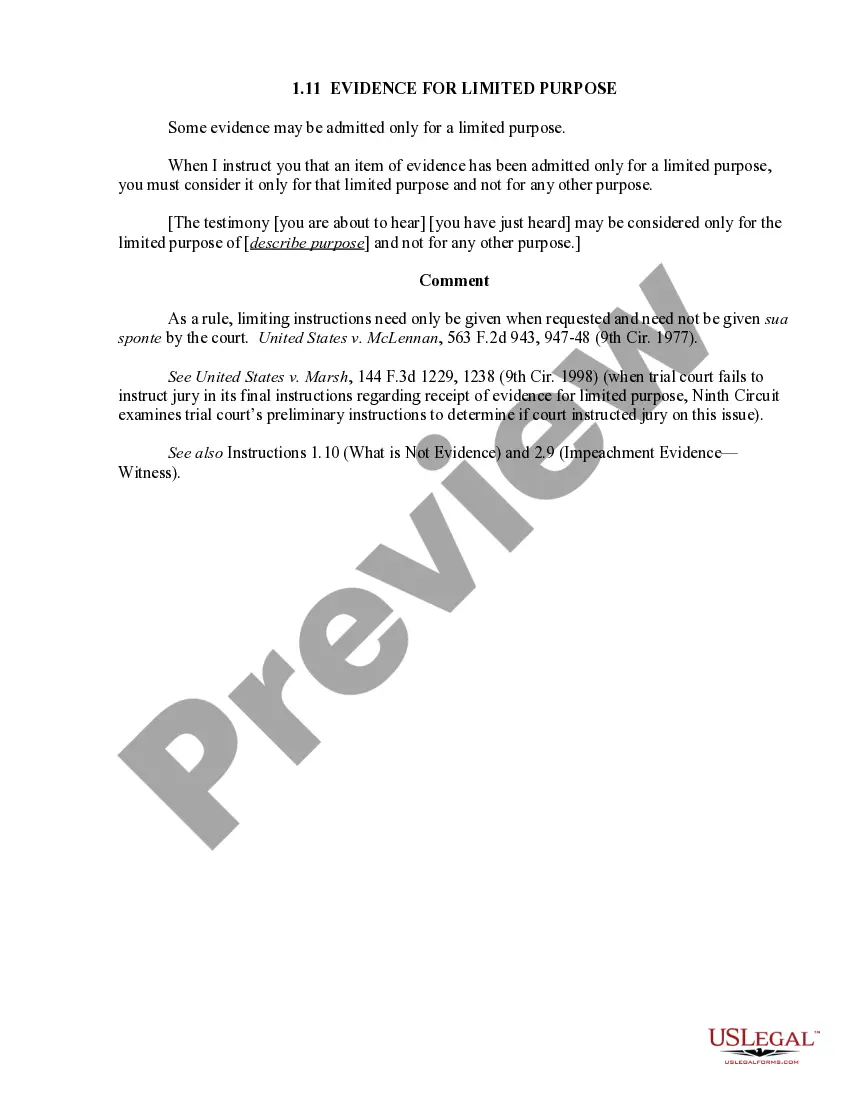

A surety bond is a three-party agreement between the principal, obligee, and surety.

A surety bond must contain the following: Name of the principal, surety and the obligee. Address of principal, surety and the obligee. The amount being lent/borrowed. The purpose for which the amount is being borrowed. The time period for which the amount is being lent. The interest to be levied on the amount.

A surety bond is a three party guarantee put into place to protect the party requesting the bond and guarantees the performance, ability, honesty and integrity of individuals performing various responsibilities and obligations. The three parties involved are the obligee, principal and surety.