The Palm Bay Florida Self-Insurers Surety Bond is a crucial requirement for businesses operating in Palm Bay, Florida. Acting as a guarantee, this bond ensures that self-insured businesses fulfill their financial obligations towards injured employees or workers who may file claims for compensation. Businesses that opt for self-insurance in Palm Bay, Florida takes on the responsibility of directly providing workers' compensation benefits to their employees instead of relying on traditional insurance companies. To safeguard the interests of employees, the city mandates the Palm Bay Florida Self-Insurers Surety Bond as a protective measure. This bond acts as a safeguard, ensuring that injured employees will receive adequate financial compensation even if the self-insured business faces financial hardship or insolvency. Various types of Palm Bay Florida Self-Insurers Surety Bonds serve different purposes to accommodate the needs of unique businesses. Some notable types include: 1. Palm Bay Florida Self-Insurers Surety Bond for Workers' Compensation: This bond ensures that self-insured employers fulfill their obligation to provide workers' compensation benefits for injured or ill employees. 2. Palm Bay Florida Self-Insurers Surety Bond for Disability Benefits: This bond focuses on self-insured employers' responsibilities towards providing disability benefits to employees who have become incapacitated due to work-related accidents or injuries. 3. Palm Bay Florida Self-Insurers Surety Bond for Medical Expenses: This bond pertains to self-insured employers' duty in covering medical expenses incurred by employees due to work-related injuries or illnesses. Acquiring a Palm Bay Florida Self-Insurers Surety Bond is essential for businesses as it not only complies with legal obligations but also demonstrates responsible corporate behavior. By providing a safety net for employees and ensuring access to sufficient compensation, this bond promotes a fair and secure work environment. Businesses should carefully evaluate their self-insurance needs and requirements to determine the appropriate type of Palm Bay Florida Self-Insurers Surety Bond for their operations. Consulting with a trusted surety bond provider or an insurance professional can help guide businesses through the process of obtaining the right bond to meet their specific needs and comply with Palm Bay, Florida regulations.

Palm Bay Florida Self-Insurers Surety Bond

Description

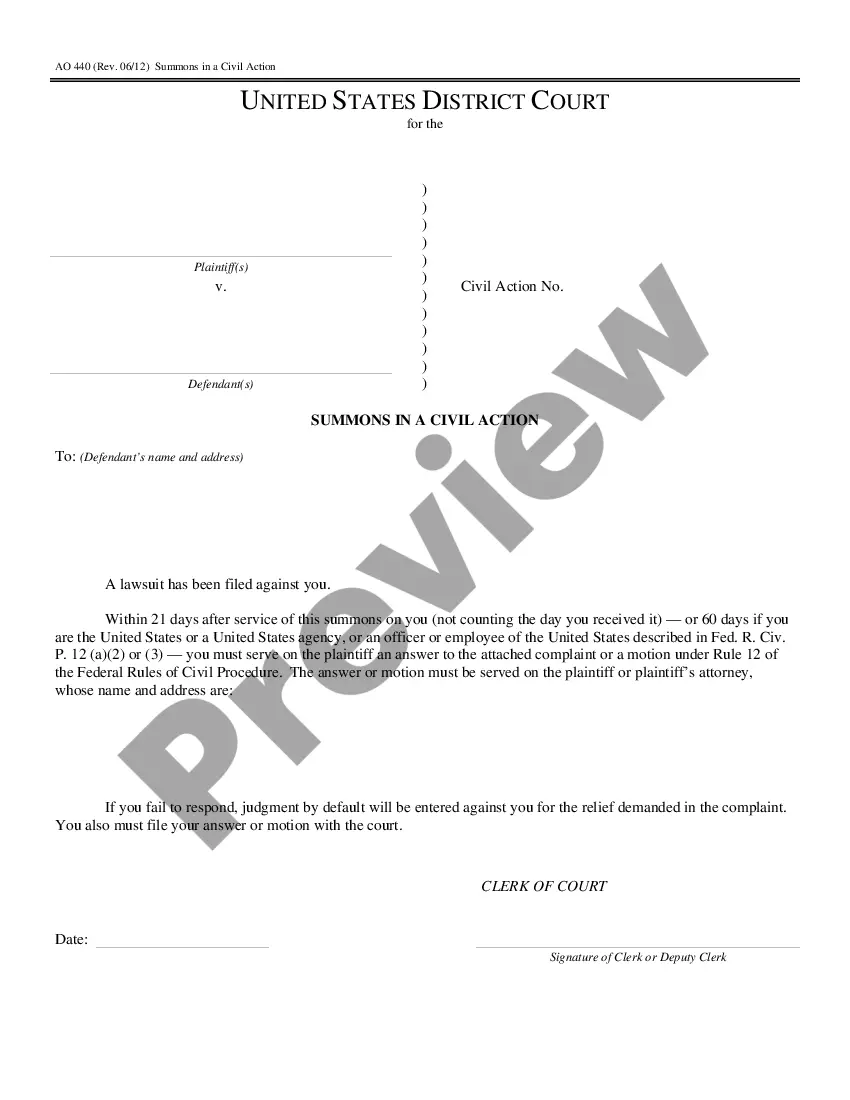

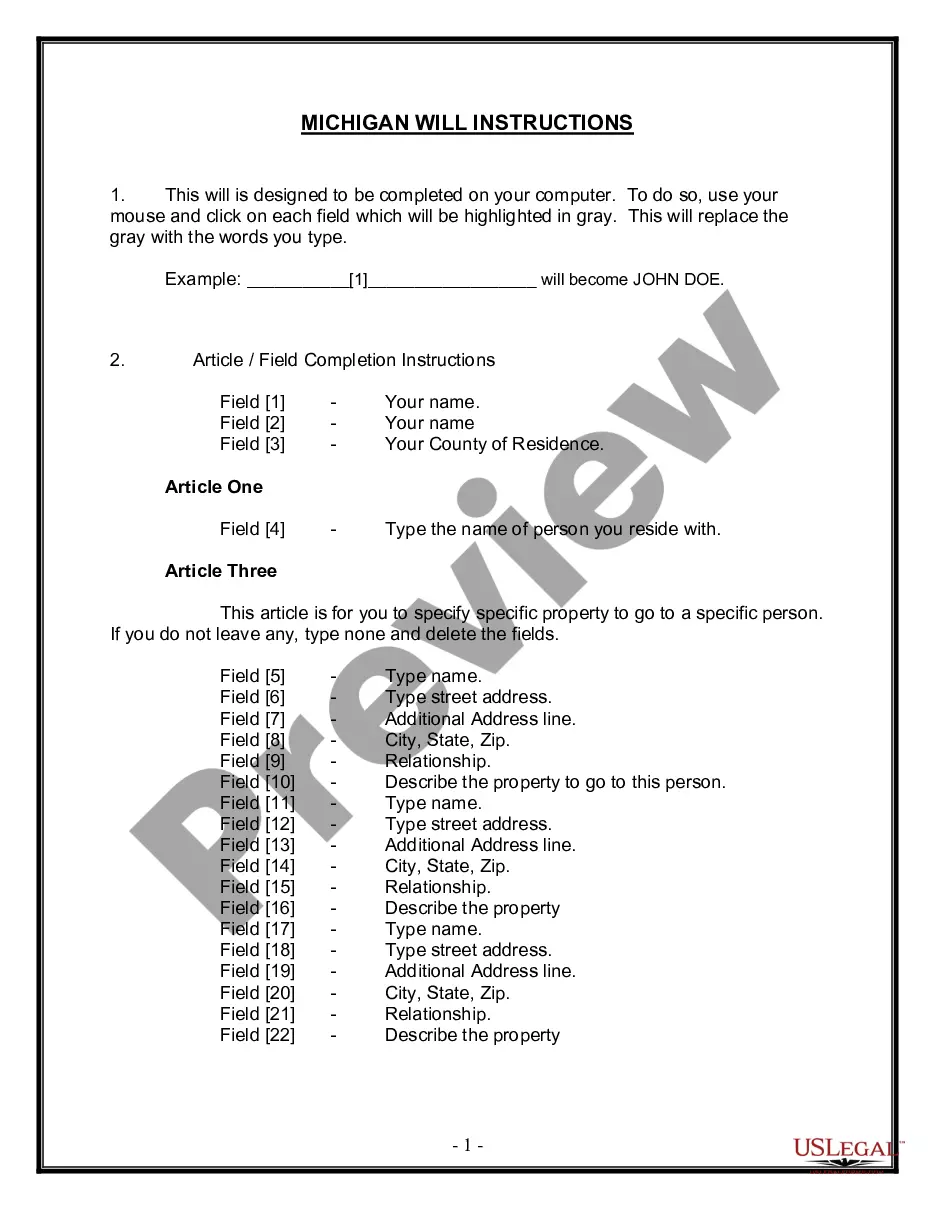

How to fill out Palm Bay Florida Self-Insurers Surety Bond?

If you’ve already used our service before, log in to your account and save the Palm Bay Florida Self-Insurers Surety Bond on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Palm Bay Florida Self-Insurers Surety Bond. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!

Form popularity

FAQ

insurance bond, specifically the Palm Bay Florida SelfInsurers Surety Bond, serves as a financial guarantee for businesses that choose to selfinsure instead of obtaining traditional insurance coverage. This bond acts as a promise to manage risks and liabilities responsibly, ensuring that you have the funds to cover potential claims. By opting for a selfinsurers surety bond, your business can demonstrate financial stability and reliability, which is often crucial for gaining contracts or licenses. It's a smart choice for businesses looking to navigate the complexities of insurance while maintaining flexibility.

To become self-insured in Florida, start by evaluating your financial situation and understanding the risks involved. Next, develop a self-insurance plan that addresses coverage, asset protection, and claims handling. Implementing a Palm Bay Florida Self-Insurers Surety Bond can also enhance your application process, ensuring you meet state requirements effectively.

A significant disadvantage of a self-insured program is the financial risk it carries. Without a traditional insurer backing you, any substantial claims can adversely affect your finances. However, pursuing a Palm Bay Florida Self-Insurers Surety Bond can help mitigate some of this risk by providing a safety measure that reassures stakeholders.

To be self-insured in Florida, you must meet specific financial criteria, including demonstrating sufficient assets to cover potential losses. You will also need to submit an application along with a detailed loss-control plan. Engaging with a Palm Bay Florida Self-Insurers Surety Bond can make navigating these requirements smoother and more effective.

In Florida, a surety bond is often required in various contexts, such as business and construction projects. This bond guarantees that you will fulfill your contractual obligations, protecting the interests of the other party involved. If you’re seeking to operate as a self-insurer in Palm Bay, understanding the nuances of a Palm Bay Florida Self-Insurers Surety Bond is crucial.

Becoming self-insured involves evaluating your risk tolerance and financial strength to cover potential claims. You will need to demonstrate your ability to manage these risks effectively, usually through a detailed financial statement. Additionally, if you look into a Palm Bay Florida Self-Insurers Surety Bond, it can enhance your credibility and provide a safety net.

To self-insure your home in Florida, you first need to assess the value of your property and determine your financial capabilities. Next, create a comprehensive plan to cover potential losses, which can include setting aside savings to act as a buffer. It is also essential to familiarize yourself with state regulations; for detailed guidance, you might consider a Palm Bay Florida Self-Insurers Surety Bond.

Filling out a surety bond form for your Palm Bay Florida Self-Insurers Surety Bond requires careful attention to detail. Start by gathering necessary information such as your personal details, the bond amount, and the specifics of your business. It's crucial to understand each section of the form to ensure accuracy. If you find it complex, you can rely on uslegalforms to simplify the process with user-friendly templates and guidance.

To obtain a Palm Bay Florida Self-Insurers Surety Bond, you should start by contacting a licensed surety bond agent. They will guide you through the application process, which typically involves providing some personal and business information. After submitting the necessary documents, the agent will summarize your options and help you understand the terms of your bond. Using platforms like US Legal Forms can simplify this process, offering resources and templates to make your application smoother.