Miami Gardens, Florida Self-Insurers Surety Bond is an important financial instrument that is mandatory for certain businesses operating as self-insured workers' compensation employers in Miami Gardens, Florida. It serves as a guarantee or assurance of the self-insured employer's ability to fulfill their financial obligations and provide benefits to employees who might be injured or suffer occupational illnesses in the course of their work. One of the main purposes of the Miami Gardens, Florida Self-Insurers Surety Bond is to protect the interests of employees by ensuring that they will receive their entitled compensation and benefits even if the self-insured employer becomes financially unstable or fails to meet their obligations. This bond functions as a safeguard against potential liabilities and ensures that injured workers will not be left without the necessary financial support. Different types of Miami Gardens, Florida Self-Insurers Surety Bonds may include: 1. Self-Insurers Compensation Bond: This type of bond is specifically designed for self-insured employers who choose to provide workers' compensation benefits directly to their employees rather than purchasing an insurance policy from a commercial carrier. 2. Self-Insurers Liability Bond: This bond caters to self-insured employers who decide to assume the risk and financial responsibility for their employees' occupational injuries or illnesses. 3. Self-Insurers Performance Bond: In some cases, self-insured employers might be required to obtain a performance bond to ensure their adherence to specific regulations, statutes, or agreements related to the provision of workers' compensation benefits. It is crucial for self-insured employers in Miami Gardens, Florida to obtain the appropriate type of surety bond to comply with state laws and regulations. Failure to secure a bond or maintain its validity can lead to legal consequences, fines, and potential suspension of self-insurance privileges. In summary, the Miami Gardens, Florida Self-Insurers Surety Bond is a crucial financial tool that protects the rights and interests of employees by guaranteeing that self-insured employers will fulfill their financial obligations regarding workers' compensation benefits. It safeguards both parties involved and ensures that injured employees receive the proper compensation and support they deserve.

Miami Gardens Florida Self-Insurers Surety Bond

Description

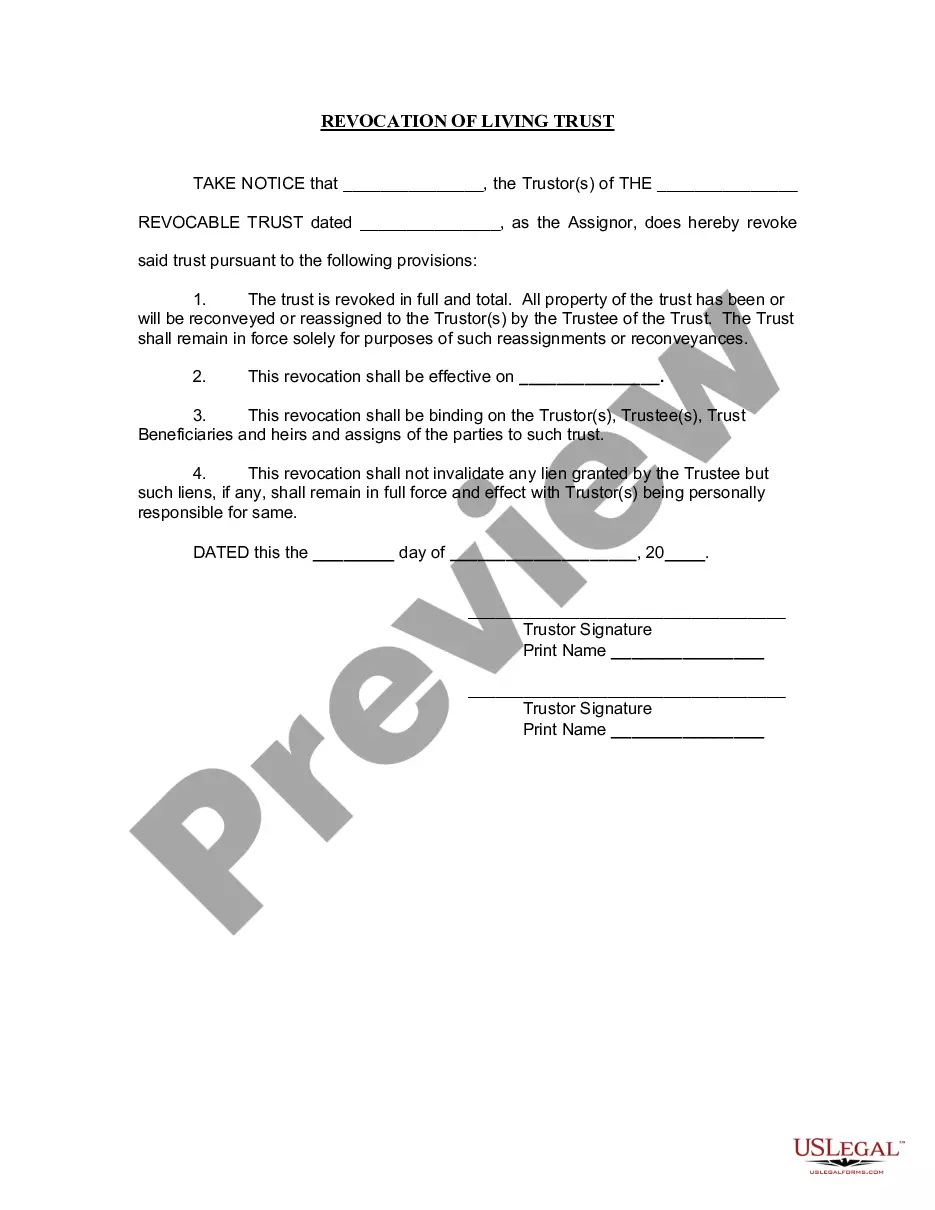

How to fill out Miami Gardens Florida Self-Insurers Surety Bond?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for legal services that, as a rule, are extremely costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Miami Gardens Florida Self-Insurers Surety Bond or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Miami Gardens Florida Self-Insurers Surety Bond adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Miami Gardens Florida Self-Insurers Surety Bond is suitable for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

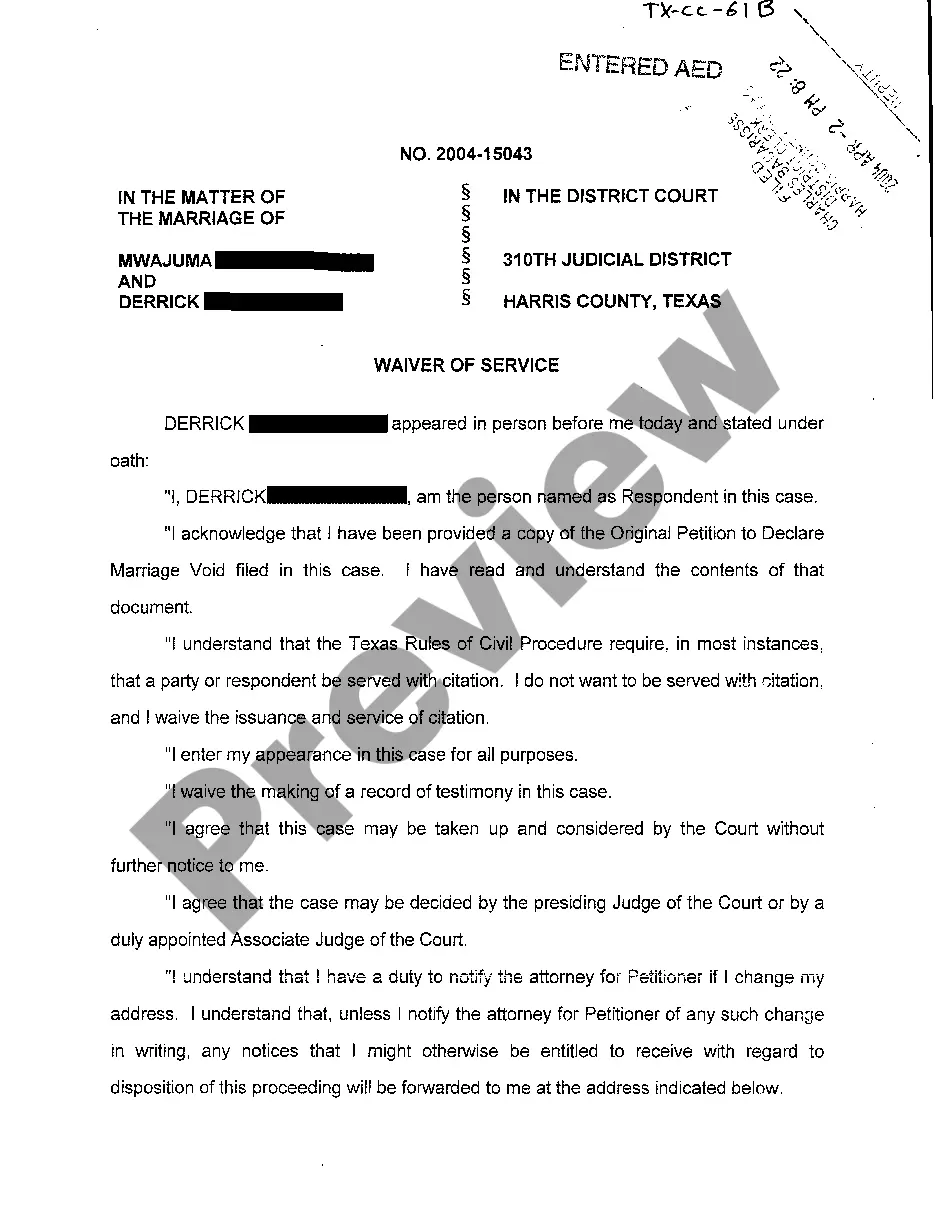

A surety bond works like a three-party agreement among a principal, an obligee, and a surety. Simply put, the principal is the person or business who needs the bond, the obligee is the one requesting it, and the surety is the party that guarantees the obligation will be fulfilled. For instance, with a Miami Gardens Florida Self-Insurers Surety Bond, the surety provides financial backing to reassure the obligee that the principal will complete their duties. If the principal fails to do so, the surety compensates the obligee, keeping the transaction secure.

An example of a surety bond is a performance bond, which guarantees that a contractor will complete a project as promised. In the context of a Miami Gardens Florida Self-Insurers Surety Bond, this type of bond protects the project owner in case the contractor fails to meet their obligations. Other examples include payment bonds or bid bonds, each serving unique purposes in different scenarios. These bonds provide peace of mind for all parties involved.

Filling out a surety bond form for a Miami Gardens Florida Self-Insurers Surety Bond begins with gathering necessary information. You will need details about your business, including its legal name, address, and relevant licenses. Next, accurately complete the form, ensuring clarity and precision in each entry. After filling it out, review the document carefully and submit it through the appropriate channel.

You do not necessarily need a bondsman for your surety bond, especially if you understand the process. The Miami Gardens Florida Self-Insurers Surety Bond can be managed without this intermediary if you follow the guidelines carefully. However, using a service like US Legal Forms can simplify things, providing the support you need to ensure compliance and peace of mind.

While you can technically obtain a surety bond on your own, navigating the process can be intricate. For Miami Gardens Florida Self-Insurers Surety Bond, working with specialists ensures that you meet all necessary requirements and avoid costly mistakes. Platforms like US Legal Forms offer user-friendly tools and resources, making it easier to manage the complexities of the bond application.

Creating a surety bond, particularly for Miami Gardens Florida Self-Insurers Surety Bond, involves a few essential steps. First, determine the specific requirements for your bond amount and type. Then, gather required documents that validate your financial stability. Finally, consider leveraging platforms like US Legal Forms for an efficient process to manage the application with clarity and support.

A primary disadvantage of a self-insured program is the potential for significant financial loss if unexpected claims occur. In Miami Gardens, Florida, without adequate funds, a self-insured entity may struggle to cover large liabilities, affecting its operations. It is crucial to conduct thorough risk assessments and maintain sufficient reserves to mitigate this risk effectively. Considering insurance alternatives is also wise if self-insuring becomes overwhelming.

insured bond is a financial instrument that helps businesses and individuals financially protect themselves against liabilities or losses. In Miami Gardens, Florida, having a selfinsured bond can enhance your credibility and meet contractual obligations. This bond acts similarly to traditional insurance but allows for more control over funding and claims. Ensuring you have the right bond is key to strengthening your financial position.

insurance bond acts as a guarantee that a selfinsurance program is adequately funded. In the context of Miami Gardens, Florida, this bond provides assurance to third parties that the selfinsured entity can meet its claims obligations. It offers a financial safety net, ensuring that the selfinsured maintains liquidity for unexpected losses. Understanding this bond's role is essential for proper risk management.

To be self-insured in Florida, entities must demonstrate financial capability and sound risk management practices. They typically need to meet specific state regulations, including maintaining sufficient reserves. Additionally, businesses may be required to file for a self-insurance certificate with the Florida Department of Financial Services. Understanding these requirements helps ensure compliance and protects stakeholders.